What a difference a year makes.

In 2009, the financial picture was bleak to say the least. All totaled, the Assembly Top 50 amassed $2.36 trillion in gross revenue in 2009, a staggering 12 percent decrease compared with 2008 sales. Thirty-six of the Top 50 took in less revenue in 2009 than they did in 2008, a record high.

Outside of the Top 50, the damage was even worse. Incredibly, 111 of the 150 manufacturers we look at for this project reported lower revenues in 2009 than they did in 2008.

In 2010-thanks in large part to the revival of the automotive industry-the numbers are dramatically better. All totaled, the Assembly Top 50 rang up $2.67 trillion in gross revenue in 2010, a healthy 13 percent increase over 2009 sales. Only seven members of the Top 50 took in less revenue in 2010 than they did in 2009. In fact, just 22 of the top 150 manufacturers reported less revenue last year than in 2009.

The numbers are even better on the profit side of the ledger. All totaled, the Top 50 earned $174.6 billion in profit for 2010, a record high and more than double the profit total for 2009.

Of all the manufacturers in our analysis, only one member of the Top 50 and eight of the top 150 had a net loss for 2010. Both totals are record lows. In comparison, 12 members of the Top 50 and 44 of the top 150 reported a loss in 2009. (The lone member of this year’s Top 50 with a net loss, No. 40 Alcatel-Lucent, hasn’t earned a profit in five straight years.)

Forty-one of the Top 50 saw profits rise in 2010, and nine members of the Top 50 retained at least 10 percent of their gross revenue as net income. Of the 20 largest profit totals ever reported in our study, four came in 2010. The companies were No. 10 IBM Corp. ($14.8 billion), No. 11 Apple Inc. ($14 billion), No. 14 Johnson & Johnson Inc. ($13.3 billion) and No. 2 General Electric Co. ($11.6 billion).

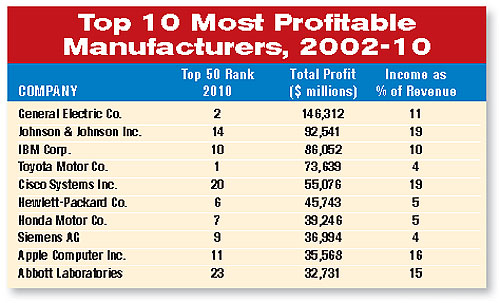

GE, IBM and J&J, in particular, have been profit machines over the past several years. From 2002 to 2010, GE, IBM and J&J have accumulated total profits of $146.3 billion, $86 billion and $92.5 billion, respectively. No other manufacturers are within even $10 billion of those totals. If it’s possible to stand out in that threesome, J&J does. Since 2002, the company’s ratio of net income to gross revenue has never been below 17 percent.

A Volatile Year

To determine the impact of product assembly on the U.S. economy, ASSEMBLY magazine ranked the top 50 publicly owned manufacturing companies by gross revenue. To qualify for our list, a company must derive a significant portion of its revenue from products it assembles or that it designs and has assembled by another company. More importantly, a substantial amount of the design and assembly of those products, whether in-house or outsourced, must occur in the United States.Two international conglomerates were grandfathered into our rankings this year after they acquired large U.S. companies. No. 18 Fiat SpA debuts in our rankings after taking over the bankrupt Chrysler Group LLC. No. 32 ABB Ltd. makes our rankings after acquiring No. 144 Baldor Electric.

2010 was a volatile year for the Assembly Top 50. Twenty companies went up in our rankings; 23 went down. Eighteen companies moved at least five spots in either direction. Seven companies reached all-time highs; seven hit all-time lows.

A pair of automotive suppliers return to the Top 50 after a one-year absence. Faurecia SA climbed 10 places to No. 44, while ZF Friedrichshafen AG rose seven spots to No. 46.

It’s not hard to see why. Compared with 2009, automobile production was up 39 percent in North America last year, 28 percent in Asia, and 15 percent in Europe. Responding to that demand, Faurecia opened new assembly plants in Madison, MS, Tuscaloosa, AL, and Chattanooga, TN, since the start of 2010. It also expanded its exhaust systems assembly plant Louisville, KY.

For its part, ZF began construction of a $350 million transmission assembly plant in Columbia, SC. The company also began to diversify its business. Last month, ZF opened a new assembly plant in Gainesville, GA, to produce gearboxes for wind turbines.

Falling out of the Top 50 are defense contractor L-3 Communications Corp., falling seven spots to No. 52, and appliance manufacturer AB Electrolux, slipping five places to No. 54. After five straight years of double-digit growth, L-3’s sales began leveling off in 2008, and the company’s revenue grew less than 1 percent in 2010. Even so, 2010 marked the company’s third consecutive year with at least $900 million in net profit.

For Electrolux, a 7 percent increase in sales in 2010 wasn’t quite enough to offset the 10 percent decrease in sales in 2009. Nevertheless, the company expects to get back into the Top 50 soon. This year, Electrolux began constructing a $200 million assembly plant in Memphis, TN, to produce ovens. At full capacity, the plant will produce 700,000 ovens annually and employ 1,200 people. In addition, the company invested $5 million to expand its assembly plant in Springfield, TN.

Auto Industry Revs Up

The performance of the Assembly Top 50 makes it clear that manufacturers have been in the vanguard leading the U.S. economy out of recession. More than half of the Top 50 reported sales increases of at least 10 percent in 2010.

Daimler AG posted the largest sales gain of any member of the Top 50-66 percent. That’s quite a feat considering the German automaker had endured three straight years of declining sales. The boost enabled Daimler to climb six spots to No. 4, its highest ranking since 2006.

The company’s Mercedes-Benz division sold the second-highest number of vehicles in company history. In China, the company sold 137 percent more vehicles in 2010 than it did in 2009. The company also saw strong gains in sales of trucks, vans and buses.

After netting a profit of more than $6.2 billion in 2010, Daimler is investing heavily in its North American production facilities. The automaker is spending more than $2 billion to boost production at its Mercedes-Benz assembly plant in Tuscaloosa, AL, which produced more than 125,000 M-Class SUVs and C-Class sedans in 2010.

The company also plans to expand production at its truck assembly plants in Mt. Holly, NC, Portland, OR, and Saltillo, Mexico. And it invested $194 million to increase production at its Detroit Diesel engine plant Redford, MI.

Daimler wasn’t the only automotive OEM to have a good year in 2010. No. 3 General Motors Co. enjoyed a 30 percent increase in sales and posted a profit of nearly $6.2 billion, its first net gain since 2004. No. 1 Toyota Motor Co., No. 5. Ford Motor Co., No. 7 Honda Motor Co., No. 8 Nissan Motor Co., No. 22 Volvo AB, and even No. 38 Mitsubishi Motors Corp. all had double-digit sales gains.

As a group, the nine automotive OEMs in the Assembly Top 50 saw their sales increase 23 percent last year, from $769.6 billion in 2009 to $946.1 billion in 2010. And whereas they posted a net loss of $18.6 billion in 2009, they had a net gain of $36.6 billion in 2010.

Their suppliers did well, too. Continental AG rose six spots in our rankings to No. 25, its highest position ever. Johnson Controls Inc. climbed four spots to No. 28, while Magna International Inc. jumped three spots to No. 37.

Collectively, the nine automotive suppliers in our rankings grew their revenues by 9 percent, from $333 billion in 2009 to $363 billion in 2010. After reporting a net loss of $614 million in 2009, they tallied a net gain of $16.9 billion in 2010.

Manufacturing Stars

The automotive industry wasn’t the only bright spot in the Top 50. Six members have enjoyed at least nine straight years of revenue growth: Apple, No. 27 Northrop Grumman Corp., No. 31 General Dynamics, No. 36 Raytheon Co., No. 42 Research in Motion Ltd. and No. 50 Medtronic Inc.What more can you say about Apple? The company introduced the iPad tablet computer in January 2010 and promptly sold nearly $5 billion worth of the devices by the end of the year. Apple’s net gain of $14 billion is a record high for the company, and it’s the second highest profit total of any manufacturer in 2010. Indeed, it’s the 10th highest profit total in the past nine years. Only Toyota, GE and IBM have ever posted higher annual profits.

At the end of 2010, Northrop had a backlog of orders totaling more than $64 billion. New awards for the year totaled $30 billion. In January 2011, Northrop completed a project to expand its navigation systems assembly plant in Salt Lake City. And in August 2011, the company started a new assembly line at its factory in Palmdale, CA, to make the fuselage of the F-35 Joint Strike Fighter. Based on the automated systems used by automakers, the new line includes automatic assembly tool systems, transportation systems and manufacturing systems, all controlled centrally and wirelessly by a factory communications system.

Although General Dynamics’ revenues grew a modest increase of 2 percent from 2009, its net income rose 10 percent to $2.62 billion. The company’s aerospace segment faired particularly well in 2010, reflecting a healthier market for business jets. With a year-end backlog of $17.8 billion in aerospace business, GD began a $500 million, seven-year expansion of its Gulfstream assembly plant in Savannah, GA.

Raytheon landed a number of major contracts last year, including an $886 million contract from the U.S. Air Force to upgrade the Global Positioning System; a $73 million contract to improve the air and missile defense systems for Taiwan and Kuwait; and a $52 million contract from the Naval Air Systems Command to upgrade radar systems for F/A-18 Super Hornet aircraft. In addition, the company began constructing a new $75 million missile assembly facility in Huntsville, AL.

Research in Motion (RIM) has enjoyed eight consecutive years of double-digit sales increases, a feat unmatched by any of 150 manufacturers in our analysis. The company’s Blackberry is the No. 1 selling smart phone in the United States, Canada, Latin America and the United Kingdom. Indeed, RIM shipped more than 52 million of the devices during its past fiscal year, which ended in February 2011. Like Apple, RIM also introduced a tablet computer in 2010, the Playbook.

Although Medtronic only grew revenue by a meager 1 percent during its past fiscal year, which ended in April 2011, it still managed to produce more than $3 billion in profit for the second straight year. The medical device manufacturer spent some $1.5 billion on research and development, introduced 60 new products, and was awarded 2,051 patents. With 43 percent of its revenue coming from outside the United States, Medtronic opened a new assembly plant in Singapore and new regional headquarters in Shanghai, China, and Mumbai, India.

Big Gains for Big Things

The resurgent automotive industry has dominated headlines this year, but another major U.S. industry has quietly made a comeback of its own, and it might surprise you. It’s tractor manufacturing.No. 21 Caterpillar Inc. saw sales increase by 31 percent and profits triple, from $895 million in 2009 to $2.7 billion in 2010. No. 35 Deere & Co. enjoyed a 13 percent sales increase and a doubling of profits, from $873 million in 2009 to $1.8 billion in 2010.

Collectively, the seven tractor manufacturers in our study-including No. 61 Cummins Inc., which makes the engines for tractors-increased sales by 24 percent last year. Even more amazing, these companies enjoyed a ten-fold increase profits.

Unlike some companies in the S&P 500, these manufacturing powerhouses aren’t sitting on their cash, either. They’re plowing it into capacity expansion and facility upgrades.

For example, Caterpillar is devoting $3 billion to capital expenditures in 2011, with about half of that going toward its U.S. operations. From January 2010 to June 2011, the company has added more than 27,000 people to its global workforce.

In August, Caterpillar began work to expand its work tools business in Wamego, KS. When the new facility is open, Caterpillar will have nearly 250,000 square feet of space under roof to make buckets, blades and other tractor attachments. The expansion is expected to increase employment at the facility by about 120 positions, bringing the total workforce to more than 500 people.

Just two months earlier, Cat announced plans to significantly expand its hydraulic excavator assembly plant under construction in Victoria, TX. Cat began building the $130 million, 850,000-square-foot facility in 2010. But, faced with increased demand, the company is spending an additional $70 million for another 200,000 square feet of manufacturing space.

Truck manufacturers did well, too. Volvo AB, parent company of Mack Trucks, recorded a 24 percent increase in sales last year, moving up eight spots in our rankings to No. 22. After eating a $2 billion loss in 2009, Volvo posted a net gain of more than $1.5 billion in 2010. Since the fall of 2010, Mack Trucks has hired more than 400 people at its assembly plant in Lower Macungie, PA.

As a group, the four heavy truck manufacturers in our study grew sales by 48 percent last year. Better yet, they amassed almost $8.5 billion in profit-a dramatic turnaround from 2009, when they posted a $4 billion loss.

ASSEMBLY ONLINE

For more information on the importance of manufacturing, visit www.assemblymag.com to read these articles:- Are Manufacturers a Good Investment?

- Reshoring: Bringing it all Back Home.

- Where Will Your Next Innovation Come From?

Who's Who

ZF Friedrichshafen AG, Friedrichshafen, Germany. With the resurgence of the global automotive industry, this Tier One supplier returns to the Top 50 after a one-year hiatus. ZF jumps seven spots to No. 46.

WHO’S OUT

L-3 Communications Corp., New York. After debuting in our rankings last year, L-3 slips out of the Top 50 after a year of flat sales growth. The defense contractor tumbles seven spots to No. 52.

AB Electrolux, Stockholm, Sweden. Once ranked as high as 35th in 2002, Electrolux has crept slowly down our rankings ever since. The appliance manufacturer leaves the Top 50 altogether this year, falling five spots to No. 54.

WHO’S UP AND COMING

TRW Automotive, Livonia, MI. After leaving the Top 50 in 2004, TRW is crawling its way back up, posting a healthy 24 percent increase in revenue in 2010. The automotive supplier jumps five spots to No. 55.

Texas Instruments, Dallas. After falling as low as No. 69, a 34 percent increase in sales in 2010 has propelled TI back up our rankings. The manufacturer of microchips and calculators rises 12 spots to No. 57.

Cummins Inc., Columbus, IN. Strong demand for tractors and heavy trucks boosted Cummins’ bottom line in 2010. The engine supplier posted a 22 percent increase in sales in 2010, lifting the company five spots to No. 61.

Parker-Hannifin Corp., Cleveland. Two straight years of declining revenues pushed Parker-Hannifin to a low point of No. 73 in our rankings last year. This year, thanks to a 24 percent increase in sales, the supplier of motion control technology jumps 12 spots to No. 65, tying a high-water mark set in 2003.

Oshkosh Corp., Oshkosh, WI. Buoyed by an influx of defense contracts, the manufacturer of trucks and specialty vehicles tallied an impressive 87 percent increase in sales for 2010. Once ranked as low as 118th, Oshkosh now sits at No. 79.

Highs and Lows

Total revenue amassed by the Top 50 in 2010, a 13 percent increase from 2009.

$174.6 billion

Total net income earned by the Top 50 in 2010, more than double the profit total from 2009.

36

Number of companies in the Top 50 with less revenue in 2009 than they had in 2008.

7

Number of companies with less revenue in 2010 than they had in 2009.

12

Number of companies in the Top 50 with a net loss in 2009.

1

Number of companies with a net loss in 2010, namely, Alcatel-Lucent.

5

Number of consecutive years that Alcatel-Lucent has posted a net loss. Among the Top 50, only No. 3 GM and No. 44 Faurecia have ever ended five straight years with a loss.

$6.2 billion

Profit posted by No. 3 GM, its first net gain since 2004.

66

Percentage increase in revenue posted by No. 4 Daimler, the largest of any company in the Top 50.

11

Rank of Apple in the Top 50, its highest ranking in history.

$34.6 billion

Minimum amount of additional revenue Apple will need in 2011 to crack the Top 10.

$14 billion

Net gain posted by Apple in 2010, the largest of any company in the Top 50 and the 10th biggest profit total in the history of our rankings.

8

Consecutive years with at least a double-digit increase in sales-an unprecedented feat achieved by No. 42 Research in Motion, maker of the Blackberry.

6

Number of companies that drop out of the Top 50 when companies are sorted by revenue from assemblies.

39

Number of companies that drop out of the Top 50 when companies are sorted by income as a percentage of revenue.

22

Percentage of revenue retained as income by No. 14 Johnson & Johnson, the highest ratio in the Top 50.

9

The rank of Fiat-parent company of Chrysler-in 2002.

17

Fiat’s rank in 2010.

The Assembly Top 50

| Company |

Rank |

Income ($M) |

Revenue ($M) |

Inc./Rev. |

% of Rev. from Assemblies |

| Toyota | 1 | 4,909 | 228,427 | 2% | 94% |

| General Electric | 2 | 11,644 | 150,211 | 8% | 40% |

| GM | 3 | 6,172 | 135,592 | 5% | 100% |

| Daimler | 4 | 6,245 | 130,628 | 5% | 88% |

| Ford | 5 | 6,561 | 128,954 | 5% | 92% |

| Hewlett-Packard | 6 | 8,761 | 126,033 | 7% | 67% |

| Honda | 7 | 6,423 | 107,479 | 6% | 94% |

| Nissan | 8 | 3,856 | 105,977 | 4% | 94% |

| Siemens | 9 | 5,552 | 103,694 | 5% | 96% |

| IBM | 10 | 14,833 | 99,870 | 15% | 18% |

| Apple | 11 | 14,013 | 65,225 | 21% | 88% |

| Boeing | 12 | 3,307 | 64,306 | 5% | 82% |

| Robert Bosch | 13 | 3,326 | 63,147 | 5% | 100% |

| Johnson & Johnson | 14 | 13,334 | 61,587 | 22% | 40% |

| Dell | 15 | 2,635 | 61,494 | 4% | 81% |

| United Technologies | 16 | 4,373 | 54,326 | 8% | 71% |

| Fiat | 17 | 710 | 48,969 | 1% | 91% |

| Lockheed | 18 | 2,926 | 45,803 | 6% | 80% |

| Mitsubishi Electric | 19 | 1,500 | 43,920 | 3% | 85% |

| Cisco Systems | 20 | 6,490 | 43,218 | 15% | 75% |

| Caterpillar | 21 | 2,700 | 42,588 | 6% | 94% |

| Volvo | 22 | 1,563 | 38,085 | 4% | 97% |

| Abbott Laboratories | 23 | 4,626 | 35,167 | 13% | 20% |

| Mitsubishi Heavy Industries | 24 | 362 | 34,922 | 1% | 100% |

| Continental | 25 | 770 | 34,804 | 2% | 61% |

| BAE Systems | 26 | 1,678 | 34,761 | 5% | 26% |

| Northrop Grumman | 27 | 2,053 | 34,757 | 6% | 63% |

| Johnson Controls | 28 | 1,491 | 34,305 | 4% | 79% |

| Philips Electronics | 29 | 1,940 | 33,965 | 6% | 99% |

| Honeywell | 30 | 2,022 | 33,370 | 6% | 65% |

| General Dynamics | 31 | 2,624 | 32,466 | 8% | 67% |

| ABB | 32 | 2,561 | 31,589 | 8% | 83% |

| Flextronics | 33 | 596 | 28,680 | 2% | 100% |

| Schneider Electric | 34 | 2,298 | 26,163 | 9% | 100% |

| Deere | 35 | 1,865 | 26,005 | 7% | 91% |

| Raytheon | 36 | 1,840 | 25,183 | 7% | 85% |

| Magna Int'l | 37 | 1,003 | 24,102 | 4% | 100% |

| Mitsubishi Motors | 38 | 189 | 22,058 | 1% | 99% |

| Xerox | 39 | 606 | 21,633 | 3% | 18% |

| Alcatel-Lucent | 40 | (443) | 21,225 | -2% | 77% |

| Emerson Electric | 41 | 2,164 | 21,039 | 10% | 100% |

| Research in Motion | 42 | 3,411 | 19,907 | 17% | 82% |

| Motorola Solutions | 43 | 633 | 19,282 | 3% | 100% |

| Faurecia | 44 | 269 | 18,434 | 1% | 100% |

| Whirlpool | 45 | 619 | 18,366 | 3% | 100% |

| ZF Friedrichshafen | 46 | 592 | 17,246 | 3% | 91% |

| Rolls-Royce | 47 | 837 | 17,208 | 5% | 48% |

| Tyco Int'l | 48 | 1,132 | 17,016 | 7% | 59% |

| EMC | 49 | 1,900 | 17,015 | 11% | 64% |

| Medtronic | 50 | 3,096 | 15,933 | 19% | 100% |

Top 30 by Net Income

| Net Income ($M) | ||||

| Company |

Rank |

2008 |

2009 |

2010 |

| IBM | 1 | 12,334 | 13,425 | 14,833 |

| Apple Computer Inc. | 2 | 6,119 | 8,235 | 14,013 |

| Johnson & Johnson | 3 | 12,949 | 12,266 | 13,334 |

| General Electric | 4 | 17,410 | 11,025 | 11,644 |

| Hewlett-Packard | 5 | 8,329 | 7,660 | 8,761 |

| Ford | 6 | -14,766 | 2,717 | 6,561 |

| Cisco Systems | 7 | 6,134 | 7,767 | 6,490 |

| Honda | 8 | 1,387 | 2,885 | 6,423 |

| Daimler | 9 | 1,993 | -2,640 | 6,245 |

| General Motors | 10 | -30,943 | -21,023 | 6,172 |

| Siemens | 11 | 8,505 | 3,350 | 5,552 |

| Toyota | 12 | -4,424 | 2,251 | 4,909 |

| Abbott Laboratories | 13 | 4,881 | 5,746 | 4,626 |

| United Technologies | 14 | 4,689 | 3,829 | 4,373 |

| Nissan | 15 | -2,371 | 454 | 3,856 |

| Research in Motion | 16 | 1,893 | 2,457 | 3,411 |

| Robert Bosch | 17 | 518 | -1,749 | 3,326 |

| Boeing | 18 | 2,672 | 1,312 | 3,307 |

| Qualcomm | 19 | 3,160 | 1,592 | 3,247 |

| Texas Instruments | 20 | 1,920 | 1,470 | 3,228 |

| Medtronic | 21 | 2,070 | 3,099 | 3,096 |

| Lockheed | 22 | 3,217 | 3,024 | 2,926 |

| Caterpillar | 23 | 3,557 | 895 | 2,700 |

| Dell | 24 | 2,478 | 1,433 | 2,635 |

| General Dynamics | 25 | 2,459 | 2,394 | 2,624 |

| ABB | 26 | 3,118 | 2,901 | 2,561 |

| Schneider Electric | 27 | 2,398 | 1,288 | 2,298 |

| Emerson Electric | 28 | 2,412 | 1,724 | 2,164 |

| Northrop Grumman | 29 | -1,262 | 1,686 | 2,053 |

| Honeywell | 30 | 806 | 1,548 | 2,022 |

| Companies in italics are not among the Top 50. | ||||