When history books are written some day in the future, 2009 will be remembered as the year of the great recessionandthe year of the battery.

Back in January, automakers unveiled a plethora of electric vehicles at the North American International Auto Show in Detroit. Since then, the Obama administration’s economic stimulus program has dangled millions of dollars to entice manufacturers to create a lithium-ion battery manufacturing infrastructure in the United States.

In March, President Obama announced that $2.4 billion would be earmarked to help American manufacturers create advanced battery components that will propel a new generation of hybrid and all-electric vehicles. More than 100 companies scrambled to participate in the Electric Drive Battery and Component Manufacturing Initiative, which is divided into seven different categories.

The biggest portion of funds will be allocated for mass-producing battery cells and battery packs. The projects are expected to create thousands of new jobs and will be funded by the American Recovery and Reinvestment Act of 2009.

Starting next year, Nissan will be mass-producing an all-electric vehicle that features a 24-kilowatt-hour battery mounted under the floor.

Bold Initiative

Last month, the U.S. Department of Energy selected seven lithium-ion battery manufacturers that will each receive grants of more than $95 million. It marks the single largest investment in advanced battery technology for electric vehicles ever. According to President Obama, the goal of the ambitious project is to “help lower the cost of battery packs, batteries and electric propulsion systems, enabling manufacturers to establish a thriving domestic electric vehicle industry.”In recent months, numerous companies have been jockeying for position and announcing plans to build state-of-the-art battery assembly lines. For instance, a consortium of battery manufacturers and suppliers has joined forces with Argonne National Laboratory to form the National Alliance for Advanced Transportation Battery Cell Manufacture (NAATBatt). It plans to build a $600 million manufacturing and prototype development center in Glendale, KY.

“The Alliance hopes to level the playing field,” says Ralph Brodd, a battery consultant based in Henderson, NV. In the not-too-distant future, he believes that batteries will be to green cars what semiconductors were to personal computers three decades ago. “Other countries are investing heavily in the manufacture of lithium-ion cells,” Brodd points out. “Those countries understand that whoever makes the batteries will one day make the cars.”

A123 Systems Inc. plans to build several world-class lithium-ion battery manufacturing facilities in the United States. Its first assembly plant will be located in Livonia, MI, to serve Detroit area customers such as Chrysler LLC.

To supply the much-anticipated Chevy Volt, General Motors Corp. (GM) plans to become the first automaker to assemble lithium-ion battery packs in the United States. “That will allow them to get more control over the manufacturing process,” says Brodd. “For instance, GM can insert proprietary electronic controls in the batteries.” The 160,000-square-foot plant in Brownstown Township, MI, will ramp up production in 2010 using cells supplied by LG Chem Ltd. and its local subsidiary, Compact Power Inc.

Johnson Controls-Saft Advanced Power Solutions LLC is building an assembly line in Holland, MI, that will supply a new plug-in electric vehicle that Ford Motor Co. will be launching in 2012. The 115,000-square-foot facility will be capable of producing 15 million lithium-ion cells annually.

Nissan Motor Co. is investing billions of dollars to become the No. 1 mass-producer of electric vehicles. It plans to offer three vehicles in three different market segments by 2013, starting with a medium-sized hatchback next year. After it ramps up production, the automaker expects to build up to 400,000 electric vehicles annually.

As part of its ambitious plan, Nissan is building a lithium-ion battery plant and an electric vehicle assembly line at its 26-year-old manufacturing complex in Smyrna, TN, in addition to new battery plants in England and Portugal. Automotive Energy Supply Corp., a joint-venture between Nissan and NEC Corp., recently began assembling advanced lithium-ion batteries in Japan.

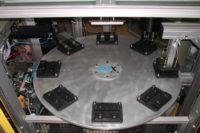

Bi cell assembly equipment prepares anode and cathode subassemblies. Alternating anode-cathode layers are prepared allowing 100 percent inspection of each subassembly before final assembly in a stack winder.

Born in the USA

Ironically, lithium-ion battery technology was developed in the United States several decades ago by John Goodenough, a professor of mechanical engineering at the University of Texas. However, until recently, most commercially available products have been manufactured in Asia by companies such as Panasonic Corp. and Sanyo Electric Co.American manufacturers concentrated their efforts on alkaline and lead-acid battery production. But, the industry has now shifted its focus to lithium-ion and other rechargeable technologies that transformed the consumer electronics industry.

Lithium-ion batteries are today’s hot technology in the auto industry. Because lithium is lighter than nickel-based alternatives, lithium-ion cells reduce battery weight and volume by more than 30 percent.

“Batteries are the most important part of the electric drivetrain, but they haven’t been exhaustively studied in the automotive world because of their limited role in gas-powered vehicles,” says Ann Marie Sastry, codirector of the Advanced Battery Coalition for Drivetrains (ABCD), a new R&D facility in Ann Arbor, MI, that was recently created by GM and the University of Michigan. “Our shared ambition is to see electrified drivetrains in a large number of vehicle types and applications. That means we need to reduce the design cycle in both time and cost.”

“The replacement of nickel-metal hydride batteries with lithium-ion enhances energy density two to three times, which [is] ideal to drive electric vehicles,” adds Anjan Kumar, a senior research analyst at Frost & Sullivan Inc. “The key challenges [facing the industry are] achieving economies of scale and standardization.”

But, lithium-ion batteries are an expensive stumbling block to full-scale green car production. “The challenge [facing the auto industry is] to reduce both manufacturing and packaging costs,” says Kumar.

If American manufacturers capture a piece of the lucrative lithium-ion battery business, they will need to invest heavily in automated assembly lines. Brodd, who has visited several battery manufacturing plants overseas, says they are all highly automated. “If you don’t use robotics and other automation technology, you can’t compete,” he warns.

Lithium-ion batteries are today's hot technology in the auto industry.

Assembly Challenges

Lithium-ion batteries use a different type of assembly process than traditional lead-acid automotive batteries. “Among other things, they require more prismatic elements, different cell structures, and flat plates to ensure uniform current distribution and dissipation,” Brodd points out. In addition, lithium-ion batteries are more sensitive to defects and require more quality checks than other types of batteries.Traditionally, lithium-ion batteries have been expensive to produce. One reason is that lithium deposits are only found in a few parts of the world, such as Argentina, Bolivia, Chile and China. The battery cells also contain an anode of graphitic carbon and a cathode of layered metal oxide.

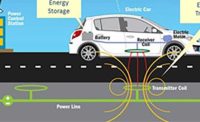

In addition, lithium-ion battery packs need to be managed electronically to ensure safe, reliable, long-term operation. For instance, they depend on an elaborate battery monitoring system that ensures optimum interaction of cells.

The current inside lithium-ion batteries is not conducted via traditional cables, but along copper bus bars that must be welded together. Bus bars allow the positive and negative electrodes used in prismatic batteries to be connected in parallel.

Lithium-ion batteries are assembled in dry rooms. “Because you need to keep moisture out of the production process, humidity and static electricity must be tightly controlled,” says Rick Blake, president of Edgewater Automation LLC, a systems integrator that supplies several battery manufacturers. “Automation lowers production cost, improves product quality and consistency, and removes people from potentially hazardous tasks.”

“There’s a tremendous amount of concern with safety and contamination issues in the industry,” adds John Dispennette, director of North America technical sales for KEMET Corp., a leading manufacturer of electrolytic capacitors. “Speed is also important for automotive applications, because up to 100 layers need to be stacked to create one individual cell. Precise alignment and tight tolerances are essential.” Once they are assembled, cells are placed in battery packs, which contain electronics, controls and interconnections.

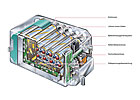

“The precision and purity needed for the battery manufacturing process presents a fairly unique set of challenges,” says Casey Butler, project manager at EnerDel Inc., which recently opened America’s first commercial-scale production line for lithium-ion automotive battery packs. The state-of-the-art assembly plant in Noblesville, IN, uses fully automated equipment to mass-produce a wide variety of prismatic batteries, which are ideal for automotive applications.

EnerDel produces its cells at a separate facility located a few miles away in Indianapolis. Key steps in the assembly process include a mixing room, where a proprietary chemical slurry is mixed and turned into a black paste. The paste is then coated onto thin aluminum and copper foils that go through a coating machine where they bake at 100 C.

The largest and most important piece of equipment in the lithium-ion battery manufacturing process is the coating machine, a 25-meter long machine similar to a pizza oven. EnerDel recently installed its first production-size machine, in addition to two machines for R&D activities, at its Indianapolis plant.

The electrodes are cut by machine into very thin sheets and dried in a clean room to reduce moisture absorption. “Any stray particles left on the electrodes could lead to a battery short circuit, so the process is carried out in a very low-humidity clean room,” explains Butler.

Robots then stack anodes, cathodes and separators. The finished stacks are placed into metallic pouches that are hermetically sealed on all edges, except for a filling spout at the top. A machine fills the pouches with electrolyte, a clear, gooey liquid that activates the battery cells.

Finished cells sit for several days in an aging room. Afterwards, they are charged and discharged repeatedly over a 24-hour period in a process called formation.

The finished cells are shipped to EnerDel’s new Noblesville facility, where robots stack them into modules, subpacks and battery packs. Assemblers install hardware and software that allow the finished batteries to communicate with electric motors, navigation systems and other onboard devices. EnerDel’s battery packs vary greatly in energy capacity, ranging from 18 to 60 kilowatt hours.

Battery pack assembly at EnerDel is fully automated. Robots stack 24 cells into modules, and then into subpacks, which are about the size of two traditional lead-acid car batteries next to each other. The subpacks then go into a final, customizable casing, which, depending on the energy requirement for the battery pack, could contain 200 to 400 cells and weigh up to 600 pounds.

Winding machines roll positive and negative electrodes and the separator together.

Hungry for Automation

EnerDel’s use of automation allows it to compete with Asian battery makers that traditionally rely on cheap labor. As more American manufacturers ramp up production, robotics, ultrasonic welders, laser welders, adhesive dispensers, leak testers, sealers, coaters, winders, conveyors, and other types of automated equipment will play a key role in addressing productivity challenges and throughput issues.

“We are seeing more interest from battery manufacturers,” says Tim Frech, senior engineer at the Edison Welding Institute (EWI). “Intra-cell efforts are geared toward higher energy density and thermal management of the cells. Cell pack or inter-cell assembly is also of interest, since joint reliability and vibration resistance are critical.”

Battery manufacturers typically weld parts, such as copper and aluminum tabs, using overlap or butt joints. “The challenges come from the dissimilar metals, or in some cases, metal-plastic or metal-ceramic joints,” explains Frech. “Also, thin foils require high welding speeds and specialized fixtures.

“Pouch battery tabs can be a challenge when assembling bus bars,” Frech points out. “The thin foil, [which is often 0.003 inch or less thick], is sometimes difficult to position reliably. Also, there is usually a 1-to-10 thickness difference with respect to tab and bus, which makes joining a challenge.

“Finally, aluminum and copper are not normally considered soluble with one another,” adds Frech. “In fact, they will form a brittle weld when fusion welded. For this reason, solid-state welding processes, especially ultrasonic metal welding and resistance spot welding, are used for tab interconnections.”

Ultrasonic welding allows battery manufacturers to join plated metals and metal combinations that are not fusion-weldable, such as copper to aluminum. “Larger-area welds are formed with ultrasonic spot welds, and this provides benefits in terms of strength and current-carrying capacity,” claims Frech.

However, recent EWI research has proven that high-speed laser welding can be used to join thin tabs of copper and aluminum. “Advantages of using laser welding to assemble batteries include speed and low cost per weld,” says Frech. “[In addition], the ability to weld close to thermally sensitive components, and tailoring of the weld into spots, seams and special shapes, are key advantages.”

Robotics technology also plays a key role in automating lithium-ion battery assembly. Because automotive battery packs often weigh hundreds of pounds, robots are ideal for material handling applications, such as end-of-the-line palletizing, in addition to the repetitive process of assembling cell stacks.

“There are very few assembly or material handling operations that are not being investigated as candidates for a robotic application,” claims Blake. “Typically, we receive requests for robots to feed and orient parts, apply adhesives, drive fasteners, and perform ultrasonic or resistance welds.”

Battery manufacturers are investing in robots to address productivity, quality and safety issues. “There’s a tremendous need for flexibility in the industry, because there’s a lot of variability,” says Dan McGillis, global business development manager at ABB Inc.

For instance, 10 to 15 cells would comprise a small battery module, while 70 to 120 cells would be considered a large module. And, there can be anywhere from five to 20 modules per battery pack. Every battery assembly line is different, so manufacturers use different numbers of robots on the plant floor.

Another automation challenge is the fact that there are no common architectures. “Because everyone has their own proprietary lithium-ion battery designs, there’s no standard for components such as bus bars,” explains McGillis. “Some designs are very basic, while others are more complex. Several agencies and consortiums are working diligently to arrive at some standards for the industry. There definitely is a need for [that]. However, this might be quite a challenge until the market decides who the winners and losers in the battery OEM community will be.

“From a safety point of view, there are applications where [humans] should not be exposed to the power, current and amperage,” McGillis points out. “In other areas, people cannot meet the high-speed requirements of [lithium-ion battery assembly], which sometimes approaches thousands of cycles per hour.

“Some [lithium-ion battery] designs require a level of assembly repeatability that cannot be met by manpower consistently,” adds McGillis. “Another key element is the error-proofing capability that robots offer for all the different build recipes present in battery modules and packs.”

According to McGillis, precision part loading, bus bar assembly, bus bar connection, and pack handling are some key applications for robots. “At this point, the battery assembly market is open for a variety of robotic configurations,” he explains.

“Speed is of great importance at the beginning of the process, so delta robots [are popular] for their high speed, high repeatability and low noise,” says McGillis. “As the battery module is assembled, the speed of the line slows and the weight increases. At this point, we see a greater use of pedestal six-axis robots.

“Robots are ideally suited to meet the needs of the emerging battery assembly market,” claims McGillis. “[However], one challenge will be to find ways to accommodate the existing battery cell designs through use of adaptive technologies, such as vision and force control.”

Lithium-ion battery manufacturers typically use modular conveyors to assemble both cells and packs. “While the general automation industry has seen a trend to one common conveying platform, this is difficult for battery manufacturing simply due to the progressive payloads, which will start light for a cell and end up very heavy for a pack,” says Mark Dinges, product manager for TS conveyors at Bosch Rexroth Corp.

“Because automotive batteries represent an emerging technology with tremendous growth potential, any conveyor design must include provisions for system expansions and modifications,” adds Dinges. “As with any new or emerging technology, [lithium-ion] battery manufacturers are working to improve the entire assembly process.

“Whether the goal is higher throughput, improved quality or lower cycle time, it’s critical that the assembly conveyor is flexible and can adapt to the demands of this growing industry,” Dinges points out. Due to the heavy payload requirements of automotive batteries, the two conveyor styles suited best for these applications are powered rollers and power-and-free roller chains, with filler blocks between the rollers.

To learn more about battery trends and technology, search www.assemblymag.com for these articles:

“We are seeing more interest from battery manufacturers,” says Tim Frech, senior engineer at the Edison Welding Institute (EWI). “Intra-cell efforts are geared toward higher energy density and thermal management of the cells. Cell pack or inter-cell assembly is also of interest, since joint reliability and vibration resistance are critical.”

Battery manufacturers typically weld parts, such as copper and aluminum tabs, using overlap or butt joints. “The challenges come from the dissimilar metals, or in some cases, metal-plastic or metal-ceramic joints,” explains Frech. “Also, thin foils require high welding speeds and specialized fixtures.

“Pouch battery tabs can be a challenge when assembling bus bars,” Frech points out. “The thin foil, [which is often 0.003 inch or less thick], is sometimes difficult to position reliably. Also, there is usually a 1-to-10 thickness difference with respect to tab and bus, which makes joining a challenge.

“Finally, aluminum and copper are not normally considered soluble with one another,” adds Frech. “In fact, they will form a brittle weld when fusion welded. For this reason, solid-state welding processes, especially ultrasonic metal welding and resistance spot welding, are used for tab interconnections.”

Ultrasonic welding allows battery manufacturers to join plated metals and metal combinations that are not fusion-weldable, such as copper to aluminum. “Larger-area welds are formed with ultrasonic spot welds, and this provides benefits in terms of strength and current-carrying capacity,” claims Frech.

However, recent EWI research has proven that high-speed laser welding can be used to join thin tabs of copper and aluminum. “Advantages of using laser welding to assemble batteries include speed and low cost per weld,” says Frech. “[In addition], the ability to weld close to thermally sensitive components, and tailoring of the weld into spots, seams and special shapes, are key advantages.”

Robotics technology also plays a key role in automating lithium-ion battery assembly. Because automotive battery packs often weigh hundreds of pounds, robots are ideal for material handling applications, such as end-of-the-line palletizing, in addition to the repetitive process of assembling cell stacks.

“There are very few assembly or material handling operations that are not being investigated as candidates for a robotic application,” claims Blake. “Typically, we receive requests for robots to feed and orient parts, apply adhesives, drive fasteners, and perform ultrasonic or resistance welds.”

Battery manufacturers are investing in robots to address productivity, quality and safety issues. “There’s a tremendous need for flexibility in the industry, because there’s a lot of variability,” says Dan McGillis, global business development manager at ABB Inc.

For instance, 10 to 15 cells would comprise a small battery module, while 70 to 120 cells would be considered a large module. And, there can be anywhere from five to 20 modules per battery pack. Every battery assembly line is different, so manufacturers use different numbers of robots on the plant floor.

Another automation challenge is the fact that there are no common architectures. “Because everyone has their own proprietary lithium-ion battery designs, there’s no standard for components such as bus bars,” explains McGillis. “Some designs are very basic, while others are more complex. Several agencies and consortiums are working diligently to arrive at some standards for the industry. There definitely is a need for [that]. However, this might be quite a challenge until the market decides who the winners and losers in the battery OEM community will be.

“From a safety point of view, there are applications where [humans] should not be exposed to the power, current and amperage,” McGillis points out. “In other areas, people cannot meet the high-speed requirements of [lithium-ion battery assembly], which sometimes approaches thousands of cycles per hour.

“Some [lithium-ion battery] designs require a level of assembly repeatability that cannot be met by manpower consistently,” adds McGillis. “Another key element is the error-proofing capability that robots offer for all the different build recipes present in battery modules and packs.”

According to McGillis, precision part loading, bus bar assembly, bus bar connection, and pack handling are some key applications for robots. “At this point, the battery assembly market is open for a variety of robotic configurations,” he explains.

“Speed is of great importance at the beginning of the process, so delta robots [are popular] for their high speed, high repeatability and low noise,” says McGillis. “As the battery module is assembled, the speed of the line slows and the weight increases. At this point, we see a greater use of pedestal six-axis robots.

“Robots are ideally suited to meet the needs of the emerging battery assembly market,” claims McGillis. “[However], one challenge will be to find ways to accommodate the existing battery cell designs through use of adaptive technologies, such as vision and force control.”

Lithium-ion battery manufacturers typically use modular conveyors to assemble both cells and packs. “While the general automation industry has seen a trend to one common conveying platform, this is difficult for battery manufacturing simply due to the progressive payloads, which will start light for a cell and end up very heavy for a pack,” says Mark Dinges, product manager for TS conveyors at Bosch Rexroth Corp.

“Because automotive batteries represent an emerging technology with tremendous growth potential, any conveyor design must include provisions for system expansions and modifications,” adds Dinges. “As with any new or emerging technology, [lithium-ion] battery manufacturers are working to improve the entire assembly process.

“Whether the goal is higher throughput, improved quality or lower cycle time, it’s critical that the assembly conveyor is flexible and can adapt to the demands of this growing industry,” Dinges points out. Due to the heavy payload requirements of automotive batteries, the two conveyor styles suited best for these applications are powered rollers and power-and-free roller chains, with filler blocks between the rollers.

To learn more about battery trends and technology, search www.assemblymag.com for these articles:

- Air May Be Key Ingredient of Future Batteries.

- From Foot Power to Battery Power?

- Inside GM's New Battery Plant.

- It’s a Great Time to Be a Battery Engineer.

- Printable Batteries Solve Weight Problem.

- Viruses Grow Lithium-Ion Batteries.