The end is near. After enduring the most nerve-wracking economic boom-to-bust period since the Great Depression, assembly professionals finally see light at the end of the long, dark tunnel. While the automotive and housing markets remain flat, they are beginning to show signs of life. Confidence is slowly starting to return, according to ASSEMBLY's 2009 State of the Profession survey.

The end is near. After enduring the most nerve-wracking economic boom-to-bust period since the Great Depression, assembly professionals finally see light at the end of the long, dark tunnel. While the automotive and housing markets remain flat, they are beginning to show signs of life. Confidence is slowly starting to return to both Wall Street and Main Street. That’s good news for assembly professionals, who are eager to start ramping up their production lines.

The 2009 ASSEMBLYState of the Professionsurvey was conducted in early March, shortly after the controversial $787 billion economic stimulus plan was signed by President Barack Obama. However, the news at the time was bleak. New vehicle sales were down 37 percent in March. And, the average work week dropped to 33.2 hours, which was a record low, according to the U.S. Department of Labor (Washington, DC). Numerous companies announced layoffs in March, pushing the unemployment rate to 8.5 percent, the highest level in 26 years.

Manufacturers in all industries have slashed their budgets in recent months. In fact, 80 percent of assemblers claim that budget cutbacks are affecting their plants, which is a 44 percent increase over last year. Another sign of the times is salary. Only 31 percent of survey respondents expect to receive a pay increase this year vs. 76 percent in 2008.

Numerous individuals have experienced pay cuts, furloughs and elimination of benefits. And, an even more sobering statistic is the fact that more than half (60 percent) of respondents claim that their retirement plans have changed because of the economy.

Despite enduring those hardships, assembly professionals remain relatively upbeat. Indeed 38 percent of respondents claim they are “highly satisfied” with their jobs, which is 1 percent higher than 2008. Perhaps those individuals are just happy to have a job, or maybe things are finally starting to pick up.

Positive Signs

Several recent reports by economists indicate the latter. For instance, the National Association for Business Economics (NABE, Washington, DC) claims the recession will end soon. “While the overall tone remains soft, there are emerging signs that the recovery is stabilizing,” says Chris Varvares, NABE president. “[However], the economic recovery is likely to be considerably more moderate than those typically experienced following steep declines.“The key downside risks remain continued large job losses, no improvement in credit conditions and further sharp declines in home values,” adds Varvares, who also serves as president of Macroeconomic Advisers LLC (St. Louis). “These same forces are causing consumers to remain cautious. The good news is that economic growth [will] turn positive in the second half of this year, with the pace of job losses narrowing over the remainder of the year and employment turning up in early 2010.”

Other experts, such as Robert Gordon, an economics professor at Northwestern University (Evanston, IL), agree with that assessment. Ironically, he bases his optimism on claims for unemployment benefits. Gordon believes the peak in jobless claims, which occurred in April, typically takes place during the bottom curve of a recession.

Another good indicator of economic health is corporate profit. According to the U.S. Department of Commerce’s Bureau of Economic Analysis (Washington, DC), corporate profits from current production increased $43 billion in the first quarter of 2009, in sharp contrast to a decrease of $250 billion in the fourth quarter of 2008.

The Institute for Supply Management (ISM, Tempe, AZ) claims that the U.S. economy grew in May for the first time in seven months. “While employment and inventories continue to decline at a rapid rate . . . there are signs of improvement,” says Norbert Ore, ISM’s chairman. The machinery and plastics industries both reported growth in May.

Recent studies conducted by the Federal Reserve Bank of New York and the National Association of Home Builders (NAHB, Washington, DC) also indicate that the economy is slowly improving. For example, the number of newly built single-family homes on the market shrank to 297,000 units in April, thinning supplies to their lowest level since May 2001. “This continued reduction in the new-homes inventory helps bring supply in line with demand, which is an important step toward the market’s recovery,” explains David Crowe, NAHB’s chief economist.

“Consumers are considerably less pessimistic than they were earlier this year, and expectations are that business condi-tions, the labor market and incomes will improve in the coming months,” adds Lynn Franco, director of the consumer research center at the Conference Board Inc. (New York). “While confidence is still weak by historical standards, as far as consumers are concerned, the worst is now behind us.

“After two months of significant improvements, the Consumer Confidence Index is now at its highest level in nine months,” claims Franco. “Current conditions have moderately improved, and growth in the second quarter [was] less negative than in the first. Consumers’ short-term outlook [has] improved significantly. Those expecting business conditions will improve over the next six months increased to 23.1 percent from 15.7 percent.”

Manufacturers in all industries have slashed their budgets in recent months.

Salary Statistics

The typicalState of the Professionsurvey respondent is 48 years old, has an average of 18 years experience and earns $75,317. However, there are exceptions at both the high and low ends of the scale. For instance, 11 percent of respondents take home less than $50,000 per year, while 23 percent earn more than $90,000.But, some other statistics are more sobering. For instance, only one-third (34 percent) of respondents claim they received a pay increase over the last 12 months. Most individuals were not that fortunate. Indeed, two-thirds (66 percent) of assemblers did not receive a raise.

But, considering the state of the economy, that’s no surprise. According to Hewitt Associates (Lincolnshire, IL), American workers are experiencing the lowest pay raises in 32 years as companies attempt to manage overhead costs. “Many organizations are being negatively impacted by the economy,” says Ken Abosch, North American practice leader for Hewitt’s compensation consulting business.

“Short-term adjustments to reduce fixed costs are required to avoid pay freezes, layoffs, or in some cases, just to survive,” Abosch points out. He says making across-the-board cuts to salary increases is one of the quickest and easiest ways for companies to lower overall costs.

Less than one-third (31 percent) ofState of the Professionrespondents expect to receive a salary increase at their next review vs. 76 percent in 2008. Assemblers in the medical device industry feel most confident about receiving an increase. Indeed, 51 percent of those individuals say they expect a raise during the next 12 months.

But, assembly professionals in the transportation equipment industry, which include automakers and suppliers, are less optimistic. Because of the dramatic slowdown in the auto industry, only 24 percent believe they will receive more compensation in the near future.

A recent study conducted by Grant Thornton LLP (Chicago) concurs with ASSEMBLY’s findings. Jack Katz, national managing partner of Grant Thornton’s financial services practice, claims that 58 percent of U.S. manufacturers will cut their operating costs by not giving out raises in 2009. In addition, he says 48 percent of companies will not hand out bonuses.

Less than half (44 percent) of ASSEMBLY’s respondents received a cash bonus during the last 12 months, a 14 percent decrease from 2008. Most of that extra compensation was tied to overall company and plant performance, in addition to meeting deadlines for new projects and implementing successful cost reduction programs.

More than one half (56 percent) of assemblers who work for companies that manufacture medical equipment, devices and instruments claim they received a cash bonus during the past year. By comparison, only 33 percent of assemblers in the plastics and rubber products industry received bonuses.

Unfortunately, a large gender gap still exists in the assembly profession, but it appears to be slowly narrowing. The average salary of female assemblers (4 percent of respondents) is $64,791. Their compensation lags behind male assemblers by $10,915 or 14 percent, which is an 11 percent decrease from 2008.

More than one-half (58 percent) of the women surveyed earn less than $70,000, while 57 percent of the men earn more than $70,000. One factor that accounts for some of this discrepancy is the fact that the women respondents had an average of 14 years experience in the assembly field, while men averaged 19 years of experience.

In addition to gender and experience, several other factors determine average pay rates, such as age, education, location and industry. Industry experience is the biggest factor that determines compensation. Individuals with less than 5 years of experience in the assembly field (13 percent of respondents) earn an average salary of $63,488. On the other hand, industry veterans with more than 15 years of experience (57 percent of respondents) are rewarded with salaries that average $78,198.

Assembly professionals tend to be loyal employees who stay with the same company for long periods of time. In fact, 46 percent of respondents have worked at the same firm for more than 10 years, while 14 percent have been with their present employer for less than two years.

Geography Determines Pay

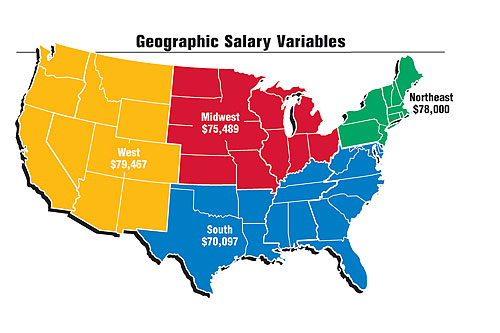

Assembly salaries vary from region to region. Often, those fluctuations are determined by the local cost of living. Traditionally, the West (Arizona, California, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington and Wyoming), which is home to only 13 percent of respondents, boasts the highest salaries in the State of the Profession survey. However, assemblers in the West also work 0.5 hour more than the national average of 45.1 hours per week.The average salary in the West is $79,467, which is 5 percent more than the national average of $75,317. Assemblers in the Northeast (Connecticut, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont) and the Midwest (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin) also earn more than the national average.

Assembly professionals in the South (Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia), which is home to 20 percent of respondents, earn 7 percent less than the national average. That may be one reason why many manufacturers continue to flock to the region.

For instance, Volkswagen AG (Wolfsburg, Germany) is building a $1 billion assembly plant in Chattanooga, TN, that’s scheduled to open in 2011. NCR Corp. (Dayton, OH), a leading manufacturer of ATM machines, just announced that it plans to build a state-of-the-art manufacturing plant in Duluth, GA. Earlier this year, St. Jude Medical Inc. (St. Paul, MN) opened a 60,000-square-foot plant in Liberty, SC, to assemble electronics used in pacemakers and implantable cardioverter defibrillators.

This summer, MFG Galileo Composites Corp. (Sparks, NV), a leading manufacturer of radomes and reflectors, is opening a 40,000-square-foot plant in Opp, AL. In addition, the National Alliance for Advanced Transportation Batteries (Argonne, IL) recently chose Glendale, KY, as the site for a $600 million lithium-ion battery plant.

Assemblers in the West are also the most confident about receiving a salary increase at their next review. Indeed, 34 percent (vs. 74 percent in 2008) of respondents say they expect a raise. However, only 27 percent of assemblers in the Midwest, home of the beleaguered auto industry, believe they’ll receive a pay increase during the next 12 months.

Of course, money can’t buy happiness. Assembly professionals in the West earn more than their peers in other parts of the country, but they also tend to be less satisfied with their jobs. Only 86 percent of respondents claim to be satisfied vs. 96 percent in the South and 94 percent in the Northeast.

One reason for that extra bit of happiness in the South may be due to the fact that more assemblers see their companies committing resources to assembly operations during the next three years. Indeed, 63 percent of respondents are optimistic vs. 56 percent in the Midwest. In addition, 40 percent of assemblers in the South claim that their company has increased staff size during the past year, compared to only 34 percent of respondents in the Midwest.

Overall, assemblers who claim to be “highly satisfied” with their jobs earn an average of $78,948, compared to $74,057 for people who claim they are “moderately satisfied.” Not surprisingly, individuals who are “not satisfied” typically do not receive cash bonuses and provide little or no input on budgeting new assembly equipment.

Size Does Matter

Salary and job satisfaction levels in the assembly profession are usually influenced by the size of a manufacturer. For instance, assemblers who work in companies with more than 2,000 employees tend to earn the highest average salary: $90,699. On the other hand, small manufacturers with less than 100 employees pay an average salary of $69,472.However, bigger isn’t always better, especially when it comes to compensation. Assembly professionals who work in larger companies are generally less happier than those who work for smaller firms.

Indeed, 44 percent of people who work in small companies (firms with fewer than 100 employees) claim they are “highly satisfied” with their jobs vs. 31 percent of respondents who work in companies with more than 1,000 employees. Assemblers who work for manufacturers with 500 to 999 employees most closely match the national “job satisfaction” average of 38 percent.

Assembly professionals in the electrical equipment and appliance industry, which includes manufacturers of batteries, household appliances, industrial controls, lighting fixtures, motors, switches and transformers, earn the highest salaries: $79,570. Their compensation is 5 percent above the national average of $75,317.

Other industries that boast salaries above the national average include transportation equipment (5 percent higher) and computer and electronic products (3 percent higher). The medical device industry most closely parallels the national average, with a salary of $74,802.

Manufacturing engineers (44 percent of respondents) rank slightly ahead of design engineers (15 percent of respondents) when it comes to compensation. They earn an average of $159 more than their peers and they tend to work slighter shorter work weeks. However, design managers make quite a bit more than manufacturing process managers: an average of 11 percent more.

Age is another important factor that often influences compensation. For instance, manufacturing engineers who are under 50 years old earn more than design engineers of the same age.

Assembly professionals who are more than 60 years old typically earn the highest salaries. For example, individuals who are 60 or older earn 14 percent more than their peers who are in their 30s and 33 percent more than 20-year-olds. The average salary for assemblers in their 60s is $83,342, compared to an average of $71,938 for respondents in their 30s.

Salaries also fluctuate dramatically based on type and level of education. For instance, assembly professionals with just a bachelor’s degree (57 percent of respondents) earn an average of $75,881. However, assemblers with master’s degrees (16 percent of respondents) earn an average of $12,547 more than individuals who only have 4-year college degrees (a 14 percent difference).

One way to earn a higher salary is by obtaining a master’s in business administration (MBA). The ASSEMBLY survey discovered that MBAs (7 percent of respondents) make an average of 19 percent more than non-MBAs. In fact, 58 percent of MBA respondents earn more than $80,000. However, MBAs typically work longer hours than other individu-als.

Another way to guarantee a higher-than-average salary is to become certified. Assemblers who hold a certified manufacturing engineer (CMfgE) or professional engineer (P.E.) designation earn an average salary 7 percent higher than noncertified engineers. Individuals with P.E.s (7 percent of respondents) earn an average of $83,372, while CMfgEs (5 percent of re-spondents) make $78,604.

Happiness Counts

Most respondents claim to be satisfied with their jobs, but a closer look at the data reveals some differences. For example, manufacturing engineers tend to be happier than design engineers. Indeed, 34 percent of manufacturing engineers claim to be “highly satisfied” vs. 28 percent of design engineers.The happiest assemblers work in the fabricated metal products industry, where 49 percent of respondents claim to be “highly satisfied” with their jobs. In contrast, only 24 percent of assemblers in the plastics and rubber products industry are “highly satisfied.” Assembly professionals who work for contract manufacturers are 6 percent happier than their peers who work for OEMs.

Job satisfaction can be defined many different ways. But, here’s what a few respondents had to say:

“Each day represents a new challenge, and the constantly changing business environment requires always staying on your toes,” says a plant manager in the medical device industry who is satisfied with his job.

“I am in a position where I am able to make decisions and changes with minimal outside influences,” adds a manufacturing engineer in the electrical equipment and appliance industry.

“I work for a great company, with good people and a supportive environment for education and improvement,” notes a manufacturing engineer at a transportation equipment manufacturer. “We make interesting products and there are some challenging production processes that are fun to ‘lean out.’”

“I have direct control over expenditures and policies that impact operational performance,” says a design engineer in the computer and electronic products industry. “Therefore, I am allowed to create my own strategies that facilitate achievement of company objectives.”

“I work for a great small company and I enjoy what I do,” explains a manufacturing engineer in the fabricated metal products industry. “I wear many hats and that gives me great opportunity to use the skills that I have.”

“It is enormously gratifying to see our equipment in use in operating rooms, helping to make a positive difference for sick patients,” says a design engineer at a medical device company.

However, some respondents are less satisfied with their jobs. “Upper management seems out of touch with actual product demands and part shortage constraints,” laments a manufacturing engineer in the machinery manufacturing industry.

“China is right on our heels,” gripes a design engineer in the furniture and fixtures industry. “We need to get more advanced, but we are not doing it quickly enough.”

“The economic downturn, combined with reduced resources and an increased workload, leave me overwhelmed, underpaid and not appreciated,” adds a plant manager in the plastics and rubber products industry.

“I started working for a small, profitable automotive parts supplier that built its own assembly equipment,” says a manufacturing engineer in the transportation equipment industry. “The company was recently bought by a big European firm that gutted the operation and moved assembly operations to Mexico. The people who hired me are long gone.”

“Individual performance is based on overall company performance, which always seems to never be good enough,” reports a design engineering manager in the fabricated metal products industry.

“Quality and manufacturing engineers take a back seat to design engineers,” says a manufacturing engineer in the electrical equipment and appliance field. “Engineers in general are considered only one step above a technician.”

“My company suffers from poor organizational objectives, communication and leadership,” adds a manufacturing engineer in the transportation equipment industry. “Roles and responsibilities are poorly defined and are not measured.”

Widespread budget cutbacks are having a huge impact on job satisfaction. Unfortunately, it’s a problem that affects assemblers who work for both large and small manufacturers. For instance, 67 percent of respondents at small manufacturers (companies with 100 or less employees) claim that budget cutbacks are affecting their job vs. 86 percent of respondents at large manufacturers (companies with 2,000 or more employees).

Assemblers in the transportation equipment industry (88 percent), which includes automakers and auto part suppliers, are the most concerned about budget cutbacks. That’s not surprising, since Chrysler and General Motors recently declared bankruptcy. Even automakers such as Honda and Toyota have scaled back production.

Not surprisingly, respondents in the medical device industry (66 percent) are less concerned about budget cutbacks. Assemblers in that field are much more concerned about issues such as keeping up with state-of-the-art technology and making new technol-ogy work.

Because of the economy, many assemblers believe their plants will be investing in less capital equipment in the near future. When asked, “How do you see your company committing resources toward improving assembly operations during the next three years?” 21 percent said “less resources” vs. 13 percent in 2008. The two industries that are most bullish about committing resources to new production equipment include plastics and rubber products manufacturers (56 percent) and medical device manufacturers (53 percent).

Less Time to Complain

Because of cutbacks, assembly professionals are spending less time on the plant floor these days. In fact, 73 percent of respondents currently work more than 40 hours a week (vs. 88 percent in 2008). The national average is 45 hours, which is one hour less than in 2008.Assemblers in the medical and plastics industries work the longest days, with a weekly average of 46 hours. At the other end of the spectrum, respondents who work in the machinery manufacturing industry put in an average of 43.8 hours per week.

However, assembly professionals who put in longer hours tend to earn higher salaries. For instance, individuals who work an average of 46 to 50 hours a week earn an average of $81,806. Individuals who typically work less than 40 hours a week earn $68,238.

Corporate managers claim to have the longest work weeks: an average of 46.8 hours. By comparison, design managers average 46.7 hours, followed by manufacturing managers (45.7 hours), manufacturing engineers (44.6 hours) and design engineers (44.1 hours). Unfortunately, the trend toward shorter weeks is expected to continue during the next 12 months, with 11 percent of assemblers claiming that their average work week will decrease vs. 6 percent in 2008.

Assemblers in the South and West plan to work more than their peers in other regions. For instance, 31 percent of respondents in those parts of the United States believe the hours they spend at work each week will increase during the year ahead. On the other hand, only 26 percent of assemblers in the Midwest and Northeast expect to work longer hours.

Assembly professionals who work for smaller manufacturers plan to spend more time at work than their counterparts in larger companies. Almost one-third (32 percent) of respondents who work for manufacturers with less than 50 employees expect to work more hours per week in the next 12 months. However, only 20 percent of assemblers who work for companies with more than 1,000 employees foresee longer work weeks ahead.

More than half (52 percent) of respondents said mounting time constraints will affect their ability to do their jobs during the next 12 months. Time constraints will also have a bigger impact on assemblers who work in large companies. For instance, 64 percent of assembly professionals who work for companies with 2,000 or more employees will be affected by time constraints vs. only 44 percent of respondents in companies with less than 50 employees.

Time constraints will cause the most stress on assemblers who work in the transportation equipment industry (57 percent) and the computer and electronic products industry (55 percent), who are under intense pressure to launch new products and meet deadlines for projects.

However, for the first time in years, a shortage of skilled labor will not be a major constraint or barrier in assembly plants. Only 26 percent of respondents cited this as a challenge vs. 42 percent in 2008. Concern over finding assemblers is greatest in the fabrication metal products industry (33 percent) and lowest in the medical device industry (17 percent).

More assembly plants are involved in green manufacturing initiatives, such as recycling programs.

Green Movement Is Growing

According to the 2009State of the Professionsurvey, green manufacturing activity continues to increase in various industries. In this year’s study, 57 percent of respondents claim they are involved in green or sustainability initiatives vs. 46 percent in 2008. Actions include everything from plantwide recycling programs to installing new energy-efficient lighting systems.Green activity is most common in the transportation equipment industry, where 69 percent of assemblers work in plants that have implemented environmental programs. For instance, General Motors Corp. (GM, Detroit) is involved in an ambitious effort to reduce the environmental impact of its worldwide manufacturing operations. One goal is to make 50 percent of the automaker’s plants landfill-free by 2010.

More than 50 GM plants have already reached that goal, which means that more than 800,000 tons of waste is diverted from landfills each year. Facilities achieve landfill-free status when all production waste or garbage is recycled, reused or converted to energy. At GM’s landfill-free plants, more than 95 percent of waste is recycled or reused, while 4 percent is converted to energy. Six GM plants in the United States use landfill-gas to fire boilers or generate electricity.

“A big part of being landfill-free is effective recycling,” claims Elizabeth Lowery, GM’s vice president for environment, energy and safety policy. “Not only does this intensive focus on recycling help the environment, it helps the company’s bottom line.”

For example, as a result of GM’s global recycling effort, scrap metal sales generated more than $1 billion in revenue in 2008. In addition to steel, the automaker recycled 17,000 tons of wood, 20,000 tons of cardboard and 4,000 tons of plastic.

Assemblers in the electrical equipment and appliances (61 percent) and computer and electronic products (55 percent) industries are also actively engaged in green programs. For instance, IBM Corp.’s facility in Poughkeepsie, NY, the recipient of ASSEMBLY’s 2008 Assembly Plant of the Year award, is a good example of a manufacturer that is committed to protecting the environment.

The 315,000 square foot high-end server plant serves as a pilot site for IBM’s new Green Sigma initiative, which is based on Six Sigma. The goal of Green Sigma is to apply principles of energy and water usage to lower environmental impact, increase efficiency and reduce costs.

Disassembly and remanufacturing play an important role in the day-to-day operations of IBM’s Poughkeepsie plant. During the last six years, the plant has reused more than 11 million parts. More than 1,450 high-end systems have been recovered, refurbished and reused, while more than 25,000 metric tons of metal have been recycled.

Large manufacturers (companies with 2,000 or more employees) are more likely to be involved with green initiatives. For example, 64 percent of assemblers in that category claim they have implemented sustainability programs at their plant during the last 12 months, compared to only 39 percent of small manufacturers (companies with fewer than 50 employees).

Survey Methodology

ASSEMBLY magazine would like to thank all the respondents who participated in its 14th annualState of the Professionsurvey. The survey was conducted online in March 2009 by Clear Seas Research (Troy, MI). All readers with e-mail addresses were contacted electronically and encouraged to click a special hot link to the online questionnaire.The charts and tables in this report highlight the major data gleaned from the survey responses. On some of the questions, the response rate does not equal 100 percent due to rounding or surveys that contained one or more unanswered questions. In cases where multiple responses were allowed, the total may exceed 100 percent.Special thanks to Erin Taylor, Vince Schneider and John Thomas for their assistance with online survey design, distribution and tabulation. For more information on this study, please contact thomasj@clearseasresearch.com or 248-786-1659.

How Industries Compare

TheState of the Professionsurvey classifies manufacturers into eight industry segments, based on the North American Industry Classification System (NAICS):Computer and electronic products:includes antennas, audiovisual equipment, automatic teller machines, clocks, computers and peripherals, connectors, digital cameras, flat-panel displays, laboratory instruments, loudspeakers, navigational instruments, printed circuit boards, process control instruments, railroad signaling equipment, satellites, semiconductors, smoke detectors, stereos, telephone apparatus, televisions, test and inspection equipment, transmitters, video recorders and watches.

Electrical equipment and appliances:includes batteries, flashlights, generators, household appliances, industrial controls, lamp bulbs, lighting fixtures and equipment, motors, switches and transformers.

Fabricated metal products:includes ammunition, cans and containers, cutlery, doors, fences, firearms, hand tools, hinges, ladders, locks, metal stampings, plumbing fixtures, prefabricated buildings, springs, valves and windows.

Furniture and fixtures:includes residential, retail and office furnishings, in addition to architectural millwork, cabinets, mattresses, shelving and window blinds.

Machinery manufacturing:includes agricultural equipment, construction equipment, conveyors, food processing machinery, lawn and garden equipment, machine tools, office machines, packaging machinery, photographic equipment, printing presses, power tools, pumps and compressors, refrigeration and heating equipment, textile machinery, vending machines and welding equipment.

Medical equipment, devices and instruments:includes medical diagnostic and monitoring equipment, in addition to cannulas, catheters, diagnostic test kits, dialysis aids, filters, inhalers, orthopedic implants, pumps, scalpels, stents, stethoscopes, surgical kits, syringes, tubes, valves and wheelchairs.

Plastics and rubber products:includes belts, bottles, floor coverings, hoses, packaging materials, pipes and fittings, plumbing fixtures and tires.

Transportation equipment:includes automobiles and automotive components, aerospace equipment, aircraft, boats, engines, motor homes, railroad locomotives and rolling stock, recreational vehicles, ships, trailers and trucks.

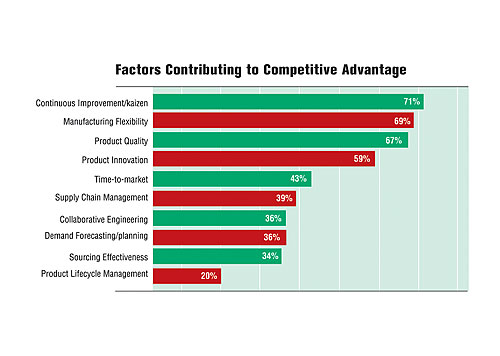

Survival Strategies Differ by Industry

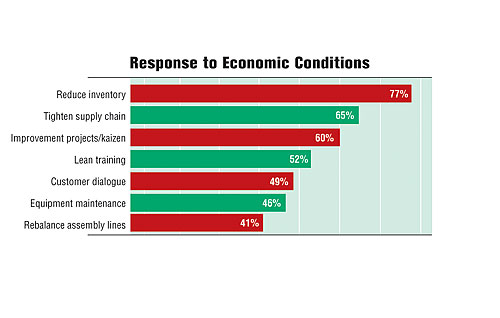

When the economy soured late last year, manufacturers reacted differently. More than three-fourths (77 percent) of the 2009State of the Professionsurvey respondents said they reduced inventory. Other popular strategies included tightening the supply chain (65 percent) and implementing improvement projects or holding kaizen events (60 percent). Assemblers have also increased lean training (52 percent), customer dialogue (49 percent), equipment maintenance (46 percent) and line rebalancing (41 percent).Inventory reduction is more prevalent in the transportation equipment industry (84 percent) and less critical in the computer and electronic products industry (69 percent). Transportation equipment manufacturers also prefer line rebalancing (58 percent), while equipment maintenance is more common in the fabricated metal products industry (56 percent).

On the other hand, customer dialogue is more popular in the plastics and rubber products industry (68 percent) than in the medical device industry (37 percent). Plastics and rubber product manufacturers are also more eager to conduct kaizen events (76 percent) than their peers in the machinery manufacturing industry (55 percent).

Large companies are more willing to reduce inventory or invest in lean training. For example, 66 percent of plants with 1,000 or more employees have engaged in training activity recently because of economic conditions. In contrast, only 45 percent of manufacturers with less than 100 employees have turned to lean lessons.

The Harsh Realities of a Slow Economy

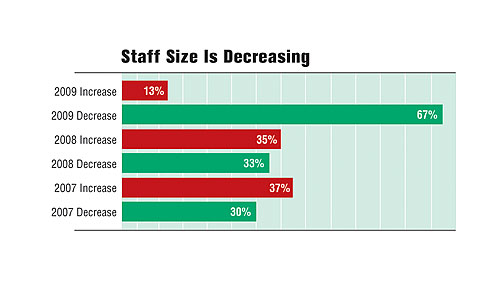

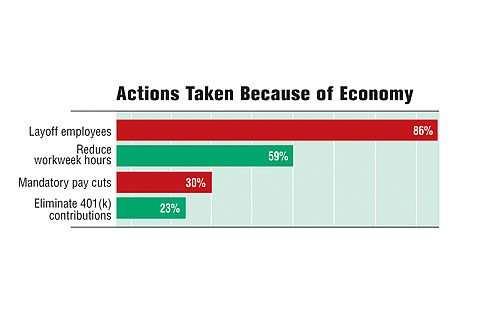

There have been many casualties of the recent economic collapse. Unfortunately, layoffs are often the first way companies react to sluggish sales and lack of demand. When the economy turned south late last year and early this year, more than three-fourths (86 percent) of 2009State of the Professionsurvey participants experienced the stress of layoffs. Other cost-cutting activities included reduced hours (59 percent), mandatory pay cuts (30 percent) and elimination of 401(k) contributions (23 percent).Industries that have been hardest hit by layoffs include plastics and rubber (91 percent), computer and electronic products (90 percent) and machinery manufacturing (88 percent). The medical device industry has been least affected, with only 77 percent of assemblers citing layoffs.

Assembly professionals in the Midwest have been the hardest hit, with 73 percent of respondents reporting reductions in the overall size of their assembly operations. The most stability is on the West Coast, where only 60 percent of assemblers claim they work in plants that have experienced headcount reductions.

Mandatory pay cuts have affected the medical device sector (41 percent) the most, while that action is less common in the electrical equipment and appliance industry (23 percent). Reductions in hours are more common in the furniture and fixtures industry (88 percent), which has been hard hit by the slump in housing and construction, and least common is the medical device field (41 percent).

Large manufacturers are more likely to mandate pay cuts. For instance, 40 percent of plants with 2,000 or more employees have cut wages within the last year because of the economy. By comparison, only 26 percent of manufacturers with less than 100 employees have slashed their payrolls.

However, large companies are less likely to eliminate 401(k) contributions. Only 19 percent of large manufacturers have taken that route vs. 25 percent of small firms.

If the poor economy continues, more manufacturers may be forced to suspend their employer 401(k) match to cut operating costs. According to Hewitt Associates (Lincolnshire, IL) companies can save millions of dollars by eliminating the practice for just one year.

“A typical large company can see savings of $25 million a year,” says Pam Hess, Hewitt’s director of retirement research. “The average midsized company can save more than $10 million, and the average small company can save nearly $2 million annually.

“Companies are making difficult decisions to keep their bottom line in the black, and the employer 401(k) match is one of the costliest retirement expenditures they sustain in a given year,” adds Hess. “Cutting this benefit to reduce costs is a much less drastic action than eliminating jobs or reducing salaries.”

Searchwww.assemblymag.comto find more State of the Professionstatistics, such as 2009 Salary Snapshot - Design Engineersand2009 Salary Snapshot - Manufacturing Engineers.