If there’s cause for concern, it’s that 26 percent of respondents will spend less in 2009 than they did in 2008. That compares with 23 percent in last year’s survey, and it’s the second highest percentage since the recession year of 2001, when 31 percent of respondents expected to spend less in the coming year.

Some historians say the Civil War was about more than the abolition of slavery. It was a conflict between two contrasting cultures: a predominantly industrial North and a largely agrarian South. Be that as it may, the South can hardly be characterized as an agrarian society today.

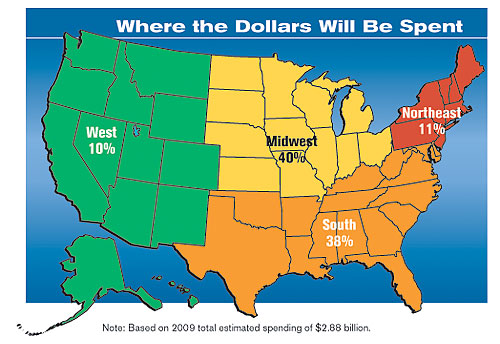

Indeed, if ASSEMBLY magazine’s 13th annual capital equipment spending survey is any indication, the South may soon eclipse the Midwest as the nation’s manufacturing center. While it’s true that 41 percent of all spending will occur in the Midwest-the 13th straight year that the nation’s heartland has outspent all other regions-the South is quickly closing the gap. In fact, for first time in our survey’s history, Southern manufacturers will spend more than $1 billion on capital equipment next year.

Specifically, Southern plants will lay out $1.09 billion on capital goods in 2009, or 38 percent more than in 2008. All totaled, Texas, Alabama and the 14 other states that make up this region will account for 38 percent of all spending on assembly technology in 2009. That compares with 28 percent in 2008 and 20 percent in 2007, and it’s a record high for the region.

The 2009 median budget for the region is $150,000. That’s twice the 2008 median, and it’s the highest figure of any region.

Of course, you scarcely need our survey to know that manufacturing is booming in the South. Just look at the headlines from the past few months:

Volkswagen will build a new assembly plant in Chattanooga, TN. VW will spend $1 billion on the new facility, which is scheduled to begin production in 2011. With an initial production capacity of 150,000 vehicles per year, the plant will employ 2,000 people. Additional jobs will be created by supplier and logistics operations.

The first shipment of manufacturing machinery for Kia Motor’s new assembly plant in West Point, GA, was delivered. The $1.2 billion facility will begin production late next year. At full capacity, it will be able to produce 300,000 vehicles annually and employ 2,500 people.

BMW supplier LSP Automotive Systems will spend $45 million to expand its plant in Greenville, SC. LSP will add 61 jobs and install a second assembly line.

Toyota Tsusho America Inc. will locate two new plants in northeast Mississippi to supply the new Toyota Motor Manufacturing facility under construction in Blue Springs, MS. The two operations will supply tire and wheel assemblies and employ approximately 70 people. The Toyota plant itself represents a $1.3 billion investment. It’s being built to assemble the Prius hybrid and could employ as many as 3,000 people.

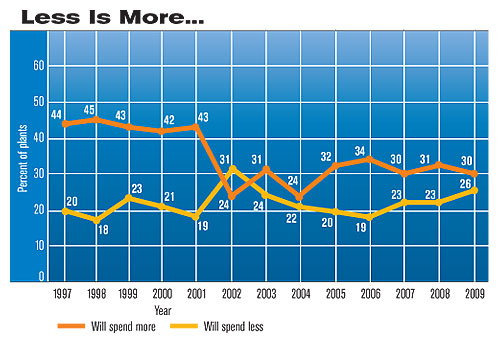

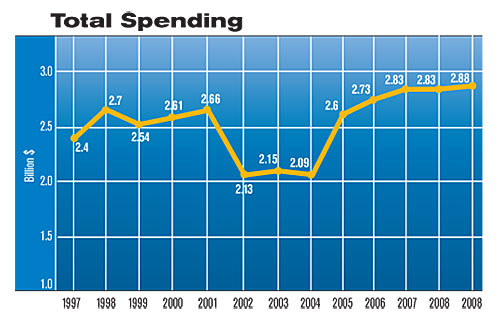

Such headlines would seem to belie gloomy economic forecasts, and while the results of our annual spending survey don’t exactly signal a boom in investment, they do indicate that the capital spending glass is half full, rather than half empty. According to our survey, U.S. assembly plants will spend $2.88 billion on new equipment in 2009, which is 2 percent more than what we projected for this year. Almost three-fourths of respondents will allocate at least as many dollars to assembly technology next year as they did this year. Specifically, 30 percent of respondents will spend more on assembly technology in 2009 than they did in 2008. That’s virtually the same as last year’s survey. In addition, 44 percent plan to spend about the same next year as this year.

If there’s cause for concern, it’s that 26 percent of respondents will spend less in 2009 than they did in 2008. That compares with 23 percent in last year’s survey, and it’s the second highest percentage since the recession year of 2001, when 31 percent of respondents expected to spend less in the coming year.

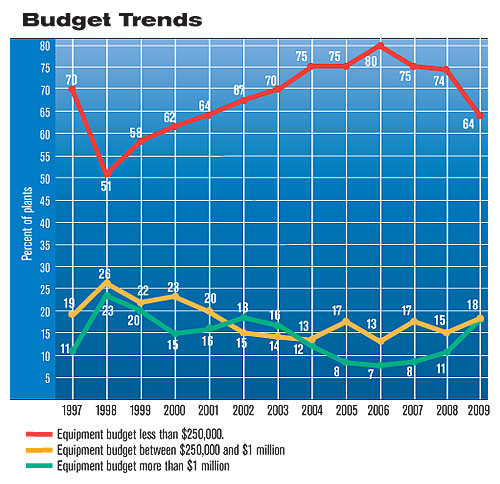

On their face, actual budget figures indicate a significant jump in spending next year. For example, 18 percent of respondents will spend more than $1 million on assembly technology in 2008. That compares with 11 percent in 2008 and 8 percent in 2007, and it’s the highest percentage since 1999.

However, it should be noted that our response rate from large facilities was higher than usual. Ordinarily, 16 percent of our respondents come from plants with at least 250 employees. This year, 30 percent of our respondents came from plants that large. As a result, our spending projection was adjusted downward to reflect a more typical distribution of plant sizes.

That said, there does appear to be a trend upward in spending. Some 28 percent of plants will spend between $100,000 and $500,000 on new equipment next year, which is exactly the same percentage as this year. At the same time, 46 percent of plants have capital budgets under $100,000 for 2009, compared with 54 percent of plants in 2008. In other words, fewer plants are on the lower end of the spending scale, and more plants are on the higher end.

The median equipment budget increased 33 percent, from $75,000 in 2008 to $100,000 in 2009. The average budget rose by 29 percent, from $690,361 in 2008 to $890,848 in 2009. Both the median and the average budget figures for 2009 are the highest since 2003.

Technology suppliers can take additional encouragement from assemblers’ motives for buying equipment, which indicate that assemblers are revamping their lines. For example, plants have more new products to assemble. Forty-one percent of assemblers will buy equipment next year to assemble a new product. That compares with 33 percent in 2008, and it’s the highest percentage since 2003. Similarly, 28 percent of assemblers are getting equipment to implement lean manufacturing. That’s the highest percentage in 5 years.

As usual, the No. 1 reason for buying equipment in 2009 is cost reduction. However, in what may be an indication that manufacturers are getting their costs under control, just 51 percent of respondents are purchasing equipment to reduce costs. In contrast, in 1997, the first year of our survey, 69 percent of respondents purchased equipment to cut costs.

Other reasons cited for buying equipment in 2009 include:

* replace old machinery, 45 percent.

* increase capacity, 44 percent.

* reduce cycle time, 33 percent.

* boost quality, 18 percent.

* improve safety, 16 percent.

The No. 1 target for cost reduction in 2009 remains direct labor. However, assemblers are growing more concerned about the cost of scrap and materials. Some 44 percent of plants will buy equipment to reduce the cost of scrap. That compares with 42 percent in 2008 and 37 percent in 2007. Similarly, 30 percent of assemblers are investing in technology to lower material costs. That’s the highest percentage in the history of our survey. Perhaps this is an indication of the growing value of components, such as sensors, microcomputers, lead-free materials and fuel cells, that go into even the most mundane products.

Other costs targeted by assemblers next year include:

* indirect labor, such as setup, maintenance and material handling, 44 percent.

* work-in-process inventory, 25 percent.

* warranty and field service, 14 percent.

Indeed, if ASSEMBLY magazine’s 13th annual capital equipment spending survey is any indication, the South may soon eclipse the Midwest as the nation’s manufacturing center. While it’s true that 41 percent of all spending will occur in the Midwest-the 13th straight year that the nation’s heartland has outspent all other regions-the South is quickly closing the gap. In fact, for first time in our survey’s history, Southern manufacturers will spend more than $1 billion on capital equipment next year.

Specifically, Southern plants will lay out $1.09 billion on capital goods in 2009, or 38 percent more than in 2008. All totaled, Texas, Alabama and the 14 other states that make up this region will account for 38 percent of all spending on assembly technology in 2009. That compares with 28 percent in 2008 and 20 percent in 2007, and it’s a record high for the region.

The 2009 median budget for the region is $150,000. That’s twice the 2008 median, and it’s the highest figure of any region.

Of course, you scarcely need our survey to know that manufacturing is booming in the South. Just look at the headlines from the past few months:

Volkswagen will build a new assembly plant in Chattanooga, TN. VW will spend $1 billion on the new facility, which is scheduled to begin production in 2011. With an initial production capacity of 150,000 vehicles per year, the plant will employ 2,000 people. Additional jobs will be created by supplier and logistics operations.

The first shipment of manufacturing machinery for Kia Motor’s new assembly plant in West Point, GA, was delivered. The $1.2 billion facility will begin production late next year. At full capacity, it will be able to produce 300,000 vehicles annually and employ 2,500 people.

BMW supplier LSP Automotive Systems will spend $45 million to expand its plant in Greenville, SC. LSP will add 61 jobs and install a second assembly line.

Toyota Tsusho America Inc. will locate two new plants in northeast Mississippi to supply the new Toyota Motor Manufacturing facility under construction in Blue Springs, MS. The two operations will supply tire and wheel assemblies and employ approximately 70 people. The Toyota plant itself represents a $1.3 billion investment. It’s being built to assemble the Prius hybrid and could employ as many as 3,000 people.

Such headlines would seem to belie gloomy economic forecasts, and while the results of our annual spending survey don’t exactly signal a boom in investment, they do indicate that the capital spending glass is half full, rather than half empty. According to our survey, U.S. assembly plants will spend $2.88 billion on new equipment in 2009, which is 2 percent more than what we projected for this year. Almost three-fourths of respondents will allocate at least as many dollars to assembly technology next year as they did this year. Specifically, 30 percent of respondents will spend more on assembly technology in 2009 than they did in 2008. That’s virtually the same as last year’s survey. In addition, 44 percent plan to spend about the same next year as this year.

If there’s cause for concern, it’s that 26 percent of respondents will spend less in 2009 than they did in 2008. That compares with 23 percent in last year’s survey, and it’s the second highest percentage since the recession year of 2001, when 31 percent of respondents expected to spend less in the coming year.

On their face, actual budget figures indicate a significant jump in spending next year. For example, 18 percent of respondents will spend more than $1 million on assembly technology in 2008. That compares with 11 percent in 2008 and 8 percent in 2007, and it’s the highest percentage since 1999.

However, it should be noted that our response rate from large facilities was higher than usual. Ordinarily, 16 percent of our respondents come from plants with at least 250 employees. This year, 30 percent of our respondents came from plants that large. As a result, our spending projection was adjusted downward to reflect a more typical distribution of plant sizes.

That said, there does appear to be a trend upward in spending. Some 28 percent of plants will spend between $100,000 and $500,000 on new equipment next year, which is exactly the same percentage as this year. At the same time, 46 percent of plants have capital budgets under $100,000 for 2009, compared with 54 percent of plants in 2008. In other words, fewer plants are on the lower end of the spending scale, and more plants are on the higher end.

The median equipment budget increased 33 percent, from $75,000 in 2008 to $100,000 in 2009. The average budget rose by 29 percent, from $690,361 in 2008 to $890,848 in 2009. Both the median and the average budget figures for 2009 are the highest since 2003.

Technology suppliers can take additional encouragement from assemblers’ motives for buying equipment, which indicate that assemblers are revamping their lines. For example, plants have more new products to assemble. Forty-one percent of assemblers will buy equipment next year to assemble a new product. That compares with 33 percent in 2008, and it’s the highest percentage since 2003. Similarly, 28 percent of assemblers are getting equipment to implement lean manufacturing. That’s the highest percentage in 5 years.

As usual, the No. 1 reason for buying equipment in 2009 is cost reduction. However, in what may be an indication that manufacturers are getting their costs under control, just 51 percent of respondents are purchasing equipment to reduce costs. In contrast, in 1997, the first year of our survey, 69 percent of respondents purchased equipment to cut costs.

Other reasons cited for buying equipment in 2009 include:

* replace old machinery, 45 percent.

* increase capacity, 44 percent.

* reduce cycle time, 33 percent.

* boost quality, 18 percent.

* improve safety, 16 percent.

The No. 1 target for cost reduction in 2009 remains direct labor. However, assemblers are growing more concerned about the cost of scrap and materials. Some 44 percent of plants will buy equipment to reduce the cost of scrap. That compares with 42 percent in 2008 and 37 percent in 2007. Similarly, 30 percent of assemblers are investing in technology to lower material costs. That’s the highest percentage in the history of our survey. Perhaps this is an indication of the growing value of components, such as sensors, microcomputers, lead-free materials and fuel cells, that go into even the most mundane products.

Other costs targeted by assemblers next year include:

* indirect labor, such as setup, maintenance and material handling, 44 percent.

* work-in-process inventory, 25 percent.

* warranty and field service, 14 percent.

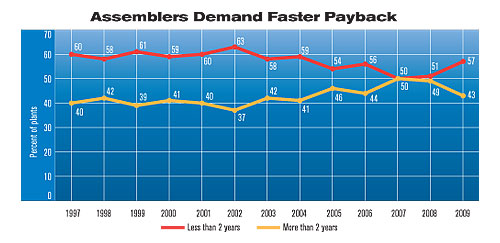

One sign that the credit crunch is already affecting assemblers can be seen in how quickly they expect to see a return on their equipment investments. Last year, half our respondents could wait 2 years or more to get payback on new technology. Today, only 43 percent can wait that long, the lowest percentage in 5 years.

Spending on assembly technology may have been flat this year, but at least assemblers spent most of what they planned. In August-when most of our surveys were completed-58 percent of our respondents had spent at least 70 percent of their 2008 equipment budgets. That’s still well below historic levels-84 percent of assemblers did so in 1998, for example-but it’s the biggest percentage in five years.

What Assemblers Want

For the first time in our survey, welding, brazing and soldering equipment will not be among the five most sought-after assembly technologies next year. Just 39 percent of assemblers will purchase such technology in 2009, compared with 54 percent in 2008 and a high of 60 percent in 2004. All totaled, spending on resistance welders, ultrasonic welders, brazing ovens and other technology will decrease 15 percent, from $288 million in 2008 to $244.6 million in 2009.Power tools have been the No. 1 item on assemblers’ wish lists for 10 of the past 12 years, and next year will be no exception. However, assemblers won’t spend quite as much on tools as they did this year. Fifty-seven percent of respondents will buy power tools in 2009, the same percentage as in 2008. But, total spending on pneumatic, electric and cordless screwdrivers and nutrunners will decrease 3 percent, from $226.3 million in 2008 to $219 million in 2009.

Spending on single-station assembly machines will continue to grow. In fact, 52 percent of plants will purchase single-station assembly machines in 2009, an all-time high percentage for this technology. Specifically, 30 percent of assemblers will purchase presses, 34 percent will get automatic screwdriving equipment, and 8 percent will buy impact riveters and orbital and radial forming machines. All totaled, our readers will spend $295.5 million on single-station assembly machines in 2009, a 20 percent increase from 2008.

Robots will be another growth technology in 2009. Twenty percent of assemblers plan to buy Cartesian, SCARA, six-axis or delta robots next year. That compares with 15 percent in 2008, and it’s the highest percentage for this technology since 2000. All totaled, spending on robots will add up to $135.1 million in 2009, a 19 percent increase from 2008.

Suppliers of conveyors and material handling equipment can also expect a good year. Thirty percent of respondents will purchase pallet-transfer conveyors, flow racks, automated guided vehicles and other technology next year, up from 26 percent in 2008. Material handling equipment will account for 5 percent of all spending in 2009, increasing from $101.8 million in 2008 to $130.5 million in 2009.

Systems integrators should see modest sales growth. Some 31 percent of plants will invest in multistation automated assembly systems next year, the highest percentage for this technology since 2001. If more plants are investing in assembly systems, there should be a concomitant rise in demand for parts feeders, and sure enough, 29 percent of assemblers plan to buy vibratory bowls, tray feeders and similar equipment next year, an increase of 4 percentage points from 2008. In all, $566.9 million will be spent on automated assembly systems next year, while $123.6 million will be spent on parts feeders, increases of 1 percent and 7 percent, respectively.

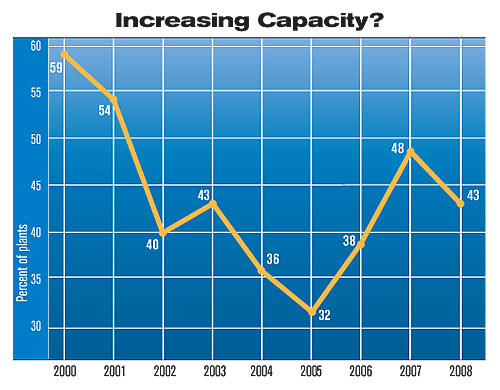

Greater demand for high-volume assembly equipment corresponds well with another trend from this year’s survey. For years, the number of high-volume assembly plants in the United States has dwindled, as OEMs moved such production overseas. Now however, there are signs that high-volume assembly is returning. In 2005, just 15 percent of respondents produced more than 1 million assemblies annually. Since then, that percentage has gradually increased, and in 2008, 20 percent of respondents say they’re high-volume manufacturers.

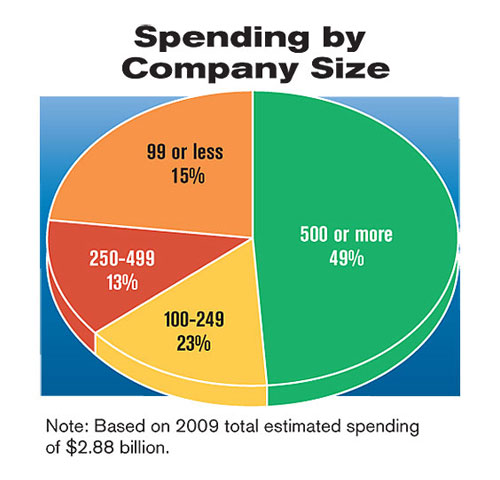

Plants with at least 500 employees will account for 49 percent of total spending next year. That’s twice the percentage in 2007, and it’s the highest percentage since 2004. However, it should be noted that we received an unusually high response rate from very large facilities this year.

Size Matters

The unusually high response rate from large plants skewed our results in favor of those facilities. However, even when we normalized the plant distribution to make our projections, we found that capital spending by smaller factories will diminish next year, while spending by large facilities will increase. Perhaps small plants are being more affected by the credit squeeze than large ones.Ordinarily, plants with fewer than 100 employees represent 65 percent of ASSEMBLY’s readership. However, such facilities will account for just 15 percent of total equipment spending in 2009, compared with 22 percent in 2008 and 31 percent in 2007. All totaled, plants with fewer than 100 employees will spend $432.3 million on assembly technology next year, or 31 percent less than what these plants spent in 2008.

Conversely, plants with more than 500 employees represent only 8 percent of ASSEMBLY’s readership. Yet these facilities will account for 49 percent of total equipment spending next year, compared with 33 percent in 2008 and 24 percent in 2007. For the first time since 2002, plants with more than 500 workers represent the majority of all assembly plants with million-dollar equipment budgets. Indeed, the 2009 median budget for our largest plants is $1 million-almost twice the 2008 median. In all, these plants will spend $1.41 billion on assembly technology in 2009, up 51 percent from 2008.

The spending forecast for midsized facilities is mixed. Plants with 251 to 500 employees will account for 13 percent of total spending in 2009. That compares with 28 percent in 2008, and it’s the lowest percentage for plants that size in the history of our survey. The median budget for these plants is $250,000, or half the 2008 median. All totaled, they will dish out $374.7 million on assembly technology next year, which is 53 percent less than what they spent in 2008.

At the same time, plants with 100 to 250 employees will represent 23 percent of total spending next year, compared with 17 percent in 2008. The median budget for this group is $200,000. That compares with $130,000 in 2008, and it’s the highest median for this group since 2002. All totaled, these plants will spend $374.7 million on assembly technology, which is 38 percent more than what they spent in 2008.

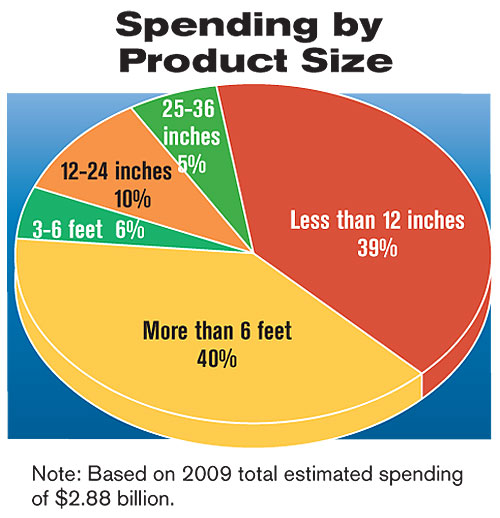

Manufacturers of large products-assemblies bigger than a 6-foot cube-will account for 40 percent of all equipment spending next year. That’s more than double the percentage from 13 years ago.

All Products Large and Small

For the first time, manufacturers of very large products will spend more on assembly technology than all other assemblers. In 1997, producers of assemblies that are bigger than a 6-foot cube accounted for just 11 percent of total spending. Since then, however, these manufacturers have gradually increased their share. In 2008, they represented 30 percent of total spending, and next year, they will account for 40 percent. That’s quite a feat considering that, on average, only 21 percent of ASSEMBLY’s readership manufactures such large products.Some 27 percent of large-product assemblers will spend more than $1 million on assembly technology next year. That compares with 18 percent for all U.S. plants, and it’s the highest percentage for this group in the history of our survey. The median budget for these manufacturers is $187,000. That compares with $75,000 in 2008, and it’s an all-time high for this group. All totaled, these manufacturers will increase spending on assembly technology by 36 percent, from $848.7 million in 2008 to $1.15 billion in 2009.

Compared with all U.S. plants, these manufacturers are not looking to assemble new products (32 percent vs. 42 percent for all plants), but they do need to cut costs (55 percent vs. 50 percent) and improve safety (23 percent vs. 16 percent). In addition, these manufacturers are much more likely to perform welding (79 percent vs. 55 percent), brazing (26 percent vs. 20 percent), and metal forming operations (78 percent vs. 56 percent). They are also more likely to use manual assembly methods (91 percent vs. 85 percent) and less likely to use fixed automation (20 percent vs. 24 percent).

Spending by manufacturers of small products will also increase significantly. Producers of assemblies that fit inside a 12-inch cube will account for 39 percent of all equipment spending next year, up from 34 percent in 2008.

Nineteen percent will spend at least $1 million on capital equipment next year, and the median budget is $150,000. Both figures are record highs for small-product assemblers. All totaled, these manufacturers will spend $1.12 billion on assembly technology in 2009, an increase of 17 percent from 2008.

Compared with all U.S. plants-and in stark contrast to large-product assemblers-manufacturers of small stuff need to assemble new products (52 percent vs. 42 percent for all plants) and boost capacity (51 percent vs. 46 percent), but they don’t need to improve safety (8 percent vs. 16 percent). These assemblers would rather bond parts (46 percent vs. 40 percent) or solder them (53 percent vs. 40 percent), than use threaded fasteners (51 percent vs. 59 percent). They’re also more likely to test their assemblies (76 percent vs. 68 percent) and package them (70 percent vs. 66 percent). They are less prone to use manual assembly methods (79 percent vs. 85 percent) and more apt to use fixed automation (31 percent vs. 24 percent).

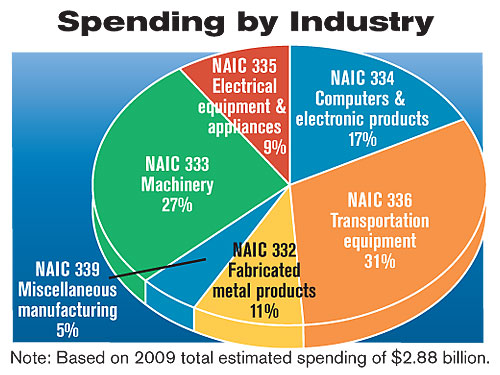

Despite the financial difficulties of the Big Three, assemblers of transportation equipment will account for 31 percent of overall equipment spending next year. That compares with 25 percent in 2008, and it’s the highest percentage for this industry in 13 years.

Transportation Equipment

If you only follow the trials and tribulations of the Big Three, you might conclude that capital spending by manufacturers of transportation equipment (NAIC 336) will decline next year. However, this industry encompasses much more than Ford, GM and Chrysler. It also includes manufacturers of military vehicles, planes, buses, motorcycles, trains, missiles, helicopters, boats and trucks, and these companies are doing just fine, thank you.In July, for example, Tiger Truck LLC opened a new assembly plant in Poteau, OK. The company invested $25 million to build the 150,000 square foot facility, which will employ 300 workers and produce 7,500 small, off-road trucks annually. That same month, 1,000 miles eastward, Rolls-Royce PLC began constructing a $100 million facility near Petersburg, VA, for assembling aircraft engines. The plant will employ 500 people within the next few years.

So it’s not too surprising that capital spending in NAIC 336 will increase 26 percent, from $707.2 million in 2008 to $893.4 million in 2009. That’s at least $100 million more than any other industry, and it represents 31 percent of total spending, an increase of six percentage points from 2008.

The 2009 median budget in this industry is $200,000. That’s twice the median for all U.S. plants, and it’s the highest figure for this industry since 2002.

Transportation equipment manufacturers are not only investing in equipment-they’re investing in people, too. One-third of plants in this industry employed more than 500 people in 2008. That compares with 25 percent in 2007, and it’s the largest percentage of any industry.

Many facilities in NAIC 336 are making new products next year. Fifty-eight percent of plants in this industry will buy equipment to assemble new products in 2009. That compares with 41 percent for all U.S. plants, and it’s the third straight year that the industry percentage has exceeded the national one.

Aging equipment is a continuing concern. Fifty-two percent of assemblers in NAIC 336 are buying new machinery to replace old or worn-out equipment. That’s the highest percentage of any industry, and it’s the third time in five years that transportation equipment manufacturers have held that distinction.

Despite the increased investment, assemblers in NAIC 336 believe they don’t need any additional capacity. Only 38 percent of plants are investing in equipment to boost capacity. That compares with 45 percent for all U.S. plants, and it’s the lowest percentage of any industry. In fact, NAIC 336 has held that distinction for nine of the past 13 years.

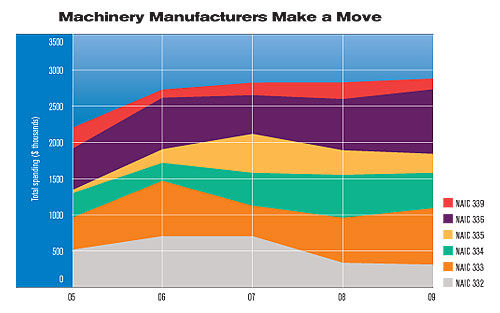

In 2007, machinery manufacturers (NAIC 333) accounted for just 15 percent of total equipment spending. Since then, the industry has gradually increased its share. Next year, assemblers of bulldozers, band saws and boring machines will represent 27 percent of spending.

Machinery Manufacturing

In October, Nordex USA Inc. announced that it will construct a new assembly plant for wind turbines in Jonesboro, AR. Nordex will invest $100 million in the new facility, which will employ 700 people. “The new plant...is a key pillar in our international strategy,” says Nordex CEO Thomas Richterich. “Our objective is to generate 20 percent of our revenues in the United States.”The Nordex facility is just one example of the continued growth in capital expenditures in the machinery manufacturing industry (NAIC 333). All totaled, assemblers of hay balers, bulldozers, band saws, vending machines, gun sights, air conditioners and ball joints will spend $778.1 million on new equipment next year. That’s 25 percent more than what the industry spent in 2008, and it’s the industry’s second straight year with a double-digit increase in capital spending.

Overall, NAIC 333 will account for 27 percent of all equipment spending in 2009. That compares with 22 percent in 2008, and it’s the most for this industry since 2006. The 2009 median budget for machinery makers is $100,000, which is twice the 2008 figure and the largest median since 1999. What’s more, 24 percent of plants in NAIC 333 will spend at least $1 million on assembly technology next year-the highest percentage for this industry in the history of our survey. In fact, 37 percent of all plants with million-dollar capital budgets are in NAIC 333.

Assemblers in this industry are less concerned about assembling new products than they are about replacing old or worn-out equipment. Only 36 percent of plants in NAIC 333 are buying equipment to assemble a new product. That compares with 41 percent for the nation as a whole, and it’s the 12th time in 13 years that this industry has been below the national percentage for assembling new products. Conversely, half the plants in this industry are looking to replace old equipment. That compares with 46 percent for all U.S. plants, and it’s the fifth straight year that this industry has outpaced the nation in that regard.

Spending on assembly technology will increase by a modest 2 percent next year.

Computers and Electronics

Demand for high-definition flat-panel televisions has boosted employment at Sony Corp.’s assembly plant in East Huntingdon, PA, from a low of 600 people in the summer of 2007 to 850 people today, and the plant now has five automated assembly lines instead of two.The picture wasn’t always so rosy. In early 2007, Sony management in Japan threatened to shutter the facility and shift production to Tijuana. However, plant managers persuaded them to assemble Sony’s new 52-inch model at the facility. The plant’s investment in automation was the deciding factor, because it made the facility more cost-competitive.

Unfortunately, the Sony facility seems to be the exception, not the rule among assemblers of televisions, computers and other electronic products (NAIC 334). The industry will spend $489.9 million on assembly technology in 2009-18 percent less than 2008 outlays. All totaled, assemblers of clocks, disk drives, telephones, radar equipment, thermostats, microchips and other electronic products will account for 17 percent of all capital spending next year, compared with 22 percent for 2008.

The median budget in this industry is $100,000, which is virtually the same as the 2008 figure of $95,000.

Twenty-eight percent of plants will spend less in 2009 than they did in 2008. That’s slightly more than the 26 percent for the nation as a whole, and it marks the third straight year that the industry has outpaced the nation in that ratio. Similarly, 28 percent of plants in NAIC 334 will spend more next year than they did this year. That’s slightly less than the 30 percent for all U.S. plants.

Getting new products to market is an imperative in this industry. Indeed, half of all plants in NAIC 334 will buy equipment to assemble a new product. That compares with 41 percent for all U.S. plants, and it’s the sixth consecutive year that this industry has outpaced the nation in this percentage.

For the third straight year, the percentage of plants with equipment budgets over $1 million has increased.

Fabricated Metal Products

In August, Sherwood Valve LLC closed its assembly plant in Niagara Falls, NY, and shifted the work done there to facilities in Cleveland and Washington, PA. The Niagara Falls facility made a variety of metal valves for industrial and medical applications.The consolidation at Sherwood Valve is emblematic of a broader trend throughout the fabricated metal products industry (NAIC 332). For the third consecutive year, manufacturers of windows, cans, tools, springs, bearings, guns and other products will decrease spending on assembly technology. Specifically, plants in NAIC 332 will spend $317 million on new equipment next year. That’s 7 percent less than what they spent in 2008, and it’s less than half what the industry spent just 2 years ago. All totaled, NAIC 332 will represent 12 percent of total spending-the lowest percentage for this industry since 2002.

Although 16 percent of plants in this industry will spend more than $1 million on assembly technology in 2009-a higher percentage than three other industries-66 percent will spend less than $250,000. As a result, the median budget for this industry is just $75,000, the lowest figure of any industry.

Safety is a major concern in this industry. Some 21 percent of plants will buy equipment next year to improve safety. That’s 5 percentage points more than for all U.S. plants, and it’s twice the percentage for transportation equipment manufacturers.

In an encouraging sign for the economy, plants appear to have more new products to assemble. Forty-one percent of assemblers will buy equipment next year to assemble a new product. That compares with 33 percent in 2008, and it’s the highest percentage since 2003.

Electrical Equipment and Appliances

In October, Whirlpool Corp. announced that it will cut 5,000 jobs by the end of 2009 due to the global credit crisis and low demand for appliances in North America and Europe. Most of the cuts will come from closing assembly plants in LaVergne, TN, Jackson, TN, Oxford, MS, Puebla, Mexico, and Reynosa, Mexico.The nation’s largest appliance maker is hardly alone. Indeed, slumping home sales and rising material costs have led to a dramatic decline in capital spending among manufacturers of electrical equipment and appliances (NAIC 335). Collectively, assemblers of lamps, refrigerators, mixers, electric motors, batteries and other products will spend $259.4 million on capital equipment in 2009. That’s 24 percent less than the industry spent in 2008, and it’s less than half what the industry spent in 2007. As a group, NAIC 335 will represent just 9 percent of all spending on assembly technology in 2009, down three percentage points from its 2008 share.

The median budget in NAIC 335 is $100,000, the same as the past 2 years. However, only 5 percent of all plants with million-dollar capital budgets in 2009 are appliance assemblers. That compares with 9 percent in 2008 and 27 percent in 2007.

Not only will appliance manufacturers spend less in the coming year, but they didn’t spend as much as they planned this year. Twenty-four percent of appliance assemblers spent less than 40 percent of their 2008 capital budget, compared with 16 percent for all U.S. plants.

Quality continues to be a major concern. Twenty-three percent of assemblers in NAIC 335 will buy equipment next year to improve the quality of their products. That’s the highest percentage of any industry, and it’s the fifth time in the past six years that this industry has held that distinction.

One sign that the credit crunch is already affecting assemblers can be seen in how quickly they expect to see a return on their equipment investments. Only 43 percent of respondents can wait two years or more to get payback on new technology. That’s the lowest percentage in five years.

Miscellaneous Manufacturing

In October, ACIST Medical Systems opened a new headquarters and assembly plant in Eden Prairie, MN. The 75,000 square foot facility will manufacture equipment for injecting contrast media into blood vessels for diagnostic imaging procedures. The company expects to spend $120 million over the next three years to develop and manufacture a string of new products.As welcome as that news is, it may not necessarily be the norm next year among companies classified under Miscellaneous Manufacturing (NAIC 339). According to the NAIC system, ACIST and other medical and dental device manufacturers are classified under NAIC 339. Although this category also includes assemblers of sporting goods, jewelry, toys, pens, mops, musical instruments and caskets, companies like ACIST represent the lion’s share of capital investment by this industry.

But, while medical device manufacturing is typically considered a bright spot in the U.S. economy, that notion isn’t reflected in the data from this year’s survey. In fact, after two straight years of growth in capital spending, NAIC 339 will take a step back in 2009. As a group, NAIC 339 will spend $144.2 million on assembly technology in 2009. That’s a 36 percent decrease from 2008, and it’s the lowest total for the industry since 2006. After accounting for 8 percent of total spending in 2008, NAIC 339 will claim just 5 percent in 2009.

In 2008, 22 percent of plants in NAIC 339 spent more than $1 million for assembly technology. In 2009, only 11 percent will do so. Fortunately, however, it appears that the million-dollar spenders from 2008 won’t be cutting too drastically, and some plants on the lower end of the spending scale in 2008 will be spending a bit more. In 2008, 9 percent of plants in NAIC 339 spent between $250,000 and $1 million, and 69 percent spent less than $250,000. Next year, 26 percent will spend between $250,000 and $1 million, and 63 percent will spend less than $250,000. The median budget for this industry next year is $100,000, which is the same as 2008.

Our survey also provides evidence that the decrease in spending actually began this year. More than half-54 percent-of assemblers in NAIC 339 spent less than 70 percent of their 2008 capital budgets. That compares with 42 percent for all U.S. plants, and it’s the highest percentage of any industry.

On the other hand, one reason for optimism is that manufacturers in this industry need additional capacity. Fifty-six percent of assemblers in NAIC 339 are investing in equipment to boost production volume. That’s compares with 45 percent for the nation as a whole, and it’s the highest percentage of any industry this year. In fact, NAIC 339 has exceeded the national percentage for increasing capacity for five straight years.

Less than 10 percent of all plants with equipment budgets of $1 million or more are located in the Northeast. That’s the lowest percentage for this region since 2006.

Spending Falls in the Northeast

In August, contract manufacturer Plexus Corp. announced that it will close its assembly plant in Ayer, MA. Two months later, another electronics manufacturing service provider, ACT Electronics Inc., announced that it will close its assembly plant in Hudson, MA. Combined, the two closures will result in the loss of 200 jobs.The closures are an indication not just of tough times for Bay State assemblers, but for all Northeast manufacturers. Indeed, just two years ago, Northeast assembly plants were investing heavily in capital equipment, accounting for nearly a quarter of all U.S. spending on assembly technology. Next year, however, the Northeast will represent just 11 percent of total spending.

All totaled, manufacturers in Massachusetts, Pennsylvania, New York and the six other Northeastern states will spend $317 million on new equipment in 2009-20 percent less than the 2008 total and half the 2006 total.

Compared with the nation as a whole, the Northeast will post a lower percentage of facilities planning to spend more next year than they did this year. In fact, that’s been the case for eight years in a row.

Actual budget figures bear this out. Only 14 percent of Northeastern plants will spend $250,000 to $1 million on assembly technology in 2009, compared with 18 percent of all U.S. plants. At the same time, 62 percent of Northeastern plants will spend less than $250,000 next year, compared with 57 percent of all U.S. plants. The median budget figure for Northeastern facilities is $65,000, which is slightly more than the 2008 median of $50,000.

Are assemblers fleeing the Western states? After accounting for as much as a quarter of total equipment spending in 2004, the West will represent just 10 percent of all spending next year.

The Midwest Stays Ahead

Outside of Michigan, the manufacturing picture in the Midwest is actually not too bad. Last month, for example, Bombardier Aerospace announced that it will install a new assembly line at its plant in Wichita, KS. The facility, which already produces three other Learjet models and employs 3,100 people, is gearing up to build the Learjet 85. To staff the new line, Bombardier is expected to hire 500 to 700 additional people over the next two years. Further north, in Mount Pleasant, WI, Ruud Lighting Inc. began producing LED streetlights on a new, robotic assembly line. Ruud already has orders for more than 16,000 of the new lights, and sales have been soaring since the product was introduced.Our survey results also show signs of optimism. For example, 32 percent of Midwestern plants expect to spend more on equipment in 2009 than they did in 2008. It’s the fifth straight year in which at least 30 percent of Midwestern plants have said they’ll spend more from one year to the next. No other region can claim such a streak over the same time period.

The median budget for Midwestern plants jumped from $75,000 in 2008 to $100,000 in 2009, and 43 percent of all U.S. plants with million-dollar capital budgets reside in the Midwest.

Nevertheless, there’s little doubt that the declining fortunes of the Big Three will have an affect on capital spending in the Midwest. After four consecutive years of increases, capital investment in the Midwest will contract a bit next year. Collectively, Indiana, Minnesota, Ohio and the nine other states that make up this region will spend more than $1.18 billion on assembly technology in 2009, a 3 percent decrease from the $1.21 billion spent in 2008.

Thanks to an influx of investment from Asian carmakers, the South will account for 38 percent of total equipment spending in 2009. That’s the highest share for this region in the history of our survey.

Spending Slips in the West

Rising oil prices have spurred demand for alternative energy, and manufacturers across the United States, particularly in the West, are rising to meet the challenge. In July, for example, Ausra Inc. opened a new assembly plant in Las Vegas. The 130,000 square foot facility will make reflectors, absorber tubes and other components for utility-scale solar thermal power installations. In September, Sanyo Electric announced that it will construct an $80 million factory in Salem, OR, to produce silicon wafers for solar cells. And, in October, Solar World opened a new solar cell assembly plant in Hillsboro, OR.That’s good news for the West, where manufacturers have decreased spending on capital equipment for the past five years. In 2004, California, Utah, New Mexico and the 10 other states that make up the West region accounted for more than a quarter of all spending on assembly technology in the United States. Since then, however, the West’s share of total spending has steadily decreased, and next year will be no exception.

All totaled, the West will spend $288.2 million on assembly technology, a 32 percent decrease from what the region’s manufacturers spent in 2008. That’s the lowest total since 1999, and it represents just 10 percent of all U.S. spending.

Only 27 percent of assemblers in the West will spend more on assembly technology next year than they did this year. That’s three points lower than the percentage for all U.S. plants, and it’s the first time since 1997 that the West has not posted a higher percentage of budget boosters than the nation as a whole.

Budget figures confirm those plans. While 18 percent of all U.S. plants will spend more than $1 million on assembly technology in 2009, only 11 percent of Western plants will. Similarly, 57 percent of all U.S. plants will spend less than $250,000 next year, but 68 percent of Western plants will. The median budget figure for Western facilities is $50,000, which is the same figure as in 2008.