Automakers and suppliers have been rebuilding their workforces and boosting production, which is up two-thirds from a year ago. The average workweek for U.S. autoworkers was 43 hours in March, a five-hour increase from the same period in 2009. Chrysler, Ford and General Motors also recently announced billions of dollars worth of retooling in their U.S. plants.

The 2010 ASSEMBLYState of the Professionsurvey was conducted in late March, as the sluggish economy slowly began picking up steam. The global economy is expected to grow 1.9 percent in 2010, but at varied speeds, with Asia in the fast lane, Europe in the slow lane, and the United States in between.

Nonfarm payroll employment in the United States increased by 162,000 in March and the unemployment rate held at 9.7 percent, ac-cording to the U.S. Bureau of Labor Statistics. In addition, manufacturing employment continued to trend up in March; the industry added 45,000 jobs in the first three months of 2010. Over the month, job gains were concentrated in fabricated metal products (9,000) and in machinery (6,000).

Rail traffic, another good economic indicator, also rebounded in March. Volume rose 8 percent during the first three months of 2010 and was up 18 percent during the second quarter. Caterpillar Inc. recently acquired Electro-Motive Diesel, an 88-year-old manufacturer of locomotives, because rail traffic volumes are expected to increase dramatically in the future.

In addition, the Conference Board’s index of leading economic indicators jumped 1.4 percent in March, the fastest pace of growth in 10 months. Seven of the top 10 indicators rose in March, led by an increase in average weekly hours worked in the manufacturing sector.

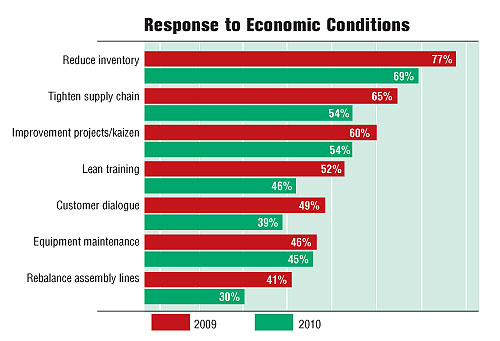

The 15th annualState of the Professionsurvey reflects some of that positive news. For instance, while manufacturers are still keeping a close eye on their expenses, there’s now less pressure to make painful cuts.

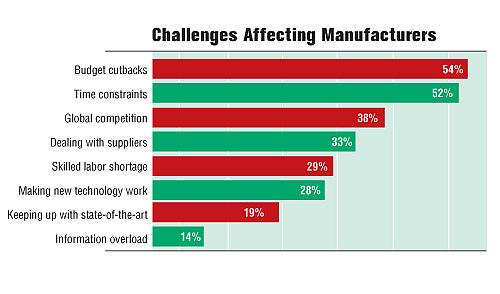

More than half (54 percent) of assemblers claim that budget cutbacks are affecting their plants, but that’s 26 percentage points less than last year. Another positive sign is compensation; 52 percent of survey respondents expect to receive a pay increase this year vs. only 31 percent in 2009.

According to the U.S. Bureau of Economic Analysis, American corporations have record cash stockpiles on hand, because they have been afraid to spend money during the recent economic downturn. After aggressively slashing their spending patterns, companies are sitting on more than $1.5 trillion. The Center for American Progress claims that is the most amount of cash on hand in the last 45 years.

As a result, manufacturers will soon begin investing in new production tools and equipment. For instance, one half (50 percent) of all ASSEMBLY respondents claim their company will be committing more resources to improving plant operations in 2010 vs. only 40 percent in 2009.

Cutbacks Ease Up

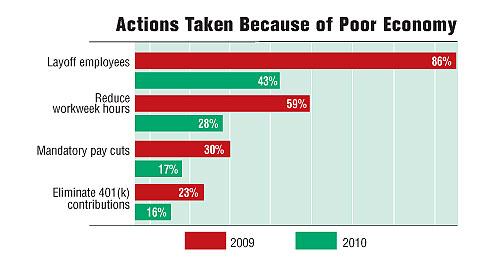

Manufacturers reacted swiftly to the recent meltdown of the economy with widespread layoffs. More than one-third (43 percent) ofState of the Professionrespondents work in plants that have reduced headcount recently. However, that is half as many as last year, when 86 percent of assemblers reported layoffs.Other cost-cutting activities that are less severe include reduced hours (28 percent in 2010 vs. 59 percent in 2009), mandatory pay cuts (17 percent in 2010 vs. 30 percent in 2009) and elimination of 401(k) contributions (16 percent in 2010 vs. 23 percent in 2009).

Industries that have been hardest hit by layoffs include fabricated metal products (21 percent), machinery manufacturing (18 percent), electrical equipment and appliances (16 percent) and transportation equipment (16 percent). The energy equipment industry has been least affected, with only 2 percent of assemblers citing layoffs.

Assembly professionals in the Midwest have felt the most pain recently, with 59 percent of respondents reporting reductions in the overall size of their assembly operations. On the other hand, the West coast is more stable, with only 47 percent of assemblers claiming they have experienced layoffs in their plants.

Mandatory pay cuts have affected the machinery manufacturing sector (24 percent) the most, while that action is less common in the medical device industry (1 percent). Reductions in hours are more widespread in the fabricated metal products industry (24 percent) and less common is the medical device field (1 percent).

Small manufacturers are more likely to mandate pay cuts. For instance, 48 percent of plants with fewer than 100 employees have cut wages within the last year because of the economy. By comparison, only 18 percent of manufacturers with more than 500 employees have slashed their payrolls.

Large companies are also less likely to eliminate 401(k) contributions. Only 7 percent of big manufacturers have taken that route vs. 9 percent of small firms.

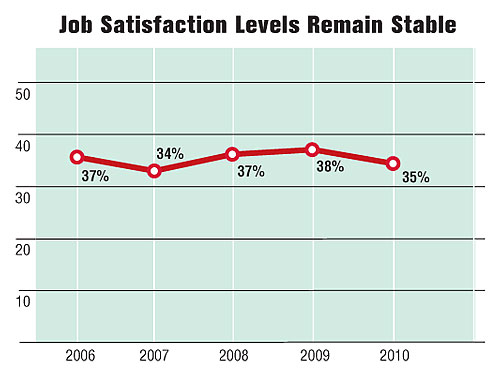

All of that belt-tightening is the reason why assembly professionals are slightly less happy today than they were a year ago. Indeed, 35 percent of respondents claim they are “highly satisfied” with their jobs, which is 3 percentage points less than in 2009.

Salary Fluctuation

The typicalState of the Professionsurvey respondent is 50 years old, has more than 20 years experience and earns more than $70,000. However, there are exceptions at both the high and low ends of the scale. For instance, 13 percent of respondents take home less than $50,000 per year, while 30 percent earn more than $90,000.The recent economic turmoil has affected assemblers. Less than one-quarter (19 percent) of respondents claim they received a pay increase over the last 12 months. Most individuals were not that fortunate. Indeed, 81 percent of assemblers did not receive a raise.

In addition, 11 percent of assemblers received a decrease in compensation, due to the economy. More than one-third (37 percent) claimed that 6 percent to 10 percent of their salary was slashed.

Many of those short-term adjustments to reduce fixed costs were required to avoid mass layoffs, or in some cases, just to survive. However, many manufacturers “remain under enormous pressure to hold down fixed costs,” says Ken Abosch, head of the North American broad-based compensation consulting practice at Hewitt Associates LLC. “But, the good news is that most don’t seem to be taking the same types of drastic cost-cutting measures we saw at this time last year.

“Although pay raises were at an all-time low last year, most employees can expect to see a slight rebound in salary increases in 2010,” claims Abosch. “Base salary increases will continue to lag.”

“While employees will see a slight increase in salary adjustments for 2010, they shouldn’t expect these increases to return to prior levels anytime soon,” warns Shekhar Purohit, Hewitt’s global compensation consulting leader.

According to Purohit, salaries in North America are expected to bounce back slightly this year, but are still projected to be much lower than the increases given in 2008 and 2009. Base pay increases for U.S. workers are projected to move up to 2.7 percent in 2010, up from 1.8 percent in 2009.

The energy industry is expected to have the highest average salary increase in 2010 (3.7 percent). Purohit says industries with the lowest increases will be industrial machinery (1.6 percent) and automotive manufacturing (2.1 percent).

More than half (52 percent) ofState of the Professionrespondents expect to receive a salary increase at their next review. Assemblers in the energy industry, which includes manufacturers of solar panels and wind turbines, feel most confident about receiving an increase. Indeed, 75 percent of those individuals say they expect a raise during the next 12 months.

But, assembly professionals in the machinery industry, which includes manufacturers of construction equipment, food processing machinery, pumps and compressors, packaging machinery and printing presses, are less optimistic. Only 41 percent believe they will receive more compensation in the near future.

Less than half (38 percent) of ASSEMBLY’s respondents received a cash bonus during the last 12 months, a 6 percentage point drop from 2009. Extra compensation was typically based on overall company and plant performance, in addition to implementing successful cost reduction programs, meeting deadlines for new projects and launching new products.

More than one-third (45 percent) of assemblers who work for companies that manufacture computer and electronic products claim they received a cash bonus during the past year. By comparison, only 27 percent of assemblers in the energy products industry received bonuses.

Unfortunately, a large gender gap still exists in the assembly profession. The average salary of female assemblers (6 percent of respon-dents) is much less than their male counterparts.

More than one-half (53 percent) of the women surveyed earn less than $70,000, while 60 percent of the men earn more than $70,000. One factor that accounts for some of this discrepancy is the fact that the women respondents had an average of 14 years experience in the assembly field, while men averaged 20 years of experience.

However, female assemblers tend to be happier than their male counterparts. Indeed, 49 percent of women said they are “highly satisfied” with their jobs vs. only 34 percent of men. And, 10 percent of men claimed they are not happy at work vs. 7 percent of women.

In addition to gender and experience, several other factors determine compensation levels, such as age, education, location and industry. Industry experience is the biggest factor that determines pay rates. Individuals with less than five years of experience in the assembly field (8 percent of respondents) earn an less than industry veterans with more than 20 years of experience (58 percent of respondents).

Assembly professionals tend to be loyal employees who stay with the same company for long periods of time. In fact, 57 percent of respondents have worked at the same firm for more than 10 years, while 10 percent have been with their present employer for less than two years.

This loyalty trend is expected to continue for the foreseeable future, according to a recent study conducted by Towers Watson, a human resource consulting firm. “On-the-job advancement now takes a back seat to a growing desire for workplace security and stability,” says Max Caldwell, leader of the company’s talent and rewards practice.

“A startling eight out of 10 respondents want to settle into a job, with roughly half saying they want to work for a single company their entire career and the rest wanting to work for no more than two to three companies,” adds Caldwell. “This move toward workplace ‘nesting’ is no doubt influenced by a perceived dearth of job opportunities, coupled with U.S. employees’ lower appetite for the risks inherent in changing jobs.”

Geographic Discrepancy

Assembly salaries vary from region to region. Often, those fluctuations are determined by the local cost of living. Traditionally, the West (Arizona, California, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington and Wyoming), which is home to only 13 percent of respondents, boasts the highest salaries in theState of the Professionsurvey.For instance, 26 percent of assemblers in the West claim to make more than $100,000 a year. By comparison, only 19 percent of assembly professionals in the Northeast (Connecticut, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont) earn six-figure salaries.

Assemblers in the West also tend to have a shorter workweek. Indeed, 33 percent of respondents claim to work 40 hours or less a week vs. 17 percent of respondents in the Midwest (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin).

Assembly professionals in the South (Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia), which is home to 19 percent of respondents, tend to earn less than their peers in other parts of the country. That may be one reason why many manufacturers continue to flock to the region.

For instance, Boeing Commercial Airplanes is building a second final assembly line in North Charleston, SC, for its new 787 Dreamliner. Mitsubishi Power Systems recently announced that it plans to build a 200,000-square-foot wind turbine plant in Fort Smith, AR.

Cardiovascular Systems Inc. is opening a new plant in Pearland, TX, to assemble its Diamondback 360, a minimally invasive catheter that’s used for treating peripheral arterial disease. In addition, Rolls-Royce is investing $500 million to build a 1,000 acre manufacturing campus in Prince George County, VA. The first phase of the Crosspointe project will be a 140,000-square-foot plant that will begin assembling turbofan engine components in early 2011.

Assemblers in the Midwest, home of the rebounding U.S. auto industry, are the most confident about receiving a salary increase at their next review. Indeed, 54 percent (vs. 27 percent in 2009) of respondents say they expect a raise. In contrast, only 47 percent of assemblers in the Northeast believe they’ll receive a pay increase during the next 12 months.

Sometimes, factors other than money, such as weather, can influence happiness. Assembly professionals in the West tend to be more satisfied than their peers in other parts of the country. A majority (94 percent) claim to be happy vs. 87 percent in the Northeast.

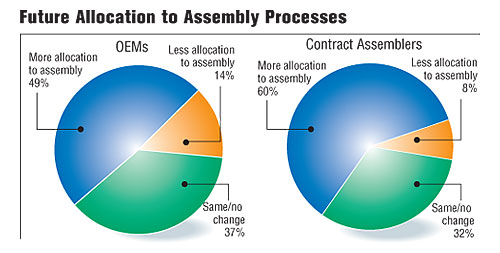

Another reason for that extra bit of happiness in the West may be due to more than just sunshine. More than half (53 percent) of respondents see their companies committing resources to assembly operations during the next three years vs. 46 percent in the Northeast. In addition, only 47 percent of respondents in the West claim that their company has decreased staff size during the past year, compared to 59 percent of assemblers in the Midwest and 58 percent in the South.

According to Hewitt Associates, workers in some parts of the United States may experience higher salary increases this year than their peers in other regions. Assemblers who work in Houston, Minneapolis and Des Moines, IA, stand the best chance of receiving a raise. However, the cities projected to have the lowest increases are Detroit, Los Angeles and San Francisco.

Sizing Up Salaries

Salary and job satisfaction levels in the assembly profession are usually influenced by the size of a manufacturer. For instance, assemblers who work in companies with more than 2,000 employees tend to be well compensated. Indeed, 90 percent of assemblers at those companies earn more than $70,000. On the other hand, only 60 percent of assemblers at small manufacturers (companies with less than 50 employees) earn more than $70,000.However, bigger isn’t always better, especially when it comes to compensation. Assembly professionals who work in larger companies are often not as happy as people who work for smaller firms. Indeed, 70 percent of assemblers who work in small companies claim they are “highly satisfied” with their jobs vs. 35 percent of respondents who work in companies with more than 1,000 employees.

Assembly professionals in the medical device industry, which includes manufacturers of cannulas, catheters, diagnostic test kits, inhalers, orthopedic implants, stents, syringes and other products, tend to earn the highest salaries. For instance, 55 percent of assemblers claim to make more than $80,000 a year. The energy equipment industry also boasts higher-than-average compensation.

In sharp contrast, only 32 percent of assemblers in the fabricated metal products industry, which includes manufacturers of ammunition, firearms, hand tools, hinges, locks, plumbing fixtures, doors and windows, earn more than $80,000. In addition, only 39 percent of as-sembly professionals in the machinery manufacturing industry make that much.

Manufacturing engineers (41 percent of respondents) rank slightly ahead of design engineers (17 percent of respondents) when it comes to compensation. But, there are variations at both the high end and the low end. For instance, 37 percent of manufacturing engineers earn less than $65,000 vs. only 35 percent of design engineers,

Manufacturing engineers also tend to work more than their design counterparts. More than three-fourths (83 percent) of manufacturing engineers claim they spend more than 40 hours a week at work vs. only 72 percent of design engineers.

However, design managers typically earn more money than manufacturing process managers. One-third (33 percent) of design managers earn more than $100,000 vs. 25 percent of manufacturing managers.

Age is another important factor that affects compensation. For instance, assembly professionals who are more than 60 years old typically earn the highest salaries. More than one-third (38 percent) of assemblers who are over 60 earn more than $90,000 vs. 17 percent of their 30-year-old peers.

In the future, age will continue to play a key role in determining compensation, because there’s a growing trend toward an older work-force. For example, more than half (53 percent) of 2010State of the Professionrespondents claim they have put off retiring because of the economy.

“Delayed retirement has been a steadily increasing trend in the U.S., but the recession has been a dramatic accelerant,” says Laura Sejen, leader of the talent and rewards business at Towers Watson. “The stock market’s impact on 401(k) balances certainly put a fine point on the validity of their concerns. Companies now have an uphill battle not only to enable better employee self-management of benefits, but also to cope with a potential logjam of aging workers-all while addressing the contrasting needs of younger employees trying to rise through the organization.”

Salaries also fluctuate dramatically based on type and level of education. For example, 19 percent of assembly professionals with just a bachelor’s degree (41 percent of respondents) earn more than $100,000 vs. 42 percent of assemblers who hold a master’s degree (22 percent of respondents).

Traditionally, obtaining a master’s in business administration (MBA) guarantees a higher salary. The ASSEMBLY survey discovered that 51 percent of MBAs (9 percent of respondents) make $100,000 or more vs. only 17 percent of non-MBAs.

However, MBAs typically work longer hours than other individuals. For instance, 85 percent of MBAs claim to work more than 40 hours a week compared to 77 percent of non-MBAs.

Happy to Have a Job

MostState of the Professionrespondents claim to be satisfied with their jobs, but a closer look at the data reveals some discrepancies. For example, manufacturing engineers tend to be slightly happier than design engineers. Indeed, 27 percent of manufacturing engineers claim to be “highly satisfied” vs. 25 percent of design engineers.Overall, 61 percent of assemblers who claim to be “highly satisfied” with their jobs earn more than $75,000 a year, while 46 percent of assemblers who are “not satisfied” earn less than $75,000. Not surprisingly, individuals who are “not satisfied” typically do not receive cash bonuses and provide little or no input on budgeting new assembly equipment.

The happiest assemblers work in the computer and electronic products industry, where 38 percent of respondents claim to be “highly satisfied” with their jobs. In contrast, only 19 percent of assemblers in the energy products industry are “highly satisfied.” Assembly professionals who work for contract manufacturers are 4 percent happier than their peers who work for OEMs.

Job satisfaction is defined in different ways by different people. But, the top three reasons cited by assemblers are: “I enjoy my work,” “My job is challenging” and “I work with a good team.” Of course, just having a job is another good reason to be happy these days.

“During the tough economic times over the last year, no one was laid off, not even temps,” says a plant manager in the transportation equipment industry. “That alone is something to be proud of. In addition, we continued with 401(k) matching and with medical insur-ance.”

“I have an extremely high number of opportunities to improve the performance efficiency of our equipment and process,” adds a manufacturing engineer in the energy industry who is satisfied with his job. “These challenges make the hard work very rewarding.”

“My position affords me a great deal of latitude, allowing me to expand my expertise across traditional engineering boundaries,” claims a design engineer in the fabricated metal products industry.

“I am able to work with everyone from our customers to our assembly line operators on all existing and new products,” says a manufacturing engineer in the electrical equipment and appliance industry. “No two days are the same.”

However, some respondents are less satisfied with their jobs. Common complaints from assemblers include poor leadership, low compensation, instability and lack of resources.

“As an engineer, it’s hard to effect change,” laments a manufacturing engineer in the plastics and rubber products industry. “You can only recommend how things should be done and have faith that management will follow that path. If they choose a different path and things don’t go well, then it’s up to us to fix the problems.”

“It seems that we have less control over the products we now make than in the past,” adds a manufacturing manager in the machinery manufacturing industry. “It is more cost-driven. We want quality, but it comes at a cost.”

“Most ideas for improvements and efficiency fall on deaf ears,” notes a design engineer in the transportation equipment industry.

“My main focus is on cost reduction and implementation of new administrative rules and processes,” says a plant manager in the fabricated metal products business.

Although the economy is showing signs of improvement, many assembly professionals are still worried about budget cutbacks. That’s especially true for assemblers who work for smaller manufacturers (73 percent) rather than large manufacturers (33 percent). Respondents in the fabricated metal products industry (83 percent), transportation equipment (77 percent) and machinery manufac-turing (73 percent) industries are more worried about cutbacks than their peers in other industries

Assemblers in the energy sector (7 percent) and medical device industry (15 percent) are less concerned about budget cutbacks. They are much more concerned about issues such as time constraints and making new technology work.

Many assembly professionals believe their plants will be investing in more capital equipment in the near future to keep up with growing demand from consumers. The three industries that are most bullish about committing resources to new production equipment include plastics and rubber products manufacturers (62 percent), medical device manufacturers (58 percent) and energy industry manufacturers (56 percent).

Time Crunch

Because of the economy, assemblers are working longer and harder than ever. More than half (67 percent) of 2010State of the Professionrespondents claim to work 40 to 50 hours a week. Assembly professionals in the energy products (75 percent) and electrical equipment and appliance (74 percent) industries work the longest days.Unfortunately, the trend toward longer workweeks is expected to continue during the next 12 months, with 33 percent of assemblers claiming that their average workweek will increase, a 5 percentage point jump over 2009. More than one-third (39 percent) of assembly professionals who work in the computer and electronic products industry expect to work more hours during the next 12 months vs. only 9 percent of assemblers in the furniture and wood products industry.

Assemblers in the West plan to work more than their peers in other regions. For instance, 40 percent of respondents in that part of the United States believe the hours they spend at work each week will increase during the year ahead. On the other hand, only 27 percent of assemblers in the Northeast expect to work longer hours.

Assembly professionals who work for large manufacturers plan to spend more time at work than their counterparts in smaller companies. More than one-third (40 percent) of respondents who work for manufacturers with more than 1,000 employees expect to work more hours per week in the next 12 months. However, only 33 percent of assemblers who work for companies with less than 100 em-ployees foresee longer work weeks ahead.

More than half (52 percent) of respondents claim that time constraints will affect their ability to do their jobs during the next 12 months. Time constraints will have the biggest impact on assemblers who work in small companies. For instance, 73 percent of assembly professionals who work for manufacturers with less than 100 employees will be affected by time constraints vs. only 30 percent of respondents in manufacturers with more than 1,000 employees.

Time constraints will cause the most stress on assemblers who work in the electrical equipment and appliance industry (81 percent) and the machinery manufacturing industry (71 percent), who are under increasing pressure to reduce inventory and develop innovative new products.

As the economy picks up, manufacturers may have to scramble to find talent. More than one-quarter (29 percent) of respondents claim that a skilled labor shortage will affect their plants during the next 12 months, which is a 3 percentage point increase from 2009. Concern over finding assemblers is greatest in the fabricated metal products industry (51 percent) and lowest in the energy products industry (1 percent). However, some manufacturers, such as Ford Motor Co., have announced that they will assign overtime to existing workers before hiring new employees.

Green Activity Grows

According to theState of the Professionsurvey, green manufacturing activity continues to increase in most industries. More than half (56 percent) of respondents claim they are involved in green or sustainability initiatives vs. 46 percent in 2008. Actions include everything from plantwide recycling programs to installing new energy-efficient lighting systems.Green activity is most common in the transportation equipment industry, where 73 percent of assemblers (4 percentage points higher than in 2009) work in plants that have implemented environmental programs. For instance, Ford Motor Co. recently announced that it plans to survey 35 of its top global suppliers on their energy use and estimated greenhouse gas emissions.

The suppliers represent close to 30 percent of Ford’s $65 billion in annual procurement spending. They include companies that make parts such as seats, steering systems, tires and metal components, which require more energy to produce and thus have a larger carbon footprint.

Johnson Controls Inc., which supplies seats, interiors, electronics and batteries to Ford and other automakers, already has goals in place to reduce greenhouse gas emissions. “As a company, we are committed to reducing greenhouse gas emissions by 30 percent by 2018, and are doing so through efficient manufacturing processes and the development of eco-friendly products,” explains Randy Leslie, vice president and general manager of the Ford Business Unit for Johnson Controls.

Assemblers in the plastics and rubber products industry (69 percent) and energy products industry (62 percent) industries are also actively engaged in green programs. In addition, 58 percent of OEMs have initiated sustainability efforts in their plants during the past 12 months vs. only 40 percent of contract manufacturers.

Large manufacturers (companies with 2,000 or more employees) are more likely to be involved with green initiatives. For example, 78 percent of assemblers in that category claim they have implemented sustainability programs during the last 12 months. On the other hand, only 31 percent of small manufacturers (companies with fewer than 50 employees) have gone green.

Survey Methodology

ASSEMBLY magazine would like to thank all the respondents who participated in its 15th annualState of the Professionsurvey. The survey was conducted online in March 2010 by Clear Seas Research. All readers with e-mail addresses were contacted electronically and en-couraged to click a special hot link to the online questionnaire.The charts and tables in this report highlight the major data gleaned from the survey responses. On some of the questions, the response rate does not equal 100 percent due to rounding or surveys that contained one or more unanswered questions. In cases where multiple responses were allowed, the total may exceed 100 percent.

Special thanks to Steven George for his assistance with online survey design, distribution and tabulation. For more information on this study, please contact John Thomas at thomasj@clearseasresearch.com or 248-786-1659.

About the Industries

Participants in the 2010State of the Professionsurvey were comprised of the following 10 industry segments, based on the North American Industry Classification System:Computer and electronic products:includes antennas, audiovisual equipment, automatic teller machines, clocks, computers and peripherals, connectors, digital cameras, flat-panel displays, laboratory instruments, loudspeakers, navigational instruments, printed circuit boards, process control instruments, railroad signaling equipment, satellites, semiconductors, smoke detectors, stereos, telephone apparatus, televisions, test and inspection equipment, transmitters, video recorders and watches.

Contract manufacturing:includes third-party companies that manufacture components, subassemblies or complete products for other companies.

Electrical equipment and appliances:includes batteries, flashlights, generators, household appliances, industrial controls, lamp bulbs, lighting fixtures and equipment, motors, switches and transformers.

Energy industry manufacturing:includes oil and gas equipment, solar panels and wind turbines.

Fabricated metal products:includes ammunition, cans and containers, cutlery, doors, fences, firearms, hand tools, hinges, ladders, locks, metal stampings, plumbing fixtures, prefabricated buildings, springs, valves and windows.

Furniture and fixtures:includes residential, retail and office furnishings, architectural millwork, cabinets, mattresses, shelving and window blinds.

Machinery manufacturing:includes agricultural equipment, construction equipment, conveyors, food processing machinery, lawn and garden equipment, machine tools, office machines, packaging machinery, photographic equipment, printing presses, power tools, pumps and compressors, refrigeration and heating equipment, textile machinery, vending machines and welding equipment.

Medical equipment, devices and instruments:includes medical diagnostic and monitoring equipment, cannulas, catheters, diagnostic test kits, dialysis aids, filters, inhalers, orthopedic implants, pumps, scalpels, stents, stethoscopes, surgical kits, syringes, tubes, valves and wheelchairs.

Plastics and rubber products:includes belts, bottles, floor coverings, hoses, packaging materials, pipes and fittings, plumbing fixtures and tires.

Transportation equipment:includes automobiles and automotive components, aerospace equipment, aircraft, boats, engines, motor homes, railroad locomotives and rolling stock, recreational vehicles, ships, trailers and trucks.

'Workin' Overtime' Ain't Necessarily Healthy

Back in the early 1970s, a rock band called Bachman-Turner Overdrive had a popular hit called “Takin’ Care of Business” that featured catchy lyrics which referred to “working overtime.” That’s exactly what assembly professionals have been doing lately. In fact, 79 percent of the 2010State of the Professionrespondents currently work more than 40 hours a week vs. 73 percent in 2009.“As job cuts sweep the nation, people are working harder than ever to make themselves indispensable in the workplace-skipping vacations, bringing projects home and working weekends,” says John Liptak, associate director of career counseling and assessment in the Experiential Learning and Career Development Center at Radford University. “Yet, they may be doing more harm than good.”

Several years ago, a star engineer at Toyota Motor Corp.’s headquarters in Japan died from working too many hours. The 45-year-old man suffered from ischemic heart disease.

A recent study conducted by doctors at University College London and the Finnish Institute of Occupational Health confirms that there is a direct link between excessive overtime and poor health. They discovered that people who work three or more hours longer than a normal, seven-hour day have a 60 percent higher risk of heart-related health problems than people who observe normal work-days.

“The balance between work and leisure is one of the most critical issues confronting today’s worker,” warns Liptak, author of Career Quizzes (JIST Publishing), which discusses the inherent dangers of working too much.

For instance, “workaholism” is a progressive disease in which people become addicted to the process of work. According to Liptak, it affects more than 1 million employees per year.

“What makes workaholism different from hard work is the obsession,” explains Liptak. “For workaholics, the desire to work is all encompassing. Even when they’re doing something social or as a hobby, they think about work. Their lives revolve around their jobs.”

As a result, people often encounter a variety of problems associated with workaholism, such as poor health, marital and family problems, stress-related diseases, and job burnout. To prevent such problems and reduce stress, Liptak encourages employees to be more aware of how they balance their work life and leisure activities. “By making balance a priority, people are more likely to achieve greater career satisfaction, which, in turn, can lead to greater success,” he explains.

Social Media Takes Hold

It’s hard to pick up a magazine or turn on a TV these days without seeing or hearing something about social media. Computer-based networking sites such as Facebook, LinkedIn and Twitter have become extremely popular in the past year.

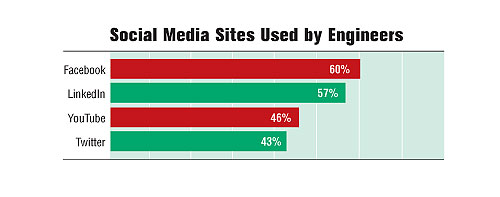

More than one quarter (26 percent) of 2010 State of the Profession survey respondents claim that they’ve used a social media Web site for business or professional purposes. LinkedIn is the most popular, with 77 percent of assemblers having accessed the site vs. 37 percent for Facebook.

LinkedIn is a business-oriented social networking site that is primarily used for professional networking. The site has more than 65 million registered users around the world.

Social media sites are more likely to be used by corporate management than by engineers. For instance, 35 percent of presidents, vice presidents and general managers claim that they have used Facebook, LinkedIn, Twitter or another site during the last 12 months. Design managers (31 percent) have also used social media to stay connected, followed by manufacturing engineers (25 percent), design engineers (24 percent) and manufacturing management (20 percent).

Facebook has been used by 43 percent of manufacturing engineers and 17 percent of design engineers. The next most popular site for engineers is LinkedIn (38 percent and 19 percent, respectively).

Engineers who work for small manufacturers are more likely to use social media. For instance, 30 percent of respondents at small manufacturers (companies with less than 100 employees) have logged on to LinkedIn during the past 12 months vs. only 9 percent of respondents who work for large manufacturers (companies with more than 1,000 employees).

Social media is most popular with people who work in the energy products industry (50 percent), followed by medical device manufacturers (33 percent) and machinery manufacturers (28 percent). Respondents in the plastic and rubber products industry (16 percent) were less likely to use Facebook, LinkedIn, Twitter or another site.

Not surprisingly, age makes a big difference is the use of social media. Assemblers who are in their 20s (35 percent) are more likely to Tweet than their peers in their 60s (13 percent). In addition, 20-year-olds (33 percent) are more likely to communicate via social media on a daily basis than 60-year-olds (6 percent).

Overall, 20 percent of assembly professionals claim they access social media sites on a daily basis. Half of the respondents (50 percent) only check out sites on a monthly basis, while 30 percent say they do it weekly.

To learn more about 2010 State of the Profession trends, click www.assemblymag.com and search for these articles:

- Green Manufacturing Is Here to Stay.

- This Is Not Your Father’s Retirement.