Increasing demand for smart devices and embedded intelligence is driving manufacturers in a variety of industries to invest in new production tools and technologies. Additive manufacturing, advanced sensors, augmented reality, cloud-based computing, collaborative robots and digital twins are just a few of the many trends transforming factory floors today.

The long-term goal of the Industry 4.0 era is to boost quality, improve productivity and reduce equipment downtime in an effort to make assembly lines smarter than ever. But, that demands a new breed of engineers who can stay ahead of the curve and harness the power of data analytics and digital manufacturing.

In this article

A Bold New EraTax Reform Fallout

Salary Discrepancies

Geographic Fluctuations

Labor Shortage

New Technology

Green Manufacturing

The 23rd annual ASSEMBLY State of the Profession survey finds that more than half (51 percent) of respondents will be allocating more resources toward assembly operations during the next 12 months. That’s a 2 percentage point increase over 2017 and 9 percentage points higher than in 2016.

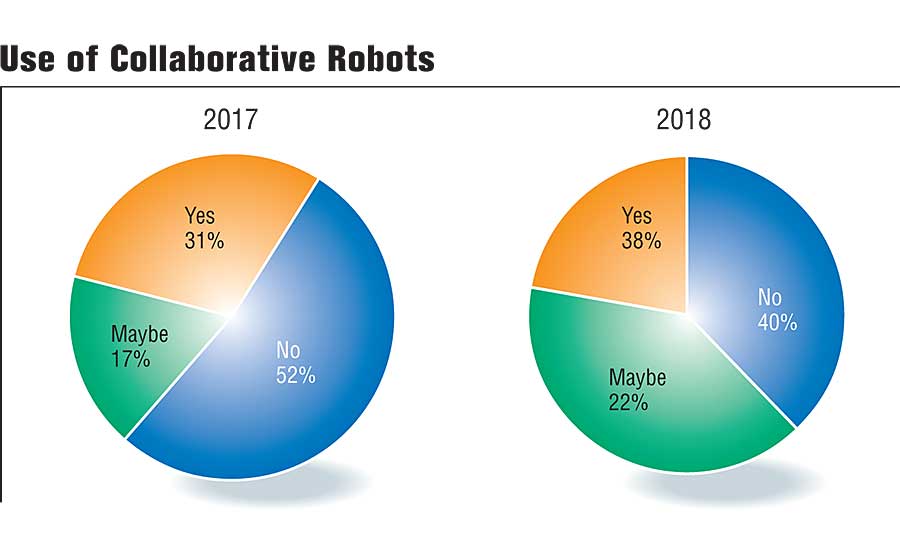

Specifically, use of collaborative robots is up 7 percentage points, while deployment of Industry 4.0 technology is up 3 percentage points. And, almost two-thirds (63 percent) of respondents believe that data analytics software, digital tools and smart technology will help them improve productivity, while 56 percent say it will lower production costs.

A Bold New Era

“Manufacturers around the globe are attempting to wrap their heads around the magnitude of change involved with Industry 4.0, where there is much uncertainty, but also opportunity,” says Tom Kelly, executive director and CEO of Automation Alley, a technology business association that serves manufacturers in the Detroit area.

“Industry 4.0 is bringing tremendous change in ways that can’t yet be fully comprehended, but the companies that can adopt a new mindset and new skillsets within their organizations are likely to find the greatest success,” notes Kelly. “While some jobs will be eliminated by Industry 4.0, it’s more important to note that new and different types of work will emerge.”

“Gone are the days where factories are rigid, slowly evolving physical environments,” adds Howard Heppelmann, divisional vice president and general manager of connected operations solutions at PTC Inc., a product design software company that specializes in developing Internet of Things (IoT) applications. “With Industry 4.0, the backbone of factories will become their digital thread.

“Tomorrow’s digital factory will enable a new era of speed, flexibility and innovation that will deliver dramatic performance improvements across every function of the manufacturing enterprise,” claims Heppelmann.

“Technology is changing so rapidly that no one knows what the future holds for smart factories,” notes Howie Choset, a professor of robotics at Carnegie Mellon University and chief technology officer for the Advanced Robotics Manufacturing Institute. “Industry 4.0 lets information flow through the manufacturing process to optimize it, as well as develop new processes we otherwise wouldn’t have thought of.”

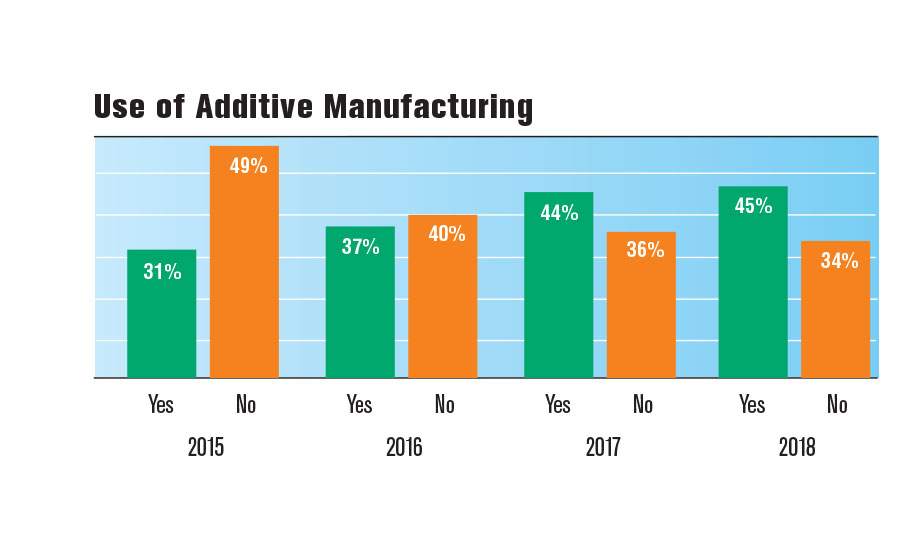

Use of Additive Manufacturing

Additive manufacturing is one of the new-age technologies that is transforming the way products are designed and made. More than one-third (45 percent) of State of the Profession respondents plan to use 3D printing during the next 12 months. That’s 8 percentage points higher than in 2016.

Large manufacturers (companies with 1,000 or more employees) are more like to use the technology than small manufacturers (companies with 100 or less employees): 60 percent vs. 33 percent.

Additive manufacturing is evolving beyond traditional prototyping applications into low-volume production. Interest in the technology is strongest in the aerospace (71 percent) and medical equipment (64 percent) industries.

According to a recent study by A.T. Kearney, 3D printing is currently used to create less than 1 percent of the world’s manufactured parts. But, it predicts that the market will skyrocket from $9 billion today to more than $26 billion by 2021.

Aerospace manufacturers are leading the charge toward production-ready printed parts.

For instance, Boeing has already produced more than 50,000 additively manufactured parts, including components for passenger and military aircraft and spacecraft.

“Additive manufacturing technology is evolving quickly,” says Richard Aston, senior technical fellow for satellite systems at Boeing. “Reduction of piece parts and part weight can be achieved through appropriate implementation of additive manufacturing, while simultaneously improving system performance.”

GE Aviation operates an additive technology center that’s filled with 90 3D printers and 300 employees. The company’s engineers used printed parts to produce 25 percent of the new Catalyst turboprop engine. They were able to combine 855 parts into just 12. That reduced the weight of the engine by 5 percent and fuel burn by 20 percent.

Another technology that’s at the forefront of Industry 4.0 initiatives is data analytics, which involves collecting and processing production data so that it can be analyzed. It looks at past histories and patterns, then “marries up” that data with statistical approaches and physics-based models.

Almost one-third (32 percent) of assemblers responding to ASSEMBLY’s 2018 State of the Profession survey claim their company will be investing in data analytics or predictive analytics software this year. That’s 3 percentage points higher than in 2017.

Large manufacturers (companies with 2,000 or more employees) are more likely to invest in data analytics (78 percent) vs. only 25 percent of small manufacturers (companies with 100 or fewer employees).

Data analytics is more popular with assemblers in the electrical equipment and appliances (52 percent), transportation equipment (46 percent), computer and electronic products (37 percent) and aerospace (36 percent) industries.

One company that’s using data analytics to improve productivity is BMW. The German automaker is applying data-driven improvements to assembly processes and systems to boost quality, reduce lead times, increase flexibility and lower costs. It uses an IoT platform to link large quantities of sensor and process data from production

and logistics.

For instance, fastener data analysis is being used to ensure more reliable error prevention on BMW’s assembly lines. Engineers monitor all bolted connections that are relevant to the safety of a vehicle. They have been using algorithms to analyze fastening tools at more than 3,000 assembly stations.

Tax Reform Fallout

Late last year, the U.S. Congress ushered in historic tax reform legislation—the first major overhaul since the Ronald Reagan era. Manufacturers in many industries have responded favorably.

“Manufacturing in America is now rising to new heights, thanks to tax reform, and as a result, manufacturers of all sizes are already investing more, growing more, hiring more and paying more,” claims David Farr, CEO of Emerson Electric Co. and chairman of the National Association of Manufacturers (NAM).

Plant Expansion Plans

A recent NAM survey discovered that 72 percent of manufacturers are increasing employee wages or benefits, 77 percent are hiring more workers and 86 percent are investing in new equipment and facilities.

One example is Fiat Chrysler Automobiles (FCA), which cites tax reform as the reason why it plans to invest $1 billion in its assembly plant in Warren, MI. As part of the effort, FCA will be reshoring production of its Ram pickup truck from a factory in Mexico.

“It is not possible to overstate how much tax reform matters to the future of manufacturing,” says Jay Timmons, president and CEO of NAM. “For decades, we weren’t playing on a level playing field.

“While we assumed America’s economic engine couldn’t be challenged, other countries got smart,” explains Timmons. “They lowered their rates so they could win jobs, win business. But now, manufacturers are empowered to compete and win.

“We’ve seen a lot of great headlines and stories of businesses investing in their workers and communities,” Timmons points out. “That’s just the beginning. We will create more jobs and hire more skilled workers.

“We will invest in more plants and attract more investment to our shores,” predicts Timmons. “And, we will enhance pay and benefits. For now, the most important fact is that the manufacturing economy in America—from Michigan to Mississippi and Maine to California—is on a more solid foundation.”

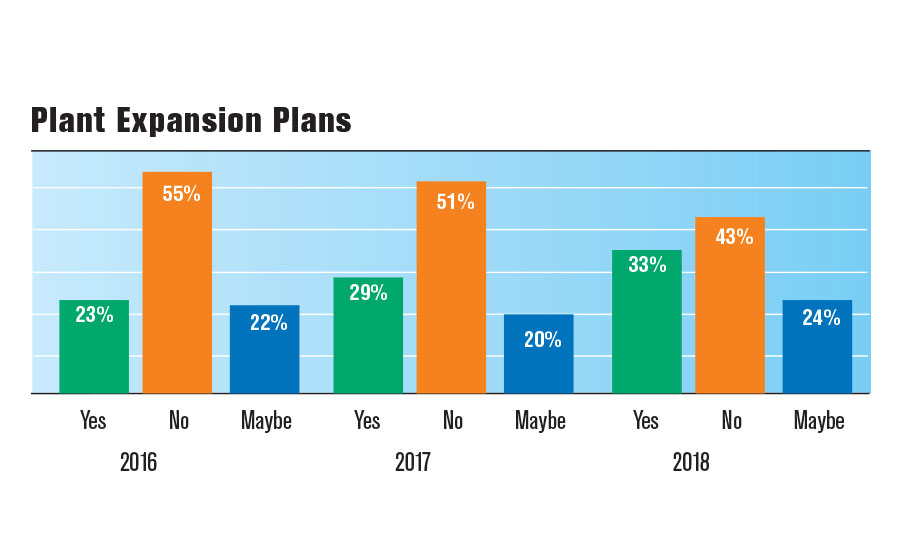

That optimism is reflected in the 2018 State of the Profession survey. One-third (33 percent) of respondents work for companies that plan to expand existing facilities or build new plants during the next 12 months. That’s 4 percentage points higher than in 2017 and a 10 percentage point increase over 2016.

Large manufacturers (companies with 1,000 or more employees) plan to build the most infrastructure (43 percent vs. 28 percent of small manufacturers). More than one-third (41 percent) of respondents in the South anticipate plant expansions during the next 12 months, followed by the Midwest (40 percent), Northeast (26 percent) and West (13 percent).

Construction activity will be strongest in the computer and electronics (82 percent), medical equipment (75 percent), energy manufacturing (51 percent), transportation equipment (48 percent) and electrical equipment and appliances (44 percent) industries.

Assemblers have also been on a hiring spree lately. More than half (51 percent) of respondents claim their plant has hired new employees during the past 12 months. That’s a 7 percentage point increase over 2017 and 13 percentage points higher than 2016.

Large manufacturers (companies with 1,000 or more employees) have hired the most new employees (51 percent vs. 39 percent of small manufacturers). More than two-thirds (67 percent) of respondents in the West work at companies that have been hiring, followed by the Midwest (56 percent), Northeast (44 percent) and the South (39 percent).

Hiring activity has been strongest in the contract manufacturing industry (72 percent), followed by the machinery (67 percent), electrical equipment and appliances (58 percent), plastics and rubber (45 percent), and computer and electronic products (41 percent) industries.

Part of the reason for all of that plant construction and hiring activity is reshoring.

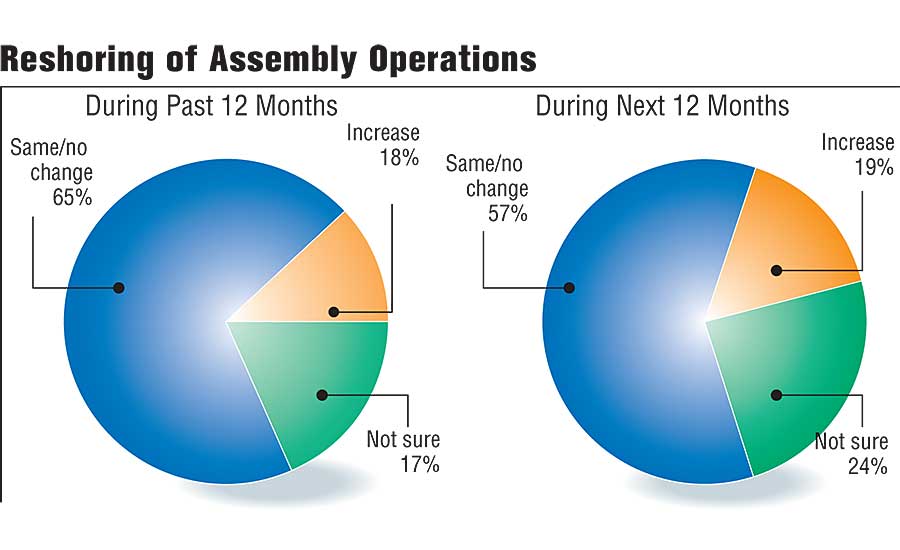

Reshoring of Assembly Operations

Eighteen percent of 2018 State of the Profession survey respondents claim that their company reshored assembly operations during the last year. That’s 10 percentage points higher than in 2017.

Large manufacturers (companies with 2,000 or more employees) are more likely to reshore. More than one-quarter (29 percent) of respondents in that category work for companies that have shifted assembly operations back to the United States during the last 12 months vs. 10 percent of small manufacturers (companies with 100 employees or less).

The heaviest reshoring activity has occurred in the computer and electronic products industry, where 41 percent of ASSEMBLY respondents claim their company has recently brought jobs back to the United States from overseas. Other industries reshoring production include energy manufacturing (33 percent), electrical equipment and appliances (24 percent), fabricated metal products (24 percent), machinery (17 percent) and aerospace (16 percent).

In addition, 19 percent of respondents expect their companies to bring work back to the states during the next 12 months. That’s 7 percentage points higher than in 2017.

The computer and electronic products industry is planning to reshore the most, according to more than half (60 percent) of respondents who work in that sector. Other industries that plan to relocate assembly activity to these shores include aerospace (37 percent), plastics and rubber (22 percent), transportation equipment (22 percent) and contract manufacturing (19 percent).

Large manufacturers (companies with 2,000 or more employees) are more likely to reshore. More than one-third (39 percent) of respondents in that category plan to shift assembly operations back to the United States during the next 12 months vs. 12 percent of small manufacturers (companies with 100 employees or less).

ASSEMBLY’s data is bolstered by statistics recently compiled by the Reshoring Initiative.

Last year, combined reshoring and related foreign direct investment (FDI) announcements surged, adding more than 171,000 jobs to the U.S. economy.

“That figure represents 90 percent of the 189,000 total manufacturing jobs added in 2017,” claims Harry Moser, president of the Reshoring Initiative. “The total number of manufacturing jobs brought to the U.S. from offshore is more than 576,000 since the manufacturing employment low of 2010.

“[We attribute this] huge increase to anticipation of greater U.S. competitiveness due to expected corporate tax and regulatory cuts following the 2016 election,” says Moser. “Similar to the previous few years, FDI continued to exceed reshoring in terms of total jobs added. But, reshoring has closed most of the gap since 2015.

“The numbers demonstrate that reshoring and FDI are major contributing factors to the country’s rebounding manufacturing sector,” Moser points out. “[However], with 3 to 4 million manufacturing jobs still offshore, as measured by our $500 billion a year trade deficit, there is potential for much more growth.

“Reshoring has been increasing at a similar rate as FDI, indicating that American companies are starting to understand the benefit of U.S. production that foreign companies have seen for the last few years,” adds Moser. “And, preliminary 2018 data trends are at least as strong as 2017.

“Proximity to customers [remains] the leading factor driving reshoring and FDI, followed by ‘Made in USA’ image branding, government incentives and ecosystem synergies,” explains Moser. “The Southeast and Texas remain the top regions for reshoring and FDI, with the Midwest gaining ground due to its strong industrial base.”

The ASSEMBLY State of the Profession study confirms this trend. Indeed, more than two-thirds (70 percent) of respondents in the Midwest claim that their company has engaged in reshoring activity during the last 12 months vs. 68 percent in the South.

Salary Discrepancies

The typical State of the Profession respondent is 53 years old, has 26 years of experience and earns $115,511. However, there are exceptions at both the high and low ends of the scale. For instance, 26 percent of respondents take home less than $75,000 per year, while 35 percent earn more than $100,000.

On average, men earn 36 percent more than women. And, almost three-quarters (72 percent) of women respondents earn less than $75,000 vs. 25 percent of men. Part of this discrepancy is due to the fact that women make up almost 50 percent of the U.S. labor force, but only about one-quarter of the country’s manufacturing workforce.

Many female respondents to ASSEMBLY’s survey also have less experience than their male counterparts. Women represented only 5 percent of respondents and had an average of 18 years of experience vs. 26 years for men.

In fact, almost three-quarters (74 percent) of men have more than 15 years of experience in the assembly field, while 43 percent of women have less than 15 years of experience.

In addition to gender, other factors that determine pay rates include age, education, experience, location and type of industry.

Industry experience is the biggest factor that determines compensation. Individuals with more than 15 years of experience (73 percent of respondents) typically earn more than assemblers with less than 15 years of experience in the assembly field (27 percent of respondents).

Assembly professionals tend to be loyal employees who stay with the same company for many years. In fact, 47 percent of respondents have worked at the same firm for more than 10 years, while 29 percent have been with their present employer for less than five years.

Two-thirds (66 percent) of ASSEMBLY’s respondents received a pay increase over the last 12 months. Only 5 percent experienced a decrease in salary. Salary raises varied widely, but the average increase was 7 percent.

More than half (53 percent) of respondents received a cash bonus during the last 12 months. Bonuses were typically tied to factors such as overall company and plant performance, in addition to implementing successful cost reduction programs, meeting deadlines for new projects, launching new products and maintaining quality standards.

More than two-thirds (71 percent) of assemblers who work in the medical equipment industry received a cash bonus during the past year, followed by assemblers in the aerospace (65 percent), transportation equipment (64 percent) and machinery (60 percent) sectors.

Almost three-quarters (72 percent) of assembly professionals expect to receive a salary increase at their next review. Assemblers in the aerospace and transportation equipment industries feel the most confident about receiving a raise in the near future.

Indeed, 82 percent of those individuals say they expect a raise, followed closely by assembly professionals in the electrical equipment and appliances (80 percent), medical equipment (71 percent) and fabricated metal products (62 percent) industries.

More than three-quarters (85 percent) of assemblers at large companies (manufacturers with 1,000 or more employees) received a cash bonus during the past 12 months vs. only 32 percent of assemblers at small manufacturers. Assembly professionals who work for larger manufacturers are also more likely to receive a raise during the next 12 months.

However, assemblers who work for smaller firms tend to be much happier (49 percent) than people who work for big companies (31 percent).

Geographic Fluctuations

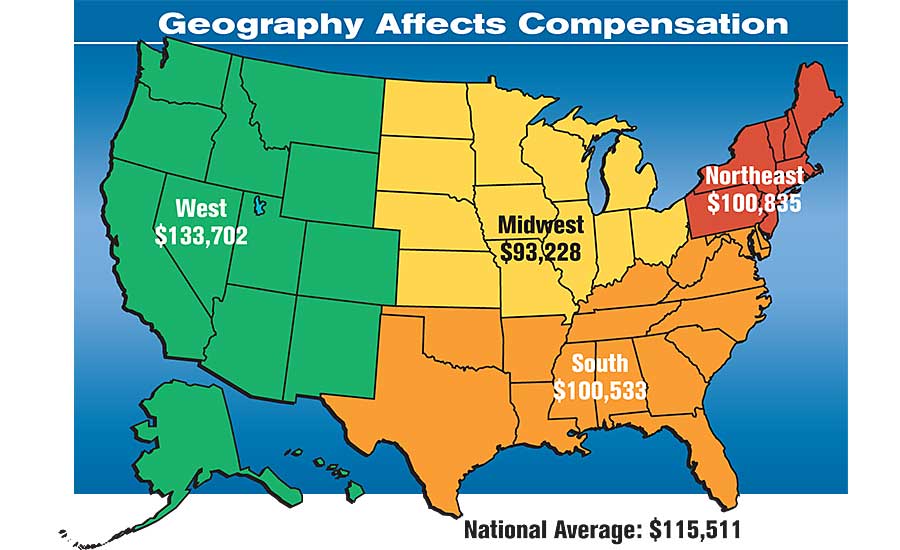

Assembly salaries typically fluctuate from region to region, due to the local cost of living, which tend to be the highest in the Northeast and on the West Coast, but lower in the Midwest and the South. For instance, Arkansas, Mississippi and Tennessee are three of the cheapest states to live in, but California, Massachusetts and New York are three of the most expensive states.

Geography Affects Compensation

The West (Arizona, California, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington and Wyoming), which is home to 16 percent of State of the Profession respondents, boasts the highest salaries—an average of $133,702.

On the other hand, assemblers in the Midwest (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin), which is home to 41 percent of respondents, average $93,228.

Assembly professionals in the South (Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia), which is home to 25 percent of respondents, average $100,533.

In the Northeast (Connecticut, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont), the average salary is $100,835.

Only 30 percent of assembly professionals in the South earn more than $100,000 vs. 54 percent of assemblers in the West.

Assemblers in the Midwest, which is home to a large number of automotive plants, tend to work one hour a week more than the national average of 46 hours, while assemblers in the South typically work two hours less. However, 33 percent of respondents in the Northeast expect to work more hours during the next 12 months vs. 16 percent of assemblers in the Midwest.

Assembly professionals in the South also tend to be more satisfied than their peers in other parts of the country. For instance, half (50 percent) claim to be “extremely satisfied” vs. 44 percent of assemblers in the Northeast.

The size of a manufacturer typically determines compensation levels. For instance, assemblers who work at companies with more than 2,000 employees earn an average of $109,464. Assembly professionals at companies with less than 100 employees earn an average of $92,968.

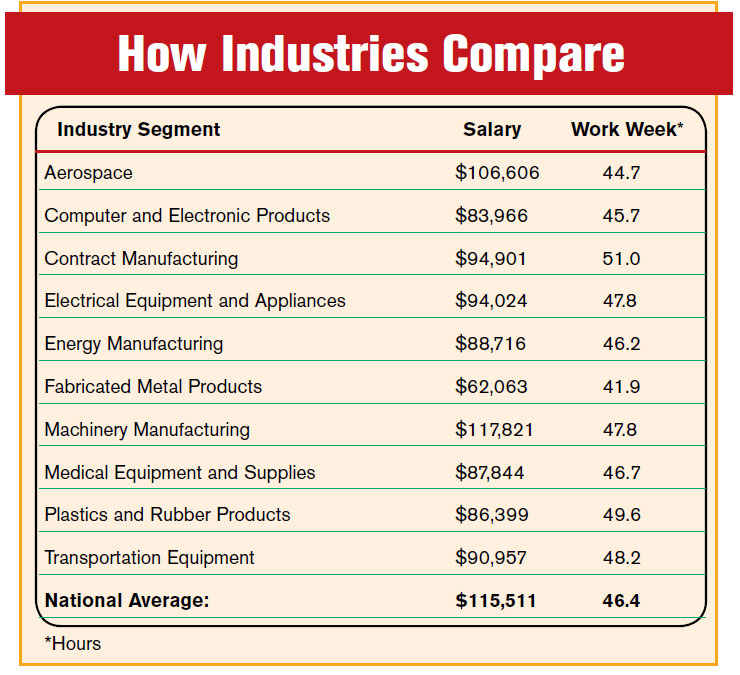

Assemblers in the machinery manufacturing sector receive higher salaries than their peers in other industries. They earn 2 percent more than the national average of $115,511. However, assembly professionals in the fabricated metal products industry earn more than 25 percent less than the national average.

Assemblers in the fabricated metal products industry also work shorter weeks than their peers elsewhere. They average four hours less than the national average of 46 hours. On the other hand, assembly professionals in the contract manufacturing sector work five hours more than the national average.

Manufacturing engineers (33 percent of respondents) earn more than design engineers (8 percent of respondents). According to the 2018 State of the Profession survey, manufacturing engineers earn an average of $138,688 vs. $85,894 for design engineers.

Salaries also fluctuate widely based on type and level of education. For example, assembly professionals with just a bachelor’s degree (39 percent of respondents) earn an average of $152.693. However, assemblers who’ve earned a two-year associates degree (15 percent of respondents) earn $84,456.

Obtaining a master’s in business administration (MBA) or a professional certification, such as a P.E., is a way to ensure a higher salary. Assemblers with MBAs (10 percent of respondents) earn an average of 19 percent more than non-MBAs. Assembly professionals who are P.E.s (6 percent of respondents) earn an average of 11 percent more than others.

Age is another critical factor that affects compensation. For instance, assembly professionals who are more than 50 years old (66 percent of respondents) typically earn the highest salaries. They average $122,647 vs. assemblers who are under 40 (14 percent of respondents), who earn an average of $76,191.

However, middle-aged assembly professionals (20 percent or respondents) tend to be happier than their older and younger peers. Indeed, more than half (60 percent) of assemblers who are 40 to 50 years old claim to be “extremely satisfied” with their jobs vs. 41 percent of those over 60 and 36 percent of those under 30.

Labor Shortage

Manufacturers in a variety of industries are plagued with a skilled labor shortage. In fact, finding skilled workers ranks as the No. 1 issue currently affecting assembly operations.

Almost two-thirds (63 percent) of 2018 State of the Profession respondents claim they are struggling to staff their assembly lines today. That’s 16 percentage points higher than in 2017.

“This skills gap remains a major barrier to the…goals of creating a manufacturing renaissance and attracting foreign direct investment in new plants in America,” warns Leo Reddy, CEO of the Manufacturing Skill Standards Council. “The current projection is that manufacturers need to fill over 3 million jobs in the next 10 years, but anticipate a shortage of 2 million with the right skills.”

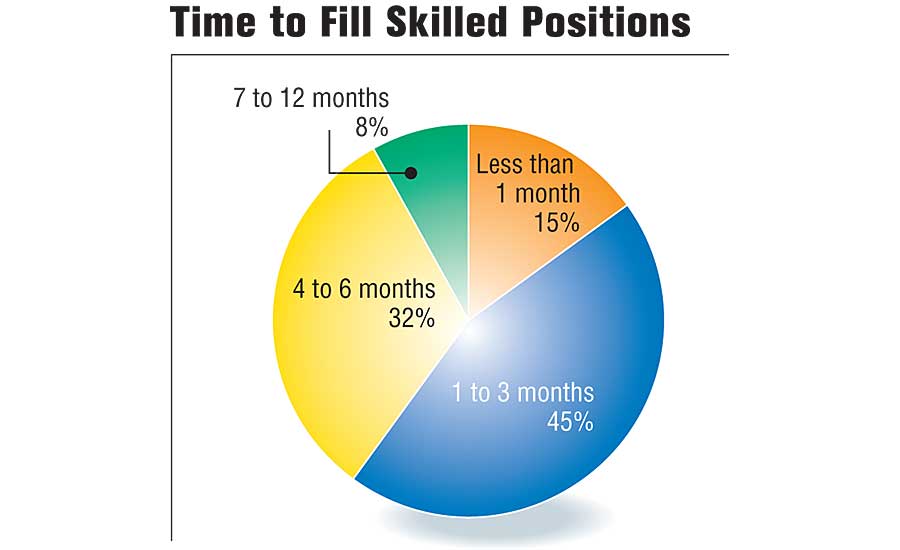

Time to Fill Skilled Positions

Both large and small manufacturers claim they are having trouble finding skilled workers. Three-fourths (75 percent) of companies with 2,000 or more employees and 67 percent of companies with 100 or fewer employees face that challenge.

The labor shortage is also felt in all corners of the United States, but the problem is more severe in some areas. For instance, more than two-thirds (70 percent) of assemblers in the Midwest report having trouble finding skill workers vs. 63 percent in the Northeast, 59 percent in the South and 53 percent in the West.

More than three-quarters (82 percent) of respondents in the machinery industry will be focusing on finding employees during the next 12 months. Other industries affected by the skills gap include contract manufacturing (81 percent), plastics and rubber (75 percent), and computer and electronic products (63 percent).

Three industries that claim to have less difficulty finding employees to staff their assembly lines are energy manufacturing (16 percent), aerospace (44 percent) and medical equipment (46 percent).

Almost half (45 percent) of assemblers claim that it now takes an average of one to three months to fill openings on their production lines. One-third (32 percent) say that it takes four to six months, while 15 percent claim they can usually fill openings in less than one month.

Lack of time is perceived to be the No. 1 on-the-job constraint that assemblers face every day. More than half (56 percent) of 2018 State of the Profession respondents complain about time constraints.

Assembly professionals at manufacturers with less than 100 employees are under more pressure to watch the clock than people who work for manufacturers with more than 1,000 employees. Indeed, more than half (63 percent) of respondents at small companies cite time constraints as a challenge vs. only 46 percent of assemblers at large firms.

Time-related pressure will pose the biggest challenge to assemblers who work for plastics and rubber (78 percent), computer and electronic products (69 percent), electrical equipment and appliances (68 percent), transportation equipment (63 percent) and machinery (59 percent) manufacturers.

And, 21 percent of assembly professionals believe their average work week will increase during the next 12 months, which is 3 percentage points higher than in 2016 and 7 percentage points higher than in 2015.

Assemblers at large manufacturers plan to spend slightly more time at work than their counterparts at smaller companies. One-quarter (25 percent) of respondents who work for manufacturers with less than 100 employees expect to work more in the next 12 months. However, 27 percent of assemblers who work for companies with more than 1,000 employees will experience longer work weeks.

More than one-third (36 percent) of assembly professionals who work in the plastics and rubber industry expect to work more hours during the next 12 months, followed by assemblers in the machinery (32 percent), energy manufacturing (31 percent) and fabricated metal products (21 percent) industry.

Assembly professionals work an average of 46 hours a week. In fact, two-thirds (66 percent) of 2018 State of the Profession respondents often work more than 45 hours a week. People who work for contract manufacturers typically spend the most time at work (an average of 51 hours per week), while assembly professionals in the fabricated metal products industry work less (an average of 42 hours per week).

How Industries Compare

The majority (68 percent) of participants in ASSEMBLY’s study say that they are doing the same amount of work-related travel today vs. one year ago. But, 10 percent of assemblers claim they are doing more travel.

New Technology

Today, assembly professionals are spending more time implementing new technology to boost productivity, improve quality and reduce time to market. More than one-third (35 percent) of State of the Profession respondents claim that they’re spending more time trying to make new technology work.

One of the biggest trends is collaborative robots that enable people and machines to work in close proximity. More than one-third (38 percent) of assemblers plan to deploy

collaborative robots during the next 12 months. That’s a 7 percentage point increase over 2017 and 12 percentage points higher than in 2016.

Use of Collaborative Robots

“Collaboration between people and robots, machines and processes is increasingly important as production in many industries has shifted from larger lots with little variation to low volumes with a high mix,” says Per Vegard Nerseth, managing director of ABB Robotics. “This means more variability and more human intervention.

“Collaborative automation allows people and robots to each contribute their unique strengths,” adds Nerseth. “People offer process knowledge, insight and improvisation for change, while robots offer tireless endurance for repetitive tasks.”

Because they are flexible and require little or no safety barriers, next-generation collaborative robots are being used by a wide variety of manufacturers. The machines appeal to both large and small manufacturers.

Indeed, more than half (59 percent) of companies that employ 1,000 or more people are interested in the technology vs. 26 percent of companies with less than 100 employees.

However, smaller manufacturers are becoming more interested in collaborative robots. For instance, 21 percent of respondents who work for companies with less than 50 employees plan to deploy the technology during the next 12 months. That’s 8 percentage points higher than in 2017.

“Small-to-medium-sized manufacturers are driving demand for collaborative robots,” says Rian Whitton, a research analyst at ABI Research Inc. “This is being driven by demand for manufacturing solutions that don’t include large-scale investment in fixed automation or large robotic arms. These include tasks like machine tending, quality control and light assembly.”

According to Whitton, smaller manufacturers require flexible automation that can easily and quickly be adapted to meet shifting demands. “They need systems that can be programmed easily and quickly, and can support multiple types of automation tasks,” he points out. “Collaborative robots fit the bill.

“Up until recently, a large percentage of [small manufacturers] have missed out on many of the benefits of automation, such as increased productivity, quality and overall competitiveness,” adds Whitton. “[Today], rapid change is underway.”

During the next seven years, Whitton predicts that collaborative robot shipments will grow 50 percent vs. 12 percent for traditional industrial robots. And, global revenue for the machines will grow from $292 million today to more than $1 billion by 2025.

More than half (57 percent) of manufacturers in the transportation equipment sector plan to invest in collaborative robots. Other industries eager to allow humans and robots to work in close proximity on assembly lines include plastics and rubber (47 percent), electrical equipment and appliances (44 percent) computer and electronic products (42 percent) and aerospace (38 percent).

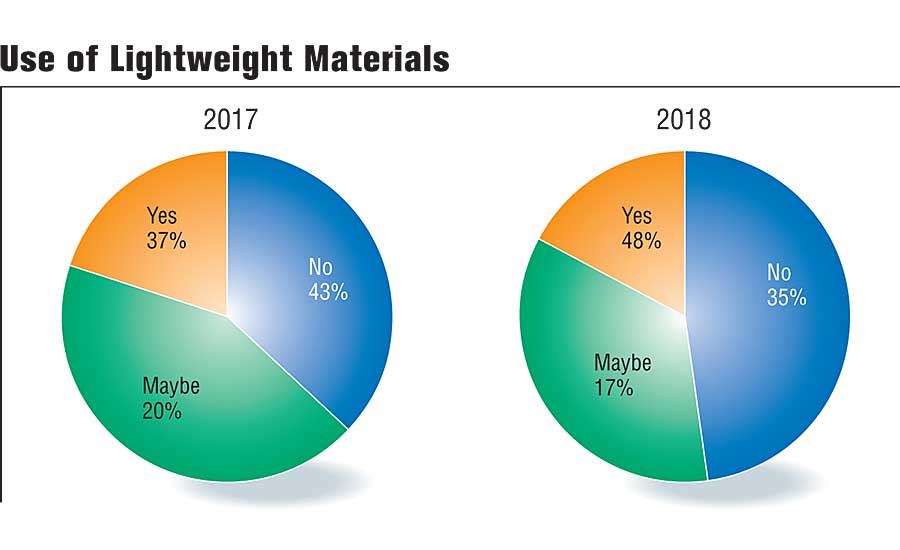

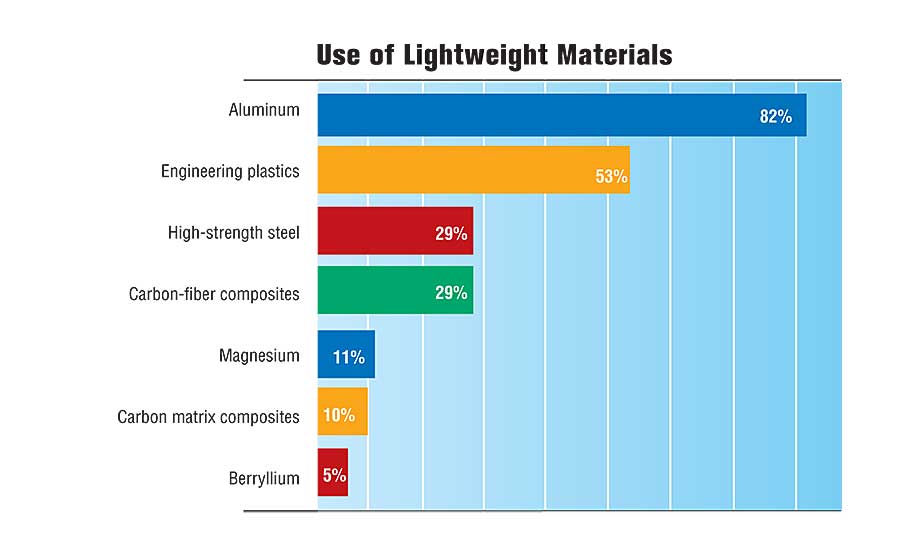

Use of Lightweight Materials

Lightweight materials, such as aluminum and carbon-fiber composites, are also transforming the manufacturing world. Almost half (48 percent) of State of the Profession respondents claim they are using materials other than traditional carbon steel. That’s an 11 percentage point increase over 2017.

Aluminum is popular with more than three-fourths (82 percent) of those assemblers. Other lightweight materials in demand include engineering plastics (53 percent) and high-strength steel (29 percent).

Carbon-fiber composites and magnesium are also becoming increasingly important. Composites are favored by more than one-quarter (29 percent) of assembly professionals, which is 5 percentage points higher than in 2017. Magnesium is cited by 11 percent of respondents, which is 4 percentage point higher than 2017.

Lightweight materials are most popular with manufacturers of products that roll, float or fly. Aluminum is favored by 90 percent of respondents in the aerospace industry, followed by carbon-fiber composites (66 percent) and magnesium (35 percent).

In the transportation equipment sector, which includes companies that assemble automobiles, boats, railcars, trailers and trucks, aluminum also is the No. 1 lightweight material. In addition, two-thirds (65 percent) of respondents are using engineered plastics, followed by high-strength steel (41 percent) and carbon-fiber composites (27 percent).

Use of Lightweight Materials

Green Manufacturing

Large and small manufacturers have developed a wide array of sustainability initiatives. In fact, almost half (48 percent) of respondents in ASSEMBLY’s 2018 State of the Profession study claim their plant has implemented green-related programs during the past 12 months.

Large manufacturers (companies with 1,000 or more employees) are more likely to be involved with green initiatives. For example, 86 percent of assemblers in that category have implemented sustainability programs during the last 12 months. On the other hand, only 26 percent of small manufacturers (companies with fewer than 100 employees) have implemented green initiatives.

Green manufacturing is most common in the aerospace sector, where nearly two-thirds (65 percent) of assemblers work in plants that have implemented environmental programs.

Assembly professionals in the electrical equipment and appliance manufacturing (62 percent), contract manufacturing (61 percent), energy manufacturing (60 percent), and plastic and rubber products (53 percent) industries are also actively engaged in various types of green initiatives.

Manufacturers are pursuing a variety of initiatives, such as installing energy-efficient HVAC systems, recycling programs and wastewater treatment.

More than three-quarters (84 percent) of State of the Profession respondents claim their assembly plant has installed energy-efficient lighting. That’s 14 percentage points higher than in 2017.

There has also been increased use of reusable shipping containers (45 percent in 2018 vs. 40 percent in 2017) and solar panels (17 percent in 2018 vs. 7 percent in 2017).

Small manufacturers (companies with less than 50 employees) are more likely to engage in more basic sustainability programs, such as energy-efficient lighting (88 percent) and paper and plastic recycling (59 percent).

On the other hand, manufacturers with more than 1,000 employees are more likely to be involved in wastewater treatment (40 percent), solar panels (34 percent) and energy-efficient HVAC systems (32 percent).

There are also some regional differences when it comes to green initiatives. For instance, manufacturers in the South (27 percent) and West (14 percent) are more likely to invest in solar panels than manufacturers in the Midwest and Northeast. However, manufacturers in the Northeast (50 percent) are more involved in wastewater treatment systems vs. manufacturers in the South (9 percent).

Survey Methodology

ASSEMBLY magazine would like to thank all the respondents who participated in its 23rd annual State of the Profession survey. The survey was conducted online in March 2018 by BNP Media’s market research division. It was sent to more than 29,000 randomly selected subscribers with an e-mail address.

The charts and tables in this report highlight the major data gleaned from the survey responses. On some of the questions, the response rate does not equal 100 percent due to rounding or surveys that contained one or more unanswered questions. In cases where multiple responses were allowed, the total may exceed 100 percent.

Special thanks to Ulka Bhide, Eric Novak and Sharanya Ramesh for their assistance with online survey design, distribution and tabulation.

“You can purchase the full report at https://clearseasresearch.com/product/2018-state-of-the-profession-assembly/?r=10”

About the Industries

Participants in the 2018 State of the Profession survey were comprised of the following 10 industry segments, based on the North American Industry Classification System.

Aerospace: includes airplanes, helicopters, jet engines, missiles, rockets and satellites.

Computer and electronic products: includes antennas, audiovisual equipment, automatic teller machines, clocks, computers and peripherals, connectors, digital cameras, flat-panel displays, laboratory instruments, loudspeakers, navigational instruments, printed circuit boards, process control instruments, railroad signaling equipment, semiconductors, smoke detectors, stereos, telephone apparatus, televisions, test and inspection equipment, transmitters, video recorders and watches.

Contract manufacturing: includes third-party companies that manufacture components, subassemblies or complete products for other companies.

Electrical equipment and appliances: includes batteries, flashlights, generators, household appliances, industrial controls, lamp bulbs, lighting fixtures and equipment, motors, switches and transformers.

Energy manufacturing: includes petroleum extraction and coal mining equipment, solar panels and wind turbines.

Fabricated metal products: includes ammunition, cans and containers, cutlery, doors, fences, firearms, hand tools, hinges, ladders, locks, metal stampings, plumbing fixtures, prefabricated buildings, springs, valves and windows.

Machinery manufacturing: includes agricultural equipment, construction equipment, conveyors, food processing machinery, lawn and garden equipment, machine tools, office machines, packaging machinery, photographic equipment, printing presses, power tools, pumps and compressors, refrigeration and heating equipment, textile machinery, vending machines and welding equipment.

Medical equipment and supplies: includes diagnostic equipment, orthopedic and prosthetic appliances, and surgical instruments.

Plastics and rubber products: includes belts,bottles, floor coverings, hoses, packaging materials, pipes and fittings, plumbing fixtures and tires.

Transportation equipment: includes automobiles and automotive components, boats, engines, motor homes, railroad locomotives and rolling stock, recreational vehicles, ships, trailers and trucks.