Many experts tout fuel cells as one of the cleanest forms of green energy, because the devices reduce CO2 emissions and provide greater energy efficiency than combustion engines. The only exhaust products are water, heat and oxygen-depleted air. The technology has huge potential, but several big hurdles continue to challenge engineers.

Hydrogen has always been considered too expensive for widespread commercial use. However, prices to manufacture fuel cells have dropped dramatically in recent years, allowing more affordable applications.

And, after years of hype and hope, hydrogen-powered cars are about to roll into the spotlight. Honda, Hyundai, Toyota and other automakers are getting ready to unveil sedans equipped with fuel cells. Other automotive applications include trucks, buses and forklifts.

The technology is also used for stationary power applications, such as backup generators and cellular telephone towers. Aerospace engineers are exploring new ways to use fuel cells for auxiliary power applications, such as landing gear, cabin lights and environmental controls.

As the fuel cell industry struggles to gain market share, engineers must tackle a number of production challenges. Most systems and components are still manually assembled, which drives up manufacturing cost. High-speed automation and high-throughput production processes will be essential to long-term success.

Diverse Devices

Fuel cells come in several different sizes, shapes and varieties. They resemble batteries in their basic construction, which consists of an anode (which, unlike in batteries, is the negative electrode or terminal), a cathode (positive electrode), an electrolyte (the conducting medium through which electrical current flows) and a separator (to electrically isolate the positive and negative electrodes).

A chemical reaction in the fuel cell between hydrogen and air creates electricity. However, a single fuel cell generates an electric potential of less than 1 volt, so multiple cells must be connected in an electrical series called a stack. The potential power generated depends on the number and size of the individual fuel cells that comprise the stack.

Fuel cells also vary by temperature range. Low-temperature fuel cells operate in the 60 to 120 C region and use a polymer membrane as the electrolyte. High-temperature fuel cells operate from 200 to 800 C and use ceramics.

Several types of fuel cell technology can be used for commercial applications, including alkaline (AFC), direct methanol (DMFC), proton exchange membrane (PEMFC), phosphoric acid (PAFC), molten carbonate (MCFC) and solid oxide (SOFC).

AFC is the most established fuel cell technology, dating back to 1839. It has been used for decades for applications in submarines and spacecraft.

DMFC technology is used in portable power systems and forklifts.

PEMFC technology is used in automobiles, portable power systems, drones, backup power systems, forklifts, and residential combined heat and power (CHP) applications.

PAFC technology was previously used in stationary power systems, but is being phased out due to poor economics.

MCFC technology is used in large stationary power systems ranging from 100 kilowatts to 1 megawatt.

SOFC technology is used in residential CHP and large stationary power systems ranging from 1 to 100 kilowatts.

Hydrogen is the fuel needed to operate PEMFC and PAFC products. DMFCs operate on dilute methanol, while MCFCs and SOFCs operate on natural gas.

“The majority of commercial sales are derived from PEMFC, DMFC and SOFC products,” claims Dave Edlund, CEO of Element 1 Corp., which makes hydrogen generators. “The majority of sales based on kilowatt capacity are due to MCFC and SOFC stationary power plants.”

Growing Demand

As fuel cell technology matures and new markets emerge over the next decade, the industry is expected to grow quickly. According to the Freedonia Group Inc., demand for materials used in the construction of fuel cells will grow 14 percent annually to $520 million in 2017, well above the pace of increase for battery materials.

“Fuel cells accounted for only 6 percent of all battery and fuel cell materials demand in 2012, but are expected to make up 9 percent in 2017 and 15 percent in 2022,” says Karen Kelly Grasso, an industry analyst at Freedonia.

“Market gains will be driven by rapidly expanding U.S. commercial fuel cell production, stimulated by continuing technological advances in fuel cell design, and by declining manufacturing and operating costs,” adds Grasso.

Larger scale commercialization is expected to initially remain in the electric power generation area—especially distributed power—where companies are marketing fuel cell-based electrical generators. For instance, eBay recently began using a data center in Utah powered by solid-oxide fuel cells made by Bloom Energy, which assembles its products in Sunnyvale, CA.

While the stationary power market is the backbone of the fuel cell industry, the sexiest application is automobiles. However, that market is expected to develop more slowly, due to formidable cost, infrastructure and technical barriers delaying large-scale commercialization.

The first vehicles will hit the streets of Southern California (the only U.S. market with hydrogen filling stations at the moment) this year. First out of the gate is the Hyundai Tucson, which can travel up to 300 miles on a full tank. The vehicles are being assembled in the same factory in Ulsan, South Korea, that produces traditional gas-powered versions of the Tucson crossover.

Next year, the Honda FCEV Concept will debut, featuring a stack size reduced 33 percent compared to the Honda FCX Clarity, which was launched in 2008. Last year, Honda entered into a long-term collaborative agreement with General Motors to codevelop a new generation of fuel cell systems and hydrogen storage technologies that will debut toward the end of this decade.

Not to be outdone, Toyota will also begin marketing fuel cell vehicles in 2015. Toyota engineers have been experimenting with the technology for two decades. In fact, they claim to have achieved a 95 percent cost reduction in the powertrain and fuel tank of the vehicle it will launch in 2015, compared to what it cost to build the original prototype in 2002.

Daimler AG and Ford Motor Co., which are involved in a joint-venture with Nissan Motor Co., plan to market fuel cell-powered vehicles by 2017. However, initial rollouts by all automakers will be in small numbers confined to a few select markets. The critical issue holding back widespread availability is infrastructure buildout.

“Until very recently, fuel cells were simply too expensive to be a practical solution for the automobile industry,” says Grasso. “Improvements in the underlying technology have brought costs down dramatically at the same time that automakers have come under greater pressure to offer zero-emission vehicles.”

Grasso doesn’t expect to see the fuel cell vehicle market take off until after 2020. “The issue of refueling continues to be a [big hurdle],” she explains. “Efforts to reduce the cost of fuel cells by reducing the use of platinum in the catalysts will need to continue. Also, fuel cells will need to be durable and [only need] reasonable maintenance.

“A drivetrain system that is run by a fuel cell will be less complex than an internal combustion engine, in much the same way that an electric vehicle is less complex,” Grasso points out. “There will be fewer moving parts, which should reduce wear.”

Assembly Challenges

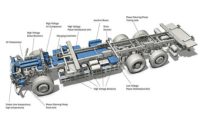

Fuel cells can be divided into two basic subassemblies: the stack and the balance-of-plant (BOP). The stack contains hundreds of electrochemical cells, as well as current collection, mechanical support and clamping, and gas-coolant flow manifolds. The BOP consists of all the other components that make the fuel cell run, such as blowers, humidifiers, valves, controls and heat exchangers.

Most BOP parts are fabricated from stainless steel, but graphite and titanium are also used. “High- temperature metals are important for heat exchangers and other hot-side components of fuel cells, especially those that operate in the 500 to -800 C range,” says Mike Ulsh, fuel cell manufacturing project lead at the National Renewable Energy Laboratory. “These are very expensive and not always easy to machine. Very thin ceramic sheets are used in high-temperature fuel cells and are often delicate to handle.”

According to Ulsh and other experts, fuel cell stacks are challenging to assemble. A fuel cell stack is made up of multiple layers of anodes, cathodes and spacer components that need to be assembled in a specific sequence. However, the hundreds of layers needed in a commercial-scale stack and the number of stacks needed to generate sufficient power make it almost impossible to manually assemble them quickly and cost competitively.

“Every component and every individual design present their own assembly challenges,” claims Stan Ream, laser technology leader at EWI. “[Fuel cells] require many thin, floppy parts with little to no tolerance for leaks.” Ream says laser welding is an ideal process for fuel cell assembly because of “speed, low distortion and lower net cost.”

Metallic interconnects in particular pose many headaches for engineers. Each interconnect can have several feet of welds that join two thin foils. In a fuel cell, there are numerous interconnects, meaning that a single fuel cell can have several hundred feet of welds. If these welds have even a small pin-hole leak, eventually the fuel cell will experience a catastrophic failure.

“The most challenging components to handle are the electrodes,” says Tim Mead, commercial director at GB Innomech, a British company that specializes in automating highly complex and labor-intensive manufacturing processes. “Their active surfaces are extremely sensitive to damage, so the plates need to be interleaved with protective plastic spacers to prevent them touching one another when stored in bulk and waiting to be added to the fuel cell stack during the assembly process.

“Also, anodes and cathodes need to be correctly placed either face up or face down to ensure the right electrical connections in the final stack,” adds Mead. “The hydrogen and oxygen spacers within the stack include a gasket material to form a gas-tight seal when compressed. All of the spacers [must be] specifically designed to optimize gas and liquid flow around the electrodes.

“Once all of the electrodes, different spacers and an end cap have been added, the stack is compressed to a predetermined load to form the seals and to create a gastight unit before being bolted together manually with tie rods,” Mead points out. “Although none of the individual components are particularly heavy, there are hundreds of layers in a commercial-scale fuel cell stack and the final completed stack needs to be moved by forklift on account of its weight and bulk.”

“The stack is a bit of a beast,” notes Ulsh. “Whether you have polymeric and other soft goods in a low-temperature stack or mainly thin ceramics in a high-temperature stack, these materials are fairly fragile. In some cases, they are very sensitive to mechanical, thermal or humidity stress.

“They cannot be damaged during stacking (layering the individual cells with current collection and gas-coolant flow hardware) or compression, because the components need to be in uniform physical contact to operate correctly,” warns Ulsh. “Some of these cells are a few centimeters square, but some are several feet on a side. You have dissimilar, fragile and flimsy materials that must be extremely precisely aligned, and must then be put under precise and uniform pressure.”

Automation Advances

Fuel cells are assembled with various methods, including arc welding, laser welding, brazing, sintering, adhesive bonding and fastening. However, because production volumes are still low, most manufacturers have been reluctant to invest in robotics, conveyors and other forms of automation.

“Assembly at the system level is still almost entirely manual,” claims Ulsh. “[In most fuel cell factories], skilled people assemble the stack, then put stack and BOP components into a housing. They do all the mechanical, electrical and fluids connections, as well as functional testing.

“Manufacturers know that the market is only so big right now, so they are hesitant to invest in process improvements or bringing in new [tools] or techniques, because they’re not sure if their income will cover the investment,” adds Ulsh. “It’s the chicken and the egg. People don’t want to over-invest in manufacturing until they’re more sure of [long-term demand].”

Anticipating future demand for automation, Greenlight Innovation recently created a new division that provides turnkey automated assembly and testing systems to fuel cell manufacturers. “We offer standardized products, such as an automated stack assembly machine and an automated station for end-of-line testing of fuel cell stacks,” says Gary Cook, manager of Greenlight’s automation division.

“We also have several machines for testing thickness and measuring resistivity of materials under varying compressive loads,” adds Cook. “And, we have just designed a semiautomatic stack assembly press, with leak testing, strap forming and integrated strap welding.”

“The challenge is to scale up manufacturing processes and to automate the assembly of stacks to a consistent quality, while also allowing the operator to safely manipulate the stacks and to complete manual process steps at the start and end of the production cycle,” notes GB Innomech’s Mead. The company recently developed a robotic assembly system for AFC Energy PLC, which produces alkaline fuel cells.

“The system can quickly and safely assemble commercial-scale fuel cell stacks at the production rate required,” says Mead. “It includes full component traceability, provides a complete build record for each stack, and also has built-in flexibility so that it can be easily and quickly reconfigured to assemble stacks with a higher or lower number of layers if required.”