On Oct. 23, on a humid rainy afternoon, the first U.S.-built Kia Sorento rolled out of the company’s new assembly plant in West Point, GA.

Kia Motors Manufacturing Georgia Inc. broke ground for the facility some three years ago. Completed at a cost of $1 billion, the plant has brought 1,200 jobs to the state, and Kia hopes to hire an additional 1,200 workers next year as production of the Sorento ramps up and manufacture of an additional model begins. Including the plant’s suppliers, the Kia facility is expected to generate 20,000 jobs in Georgia and Alabama over the next three years.

The opening of the Kia plant was one of the few bright spots in an otherwise grim year for U.S. manufacturing. A few statistics tell the tale:

According to the federal Bureau of Labor Stastics, the manufacturing sector lost an average of 161,000 jobs per month from October 2008 through June 2009.

According to the American Machine Tool Distributors’ Association, sales of machine tools for first nine months of 2009 were down 68 percent compared with the same period in 2008.

According to the Robotic Industries Association, robot sales in North America are down 43 percent for the first nine months of 2009, compared with the same period in 2008.

According to the IPC-Association for Connecting Electronics Industries, circuit board sales for the first nine months of 2009 are down 25 percent compared with the same period in 2008.

It was into this climate that we sent out questionnaires for our 14th annual capital equipment spending survey. The results, therefore, were not surprising: Manufacturers will spend less on assembly technology next year than they did this year.

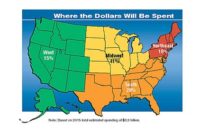

Specifically, U.S. assembly plants will spend $2.36 billion on new equipment in 2010. That’s a decrease of 18 percent from the $2.88 billion projected to be spent in 2009.

Just 27 percent of respondents will spend more on assembly technology next year than they did this year. That’s the lowest percentage in six years. Conversely, 34 percent of respondents will spend less in 2010 than they did 2009. That compares with 26 percent in last year’s survey, and it’s the highest percentage in the history of our survey. In fact, it’s only the second time in the history of our survey that the percentage of those spending less exceeds the percentage of those spending more.

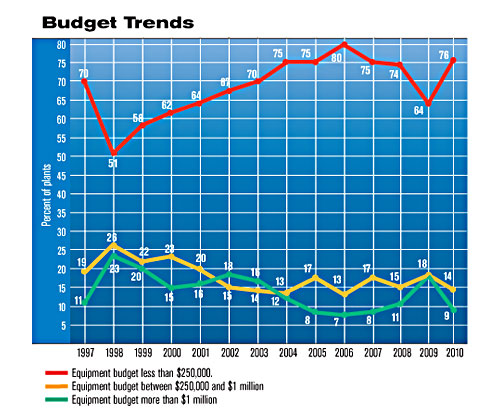

Actual budget figures reveal the downward trend in greater detail. For example, 9 percent of respondents will spend more than $1 million on assembly technology in 2010. That compares with 18 percent in 2009 and 11 percent in 2008. Similarly, 14 percent of respondents will spend between $250,000 and $1 million in the coming year. In 2009, 18 percent planned to spend that much.

Conversely, 76 percent of plants will spend less than $250,000 on new equipment in 2010. That compares with 64 percent in 2009, and it’s the highest percentage since 2006.

The average budget decreased 7 percent, from $890,848 in 2009 to $829,094 in 2010. The median budget for 2010 is $50,000, which compares with $100,000 in 2009 and $75,000 in 2008.

Our survey indicates that the recession began affecting assemblers well before they outlined their 2010 budgets. Just 44 percent of plants have spent at least 70 percent of their 2009 capital equipment budgets. That compares with 58 percent in 2008 and 55 percent in 2007. Moreover, 27 percent of plants spent less than 40 percent of their capital budgets this year-a record high for our survey. As a whole, assemblers spent, on average, just 59 percent of their 2009 budgets, a record low. By way of comparison, assemblers spent an average of 67 percent of their 2008 budgets and 79 percent of their 2002 budgets.

Only 9 percent of respondents will spend more than $1 million on assembly technology in 2010. That compares with 18 percent in 2009 and 11 percent in 2008.

Spending Motives

If technology suppliers need further evidence of the recession, they’ll find it among assemblers’ motives for buying equipment, which indicate a lack of expansion and a desire to cut costs.For example, just 31 percent of respondents will buy equipment next year to boost capacity. That compares with 44 percent in 2009, and it’s the lowest such percentage in 14 years. Similarly, 35 percent of plants are getting equipment to assemble a new product. In 2009, 41 percent had something new to assemble.

As usual, the No. 1 reason for buying new equipment is cost reduction. Some 62 percent of plants will purchase equipment next year to reduce costs, the most since 2004.

Other motives indicate that assemblers are looking for ways to get relatively large returns from small investments. For example, 29 percent of plants-the most in survey history-are buying equipment to implement lean manufacturing. Twenty percent of plants will get equipment to increase safety, compared with 16 percent in 2009. And, 21 percent are looking for technology to boost quality. That compares with 14 percent in 2009, and it’s the largest percentage since 2003.

The No. 1 target for cost reduction in 2010 remains direct labor. However, assemblers are growing more concerned about warranty costs. Twenty-one percent of plants will buy equipment to lower warranty costs. That compares with 14 percent in 2009, and it’s a record high for our survey.

Perhaps this is fallout from a spate of headline-grabbing recalls this year. In November, for example, Nokia recalled 14 million phone chargers, while Maclaren recalled 1 million baby strollers. Even such quality stalwarts as Toyota Motor Co. and Honda Motor Co. had their issues this year. In July, Honda recalled more than 440,000 vehicles to replace defective air bag inflators. In September, Toyota recalled 3.8 million vehicles due to improper fitting floor mats. It was the largest recall the company has ever issued.

Other costs targeted by assemblers next year include:

* scrap, 44 percent.

* indirect labor, such as setup, mainenance and material handling, 40 percent.

* materials, 27 percent.

* work-in-process inventory, 23 percent.

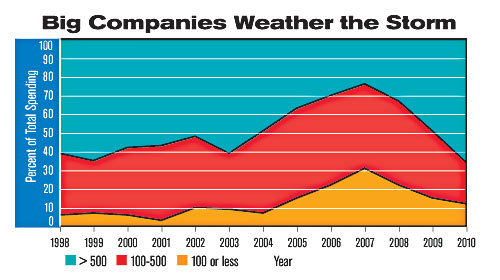

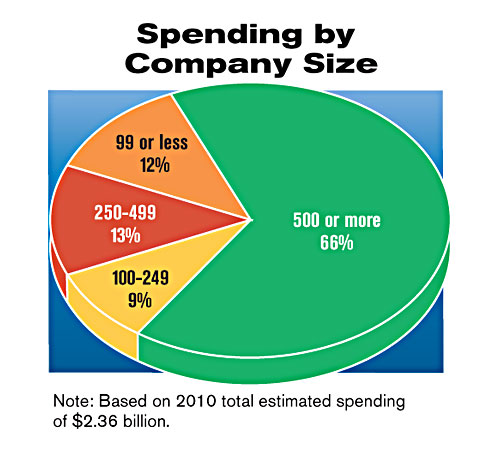

Over the past four years, companies with more than 500 employees have gradually increased their share of total spending on assembly technology.

What Assemblers Want

With the recession curtailing assemblers’ spending plans next year, plant managers are hunting for bargains. Indeed, assemblers expect to spend 38 percent of their capital funds on used or rebuilt equipment next year. That compares with 31 percent in 2009, and it’s a record high for our survey.With two exceptions, spending on various assembly technologies will be lower in 2010 than it was this year. Those exceptions are dispensing equipment and computers and software.

Some 29 percent of plants will buy time-pressure dispensers, positive-displacement dispensers, meter-mix equipment, valves and other dispensing technology next year, up from 23 percent in 2009. Some 11 percent of assemblers will spend at least 10 percent of their 2010 budgets on equipment to dispense epoxy, grease, tape and other materials. All totaled, assemblers will spend $85 million on dispensing equipment in 2010. That’s a 10 percent increase from 2009, and it’s the highest total for this technology since 2003.

For the second straight year, computers and software are the second-most popular line item on assemblers’ budgets. More than half of respondents-53 percent-will invest in such technology next year, the largest percentage in survey history. In fact, 9 percent of plants will allocate 20 percent of their 2010 budgets to programmable logic controllers, design-for-assembly software, flat-screen displays for workstations, and similar technologies. All totaled, assemblers will spend $189.9 million on computers and software, an increase of 2 percent compared with 2009.

Assemblers may have less money to spend in 2010, but that doesn’t necessarily mean they’re looking for low-tech investments. Indeed, only 41 percent of plants will buy workstations next year, an all-time low percentage for this technology. Whereas workstations and ergonomic accessories were once the second- or third-most popular line item on assemblers’ budgets, the technology ranks seventh for 2010. All totaled, assemblers will spend $55 million on workstations next year, an 18 percent decrease from 2009.

After showing some signs of life in 2009, the market for multistation automated assembly systems is expected to take a step back in 2010. With the automotive industry struggling, only 27 percent of respondents will invest in automated assembly systems next year, compared with 31 percent in 2009. All totaled, plants will invest $424.8 million on automated assembly systems in 2010, or 25 percent less than the 2009 total.

If the market for automated assembly systems will be down in 2010, so too will sales of related technologies. Only 23 percent of plants will buy parts feeders next year, while 13 percent will invest in motion control equipment. Both percentages are record lows. Sales of vibratory bowls, tray feeders and similar equipment are expected to decrease 33 percent, from $123.6 million in 2009 to $83.3 million in 2010. Sales of pneumatic cylinders, linear actuators and other motion control devices will decline 30 percent, from $52.5 million in 2009 to $36.8 million in 2010.

Although assemblers are less willing to commit to full automation, that doesn’t mean they are foregoing automation altogether. Indeed, our survey indicates that most assemblers continue to seek ways to automate individual processes. Some 54 percent of plants-a record high-plan to buy presses, screwfeeders, orbital forming equipment and other single-station assembly machines in 2010. Demand for semiautomatic screwdriving and nutrunning machines could be particularly good. Some 36 percent of assemblers will invest in such technology in 2010, up from 34 percent in 2009 and 23 percent in 2008. In fact, 11 percent of respondents will spend at least 10 percent of their 2010 budgets on automatic screwdriving and nutrunning machines.

For the 14th consecutive year, power tools are the No. 1 item on assemblers’ wish lists-a record 69 percent of plants will buy handheld electric, pneumatic and battery-powered tools for installing screws, nuts, bolts and rivets. Even so, assemblers will be spending less on tools next year. All totaled, assemblers will spend $177 million on power tools in 2010. That’s down 19 percent from 2009, and it’s the lowest total for this technology since 1997.

Size Matters

According to our survey, the economic downturn is hitting smaller companies harder than larger ones.Although plants with more than 500 employees represent only 7 percent of ASSEMBLY’s readership, they will account for an astonishing 66 percent of total equipment spending next year, a record high. For the second straight year, facilities with more than 500 workers represent the majority of all plants with million-dollar equipment budgets.

In fact, while the median budget for plants in every other size category is lower for 2010 than it is for 2009, the median budget for our largest plants actually increased, from $1 million in 2009 to $1.2 million in 2010. That’s a record high, and it’s more than twice the 2010 median for all U.S. plants. In all, plants with at least 500 workers will spend $1.56 billion on assembly technology in 2010, up 10 percent from 2009.

Conversely, companies with fewer than 100 employees represent 66 percent of ASSEMBLY’s readership. However, over the past four years, they’ve represented a dwindling share of total spending. In 2010, these facilities will account for just 12 percent of spending, compared with 15 percent in 2009 and a high of 31 percent back in 2007. Altogether, plants with fewer than 100 workers will spend $283.2 million on assembly technology next year. That’s 34 percent less than what these plants spent in 2009, and it’s the smallest total since 2004.

Midsized companies aren’t faring much better. Indeed, the median budget for plants with 100 to 249 workers is just $60,000 for 2010, compared with $200,000 in 2009 and $130,000 in 2008. Similarly, the median budget for plants with 250 to 500 workers is $175,000 for 2010, compared with $250,000 in 2009 and $500,000 in 2008. Plants with 100 to 249 workers will account for just 9 percent of total spending next year, their smallest share since 1999. Plants with 250 to 500 workers will represent 13 percent of spending, which is just what they did in 2009.

All Products Large and Small

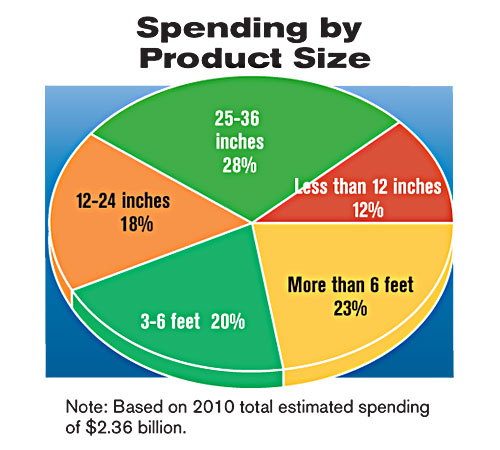

Back when we began our survey in 1996, manufacturers of small products accounted for the majority of capital equipment spending. In 1997, for example, 62 percent of all plants with million-dollar equipment budgets assembled products that fit inside a 24-inch cube, while 26 percent assembled products larger than a 36-inch cube.Since that time, however, outsourcing became the order of the day, and production of many small products-toys, electric shavers, consumer electronics, auto parts-shifted to Asia and Central America. Assembly of large products-cars, trucks, tractors, engines, water heaters-remained in the United States, simply because they are too costly to ship.

As a result, we’ve seen capital spending gradually shift in favor of larger products. Indeed, in 2010, the distribution of plants with million-dollar budgets will be virtually the reverse of what it was 14 years ago. Some 61 percent of all plants with million-dollar equipment budgets assemble products larger than a 36-inch cube, while 22 percent assemble products that fit inside a 24-inch cube.

In all, plants that assemble products smaller than a 24-inch cube will invest $708 million in assembly technology next year, accounting for 30 percent of total spending. Plants that assemble products larger than a 36-inch cube will devote $991.2 million to assembly technology, which represents 42 percent of total spending.

Budget size isn’t the only difference between assemblers of large and small products. Their reasons for buying equipment differ, too. For example, 21 percent of plants that assemble products larger than a 6-foot cube will buy equipment next year to increase safety. That compares with just 8 percent for plants that assemble products that fit inside a 12-inch cube. Conversely, 33 percent of plants that assemble products smaller than a 12-inch cube are investing in equipment next year to reduce cycle time. But, only 19 percent of plants that assemble products larger than a 6-foot cube will do so.

While 32 percent of plants assembling very large products are buying equipment next year to boost capacity, only 21 percent of plants assembling very small products will do so. And, although 36 percent of plants making very small assemblies are getting equipment to build a new product, only 28 percent of plants making very large assemblies will do so.

Assemblers of large and small products are targeting different costs, too. Not surprisingly, labor costs are more important to manufacturers of large products than small ones. Some 82 percent of plants that assemble products larger than a 6-foot cube are looking to reduce direct labor costs and 42 percent need to reduce indirect labor costs. In contrast, 71 percent of plants that assemble products smaller than a 12-inch cube want to reduce direct labor costs and 33 percent hope to cut indirect labor costs.

Warranty costs aren’t an issue if you’re producing, say, valves for bottles of laundry detergent, but they can be astronomical if you’re assembling cars. Thus, 27 percent of large-product assemblers want to reduce warranty costs next year, while only 11 percent of small-product assemblers need to do so.

Transportation Equipment

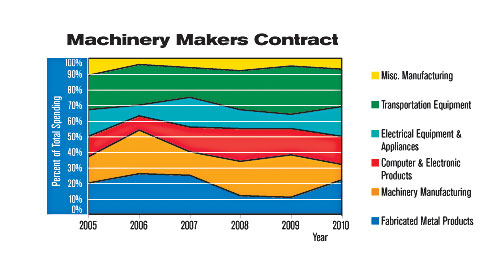

2009 was a year of extremes for manufacturers of transportation equipment (NAIC 336). While Chrysler and General Motors were filing for bankruptcy, Volkswagen was breaking ground on a new assembly plant in Chattanooga, TN, and Boeing announced that it will construct a second assembly line for the 787 in Charleston, SC.So perhaps it’s not surprising that even though this industry will spend 35 percent less on assembly technology-$566.4 million in 2010 vs. $893.4 million in 2009-NAIC 336 will still account for a greater share of total equipment spending than any other industry. In fact, this industry has held that distinction for three straight years.

Fifteen percent of plants in NAIC 336 will spend more than $1 million on assembly technology in 2010, compared with 10 percent in 2009 and 9 percent of all U.S. facilities. Of all assembly plants with million-dollar budgets, 31 percent manufacture cars, planes, motorcycles, trucks, boats and missiles.

The 2010 median budget for this industry is $80,000. That’s less than half the 2009 median of $200,000, but it’s more than the median for any other industry besides electrical equipment and appliances.

Thirty percent of plants in NAIC 336 will spend more on assembly technology next year than they did this year. That compares with 20 percent of machinery manufacturers and 27 percent for all U.S. plants.

Transportation equipment manufacturers have been on the forefront of safety for years, and their efforts appear to be paying dividends. Only 16 percent of plants in this industry are buying equipment to improve safety. That compares with 20 percent for all industries, and it’s the second straight year that the industry has been below the national percentage in that regard.

Compared with other industries, assemblers of transportation equipment will purchase more robots (21 percent for NAIC 336 vs. 18 percent for all plants), power tools (79 percent for NAIC 336 vs. 69 percent for all plants), and automatic identification technology (39 percent for NAIC 336 vs. 32 percent for all plants).

After accounting for 27 percent of total equipment spending in 2009, machinery manufacturers will represent just 10 percent of spending in 2010. That’s the lowest percentage for this industry in the history of our survey.

Machinery Manufacturing

After accounting for 27 percent of total equipment spending in 2009, machinery manufacturers (NAIC 333) will represent just 10 percent of spending in 2010. That’s the lowest percentage for this industry in the history of our survey.All totaled, assemblers of combines, backhoes, vending machines, drill presses, air conditioners and ball joints will spend $236 million-70 percent less than what the industry spent in 2009.

Only 20 percent of plants in this industry will spend more next year than they did this year-the lowest percentage of any industry. The median budget figure for the industry is a meager $27,500. That compares with $100,000 in 2009, and it’s the lowest median of any industry. In 2009, 24 percent of plants in this industry spent at least $1 million on assembly technology. In 2010, just 3 percent will do so. In 2009, 64 percent of plants in NAIC 333 spent less than $250,000 on assembly technology. In 2010, 84 percent will do so.

One reason for the lack of investment may be that assemblers in this industry don’t have anything new to assemble. Just 22 percent of machinery manufacturers will buy equipment next year to assemble a new product. That compares with 35 percent for the nation as a whole, and it’s the lowest percentage of any industry. In fact, it’s the seventh straight year that NAIC 333 has been lower than the national percentage in that regard.

Getting product out the door is a growing concern in this industry. Thirty-six percent of plants in NAIC 333 need to reduce the costs of work-in-process inventory. That’s the highest percentage of any industry.

Compared with other industries, machinery manufacturers will purchase more single-station assembly machines (62 percent for NAIC 333 vs. 54 percent for all plants), robots (25 percent for NAIC 333 vs. 18 percent for all plants), and automatic identification technology (41 percent for NAIC 333 vs. 32 percent for all plants).

Computers and Electronics

Like the transportation equipment industry, the computer and electronics industry (NAIC 334) endured considerable highs and lows in 2009. In October, for example, Dell Inc. announced that it would be closing its assembly plant in Winston-Salem, NC, just four years after it opened. Yet one month later, Sanyo Electric Co. Ltd. started operation of a new factory in Salem, OR, to manufacture solar cells. Together with an existing facility in Carson, CA, Sanyo Electric intends to establish an annual manufacturing capacity of 100 megawatts in the United States by the end of 2010.All in all, our survey indicates that capital equipment spending among manufacturers in NAIC 334 will decline only slightly next year. Assemblers of clocks, disk drives, telephones, radar equipment, thermostats, microchips and other electronic equipment will spend $424.8 million on assembly technology in 2010, a 13 percent decrease from 2009 outlays. That total represents 18 percent of all spending next year, a bit more than what this industry contributed in 2009.

Just 16 percent of plants in this industry plan to spend less on assembly technology next year than they did this year-less than half the percentage for all U.S. plants. Moreover, 32 percent say they’ll spend more next year, compared with 27 percent for all U.S. plants.

However, that optimism isn’t necessarily reflected in actual budget numbers. The median budget for plants in NAIC 334 is $50,000, which compares with $100,000 in 2009 and $95,000 in 2008. Some 89 percent of plants will spend less than $250,000 on new equipment next year. That compares with 56 percent in 2009 and 77 percent for the nation as a whole. Just 5 percent of all U.S. plants with million-dollar equipment budgets manufacture computers and electronic products.

Compared with other industries, electronics assemblers will purchase more dispensing equipment (36 percent for NAIC 334 vs. 29 percent for all plants), multistation automated assembly systems (44 percent for NAIC 334 vs. 27 percent for all plants), computers and software (64 percent for NAIC 334 vs. 53 percent for all plants), test equipment (76 percent for NAIC 334 vs. 50 percent for all plants), and circuit board assembly machines (52 percent for NAIC 334 vs. 13 percent for all plants).

Given the nature of their products, electronics assemblers are much less likely to build their own assembly systems than assemblers in other industries. Indeed, electronics assemblers supply just 23 percent of their assembly technology needs with equipment built in-house. That compares with 42 percent for all U.S. plants.

Fabricated Metal Products

In September, metal fabricator Dynamic Materials Corp. received a $14.8 million order for explosion-welded metal plates. The plates, which will be assembled at the company’s plant in Mount Braddock, PA, are destined for off-shore drilling machinery. The order was among the largest in the company’s history.Although the fabricated metal products industry (NAIC 332) has been hit hard by the downturn in the automotive industry, enterprising fabricators like Dynamic Materials are finding new business in other industries, such as the energy sector, aerospace and defense. That may explain why assemblers in this industry are increasing their investment in capital equipment next year.

As a group, manufacturers of windows, cans, springs, bearings, guns and other products will spend $519.2 million on assembly technology next year, an increase of 64 percent compared with 2009 and the highest total for this industry since 2007. NAIC 332 will account for 22 percent of all capital equipment spending in 2010-more than twice what this industry contributed in 2009.

The median budget for plants in NAIC 332 is $50,000, which compares with $75,000 in 2009. Only 5 percent of plants in this industry will spend more than $1 million on capital equipment next year, but 16 percent will spend between $250,000 and $1 million. In 2009, those percentages were 16 percent and 18 percent, respectively.

Thirty-seven percent of plants in this industry are buying equipment next year to increase capacity. That compares with 31 percent for all U.S. plants, it’s the highest percentage of any industry.

Compared with other industries, fabricators will purchase more parts feeders (29 percent for NAIC 332 vs. 23 percent for all plants), robots (22 percent for NAIC 332 vs. 18 percent for all plants), conveyors (34 percent for NAIC 332 vs. 25 percent for all plants), and welding, brazing and soldering equipment (49 percent for NAIC 332 vs. 43 percent for all plants).

Electrical Equipment and Appliances

Over the past year, the electrical equipment industry (NAIC 335) has been, well, re-energized by an influx of capital to mass-produce batteries, fuel cells, electric motors, generators and other products related to the burgeoning alternative energy market. Indeed, 30 percent of plants in NAIC 335 plan to spend more on assembly technology next year than they did this year, the highest percentage of any industry.All totaled, assemblers of lamps, refrigerators, mixers and other electrical products will spend $448.4 million on new equipment next year, a 73 percent increase from 2009 and the most for this industry since 2007. NAIC 335 will account for 19 percent of total spending in 2010, or twice what this industry contributed in 2009.

The median budget for plants in NAIC 335 is $100,000, a figure that has held constant for four straight years. Twenty percent of plants in this industry will spend more than $1 million on assembly technology next year, compared with 22 percent in 2009. In addition, 20 percent of plants will spend between $250,000 and $1 million, compared with 16 percent in 2009.

When most people think of lean manufacturing, they think of the automotive industry. However, assemblers of electrical equipment are no less interested in the strategy. Indeed, 35 percent of plants in NAIC 335 will buy equipment next year to get lean. That compares with 31 percent in 2009 and 29 percent for all U.S. plants. In fact, NAIC 335 has outpaced the nation in this regard for five of the past six years.

Compared with other industries, assemblers of electrical equipment and appliances will purchase more dispensing equipment (56 percent for NAIC 335 vs. 29 percent for all plants), automated screwdriving systems (44 percent for NAIC 335 vs. 36 percent for all plants), automatic identification technology (44 percent for NAIC 335 vs. 32 percent for all plants), inspection equipment (50 percent for NAIC 335 vs. 44 percent for all plants), workstations (56 percent for NAIC 335 vs. 41 percent for all plants), and wire processing machines (22 percent for NAIC 335 vs. 10 percent for all plants).

Miscellaneous Manufacturing

In March, St. Jude Medical Inc. opened a new assembly plant in Liberty, SC. The 60,000-square-foot facility will assemble hybrid microelectronic circuits for pacemakers and implantable cardioverter defibrillators. If the results of our survey are any indication, such investment should continue in 2010.According to the NAIC system, St. Jude and other medical and dental device manufacturers are classified under Miscellaneous Manufacturing (NAIC 339). Although this category also includes assemblers of sporting goods, jewelry, toys, pens, mops, musical instruments and caskets, companies like St. Jude represent the lion’s share of capital investment by this industry.

Collectively, NAIC 339 will spend $165.2 million on assembly technology in 2010. That’s still much less than the industry’s high-water mark of $286 million in 2005, but it’s nevertheless a 15 percent increase from what the industry spend in 2009, and it represents 7 percent of total spending in the United States.

The median budget for assemblers in NAIC 339 is $50,000, or half the median in 2009. On the other hand, 11 percent of plants in this industry will spend more than $1 million on assembly technology in 2010, which is exactly the same percentage as 2009. It’s the spenders in the middle ground that are downshifting on capital outlays. In 2009, 26 percent of plants planned to spend $250,000 to $1 million on new equipment, while 63 percent planned to spend less than $250,000. For 2010, those percentages are 6 percent and 83 percent, respectively.

The onset of the recession did not seem to affect assemblers in NAIC 339 as much as those in other industries. Some 55 percent of plants in NAIC 339 spent at least 70 percent of their 2009 capital budgets. That compares with 44 percent for all U.S. plants, and it’s more than any other industry.

Oddly, assemblers in NAIC 339 are more likely to buy used or rebuilt equipment than facilities in any other industry. On average, plants in NAIC 339 supply 46 percent of their equipment needs with used or rebuilt machines. That compares with 38 percent for the nation as a whole, and it’s the highest percentage of any industry.

Compared with other industries, plants in Miscellaneous Manufacturing will purchase more assembly presses (41 percent for NAIC 339 vs. 31 percent for all plants), conveyors (41 percent for NAIC 339 vs. 25 percent for all plants), packaging equipment (47 percent for NAIC 339 vs. 37 percent for all plants), and wire processing machines (18 percent for NAIC 339 vs. 10 percent for all plants).

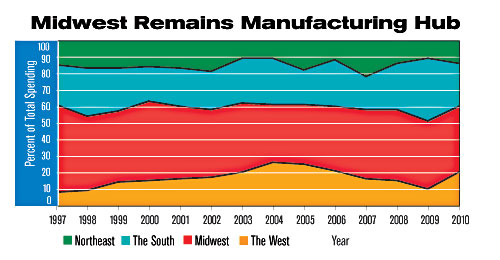

The West

In October, startup Green Vehicles Inc. began renovating a shuttered tire factory in Salinas, CA, to assemble its line of three electric vehicles. One model, the $25,000 Triac, is a three-wheeled vehicle with a top speed of 80 mph and a range of 60 to 100 miles per charge. The company plans to start with 15 workers and hopes to employ 70 in three years. The company hopes to produce 100 to 200 vehicles per month beginning next year.The plant is a prime example of the growing number of manufacturing startups that are taking advantage of the vast engineering talent in California, Utah, New Mexico and the 10 other states in the West. While capital investment has fluctuated in the Midwest, South and Northeast, it has held steady in the West. Indeed, the median budget for Western plants is $50,000, a figure that has held constant for three straight years. Twenty-one percent of plants in this region will spend between $250,000 and $1 million on capital equipment next year, which is the same percentage as in 2009.

All totaled, Western facilities will spend $472 million on assembly technology in 2010, a 64 percent increase from 2009 and the largest total for this region since 2006. The 2010 total is big enough to account for 20 percent of all U.S. spending. That’s twice what the region contributed in 2009, and it’s the most for the West since 2006.

Compared with other regions, Western plants will purchase more dispensing equipment (42 percent for the West vs. 29 percent for all plants), multistation automated assembly systems (32 percent for the West vs. 27 percent for all plants), robots (23 percent for the West vs. 18 percent for all plants), and circuit board assembly machines (29 percent for the West vs. 13 percent for all plants).

For the 14th consecutive year, the Midwest will spend more on assembly technology than any other region.

The Midwest Stays Ahead

The downturn in the automotive industry hit the Midwest harder than any other region. However, that doesn’t mean that capital equipment investment in the region has completely dried up. In August, for example, Winergy Drive Systems Corp. and Siemens Drive Technologies opened a new assembly plant in Elgin, IL. Representing an investment of more than $20 million, the plant will assemble gear drives for wind turbines. The facility will employ 300 production workers and 55 office workers over the next three to four years.“Rust belt” or not, the Midwest will still account for more capital spending than any other region, a distinction it has held for 14 consecutive years. Specifically, Indiana, Minnesota, Ohio and the nine other states that make up this region will spend $944 million on assembly technology in 2010, a 20 percent decrease from 2009. That’s the lowest total for the region since 2005, but it’s still good enough to represent 40 percent of all spending in the United States.

The 2010 median budget for Midwestern plants is miniscule-$50,000-compared with the 2009 median of $1 million. Then again, that figure was overinflated due to a higher than normal response rate from the region’s largest plants.

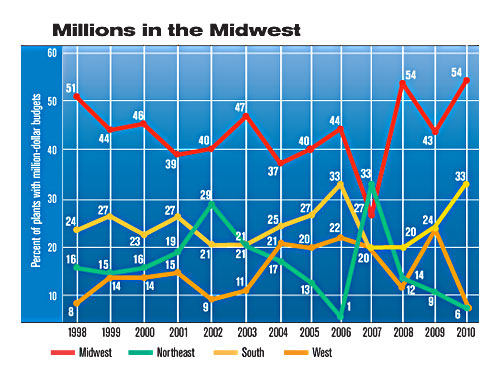

A more detailed look at Midwestern budgets shows a little more promise. Twelve percent of plants in the region will spend more than $1 million on assembly technology next year. That compares with 18 percent in 2009, and it’s the most of any region. Another 12 percent of plants will spend between $250,000 and $1 million, compared with 19 percent in 2009.

Compared with other regions, Midwestern plants will purchase more automatic identification technology (39 percent for the Midwest vs. 32 percent for all plants), motion control equipment (19 percent for the Midwest vs. 13 percent for all plants), welding, brazing and soldering equipment (47 percent for the Midwest vs. 43 percent for all plants), and workstations (52 percent for the Midwest vs. 41 percent for all plants).

There won’t be as many plants with million-dollar budgets in 2010 as there were in 2009, but if you want to find one, look to the Midwest. Fifty-five percent of all plants with million-dollar budgets are in the Midwest-an all-time high for the region.

The Northeast Hangs On

In April, Cirtronics Corp. celebrated its 30th anniversary by opening a 75,000-square-foot addition to its assembly plant in Milford, NH. “Our business remains resilient even in hard economic times,” says Gerardine Ferlines, president of the electronics manufacturing services provider.Resilience could also describe the manufacturing climate for the Northeast as a whole. Between 2002 and 2009, the amount of Northeastern plants planning to spend more on assembly technology from one year to the next has lagged behind the national percentage. Now, that streak has finally ended. According to our survey, 37 percent of Northeastern plants will spend more in 2010 than they did in 2009. That’s the highest percentage in the nation. At the same time, just 23 percent expect to spend less in 2010 than they did in 2009, a nationwide low.

All totaled, manufacturers in Massachusetts, Pennsylvania, New York and the six other Northeastern states will spend $330.4 million on new equipment in 2010-4 percent more than the 2009 total. That sum represents 14 percent of total spending, compared with 11 percent in 2009.

The median budget for Northeastern plants in 2010 is $40,000, which is 38 percent less than the 2009 median. Three percent of plants in the Northeast will spend more than $1 million on assembly technology next year, compared with 9 percent for the nation as a whole. However, 11 percent of plants here will spend between $250,000 and $1 million, which is almost four times the percentage for all U.S. plants.

Cost-cutting continues to be a major concern in the region. For the third straight year, the Northeast has led the nation in the percentage of plants-70 percent in 2010-that are buying equipment to lower costs.

Compared with other regions, Northeastern plants will purchase more dispensing equipment (32 percent for the Northeast vs. 29 percent for all plants), power tools (72 percent for the Northeast vs. 69 percent for all plants), and wire processing equipment (15 percent for the Northeast vs. 10 percent for all plants).

The South Slows

The South certainly dominated the manufacturing headlines over the past year. Volkswagen, Kia, Boeing and NCR are just a few of the companies that opened or began building new plants in the region. And yet, our survey indicates that capital equipment spending in the South will be lower next year than it was this year.Specifically, Southern plants will lay out $613.6 million on capital goods in 2010. That’s 44 percent less than they spent in 2009, and it’s the lowest sum for this region since 2007. All totaled, Texas, Alabama, North Carolina, Maryland and the 12 other states that make up this region will account for 26 percent of all spending on assembly technology in 2010, compared with 38 percent in 2009.

Forty percent of plants in the South expect to spend less next year than they did this year-the highest percentage of any region.

The 2010 median budget for the region is $50,000. That compares with $150,000 in 2009 and $75,000 in 2008. In 2009, 19 percent of Southern facilities planned to spend more than $1 million on assembly technology. In 2010, only 11 percent will do so. In 2009, 18 percent of plants planned to spend $250,000 to $1 million on capital goods. In 2010, 13 percent will do so.

Compared with other regions, Southern plants will purchase more single-station assembly machines (65 percent for the South vs. 54 percent for all plants), conveyors (31 percent for the South vs. 25 percent for all plants), robots (23 percent for the South vs. 18 percent for all plants), and welding, brazing and soldering equipment (48 percent for the South vs. 43 percent for all plants).