The process of selecting assembly technology and vendors is similar to finding a spouse. There are many different techniques that can be used to narrow the field of contenders. Before choosing a finalist, you have to weigh all the factors and determine which attributes meet your short-term needs and long-range goals. It pays to take your time and choose wisely, because a bad decision can be disastrous.

According to the 2000 ASSEMBLY State of the Profession survey (July 2000, p. 12), assemblers are spending more time selecting technology and evaluating suppliers than in the past. In fact, between 1999 and 2000, there was an 8.3 percent increase in the amount of time assembly professionals devoted to supplier evaluation. And, there was a 5.7 percent increase in the amount of time assemblers spent selecting new technology.

That trend is being driven by several factors. Manufacturers are under more pressure to control their costs today. As a result, any funds allocated for capital equipment must definitely contribute to the bottom line. Careful decision-making up front is more important than ever.

However, age discrepancy and changes in engineering demographics are also playing a role. Veteran engineers tend to be very complacent. They're often willing to keep doing things the same old way, especially when it comes to their business relationships with vendors.

"Many engineers have spent an entire career with the same set of products and processes," says Bob Jeske, a consultant at the Bourton Group (Rockford, IL). "They have not had the opportunity to explore different process, control and material handling technologies." Jeske believes it's important to constantly explore the marketplace to see what's available. Without taking the time to do that, engineers run the risk of having applicable technologies pass them by, he says.

The recent influx of young engineers also appears to be having an influence. New engineers typically spend more time selecting technology and vendors. "They are being trained a little better," notes Mike Perreault, vice president of Midmac Systems Inc. (St. Paul, MN). "Young engineers generally have more to lose. They will be the ones who pay the consequences if a new machine doesn't meet its expectations several years down the road. Since many of these individuals are trying to promote themselves or advance their careers, they tend to be more cautious during the selection process."

Unfortunately, techniques for se-lecting technology and vendors tend to be somewhat of a gray area. There's no universal formula that can be used by every company. "There are no standards or definitive rules to follow," says Scott Lauer, president of Hi-Speed Automation Inc. (Cedarburg, WI). "It's a very subjective process. Each situation is unique due to factors such as application, budget, performance criteria and individual personalities."

According to Lauer, practice makes perfect. Indeed, the best practitioners simply apply previous knowledge and experience to the selection process.

"You have to look at what your application is," says Dennis Dureno, vice president of Buker Inc. (Gurnee, IL). "Choosing something like cylindrical drives is one thing; most of those products are available off-the-shelf. However, many assembly machines are not generic, so the selection process becomes much more of a challenge." Dureno believes it's very important to clearly define what you need before beginning the selection process.

Know What You Want

The old Boy Scout motto, "Be Prepared," also applies to selecting technology and vendors. "Selecting a vendor is made easier by good preparation on the buyer's part," says Lauer. "It's important to know exactly what you want. The better you can define your wants and convey them to a vendor, the better they can respond to your request."According to Lauer, it helps to have a written project scope that encompasses many different areas, such as what the machine or system must do; when it's required; how fast it must run; current and future production volumes, broken down hourly, daily, weekly and monthly; what is envisioned as a manual process and what should be automated; all process specifications and descriptions; product drawings with tolerances; power preferences, such as hydraulic or pneumatic; and the type of transport envisioned, such as rotary dial, power and free, in-line or carrousel.

It's important to have the process completely defined before contacting suppliers. For example, you should know if you want to own the design or if it's acceptable for the vendor to own the design. Also, know what system documentation you want and the kind of format the documentation should be provided in. In addition, it helps to know approximately how much money will be budgeted for the equipment, so you don't ask for fancy bells and whistles when all you can afford is a simple buzzer.

"By clearly defining what is required, you can more clearly determine, by the proposed vendors' responses, which vendors are capable of supplying the equipment and which are not," says Lauer. "Make sure you ask the same question to each vendor so they can be compared evenly."

According to Jeske, potential suppliers will interpret your needs based upon the strengths that are resident in their product offerings. "The same set of specifications that go out to two different potential suppliers will ultimately yield the same solution," says Jeske. "However, each supplier will take an approach to get there that is based upon their particular technical familiarities and strengths."

The next step is to develop a pool of potential suppliers. Dureno suggests creating a long list and a short list of "players." Ideally, 10 companies should be on the long list. Gather as much basic information as you can from them. Request technical literature, spec sheets, case studies, mission statements and other background material, such as CD-ROMs, videos, photos and white papers.

Expect vendors to answer your basic questions and follow through on your requests, but be reasonable. "In the beginning phases of your search, learn from them, but don't needlessly exploit them with detailed requests for proposals," warns Jeske. "Save that step for the true finalists."

Internet Pros and Cons

Trade shows, trade magazines and industrial directories have traditionally served as excellent resources for gathering information on potential technology and vendors. While all three methods are still widely used, more and more engineers now begin the selection process by surfing the World Wide Web.The Internet is a great tool to use early in the selection process. "Today, it's much easier to find a current list of potential vendors and research their capabilities than it was in the past," says Lauer. "You can get a good feel for whether or not someone is a potential vendor without even making a phone call."

However, some observers argue that the Web has been both a blessing and a curse. "The Internet is helpful," says Jeske. "It allows an engineer to get acquainted with current technologies, select potential contenders and do some background investigation. However, it is no substitute for the human processes of evaluation."

Some Web sites can also be misleading. "It's easy to deceive people with elaborate Web sites that contain fancy pictures or elaborate graphs," warns William Bodine, senior vice president of Bodine Assembly and Test Systems (Bridgeport, CT). "Taking a virtual tour of a vendor's facility is not a substitute for a personal visit." According to Bodine, some upstart vendors rely heavily on the Internet to create an image of technical sophistication or competence.

While it's important to consider newcomers that might offer innovative technology or fresh ideas, beware: A company with a hot new idea might not be able to back up its claims.

It's easy to be lured by a company that claims to have exciting new processes or unique applications. However, when you're dealing with a leading-edge technology or vendor, there's a higher risk factor. "The odds of success are better with a company that's been around a long time," notes Lauer.

"Personally, I would put my money with an established company with a good track record," says William Pierce, president of Common Sense Fastener Technology (Russiaville, IN). "However, if you feel that your own engineering force is totally knowledgeable and you have the money to assist a startup company, then it could be a win-win for both of you." Pierce does not recommend taking that approach unless the startup company has good financial backing.

Any company you ultimately select should have the ability to deliver the equipment when promised and support it after the sale. Indeed, the financial health of a vendor is extremely important. If a company is struggling and isn't financially solvent, it probably won't be around in a few years if you have a problem or need assistance.

"Look for a supplier with a history and reputation of successfully implementing their approaches utilizing their technical strengths," says Jeske. "You want a supplier that has successfully been there before. Unfortunately, no supplier will have addressed your exact set of specifications. But, you need to be sure that the supplier has successfully applied its technologies to products with similar shapes, sizes, materials, processes, number of components and cycle times."

Pierce believes the engineering expertise of a potential vendor is more important than the overall dollar size of the company. "If your supplier does not have an excellent engineering staff and R&D laboratory, their sales dollars are not going to help you when you get in trouble," he points out.

"Some suppliers have vast resources at their disposal that will mandate a higher price," adds Pierce, a retired General Motors engineer. "There are also those suppliers that have limited resources that may meet your organization's criteria and still make it possible to have lower prices."

Dureno agrees there is nothing wrong with considering small vendors. "A smaller guy usually can't afford to screw up," he explains. "If they want to use you as a future reference, they'll probably give you more attention and support. You'll definitely be important to them."

Select Contenders

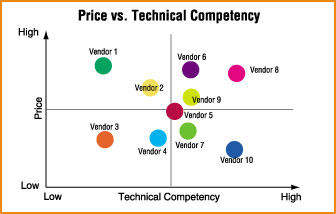

Eventually, the pool of potential suppliers has to become shallower. "You have to do your homework up front to narrow the field down," says Bodine. "Most people make the mistake of including too many companies in their search. If you start with eight to 10 possible vendors, you should be able to boil it down to three or four companies. And, the way four different companies approach your project can be world's apart."To select several contenders, it helps to use a matrix to plot where each company ranks in relation to a couple of key factors, such as price and technical competence.

Ideally, suppliers that rank high in price and low in technical competence should be dropped from further consideration. On the other hand, a supplier with a low price and a high degree of technical competence is not necessarily the best company to work with. Be aware that you get what you pay for--technical competence often comes with a higher price tag. "There's a reason why more expensive equipment is more expensive," says Bodine.

"As with many capital equipment purchases, the least expensive system isn't always the best," adds Todd Williams, sales manager at Sheepscot Machine Works (Newcastle, ME). "Likewise, the most expensive system with all the 'lights and whistles' can often be overkill for the application."

Many purchasing agents fail to grasp that concept. And, like it or not, purchasing professionals are getting involved earlier in the capital equipment acquisition process. They're under pressure from top management to control costs and use their negotiating skills.

"Purchasing has a much larger role today and price has become a more important criteria," says Bodine. "More and more people are price sensitive."

Bodine believes engineers must find a way to communicate better with purchasing departments. "Try educating purchasing people on the costs to the company when equipment doesn't operate to expected capacities," adds Bodine. "Look at the cost of failure. Lost market share due to an inability to deliver product is a huge cost." He suggests using spreadsheets with hard facts based on factory floor data.

"You have to consider how the machine is going to run over the next five to 10 years," says Bodine. "You also have to look at how much it's going to cost over that same time period."

When it comes to dealing with price-pushing purchasers, Lauer suggests heeding the advice of John Ruskin, a 19th century English poet and philosopher: "There is hardly anything in this world that some man cannot make a little worse and sell a little cheaper, and the people who consider price only are this man's lawful prey."

Get Personal

Communication plays an important role when narrowing down your selection. Talking to people, asking questions, listening and taking notes is extremely critical. Part of that process involves asking vendors for referrals.It's very important to find out what type of experience others have had with similar systems or technology. By talking to a handful of current and former customers of each vendor--via telephone or e-mail--you'll obtain some valuable information.

Develop a list of standard questions to ask each individual. Potential questions might include:

- What kind of training and documentation did the vendor provide after the sale?

- How long did it take until the system reached fully rated production output?

- How reliable has the equipment been?

- Are you working with this supplier on any new programs? Why or why not?

"Ask questions about the features of each system," Williams suggests. "If necessary, cull out the most important features from each quote, write a spec that best meets your needs and ask the vendors to resubmit quotes that will meet or come close to that spec. This will also better enable you to factor in the cost-benefit ratio of each offering."

Before you make a final decision, be sure you visit each vendor's facility. "A site visit and a financial review must be at the top of the to-do list when evaluating potential sources," says Pierce.

Unfortunately, personal visits are often overlooked because of time constraints. But, it's a good way for a vendor to prove that it has the capability to do what it says it can do. Plan to spend a full day touring the facility and interacting with key personnel.

"You need to validate what the supplier's sales force is telling you," says Jeske. "See how they work with other customers. Verify that the supplier has the appropriate resources to deal with the level of your program."

"Personal visits provide a great opportunity to make sure there's a good match technology-wise and personality-wise," adds Bodine. He suggests sending several different people on these visits. "Different people see different things," explains Bodine. "For instance, a mechanical engineer will see things that an electrical engineer might overlook."

Measurement Tools

To select technology and suppliers objectively, it helps to have a standardized method that compares strengths and weaknesses. Many experts recommend using spreadsheets or scoring charts that help visualize differences.Using this method, potential vendors are evaluated against a fixed set of key criteria. Dan Bradshaw, business manager at Liquid Control Corp. (North Canton, OH), suggests looking at five areas: size, resources, experience, diversity and facilities. "Resources refers to people, training and materials," says Bradshaw. "Diversity reflects how exposed a company has been to different applications and different challenges, problems and solutions."

"It's important to create an objective viewpoint rather than personal preference," adds Midmac Systems' Perreault. His company uses an evaluation form that compares four vendors. Rating criteria include factors such as supplier flexibility, maintenance, documentation, delivery and price. The form also includes several fill-in-the-blank lines so it can be customized to include special criteria, such as ergonomics or clean room experience.

The final line is reserved for "gut feel," which Perreault says is totally subjective. "You can try to quantify everything, but you still might have something in your stomach that says, 'I don't know about that,'" he explains. "The 'gut feel' line allows evaluators to check their personal instincts and ask themselves if it feels right."

Each criteria is rated in importance: high, medium or low. "It's a beneficial tool," says Perreault. "It can be modified and adapted to evaluate vendors or technology." However, the key to its success is involving as many people as possible, early in the process, to set the weight for each category. For instance, Perreault says mechanical and electrical engineers, maintenance personnel, safety experts, machine operators and purchasing agents should all be involved.

"The process of weighing the categories allows people to discuss what's important and come to a consensus," says Perreault. "It often brings up issues and concerns that you may never have thought of before."

When evaluating suppliers, don't forget to consider the long-term goals of your company. Any vendor you select should ultimately have a positive impact on your company's bottom line. Make sure the vendor's business philosophy is compatible with your company's strategic goals. And, insist that they will work with you to achieve objectives such as cost savings, increased market share or faster time to market.

Sidebar: Characteristics of a Great Supplier

Can you put a check mark next to each of the following items? If not, it may be time to start looking for a new supplier.- Has a track record of on-time delivery. Anticipates potential problems or delays and communicates to you in a timely fashion.

- Focuses on total cost rather than just initial purchase price. Has a proven ability to reduce costs and is willing to address your company’s cost-cutting goals.

- Has in-depth knowledge of your industry, including products, manufacturing processes, assembly challenges, competitors and current trends.

- Is willing to share data, knowledge and in-depth financial information with you.

- Offers superior after-the-sale service, such as documentation, training and technical support.

Sidebar: Vendor Selection Steps

- Create a written project scope that encompasses many different areas, including application parameters.

- Develop a pool of potential suppliers. Use the Internet, trade shows, trade magazines, industrial directories and other sources to create a list of approximately 10 companies.

- Request technical literature, spec sheets and other background material, such as CD-ROMs, videos and white papers.

- Narrow the list down to three or four finalists.

- Get referrals and talk to current or former customers of each vendor.

- Arrange personal visits to each vendor. Spend a day touring the facility and interacting with key personnel.

- Use a spreadsheet or matrix to benchmark vendors against an established set of key criteria.

- Make a final decision and stick to it. Establish a timeline for installing the equipment and ramping up production.