Boeing, Caterpillar, Chrysler, Electrolux, Ford, General Electric, General Motors and Whirlpool are just a few of the companies that are investing billions of dollars in their American factories. For instance, GM recently announced that it will spend more than $2 billion to improve its plants in eight different states.

Meanwhile, Whirlpool is celebrating its centennial this year by building a new 1 million square foot plant in Tennesseee. “[This is the] largest single investment we’ve ever made anywhere in the world and reinforces our commitment to the competitiveness of U.S. manufacturing,” claims Jeff Fettig, Whirlpool’s CEO.

“Business conditions in manufacturing are booming,” says Daniel Meckstroth, chief economist at the Manufacturers Alliance/MAPI. “United States manufacturing continues to recover from an exceptionally severe recession that has created pent up demand for consumer durables, particularly motor vehicles and business equipment.”

“Much of manufacturing has emerged from the economic downturn and is experiencing significant growth,” adds Norbert Ore, chairman of the Institute for Supply Management’s manufacturing business survey committee. “Capacity utilization is back to typical levels and manufacturers are significantly investing in their businesses.”

The 16th annual ASSEMBLY State of the Profession survey reflects some of that bullish optimism. For instance, more than one half (61 percent) of all respondents claim their company will be committing more resources to improving plant operations in 2011 vs. 50 percent in 2010 and 40 percent in 2009.

Only 42 percent of assemblers claim that budget cutbacks are affecting their plants, which is 12 percentage points less than 2010 and 38 percentage points less than 2009. Compensation levels are also up, after several years of decline. Indeed, 66 percent of survey respondents expect to receive a pay increase this year vs. 52 percent in 2010 and only 31 percent in 2009.

According to the Boston Consulting Group Inc. (BCG), the United States will be experiencing a “manufacturing renaissance” during the next five years. “As the wage gap with China shrinks, some U.S. states [will] become some of the cheapest locations for manufacturing in the developed world,” claims Harold Sirkin, a BCG senior partner.

“We expect net labor costs for manufacturing in China and the U.S. to converge by around 2015,” adds Sirkin. “As a result of the changing economics, you’re going to see a lot more products ‘Made in the USA’ in the next five years.”

The 2011 State of the Profession survey was conducted in early March, as the U.S. economy showed several healthy signs of improvement. During that month, manufacturing continued to rebound. According to the U.S. Commerce Department, durable good orders increased 3 percent, which was much stronger than initially predicted.

Despite rising fuel costs and a shaky housing market, more than 190,000 new jobs were created in March. The U.S. Bureau of Labor Statistics also claims that unemployment was down 10 percent from a year earlier, while manufacturing productivity was up 6.3 percent.

Buoyed by that confidence, the Big 3 added more than 120,000 units to their first-half production schedule. Experts predict that 13.2 million new cars will be sold in the U.S. this year vs. 11.6 million in 2010 and 10.6 million in 2009.

Although many manufacturers are still keeping a close eye on their bottom lines, life is less stressful for assemblers today than the past two years, when many companies were busy chopping salaries and slashing jobs.

Less Stress

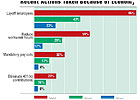

During the Great Recession, layoffs were an everyday fact of life in assembly plants. However, things are getting back to normal. Only 23 percent of respondents work at facilities that have experienced layoffs recently. That’s a 20 percentage point drop from 2010 and a whopping 53 percentage points lower than 2009.Other cost-cutting activities that are less severe today include reduced hours (12 percent in 2011 vs. 28 percent in 2010 and 59 percent in 2009), elimination of 401(k) contributions (6 percent in 2011 vs. 16 percent in 2010 and 23 percent in 2009), and mandatory pay cuts (4 percent in 2011 vs. 17 percent in 2010 and 30 percent in 2009).

Industries that have been hardest hit by layoffs include fabricated metal products (85 percent), electrical equipment and appliances (75 percent) and machinery manufacturing (67 percent).

Assembly professionals in the Midwest have felt the most pain recently, with 22 percent of respondents reporting reductions in the overall size of their assembly operations. On the other hand, the West coast is more stable, with only 16 percent of assemblers claiming they have experienced layoffs in their plants.

Mandatory pay cuts have affected the plastics and rubber products industry (33 percent) the most, while that action is less common in the transportation equipment industry (14 percent). Reductions in hours are more widespread in the contract manufacturing industry (50 percent) and less common is the computer and electronic products sector (20 percent).

Small manufacturers are more likely to mandate pay cuts. For instance, 22 percent of plants with fewer than 100 employees have cut wages within the last year because of the economy. That’s 26 percentage points lower than in 2010. Only 17 percent of manufacturers with more than 2,000 employees have slashed their payrolls.

Large companies are also less likely to reduce daily or weekly hours. Only 33 percent of big manufacturers have taken that route vs. 61 percent of small firms.

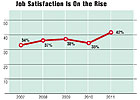

With less on-the-job stress, assembly are the happiest they’ve been in several years. More than one-third (42 percent) of respondents claim they are “highly satisfied” with their jobs today, which is 7 percentage points higher than in 2010.

Bigger Payday

The typical State of the Profession survey respondent is 49 years old, has 23 years of experience and earns $80,287. However, there are exceptions at both the high and low ends of the scale. For instance, 11 percent of respondents take home less than $50,000 per year, while 31 percent earn more than $90,000.The recent upturn in the economy has benefitted assemblers. One-half (51 percent) of respondents claim they received a pay increase over the last 12 months. Only 5 percent experienced a decrease in salary. The typical raise ranged from 2 percent to 5 percent.

According to Towers Watson, a human resource consulting firm, the average increase nationwide is 3 percent. “Most companies have turned the corner and are now in a much stronger position financially to recognize and reward employees, especially their top performers,” says Laura Sejen, global head of rewards consulting at Towers Watson.

A recent study by Aon Hewitt says 75 percent of companies expect to reach or exceed business performance goals this year, leading to the stabilization of compensation budgets in 2011. Additionally, few companies anticipate having to take drastic actions, such as pay freezes, to reduce costs.

“Most companies (56 percent) made no revisions to their original base salary increase budgets, which are anticipated to be at their highest levels in two years,” says Ken Abosch, marketing strategy and development leader in Aon Hewitt’s broad-based compensation consulting practice. “In 2011, salary increases for salaried exempt workers are expected to be 2.8 percent.” This is up from 2.4 percent in 2010 and 1.8 percent in 2009.

“Prior to the recession, companies were optimistic about their compensation budgets but ultimately scaled back from their original projections in an effort to control costs,” Abosch points out. “As business performance increases, organizations are more comfortable with stabilizing salary budgets. That said, we will not see base pay raises return to pre-recession levels, as these sub-3 percent increases represent the new normal in base-pay spending.”

Two thirds (66 percent) of State of the Profession respondents expect to receive a salary increase at their next review, which is 14 percentage points higher than 2010. Assemblers in the medical equipment, devices and instruments industry, which includes manufacturers of cannulas, catheters, inhalers, orthopedic implants, stethoscopes and syringes, feel most confident about receiving an increase in the near future. Indeed, 83 percent of those individuals say they expect a raise.

But, assembly professionals in the fabricated metal products industry, which includes manufacturers of ammunition, firearms, hand tools, hinges, locks, plumbing fixtures, doors and windows, are less optimistic, with only 64 percent expecting a raise during the next 12 months.

More than half (54 percent) of ASSEMBLY’s respondents received a cash bonus during the last 12 months, a 16 percentage point increase from 2010. Extra compensation was typically based on overall company and plant performance, in addition to meeting deadlines for new projects, implementing successful cost reduction programs and launching new products.

Almost two-thirds (65 percent) of assemblers who work for companies that manufacture cars, trucks, aircraft, locomotives and other transportation equipment claim they received a cash bonus during the past year. By comparison, only 33 percent of assemblers in the furniture and wood products industry received bonuses.

Despite fluctuations in the economy, the gender gap in the assembly profession persists. The average salary of female assemblers (5 percent of respondents) is 8 percent less than their male counterparts.

More than three-fourths (77 percent) of the women surveyed earn less than $80,000, while 48 percent of the men earn more than $80,000. One factor that accounts for some of this discrepancy is the fact that the women respondents had an average of 14 years experience in the assembly field, while men averaged 23 years of experience.

However, female assemblers tend to be happier than their male counterparts. Indeed, 43 percent of women said they are “highly satisfied” with their jobs vs. only 33percent of men. And, 11 percent of men claimed they are not happy at work vs. 8 percent of women.

In addition to gender and experience, several other factors determine compensation levels, such as age, education, location and industry. Industry experience is the biggest factor that determines pay rates. Individuals with less than 10 years of experience in the assembly field (18 percent of respondents) earn less than industry veterans with more than 20 years of experience (56 percent of respondents).

Assembly professionals tend to be loyal employees who stay with the same company for long periods of time. In fact, 57 percent of respondents have worked at the same firm for more than 10 years, while 10 percent have been with their present employer for less than two years.

That trend may change in the future, however. As the U.S. economic outlook continues to improve, employee loyalty is on the decline, claims a recent study conducted by MetLife Inc.

“Worker loyalty has been slowly ebbing over the last several years,” says Anthony Nugent, executive vice president of U.S. Business at MetLife. “The short-term gains employers realized from greater productivity appear to be short-lived and now pose bottom-line challenges as key talent considers other employment opportunities that have arisen as a result of the improving economy. There is no doubt that the rebounding economy will bring more opportunities for employees.”

Zip Codes Determine Pay Checks

Traditionally, salaries vary from region to region. Those fluctuations are usually determined by the local cost of living. The West (Arizona, California, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington and Wyoming), which is home to only 15 percent of State of the Profession respondents, boasts the highest salaries.For instance, 37 percent of assemblers in the West claim to make more than $100,000 a year. By comparison, only 13 percent of assembly professionals in the South (Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia) earn six-figure salaries.

Assembly professionals in the Northeast (Connecticut, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont) tend to earn less than their peers in other parts of the country. But, those individuals can boast that they work fewer hours per week than their counterparts. They work an average of 44 hours a week vs. 47 hours for assemblers in the Midwest (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin).

Only 27 percent of respondents in the Northeast expect to work more hours during the next 12 months vs. 38 percent in the Midwest. But, 80 percent of assemblers in the Northeast expect a raise in the near future vs. only 62 percent in the West.

Of course, money can’t always buy happiness. Assembly professionals in the West tend to be more satisfied than their peers in other parts of the country. A majority (97 percent) claim to be happy vs. 93 percent of assemblers in the Northeast.

One reason for that extra bit of happiness in the West may be due to more than warm weather. More than two-thirds (71 percent) of respondents expect their companies to invest in assembly operations during the next three years vs. only 48 percent in the Northeast. In addition, 38 percent of respondents in the West claim that their company has increased staff size during the past year, compared to 30 percent of assemblers in the Northeast.

According to the U.S. Bureau of Labor Statistics, geographic discrepancies in compensation are widespread. For example, average pay in the San Jose-San Francisco-Oakland, CA, metropolitan area was 20 percent above the national average in 2010. On the other hand, the Brownsville-Harlingen, TX, metropolitan area averaged 20 percent less than the national average.

That may be one reason why Regal Beloit Corp. recently opened a 125,000-square-foot plant in McAllen, TX, or why Caterpillar Inc. is currently building a 600,000-square-foot plant in Victoria, TX.

Small vs. Big Companies

Salary and job satisfaction levels in the assembly profession are usually influenced by the size of a manufacturer. For instance, assemblers who work in companies with more than 2,000 employees tend to be well compensated. Indeed, 72 percent of assemblers at those companies earn more than $80,000. On the other hand, only 27 percent of assemblers at small manufacturers (companies with less than 50 employees) earn more than $80,000.However, bigger isn’t always better, especially when it comes to compensation. Assembly professionals who work in larger companies are often not as happy as people who work for smaller firms. Indeed, 39 percent of assemblers who work in companies with less than 100 employees claim they are “highly satisfied” with their jobs vs. 44 percent of respondents who work in large companies.

Assembly professionals in the computer and electronic products industry, which includes manufacturers of antennas, automatic teller machines, loudspeakers, navigational instruments and satellites, tend to earn higher salaries than their peers in other industries. For instance, they earn 15 percent more than the national average of $80,287.

Assemblers in the transportation equipment industry also boast higher-than-average compensation. However, respondents who work for contract manufacturers earn 16 percent less than the national average.

Manufacturing engineers (40 percent of respondents) rank slightly ahead of design engineers (12 percent of respondents) when it comes to compensation. According to the 2011 State of the Profession survey, manufacturing engineers earn an average of $74,836 vs. $71,250 for design engineers. Manufacturing engineers also work 1.7 hours more per week than their colleagues.

However, design managers typically earn 13 percent more money than manufacturing process managers. Those individuals also work almost two more hours per week than their manufacturing counterparts.

Age is another key factor that affects compensation. For instance, assembly professionals who are more than 60 years old (17 percent of respondents) typically earn the highest salaries. They average $84,400 vs. assemblers who are under 30 (5 percent of respondents), who earn an average of $61,824.

In the future, age will continue to play a key role in determining compensation, because there’s a growing trend toward an older workforce. For example, one-half (49 percent) of respondents claim they have put off retiring because of the economy.

That’s in line with a new report conducted by The Conference Board. “Retirement rates declined significantly during and after the Great Recession,” says Gad Levanon, associate director of macroeconomic research at The Conference Board. “Workers have been working longer and retiring later since the mid 1990s, but the recession has put even greater pressure on workers to stay on the job.

“However, we see that delayed retirement has been more prevalent for some occupations and industries,” Levanon points out. “Mature workers in high-paying occupations were much more likely to delay retirement than workers in low-paying ones. Those in higher-paying jobs tend to have higher financial expectations for their retirement years. Also, high-paying occupations tend to have limited physical requirements, making it easier to continue working.”

Assemblers in the medical device industry (67 percent) are more likely to rethink retirement plans than their colleagues in other industries, such as computer and electronic products (33 percent) and plastics and rubber products (29 percent).

Salaries also fluctuate dramatically based on type and level of education. For example, assembly professionals with just a bachelor’s degree (45 percent of respondents) earn an average of $84,129. However, assemblers armed with a master’s degree (24 percent of respondents) earn $89,670.

Obtaining a master’s in business administration (MBA) is one way to ensure a higher salary. The ASSEMBLY survey discovered that MBAs (10 percent of respondents) make a whopping $26,350 more than non-MBAs. However, MBAs work almost four more hours per week than non-MBAs.

Job Satisfaction Varies

Most State of the Profession respondents claim to be satisfied with their jobs, but a closer look at the data reveals some variations. For example, design engineers are happier than manufacturing engineers. Indeed, 43 percent of design engineers claim to be “highly satisfied” vs. 34 percent of manufacturing engineers.Overall, 41 percent of assemblers who claim to be “highly satisfied” with their jobs earn more than $80,000 a year, while 89 percent of assemblers who are “not satisfied” earn less than $80,000. Not surprisingly, individuals who are “not satisfied” typically do not receive cash bonuses and provide little or no input on budgeting new assembly equipment.

The happiest assemblers work in the medical equipment, devices and instruments industry, where 50 percent of respondents claim to be “highly satisfied” with their jobs. In contrast, only 33 percent of assemblers in the furniture and fixtures industry are “highly satisfied.” Assembly professionals who work for contract manufacturers are 5 percentage points happier than their peers who work for OEMs.

Job satisfaction is defined in different ways by different people. But, the top three reasons cited by assemblers are: “My job is challenging,” “I enjoy my work” and “Constant changes keep things interesting.” Of course, just having a job is another good reason to be happy these days.

“I am involved in day-to-day operations, as well as setting longer term strategies,” says a manufacturing manager in the electrical equipment and appliance industry. “Also, we are able to implement strategy once it is agreed upon.”

“I like developing and enhancing products and solving technical problems,” adds a design engineer at a medical device company.

“I’m allowed to be creative using lean tools to justify improvements within our company,” explains a plant manager in the machinery manufacturing industry who is satisfied with his job.

“I am involved in almost every part of the business, including quality improvement, new product development, training and budgets,” notes a plant manager in the transportation equipment industry.

However, some respondents are less satisfied with their jobs. Common complaints from assemblers include low compensation, poor leadership, instability and lack of resources.

“Lack of manpower in my department makes it difficult to complete many jobs in a timely manner,” says a manufacturing engineer in the transportation equipment industry. “A good portion of my time is spent working on things that add no value to the company.”

“The people who work at my company are stuck in their ways and resist changes, especially ones that can reduce waste and inefficiency,” laments a design engineer in the plastics and rubber products industry. “They like doing things a certain way and don’t want their routines to be interrupted by progress.”

“We continue to try to do more with fewer resources, so stress on the job has increased,” claims a plant manager in the fabricated metal products industry.

“There’s no commitment from top management for improvement, in addition to a lack of leadership and defined goals,” adds a manufacturing engineer in the electrical equipment and appliance industry.

“I have not been rewarded for this plant’s stellar performance, because company performance lagged due to poor performance at other plants,” says a manufacturing manager in the transportation equipment industry.

Assemblers are less worried about budget cutbacks, but it depends on the size of their company. For instance, only 29 percent of assemblers who work for smaller manufacturers (companies with less than 50 employees) are concerned about cutbacks, while 64 percent of assemblers who work for large manufacturers (companies with 2,000 or more employees) are worried.

Respondents in the computer and electronics industry (46 percent), transportation equipment (44 percent), and plastics and rubber industry (43 percent) industries are more worried about cutbacks than their peers in other industries

Assembly professionals in the energy sector (14 percent), which includes manufacturers of solar panels and wind turbines, are less concerned about budget cutbacks. They are much more concerned about issues such as time constraints and global competition.

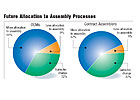

The energy industry is also bullish about investing in more capital equipment. Other industries that expect to commit more resources to new production equipment in the near future include medical device manufacturers (83 percent), plastics and rubber products manufacturers (79 percent) and transportation equipment manufacturers (74 percent).

Watching the Clock

Assemblers continue to work long hours. In fact, more than one-third (44 percent) of 2011 State of the Profession respondents claim they’ve been spending more time at work during the past year. And, 84 percent work more than 40 hours a week. Assembly professionals in the fabricated metal products and computer and electronic products industries work the longest days.Unfortunately, the trend toward longer workweeks is expected to continue during the next 12 months, with 36 percent of assemblers claiming that their average workweek will increase, a 3 percentage point increase over 2010 and an 8 percentage point jump over 2009. One-half (50 percent) of assembly professionals who work in the medical industry expect to work more hours during the next 12 months vs. only 14 percent of assemblers in the energy industry.

More than one-third (38 percent) of assemblers in the Midwest, which is home to the rebounding auto industry, expect to work more hours a week during the year ahead. On the other hand, only 27 percent of assemblers in the Northeast expect to work longer hours.

Assembly professionals who work for small manufacturers plan to spend more time at work than their counterparts in larger companies. More than one-third (43 percent) of respondents who work for manufacturers with less than 50 employees expect to work more hours per week in the next 12 months. However, only 32 percent of assemblers who work for companies with more than 2,000 employees foresee longer work weeks ahead.

One-half (49 percent) of respondents claim that time constraints will affect their ability to do their jobs during the next 12 months. Time constraints will pose the biggest challenge to assemblers who work in large companies and the medical device industry.

Many assemblers will be spending more time trying to find people to work on their lines. More than one-third (38 percent) of respondents claim that a skilled labor shortage will affect their plants during the next 12 months, which is an 8 percentage point increase from 2010 and an 11 percentage point increase from 2009.

According to ASSEMBLY's State of the Profession survey, concern over finding talent is greatest in the plastic and rubber products industry (57 percent) and lowest in the energy products industry (14 percent).

The skilled labor shortage will have the biggest impact on assemblers who work in large companies. For instance, 41 percent of assembly professionals who work for manufacturers with more than 1,000 employees will be affected by labor shortages vs. only 32 percent of respondents in manufacturers with less than 100 employees.

Survey Methodology

ASSEMBLY magazine would like to thank all the respondents who participated in its 16th annual State of the Profession survey. The survey was conducted online in March 2011 by BNP Media’s Market Research Division. It was sent to more than 11,000 randomly selected subscribers with an e-mail address.The charts and tables in this report highlight the major data gleaned from the survey responses. On some of the questions, the response rate does not equal 100 percent due to rounding or surveys that contained one or more unanswered questions. In cases where multiple responses were allowed, the total may exceed 100 percent.