CAMBRIDGE, England—As demand for lithium-ion batteries continues to increase, the need to manage their sustainability through their entire life cycle, including end-of-life, is becoming increasingly important. The batteries can be recycled to re-obtain valuable metals such as cobalt, lithium and nickel.

Depending on the recycling technique employed, materials obtained from these processes may need further refining or processing to enable their re-introduction into new battery manufacturing.

“Battery manufacturers are keen to source materials produced from recycling to mitigate against fluctuating metal prices and to domesticate material supply,” says Conrad Nichols, technology analyst at IDTechEx. “As the volume of end-of-life lithium-ion batteries continues to grow, recyclers will continue to scale up their recycling capacities through the construction of new plants to meet recycling demand.”

A new report from IDTechEx analyzes the three key technologies currently being used: mechanical, pyrometallurgical and hydrometallurgical recycling.

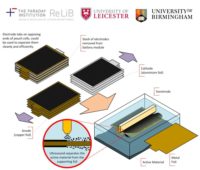

Mechanical processing is the simplest technique. It is employed by many players globally, and is typically the initial step in lithium-ion battery recycling. This often starts with a disassembly step, which is performed manually due to differences in EV battery pack design. However, it requires a skilled workforce.

After disassembly, typical steps include shredding, grinding and crushing. This breaks down the high-value materials, separates them from foils and casings. This recycling step must be performed in an inert atmosphere. Often, sieving is used to separate larger fragments of current collectors, casings and separators from electrode materials, which are constructed of very fine powders.

“This results in the production of black mass, which requires further refining via hydrometallurgical or pyrometallurgical processing to produce battery-grade metal salts,” explains Nichols. “The majority of players in Europe and North America currently only have mechanical recycling capabilities. Therefore, most of these recyclers do not have the ability to produce battery-grade materials that are ready to be introduced into new battery manufacturing. This black mass is typically transported to recyclers in the Asia-Pacific region that have these capabilities.”

Pyrometallurgy refers to the use of heat to extract battery materials. This process is typically performed in an electric arc or shaft furnace and requires little pretreatment. In addition, this type of recycling is battery chemistry agnostic. It can receive various metal-containing waste streams as feedstock, such as nickel-metal hydride, nickel-cadmium and lithium-ion batteries.

“However, the process has high-capital requirements and is also energy intensive while requiring off-gas cleaning,” Nichols points out. “Pyrometallurgy produces a mixed metal alloy, as well as a slag stream, containing lithium, manganese and aluminum. Therefore, this would still require further hydrometallurgical processing if all valuable metals were to be re-obtained at battery grade.”

Hydrometallurgical techniques can be used to recycle black mass directly or refine alloys produced from pyrometallurgy to form battery-grade metal salts. These salts can be re-introduced into new cathode precursor manufacturing and are therefore of higher value than black mass produced from mechanical recycling. In hydrometallurgical recycling, leaching, solvent extraction or precipitation steps can be employed to selectively extract metals such as nickel and cobalt from black mass produced by mechanical recycling in the form of battery-grade salts.

“The key benefits of hydrometallurgical recycling are that more of the valuable metals can be recovered, and it is less energy intensive than pyrometallurgical recycling,” says Nichols. “The costs of reagents and high volumes of water consumption also pose some downsides. However, some recyclers [claim] that they are able to cycle water multiple times through the recycling process to maximize its efficiency.

“Currently, the majority of hydrometallurgical recycling capacity resides in the Asia-Pacific region, including key players such as SungEel HiTech, Exigo Recycling and ACE Green Recycling,” adds Nichols. “But, players in Europe and the United States recognize the benefits of hydrometallurgical processing and are in the process of expanding their capacities.”

Fortum Battery Recycling recently commenced commercial operations at its hydrometallurgical plant in Harjavalta, Finland. In North America, Li-Cycle Holding Corp. is planning to establish its own commercial-scale hydrometallurgical plant.