In September, Toyota announced that it will invest $391 million in its truck assembly plant in San Antonio. Hyundai announced that it is investing nearly $300 million in its factory in Montgomery, AL. Brake manufacturer Bendix Spicer began construction on a $65 million expansion of its assembly plant Bowling Green, KY. And, automotive supplier Hirotec Group said it will invest $48 million to build a new assembly plant in Fayetteville, TN.

If you’re keeping score, that’s $805 million in capital investment from just four companies, in one month, in one industry, in one region of the country. Yes, it is, indeed, a good time to be in the assembly technology business.

Despite a global trade war, a UAW strike at GM that lasted 40 days, rising tensions in the Middle East, and, um, political friction in Washington, the U.S. economy continues to roll. Unemployment hit a 50-year low in September, and nonfarm payrolls rose by 136,000 jobs. The jobless rate dropped 0.2 percentage points to 3.5 percent, matching a level last seen in December 1969. From October 2018 to September 2019, the economy created an average of 179,000 jobs per month. That’s more than the average of 168,000 jobs per month from October 2016 to September 2017, and it’s not that much less than the average of 219,000 jobs per month from October 2017 to September 2018.

What’s more, average hourly earnings in 2019 have increased by 79 cents, or 2.9 percent, the largest increase since June 2009.

Manufacturing employment is leveling off, but it’s still at the highest level in 11 years. More than 12.8 million Americans held manufacturing jobs in September 2019. That’s just 1 percent more than in September 2018, but it’s nearly 1.4 million more than in March 2010, the low point of the Great Recession.

Pressed for workers, assemblers have no choice but to automate routine tasks like machine tending, screwdriving and adhesive dispensing. That trend is reflected in the results of our 24th annual Capital Equipment Spending Survey, which indicate that manufacturers will increase spending on assembly technology in 2020.

Continued Growth

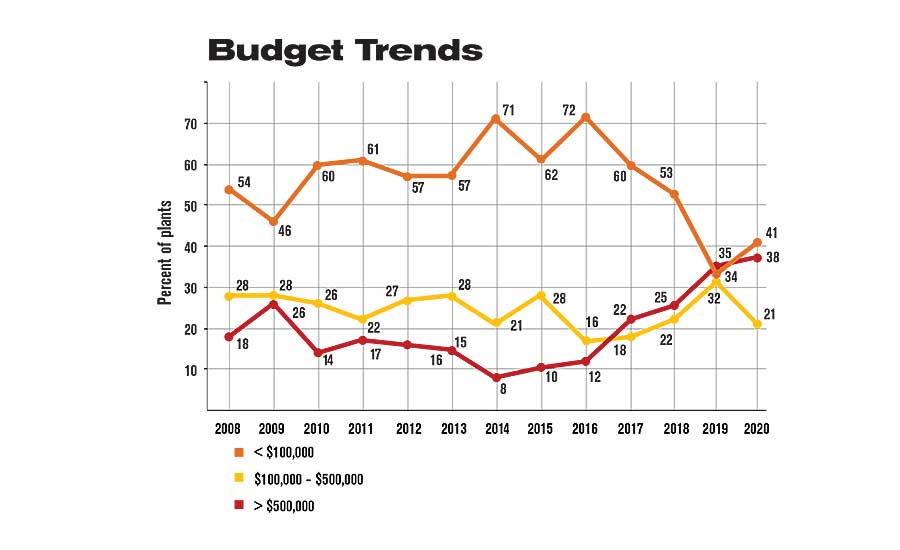

Some 44 percent of respondents will spend more on assembly technology next year than they did this year. That marks the third straight year that the “we’ll spend more” percentage has been above 40 percent and the 10th straight year that it’s been over 30 percent. Forty-four percent will spend the same as they did in 2019, and only 12 percent of respondents will spend less in 2020 than they did 2019—the same record-low percentage as last year.

Of those that will spend more, the average budget increase is 33 percent. Of those that plan to spend less, the average budget decrease is 15 percent.

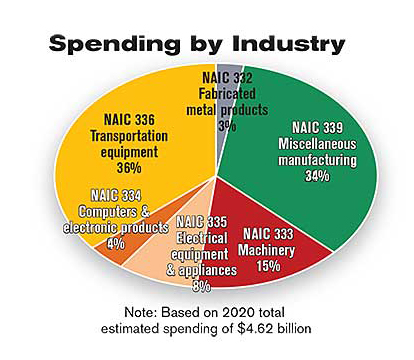

That’s not to say, however, that overall spending will increase that much. Our data indicate that U.S. assembly plants will spend $4.62 billion on new equipment in 2020, an increase of 5 percent from the $4.4 billion projected to be spent in 2019.

On average, manufacturers will spend $748,037 on assembly technology in 2020. That compares with $697,841 in 2019, and it’s the seventh highest average in survey history. The median budget total is $150,000—the second largest total in survey history.

“Our sales in 2019 will be up 10 percent over last year, and we are predicting a 5 to 10 percent increase in sales for 2020,” says Vic Glenn, president of Design Tool Inc., a supplier of automated screwdriving equipment. “Customers are telling us that they are automating everything they can to be competitive in U.S. markets and overseas. Overall, our customers are upbeat, but we do have some that are slowing.”

Aggregate budget data indicate that the increase in spending will be driven primarily by large companies with large budgets. For example, 30 percent of plants have capital budgets of at least $1 million, a record high that compares with 24 percent in 2019 and 19 percent in 2018.

At the same time, many of the companies that had midlevel budgets in 2019 will have lower-tier budgets next year. Specifically, 30 percent of plants will spend between $100,000 and $999,999 in 2020, compared with 43 percent in 2019, while 40 percent of plants will spend less than $100,000 next year, compared with 34 percent in 2019.

“I am not surprised your data indicate increased spending at assembly plants,” says Jeff French, national managing partner for consumer and industrial products at accounting firm Grant Thornton LLP in Chicago. “Despite the volatile news stream and economic indicators, we are still seeing a relatively positive outlook among our manufacturing clients.

“In addition, Grant Thornton conducted a survey gauging how companies are preparing for an economic downturn, and respondents indicated they would continue to innovate and spend money on technology advancements. Participants in our Manufacturing CFO Insights Exchange also have indicated that, regardless of economic conditions, they will continue to invest in capital equipment and technology that will drive production efficiencies.”

Gregory Daco, chief U.S. economist at Oxford Economics USA in New York, is surprised by our survey results. “I feel like it’s optimistic,” he argues. “We expect overall business investment to flatline over the course of 2020, because of a number of headwinds the economy is facing. These include a slowdown in global growth; trade tensions between the U.S., China and most of its trading partners; the strong dollar; and cooling domestic demand, including on the housing front. There’s a lot of economic uncertainty right now, and all those elements will limit the potential for investment in 2020.”

David Payne, staff economist at financial news firm Kiplinger in Washington, DC, is equally pessimistic. “Business investment in new equipment is likely in for a prolonged slump because of the global economic slowdown and because of uncertainty about the outcome of the U.S.-China trade war,” he says. “Global growth is slowing as trade tensions have ramped up. Europe’s outlook is deteriorating as its exports to China soften, while China itself is experiencing a decline in exports that is putting its economy under strain.”

Brian Beaulieu, CEO of ITR Economics, an economic research and consulting firm in Manchester, NH, advises assemblers to time next year’s investments carefully.

“Despite the current optimism of business owners, it’s critical that they make their investment decisions with the business cycle in mind,” he says. “ITR Economics predicts that the industrial economy will be under pressure in the first half of 2020, with a cyclical low expected around midyear. As we’ve recommended many times in the past, the time to invest is during or shortly after the business cycle low point. Not only are costs typically lower at that time, but it will give companies the opportunity to get the new assets ramped up in time for the next cyclical rising trend, which is expected in the second half of next year and into 2021.”

The National Association of Manufacturers (NAM) believes that the U.S. manufacturing sector will continue to grow, albeit more slowly. According to the association’s quarterly Manufacturers’ Outlook Survey, which was last published in June, four out of five manufacturers have either somewhat or very positive outlooks for the next 12 months. While that was down from nearly 90 percent in the first quarter of 2019, it continues to reflect a mostly positive sentiment in the sector.

“Clearly, optimism is still strong among manufacturers, but you can’t overlook the fact that trade uncertainties are causing concern for manufacturers,” says NAM chief economist Chad Moutray. “All things equal, I would expect these numbers to improve if we get the U.S.-Mexico-Canada Agreement across the finish line, strengthen our trading relationships by removing the threat of 232 auto tariffs, and get a trade deal with China done.”

Respondents expect capital investments to rise 2.2 percent over the next 12 months, down from 2.8 percent in March. Even so, 45 percent of manufacturers anticipate higher capital spending in the next year, with 29 percent expecting investment growth of 5 percent or more. In contrast, only 12 percent predict less capital spending over that time frame.

Similarly, the latest Horizon Report from the Equipment Leasing and Finance Foundation (ELFF) predicts that capital equipment spending by businesses will increase 3 percent next year. ELFF’s report looks at multiple business sectors, including financial, construction, education and professional services, as well as manufacturing. It also encompasses a wider range of capital goods, such as cars and aircraft.

Nevertheless, most respondents to ELFF’s survey (56 percent) expect their capital spending to remain the same over the next 12 months, while the share of end-users who expect investment to increase (22 percent) roughly matches the share who expect it to decrease (21 percent). Among manufacturers specifically, 22 percent expect to increase spending in 2020, while only 13 percent expect to reduce it.

Regarding the external factors most likely to influence their decision to purchase new equipment over the next 12 months, “general economic conditions” topped the list, followed by technology advancements, tax incentives, trade policy conditions, and interest rates.

Boosting Capacity

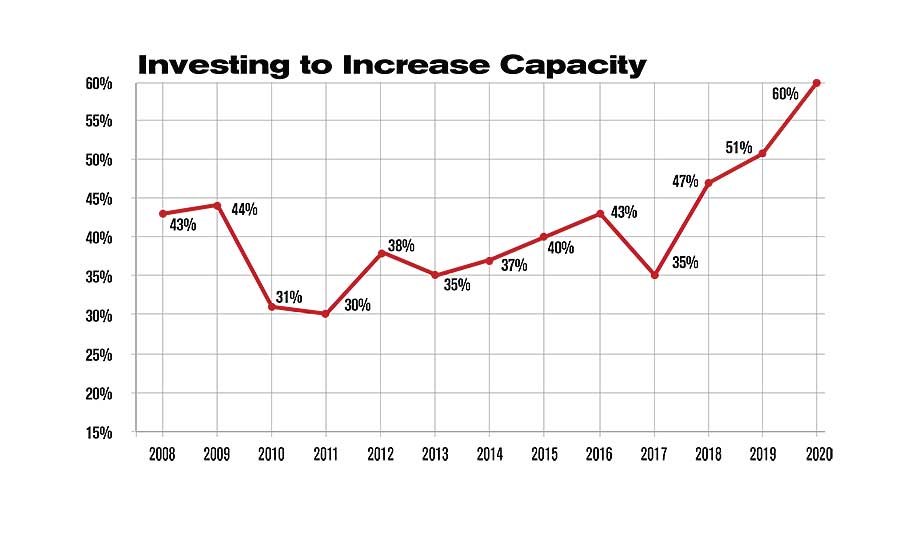

For just the second time in survey history, increasing capacity is the No. 1 reason for investing in assembly technology. In fact, 60 percent of assembly plants—a record high—are looking to increase capacity or output larger volumes of existing products in 2020. That compares with 51 percent in 2019, and it marks the third straight year in which that percentage has increased.

That number stands in contrast to the latest data from the Federal Reserve, which indicate that U.S. durable goods manufacturers were running at 74.1 percent of capacity in October, down from 76.6 percent in October 2018. On the other hand, 74.1 percent capacity is still higher than the low-water mark of 63.7 percent set in 2009 during the Great Recession.

“It’s interesting that 60 percent of plants say they need increased capacity,” says French. “However, if respondents are referring to labor capacity, I can understand the response. Manufacturers are still having difficulty finding skilled labor to meet production needs.”

The need to boost capacity is particularly acute in the aerospace and defense industries. According to our survey, 67 percent of aerospace manufacturers report they need to increase capacity next year, up from 54 percent in 2018.

It’s not hard to see why. Despite Boeing’s issues with the 737-MAX, both Boeing and rival Airbus have record backlogs: 5,705 aircraft for Boeing and 7,133 for Airbus.

“The commercial aircraft order backlog remains at an all-time peak,” says Wendy Harding, an analyst with consulting firm ARC Advisory Group. “Short-term demand for the current generation of commercial aircraft is being driven by the need for carriers to replace older airframes, as well as rapidly growing aviation markets in China and India.

“In addition, defense spending has seen a significant uptick over the past year driven by geopolitical uncertainty. For instance, China, France, India, and the U.S. have each substantially increased their defense budgets.”

OEMs and their suppliers are responding. For example, in February, Airbus began construction of a new $300 million assembly plant in Mobile, AL, to manufacture the A220 jetliner. The project is expected to create 432 full-time jobs.

Airbus already produces the larger A320 jetliner in Mobile. That facility, which opened in 2015, employs 700 people. It is producing 4.5 aircraft per month and could be making as many as five per month by the end of 2019. The plant delivered its 100th jetliner last January.

The new assembly line is expected to produce four A220s a month, with the first jet to be delivered in 2020. U.S. airlines have already ordered 250 of the jets, which can seat 110 to 130 people.

The automotive industry, in contrast, is dealing with overcapacity. Only 35 percent of automotive assemblers are looking to add capacity next year, the lowest percentage of any industry.

Certainly, that appears to be true for the Detroit Three. Late last year, General Motors announced that it was cutting 15 percent of its salaried workforce and idling assembly plants in Michigan, Ohio, Maryland and Canada. Ford Motor Co. eliminated some 800 white-collar jobs this year, and it will be closing its Romeo (MI) Engine Plant. (No layoffs are expected to occur as a result of the closure, however.) And, FCA laid off 1,400 workers at its assembly plant in Belvidere, IL, and 1,500 workers at its assembly plant in Windsor, ON.

On the other hand, transplants seem to be adding capacity. In September, for example, Japanese truck maker Hino Motors Manufacturing opened a new assembly plant in Mineral Springs, WV, to produce medium- and heavy-duty trucks. In October, Toyota announced plans to add 400 workers as soon as possible to its assembly plant in Georgetown, KY. And in November, Volkswagen started construction on an $800 million assembly plant in Chattanooga, TN, to build electric vehicles and battery packs.

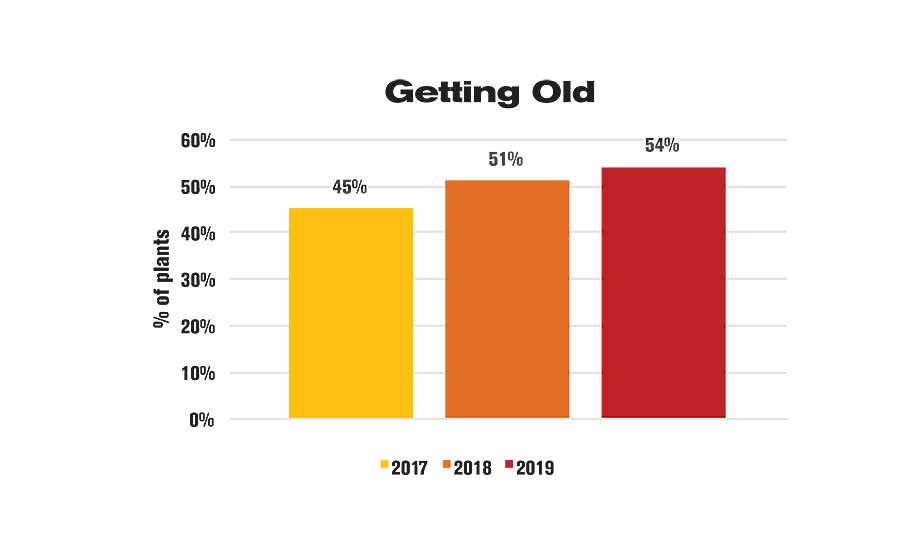

Getting Old

More than half of assemblers, 54 percent, will buy equipment next year to replace old or worn-out machinery—a record high for our survey. It’s the fourth time in six years in which that percentage has been above 46 percent. Perhaps assemblers are implementing Industrial Internet of Things technology. Or, it may be that manufacturers postponed replacing capital equipment during the Great Recession and are now desperate for new machinery.

“Replacing old equipment is in line with manufacturers’ need to become more efficient, especially in light of the labor shortages,” notes French. “Manufacturers are looking to replace old, antiquated equipment to improve production performance and lower costs. In addition, manufacturers are very good at maintaining and extending the life of equipment. Early on in a rising economy, companies will stick with their old equipment to meet increased orders, but the cost of maintenance and downtime will eventually erode margins—hence their need to replace worn out equipment, especially later in a robust business cycle.”

The problem may be particularly acute among assemblers of appliances and electrical products. Seventy-one percent of assemblers in this industry are looking to replace old equipment in 2020, the most of any industry.

Certainly, equipment updates will be part of GE Appliances’ plan, announced in September, to invest $60 million to create a Manufacturing Center of Excellence for water heaters in Camden, SC. Renovation and retooling efforts will transform the plant, which currently produces refrigerators, into a high-volume water heater production facility with capacity for future growth. The new assembly line is expected to start production in the fourth quarter of 2020.

Old equipment is also an issue in the medical device industry. Sixty-seven percent of medical device assemblers will replace old machinery next year, marking the fifth time in six years that this industry has been above the national figure in that regard.

More New Products?

Forty-four percent of plants will buy equipment next year to assemble a new product. That compares with 40 percent in 2019, and it’s the highest percentage since 2003.

“Manufacturers are seeing customer demand for new products,” says French. “New sizes, new colors, new features, and disruption of older technology are leading to the proliferation of products at many manufacturers. I expect this trend will only continue.”

As one might expect, 63 percent of electronics manufacturers are investing in technology to assemble new products. It’s the fourth consecutive year in which electronics assemblers have outpaced the national figure in spending to make new products.

In contrast, only 29 percent of machinery manufacturers will buy equipment next year to make something new. That’s the least of any industry, and it’s the 11th time in 24 years in which machinery manufacturers have held that distinction.

That not’s too surprising. Products such as plows, printing presses and pizza ovens are built to last a long time, and their designs don’t change all that much from year to year.

Indeed, manufacturers of larger products are much less likely than manufacturers of smaller ones to be purchasing equipment to assemble a new product. For example, assemblers of products that can fit inside a 12-inch cube are nearly twice as likely as assemblers of products larger than a 6-foot cube to buy equipment to make something new: 53 percent vs. 27 percent.

Other Motives

Other motives for investing in assembly technology include:

- Forty-seven percent will buy equipment to reduce cycle time or eliminate a bottleneck. That makes it the third most common reason to invest in new technology in 2020, and it’s the highest percentage since 2011.

- Forty-one percent will buy equipment to increase safety, the highest percentage since 2008.

- Twenty percent will buy equipment in increase quality. This percentage has been 19 percent or more for three of the past four years.

- Forty-seven percent will buy equipment to cut costs. This percentage is typically higher among manufacturers of fabricated metal products than for other industries.

- Twenty-four percent will buy equipment to implement lean manufacturing. This percentage is higher for aerospace manufacturers and, surprisingly, medical device manufacturers.

- Sixteen percent will buy equipment to keep up with competition. Aerospace assemblers are twice as likely as manufacturers in other industries to be buying equipment for this reason.

- Thirteen percent will buy equipment to meet OEM or downstream requirements.

- Eleven percent will buy equipment to comply with standards or industry regulations. Not surprise here: Medical device manufacturers are two times more likely than other manufacturers to be getting equipment for this reason.

Labor Costs

As always, the top two targets for cost reduction are direct labor and indirect labor. However, only 65 percent of plants are looking to decrease direct labor costs next year. That compares with 68 percent in 2019, and it’s the second lowest percentage in survey history.

That may seem odd, given the low unemployment rate. However, while manufacturing wages are rising, they’re not rising as fast as other industries. According to the Bureau of Labor Statistics (BLS), wages for U.S. workers in durable goods manufacturing increased 2.6 percent in the past year, from an average of $22.63 per hour in October 2018 to $23.21 per hour in October 2019. In contrast, wages for all private sector businesses increased by 3.5 percent over that same time period.

It remains to be seen whether the continuing labor shortage will put upward pressure on wages. The BLS estimates that there were approximately 309,000 open jobs among U.S. durable goods manufacturers in October 2019, 4 percent more than there were in October 2018.

Machinery manufacturers are particularly concerned about labor costs. Some 76 percent of companies that make compressors, conveyors and other machinery are targeting direct labor costs next year. That’s more than any industry, and it marks the third time in 10 years that this industry has led all others in that statistic.

One reason machinery makers are concerned about labor costs might be a lack of automation. Most products made by this industry are large assemblies produced in low volumes. Some 82 percent of manufacturers in this industry employ manual assembly methods. That compares with 78 percent for all U.S. assembly plants, and it’s the highest percentage of any industry.

Another reason could be the impact of tariffs. About half the value of U.S. imports consists of intermediate goods (raw materials, industrial inputs, machine parts, etc.) and capital equipment. These are the purchases of U.S. businesses, not households. Most of the Chinese products on the tariff list are inputs to U.S. production.

Machinery manufacturers have been hit particularly hard by these tariffs. For example, manufacturers of lawn and garden equipment consumed $6 billion in intermediate goods in 2007, the last year for which data is available. More than $3.7 billion in those goods, or 62 percent, are now subject to tariffs. Similarly, manufacturers of vending machines and commercial laundry equipment consumed $8.6 billion in intermediate goods, of which 58 percent are now subject to tariffs.

One industry that is not concerned about direct labor costs is medical device manufacturing. Only 44 percent of plants in that industry are targeting direct labor costs next year. That’s the lowest of any industry, and it’s the sixth straight year in which this industry has been below the national figure.

That makes sense. Medical devices tend to be small, high-value products produced at high volumes, which makes them ideal candidates for automated assembly.

Other Cost Targets

Labor costs aren’t the only expense assemblers are hoping to reduce next year. Other cost targets include:

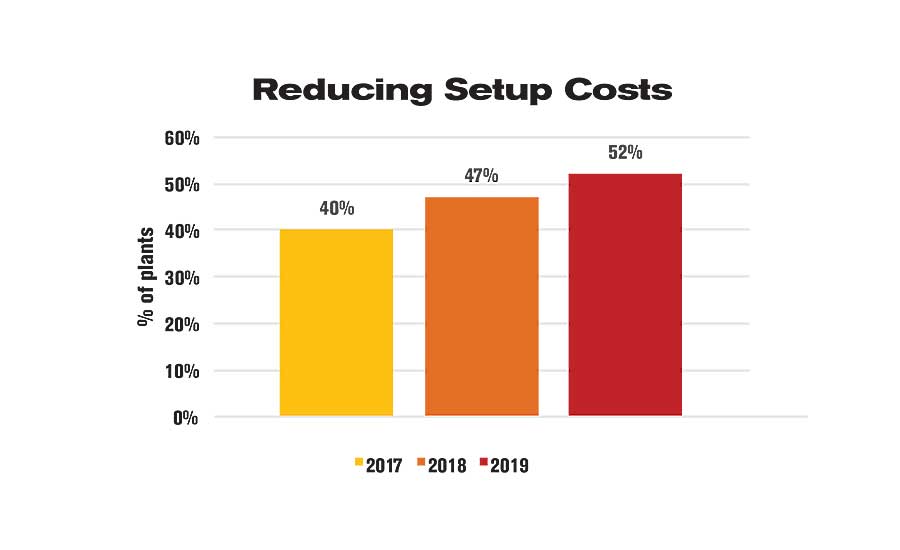

- Fifty-two percent of plants want to lower indirect labor costs, such as setup and maintenance. That’s the highest percentage since 2000, and it marks the fourth straight year in which this

- percentage has been 40 percent or more. From 2013 to 2016, this percentage has been under 40 percent.

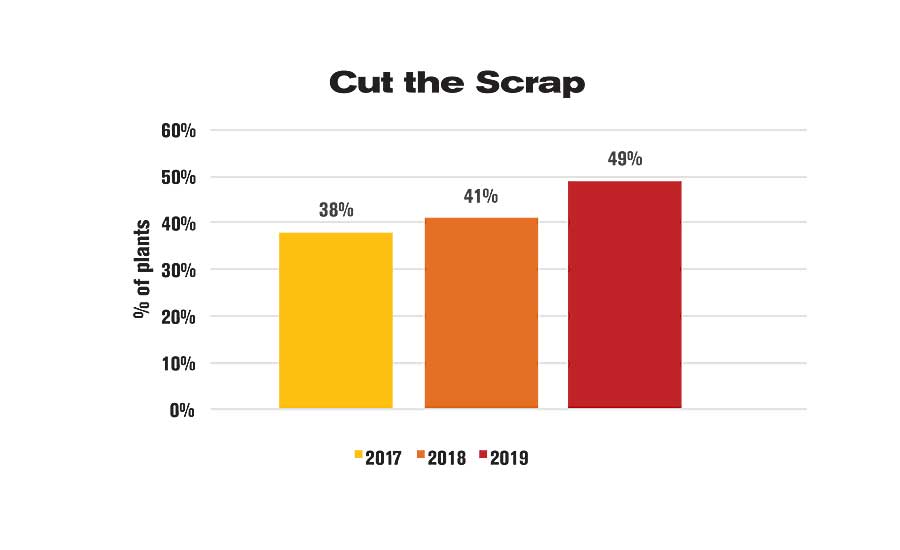

- Forty-nine percent of plants are targeting scrap costs next year. That’s the highest percentage since 2001, and it’s the third time in the past three years in which this percentage has exceeded 40 percent.

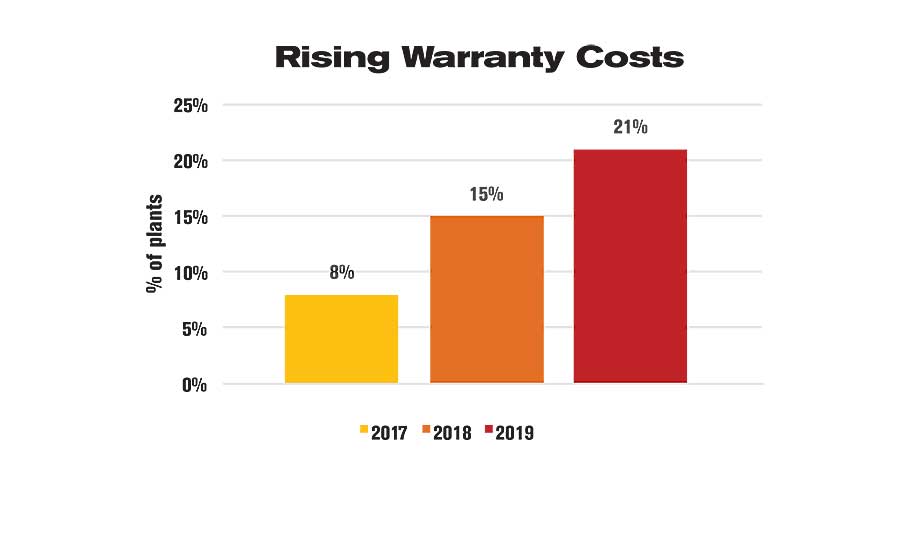

- Twenty-one percent of plants want to reduce warranty costs. That compares with 15 percent last year, and it’s the most since 2010. Warranty costs are particularly a concern in the automotive and electronics industries.

- One-third of assembly plants want to cut material costs. This percentage has topped 30 percent for four straight years now. To put that in perspective, this percentage hit 30 percent just once between 1996 and 2015.

- Just 15 percent hope to lower energy costs, the lowest percentage in four years. Not surprisingly, energy costs are most concerning in the automotive industry, a high-volume industry with energy-intensive processes like welding and painting.

- Twenty percent want to reduce work in process, which is on par for the past 10 years.

What Assemblers Want

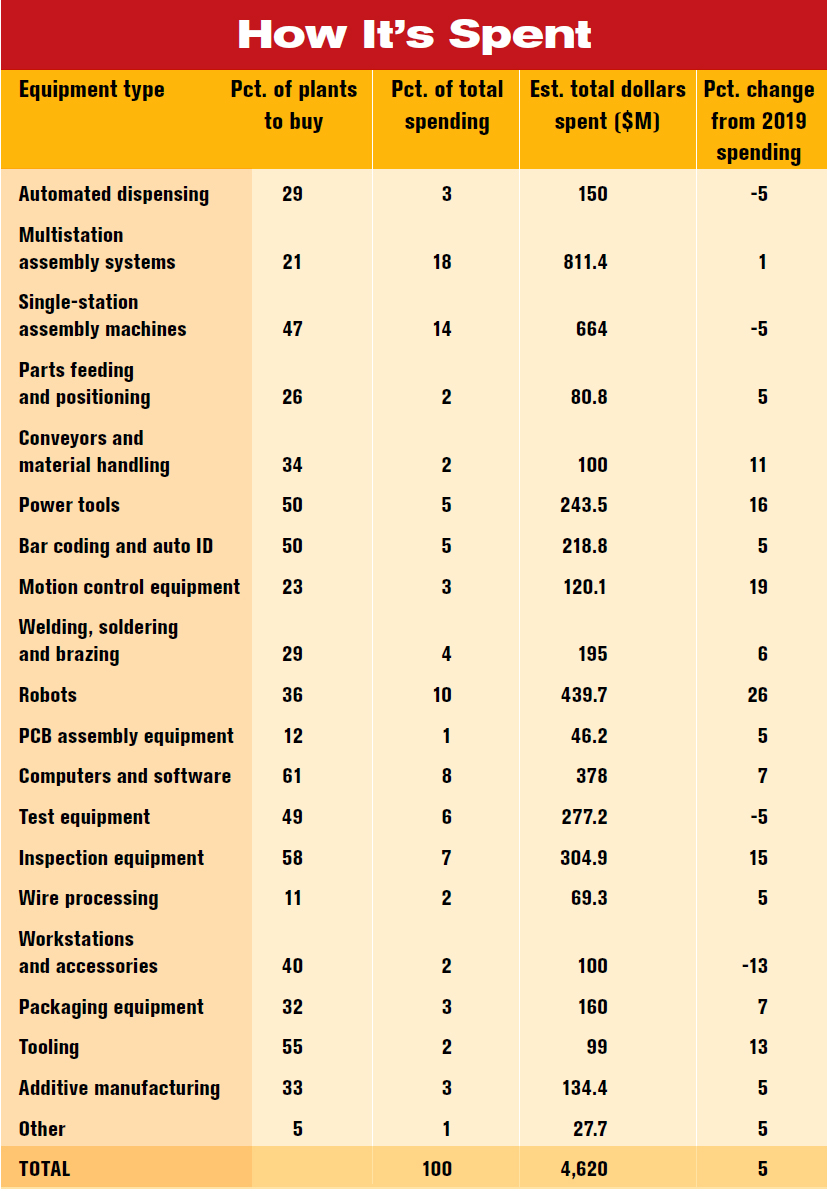

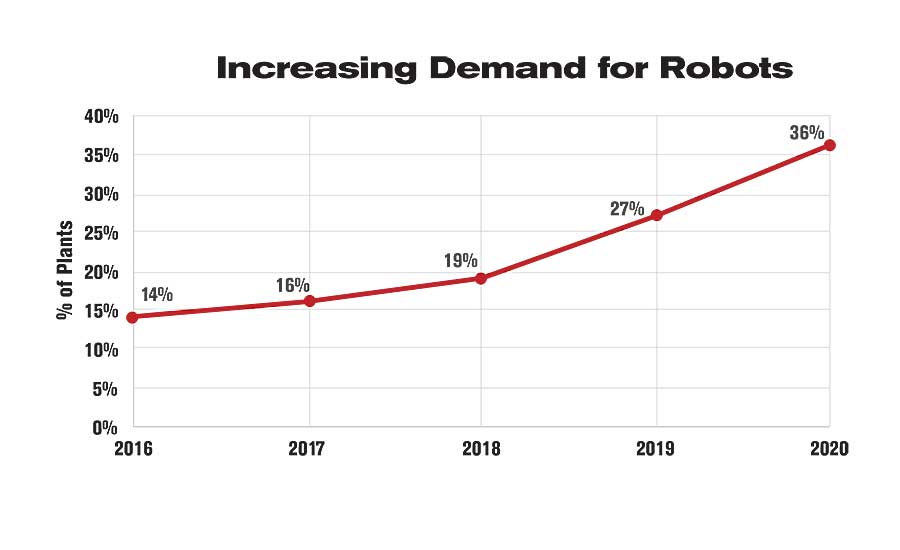

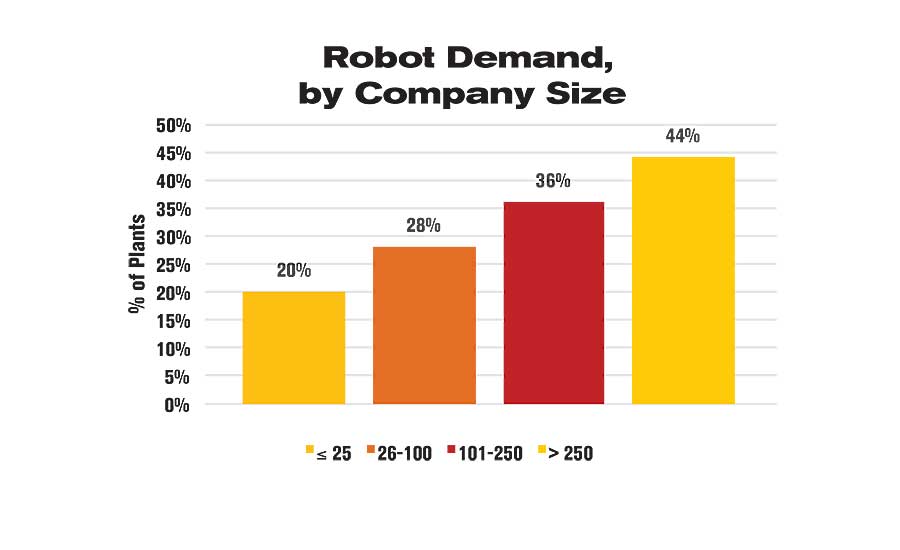

In terms of what assemblers will be buying in 2020, the biggest story from this year’s survey is the increased demand for robots. Thirty-six percent of plants will purchase robots next year. That compares with 27 percent in 2019, and it’s a record high. Demand for robots should be particularly strong in the aerospace, appliance and automotive sectors.

Although robots are now much easier to use and much less expensive than ever before, the technology remains the province of larger companies. Only 20 percent of companies with 25 employees or fewer will buy robots next year, while 44 percent of companies with more than 250 employees will invest in the technology.

In all, assemblers will spend $439.7 million on six-axis robots, SCARAs, grippers and other robotic technology next year, an increase of 26 percent over 2019 sales.

“We’re seeing improvement in the robotics market,” observes Jeff Burnstein, president of the Robotic Industries Association. “We hope to end the year strong and see growth in 2020 as well.”

Burnstein indicated that orders from non-automotive customers are at near record numbers, a healthy sign for the long-term growth of the robotics industry.

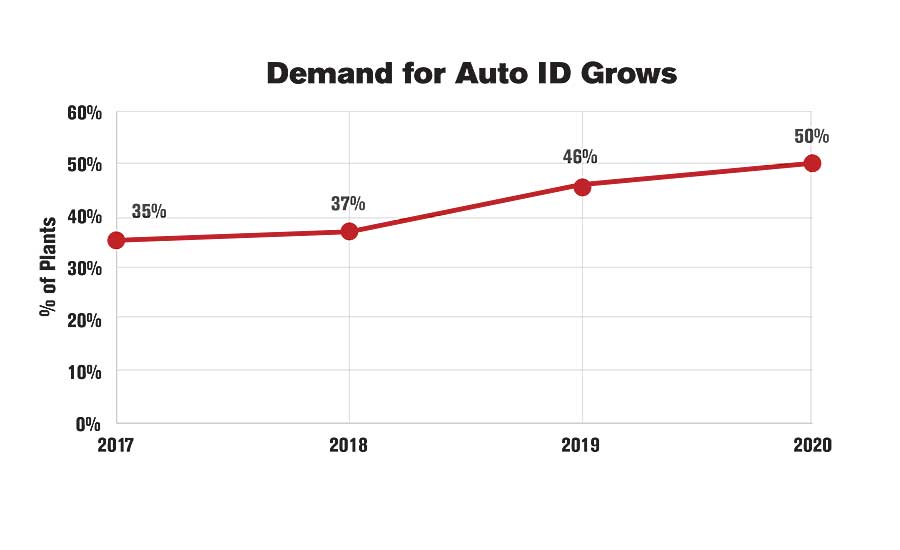

Next year should also be good for suppliers of automatic identification technology. Whether in response to “Industry 4.0” initiatives, increasing traceability requirements or a growing product mix, 50 percent of U.S. assembly plants—a record high—will purchase bar code scanners, label printers, laser engraving equipment, radio frequency identification tags and other auto ID technology next year.

Demand for auto ID technology is expected to be above average in the aerospace and automotive industries, but below average in the electronics and fabricated metal products industries. All totaled, assemblers will spend $218.8 million on auto ID technology in 2020, up 5 percent from 2019.

“2019 was an extremely successful year for us in North America,” says Adam L. Brown, U.S. marketing manager for Pro-Glove, a manufacturer of wearable bar code scanners. “Not only did we extend our local leadership team to better address market growth, but we also quadrupled our revenue.

“Without a doubt, our technology…is gaining traction. We continue to engage in exciting discussions with some of the world’s biggest brands. They’ve expressed a real need for the increased efficiency and benefits…of wearable scanning solutions. We are expecting 2020 to be another strong year of growth in North America.”

In what could also be the result of increasing interest in Industry 4.0 and the Industrial Internet of Things, 23 percent of assembly plants will buy motion control technology next year. That compares with 19 percent in 2019, and it’s the highest percentage since 2007. Demand for servomotors, linear actuators, controllers, bearings, indexers and other motion control products will be strongest in the aerospace, machinery and fabricated metal products industries.

All totaled, assemblers will spend $120.1 million on motion control technology next year, or 19 percent more than they did in 2019.

Some 58 percent of assemblers will acquire inspection technology in 2020. That compares with 50 percent in 2019, and it, too, is a record high. Demand for vision systems, sensors, gauges and other inspection technology will be highest in the aerospace, fabricated metal products, and medical device industries.

In all, assemblers will spend $304.9 million on inspection technology next year, a 15 percent increase from 2019.

Suppliers of automatic screwdriving equipment could see sales rise next year. Twenty-nine percent of plants will buy automatic screwdriving equipment in 2020, marking the sixth straight year in which that percentage has exceeded 25 percent. Demand will be strongest in the automotive, appliance and electronics industries.

“We did a record year in 2019 and are expecting to break that in 2020,” predicts Gene Mack, vice president of Nitto Seiko America, a supplier of automatic screwdriving systems. “In the past, many of our potential customers could not cost-justify automating their screwdriving processes. Today, they not only can automate their screwdriving processes, but they have to. We expect to see that grow and expand to more industries, as the need for quality and traceability moves past the automotive industry and into other industries.”

One of the biggest technology surprises from this year’s survey doesn’t involve an assembly product—it’s additive manufacturing. One-third of assembly plants, a record high, will invest in metal and polymer additive manufacturing technologies in 2020. That makes additive manufacturing the ninth most popular production technology in our survey, ahead of packaging, adhesive dispensing and even welding equipment.

Demand will be highest in the aerospace and medical device industries. And, as with robots, the technology seems to be more in the reach of larger companies than smaller ones. For example, 40 percent of companies with more than 250 employees will invest in additive manufacturing products next year, compared with 21 percent of companies with 26 to 100 employees.

Total spending on additive manufacturing technology is expected on increase 5 percent, from $128 million in 2019 to $134.4 million in 2020.

Survey Methodology

ASSEMBLY magazine is sent to 54,001 assembly professionals in more than 33,000 locations.

The survey was conducted in conjunction with Clear Seas Research, an affiliate of BNP Media, ASSEMBLY magazine’s parent company. Clear Seas is a full service, B-to-B market research company. Custom research products include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

Questionnaires were e-mailed in mid-July to a random sample of 21,597 subscribers in manufacturing positions. Forty-one percent of respondents were engineers; 47 percent were management; and 4 percent were classified as “other.”

The cutoff date for returning the surveys was July 29. Some 206 surveys were returned for a response rate of 1 percent.

The survey was sent to manufacturers in the following industries: aerospace, electronics, appliances, fabricated metal products, furniture, machinery, medical devices, plastics and rubber products, automotive, energy and miscellaneous manufacturing.

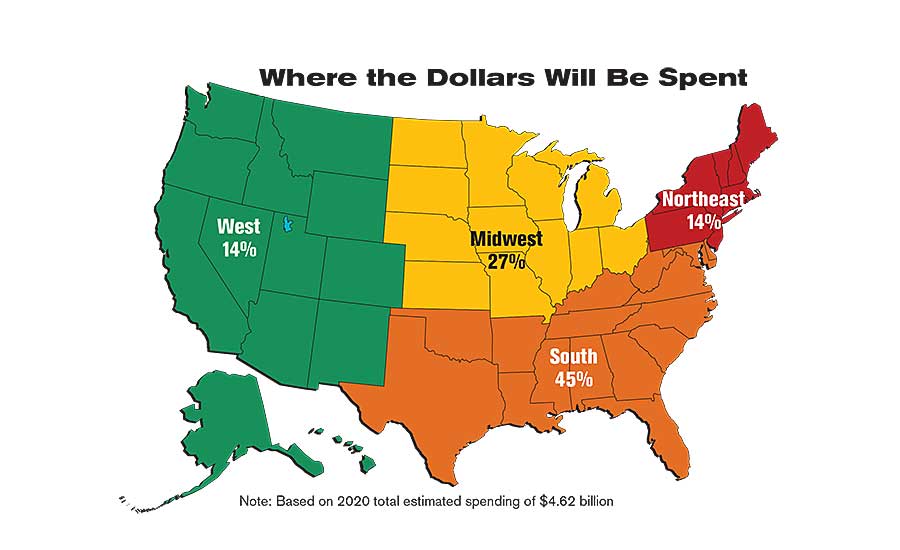

Geographically, 15 percent of respondents were located in the Northeast, 51 percent were in the Midwest, 19 percent were in the South, and 15 percent were in the West.

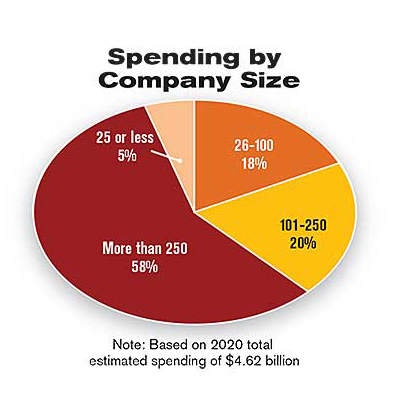

Fourteen percent of respondents had 25 employees or less. In addition, 20 percent had 26 to 100 employees, 10 percent had 101 to 250 employees, and 56 percent had more than 250 employees.

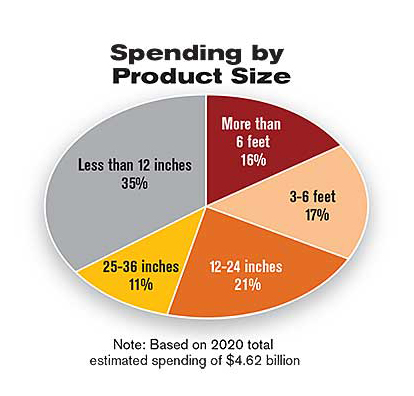

Twenty-one percent of respondents assemble products that can fit inside a 12-inch cube, 19 percent make products that can fit inside a 24-inch cube, 14 percent make products that fit inside a 36-inch cube, 21 percent make products that fit inside a 6-foot cube, and 24 percent make products that are larger than a 6-foot cube.

To purchase and download the entire capital spending report, please visit https://clearseasresearch.com/product/2019-capital-spending-study-assembly/?r=6. You can also email info@clearmarkettrends.com with any questions.