The North American auto industry is converting to a metric wire standard, because it’s eager to produce more global vehicle platforms. Chrysler, Ford and General Motors will be switching from SAE J1128 to ISO 6722 over the next several years, as new vehicles are developed.

To reduce costs and operate more efficiently, automakers want to build global platforms that share a wide variety of common components. For instance, the next-generation Ford Focus, scheduled to debut in the United States next year, will share more than 85 percent of the parts as similar versions of the vehicle made in other parts of the world.

Up to 10 different models will be built on Ford’s new global C-segment platform, which replaces three platforms currently in production regionally. Similar cars will be assembled in the United States, Germany, Spain, Russia and China.

“That’s why we’re eager to adopt the ISO wire standard,” says Don Price, connectors and components technical specialist at Ford Motor Co. Price recently participated in a panel discussion on the topic at the National Electrical Wire Processing Technology Expo in Milwaukee. He was joined by engineers from Chrysler LLC and General Motors Co.

The Big 3 are converting to ISO 6722 wire on new product lines. However, all carryover vehicles will continue to use traditional SAE J1128 wire. Japanese automakers plan to continue to adhere to JASO standards, but there is a move to adopt ISO standards.

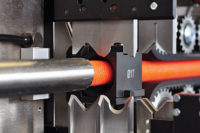

Thinner wire is one of the benefits of moving to the ISO standard. However, the ambitious initiative will affect wire harness assembly processes, such as stripping and crimping.

The ISO 6722 standard will affect how terminals and connectors are assembled.

Ambitious Conversion Process

The Electrical Wiring Component Application Partnership (EWCAP), a noncompetitive industry standards organization, is overseeing the conversion process among the Big 3. EWCAP focuses on developing common electrical interfaces and is part of the United States Council for Automotive Research (USCAR), which provides a common voice to the supply base.“[The] change to ISO wire is [under way],” says Jim Roberts, EWCAP administrator. “We, as an industry, need to make sure we understand it and make the effort necessary to avoid any vehicle electrical failures as a result of this change.

“The conversion to metric wire is already underway at Ford,” adds Roberts. “All new Chrysler programs [such as the Nassau sedan and Fiat-based compact cars, such as the 500] and GM vehicle programs will also use ISO wire specifications.”

The entire transition process will take several years to implement. “As the older car lines are replaced and the component parts are modified to be compatible with the ISO wire, the SAE-type wire will become obsolete for the North American auto market,” Roberts points out. “But, if a current car line continues for 10 years, the SAE wire will also continue.”

The ISO 6722 standard specifies the dimensions, test methods and requirements for single-core 60-volt wire and cable intended for use in road vehicle applications. But, it’s not new.

“ISO 6722 has been around for more than 25 years,” says Fred Kelley, engineering director at Prestolite Wire LLC. The SAE J1128 standard is even older-it was first published in November 1975. And, the Big 3 have subscribed to the American Wire Gauge for more than 100 years. So, the North American auto industry’s change to ISO will erase decades of familiarity with wiring harnesses, connectors and terminals.

“We’ve been working on this for a long time,” notes Kelley, who has served on both ISO and SAE standards committees for many years and also provided input to EWCAP. “In 2005, I made a presentation to the Automotive Wiring Component Forum in France and discussed the OEM benefits of ISO harmonization: Components for global platforms and reduced future vehicle design time and cost for the OEM.

“This represents a big systems change for the industry,” adds Kelley. “And, any time you change, there’s cost associated with it. For instance, all suppliers have to tool up and invest in ISO-compatible wire processing equipment. But, it will reduce overall design time, which will eventually result in reduced cost for OEMs and suppliers.”

Prestolite has been building both SAE and ISO constructions for many years. “We are sharing our [knowledge] with OEMs, Tier One suppliers and USCAR,” says Kelley. “These lessons learned will help others avoid making mistakes and have a realistic view of the time and cost to achieve ISO capability.

“Global harness producers must change and use ISO terminals, seals and connectors designed for correct system fit, form and function,” Kelley points out. “This will add costs due to material development to meet performance expectations and manufacturing development to cut, strip and terminate the reduced wall thicknesses of wire harnesses.” Of course, product testing and approval costs also must be factored into the equation.

“We are converting to ISO 6722 when vehicle platforms go through a refresh cycle that requires wiring system redesign,” says Nick Cappa, an engineering and technology spokesman for Chrysler. “[Associated costs include] monitoring crimp integrity on older terminals and seals. Older systems require requalification of crimp height and width for use with the equivalent ISO 6722 wire.

“In rare cases, grip size modifications are required,” adds Cappa. “Seals [also] need to be re-evaluated for the reduced outer diameter of ISO 6722 wire. In some cases, a reduction to the next smaller size is required.”

“More product (wire) availability may bring costs down, but different processing requirements may add costs,” notes Rob Boyd, crimping product manager at Schleuniger Inc. “At this point, the total cumulative affect is not known. There are many questions that will only be answered with time.”

According to some industry observers, the move to ISO 6722 will affect cable manufacturers more than wire processors, because they will need to manufacture and store both types of wire for several years. North American cable producers must adapt from SAE to ISO conductor designs. Global cable producers must qualify and PPAP (production part approval process) new ISO constructions in North America. Costs include material development to meet reduced wall thickness performance expectations and manufacturing development to produce reduced wall thicknesses.

“We’ve been working on the transition from SAE J1128 to ISO 6722 for several years now,” says Rick Antic, vice president of business development at Champlain Cable Corp. “The thin wall insulations are more challenging to meet temperature requirements and abrasion resistance. In addition, some of the thin insulated wires will be more difficult to strip and may create [demand] for radius V blades, which are more costly and more difficult to maintain.”

North American automakers will use both SAE and ISO wire types as they convert their vehicle lines over the next decade. “Supplier system engineers will need to work closely with their OEM counterparts to ensure that fuse matching, current matching and correct circuit designations are made,” says Eric Leszczynski, senior technical specialist at Yazaki North America. “They will also need to [encourage] OEM engineers to choose standard wire constructions to keep complexity controlled.”

This halogen-free, thin-wall cable is designed to ISO 6722 standards. Photo courtesy Delphi Corp.

Numerous Challenges

Many issues must be resolved to migrate from SAE J1128-style wire to ISO 6722-style wire. During the Milwaukee presentation, Roberts outlined several key differences between SAE J1128 and ISO 6722 that will affect automakers and suppliers.“Switching from one wire type to another will affect circuit performance, such as voltage drop and fuse protection, which should be considered during the harness design process,” he explains.

There also is a distinct wire core difference between SAE J1128 and ISO 6722. “It is important to recognize that wire can have the same name, but based on the specification, will mean a different size,” Roberts points out. “Depending on the wire size, there could be as much as a 17 percent difference in cross-sectional area between ISO and SAE.”

According to Roberts, SAE minimum conductor size is controlled by core cross-sectional area, while ISO minimum conductor size is controlled by the resistance of the wire core. As a result, the core size changes as the conductivity of the core material changes.

“For instance, 0.5 millimeter wire per SAE J1128 thin-wall specifications has a minimum core area of 0.508 millimeters,” adds Roberts. “The same wire per ISO 6722 has a minimum core area of 0.465 millimeter.”

“As you reduce the copper conductor size, you must also reduce the amount of work that the product can accomplish,” warns Kelley. “Resistance will go up, and so will voltage drop, as conductor size goes down. It may be necessary to increase the size of the wire for the system. Fusing is a function of wire size, so it will be necessary to rethink the fusing strategy and may also affect other mating component designs.”

Stranding construction will also be affected by the move to metric wire. For instance, the new ISO specification allows both symmetric and asymmetric core construction. However, the North American auto industry favors symmetrical construction, because asymmetrical wires can be more difficult to strip.

“Symmetrical wire bundles allow stripping blades to close further, thereby allowing more insulation to be cut,” says Boyd. “Furthermore, regardless of what angle the wire is when it is in the blades, the individual strands are in the same spot. With asymmetrical wire bundles, the strand positions may be different, depending on the angle of the wire.”

Many of the differences between ISO and SAE wire are subtle. “On average, ISO wire uses about 12 percent less copper than SAE wire,” says Leszczynski. “With 20 and 22 gauge wire, the physical sizes are similar. But, with larger wire, such as 16 and 18 gauge, the differences are greater.”

“Insulation is about 25 percent thinner in ISO wire,” adds Kelley. “There is less wall thickness, so end users must be careful when setting up tooling.”

Because of those differences, the new wire types will create several assembly challenges to automakers and suppliers. “Stripping, core crimp, insulation crimp and seal compatibility must be considered when switching from SAE to ISO wire types,” warns Roberts.

For instance, terminals with a grip wire length designed for thicker insulation crimped on thinner insulation can result in several problems, such as inadequate strain relief; incorrect terminal fit in the connector cavity; damage to mat seals due to sharp edges on the insulation grip after crimping; and damaged insulation or core due to excess wing length.

The changeover from SAE to ISO wire will spur demand for smaller components in the future. “Adopting wire with a reduced outer diameter allows terminals to be packaged tighter,” explains Roberts. “Smaller wire, such as 0.13 or 0.08 millimeter, will also be used to reduce package sizes.”