Automotive and aerospace manufacturers have been at the forefront of the lightweighting trend for some time now. But, they’re not the only ones. The railway industry could also benefit from the use of new, lightweight structural materials.

Today, aluminum is widely used in railway applications, but advanced carbon-fiber composites and superalloys also appeal to engineers scrambling to reduce weight and optimize performance.

Although the United States pioneered lightweight passenger trains almost 100 years ago, research and development efforts are now centered in Europe, where sleek high-speed rail networks connect many far-flung regions. By avoiding airport congestion, train travelers can easily glide from city center to city center in a matter of hours.

In recent years, there’s been a resurgence in rail travel in Europe, including the comeback of overnight sleeper trains. In particular, France, Germany, Italy and Spain are at the cutting edge of high-speed technology. Other countries that have invested heavily in state-of-the-art rail networks include China, England, Japan, Morocco, Saudi Arabia, South Korea and Turkey.

Unfortunately, the United States is far behind. The only thing that comes close to what’s available in Asia and Europe is Amtrak’s Acela service that links New York City, Philadelphia and Washington. But, that may change over the next two decades.

A New Era?

According to a recent report from UBS Research, many travelers will switch from air to rail in the post-coronavirus world. It claims that more local, state and federal governments will “pursue the expansion of high-speed rail,” with billions of dollars being invested, which will generate “incremental demand for new equipment to boost speeds and density.”

High-speed rail projects are currently underway in California, Florida and Texas. Another line linking Las Vegas and Los Angeles is in the planning stages.

To succeed, high-speed passenger rail networks require several characteristics, including dedicated tracks that aren’t shared with freight traffic; few, if any, level road crossings; overhead electric catenary wires; railcars equipped with a low center of gravity to negotiate curves at high speeds; and double-ended power cars that are integrated into trainsets to eliminate the need for separate diesel locomotives.

Building that sort of infrastructure in the U.S. could take several decades. By then, emerging technology, such as maglev and hyperloop systems, may be more cost-effective alternatives to traditional wheel-on-rail designs.

However, no matter what technology wins out, future passenger trains will require lightweight rolling stock that can travel at speeds above 150 mph. Aluminum, carbon-fiber composites, high-strength steel, magnesium and other materials will play an important role.

Lightweighting is critical, because it has the potential to reduce both energy consumption and track damage.

“The new generation of car body shells, if they are lighter, will be able to carry more passengers within the same axle load constraints, use less energy and have a reduced impact on rail infrastructure,” says Elena Jubete, Ph.D., business development manager for polymers and composites at Cidetec Surface Engineering, one of the three leading institutes of CIDETEC, an internatoonal applied research organization based in Spain.

“Rail vehicles require a step change in technologies and design to remain competitive,” claims Jubete, who served as coordinator of Mat4Rail, a recent project that developed new lightweight materials and components under the auspices of a European Union initiative called Shift2Rail Joint Undertaking.

“Lightweighting of rolling stock, apart from energy reduction, will lead to greener technologies, reduced carbon footprints and improved performance,” adds P.K. Thukaram, director of heavy engineering at Altair Engineering Inc. “Weight reduction will result in lower inertia, less track wear and carry extra pay load.

“Globally, manufacturers of high-speed trains are working toward innovative weight reduction projects to use lighter components and minimum wheel sets,” Thukaram points out. “From the earlier bullet trains to recent maglevs, we can see dramatic improvements in overall designs from almost all train manufacturers.

“The weight reduction initiative is mainly driven by short-haul air travel competition, reduction in operating and maintenance costs due to better material properties, and [the desire] to carry more payload and passengers,” says Thukaram.

According to Thukaram, many of today’s rail car designs are lighter, faster and more energy-efficient than ever. Engineers are searching for technology that can help maximize manufacturing and operational efficiencies, while expanding design options and flexibility.

“The initial benefit from lightweighting is reduced energy requirement, and this in turn results in reduced fuel costs and reduced carbon emissions,” says Simon Iwnicki, director of the Institute of Railway Research at the University of Huddersfield in the U.K., which is located near where the world’s first intercity railway opened in 1830. “This is one of the key drivers at the moment and has a high level of scrutiny.

“Other benefits of lower mass and consequent lower axle load include reduced track damage,” explains Iwnicki. “There is also the potential for a ‘virtual spiral,’ where reduced mass results in reduced forces and the reduced forces result in reduced strength requirement and further mass reduction.”

Looking for the Light Answer

Whether they’re carrying freight or people, everything from boxcars to passenger cars traditionally have to be robust to withstand constant vibration. However, heavy railcars can have a negative impact on track, including wear and tear on rails, ties and ballast.

“There are various damage mechanisms, such as ballast settlement and degradation, rail-head wear and rolling contact fatigue,” says Iwnicki. “Many can be modelled, but not all are fully understood. Each require good data about the system, the environment and traffic volumes.

“Another way of looking at this is to consider the maintenance activities that are required to restore track after damage,” adds Iwnicki. “Key among these are tamping (leveling the track by adjusting the ballast), grinding (restoring the cross-sectional profile of the rail head), and inspection and replacement of cracked rail. Each of these steps cost money [and negatively affect rail traffic].”

Increased use of light materials is one way that these challenges can be addressed. However, lightweighting in the rail sector is easier said than done. In fact, generations of engineers have attempted to tackle the issue.

The first major breakthrough occurred around 1910 when Chicago-based Pullman Co. switched from wood to steel railcars after perfecting the art of riveting frames and body panels. In the early 1930s, engineers at the Budd Co. took the next step when they developed a way to join large sheets of stainless steel using shotwelding. At the 1933 Century of Progress world’s fair, the company debuted the Burlington Zephyr, a lightweight diesel-powered train that set speed records and revolutionized the conservative railroad industry.

At the same event in Chicago, Pullman showcased a new-fangled material called aluminum. Its lightweight Railplane featured a welded tubular frame covered with a riveted aluminum skin. In addition, Pullman and the Union Pacific railroad displayed an all-aluminum streamliner dubbed the M-10000.

Despite those early innovations, the U.S. lags far behind Europe today. The epicenter of high-speed rail in this country is in Hornell, NY, at a 100-year-old factory operated by Alstom SA. That’s where 28 next-generation Acela trainsets are being assembled. The first set recently left the factory and is undergoing tests at the Transportation Technology Center in Pueblo, CO. It’s expected to enter service sometime next year.

The new Acela 21 features aluminum coach carbodies that are supported on articulated bogies (trucks) between nine permanently coupled cars. Each end of the electric-powered train contains a power car that’s made from carbon steel with a built-in crash energy management system designed to mitigate collision impacts.

Ironically, the fastest trains in North America will ride on metal subassemblies made a few miles south of Pullman in Harvey, IL. That’s where LB Steel is fabricating and assembling the bogies used on the Acela 21.

LB Steel is housed in one of the oldest industrial complexes still in daily use in the Chicagoland area. Some of its buildings date back to 1894, when they were constructed to house the Whiting Foundry Equipment Co. Whiting Corp., a leading manufacturer of overhead industrial cranes and railcar maintenance equipment, vacated the complex several decades ago when it relocated 15 miles south to a new facility in Monee, IL.

Unique Challenges

Engineers face many unique challenges when trying to reduce the weight of railcars. First, they need to understand the physics of weight distribution in a passenger car.

The car body itself accounts for approximately 25 percent of the total weight, followed by the running gear and bogie (truck) system at 35 percent. The remaining 40 percent comprises the car’s interior, including seats, HVAC systems and wiring harnesses.

“Running gear is primarily made up of steel components, suspensions and brakes, with articulated joints offering very little scope for weight reduction,” says Thukaram. “Rail car weight can be reduced around 15 percent to 20 percent by use of multimaterials and optimization techniques. Interior weight can also be reduced with sleek designs and choice of lighter materials.

“High-strength steel, steel profiles, aluminum and aluminum profiles, multimaterial sandwich panels with carbon fiber, aluminum-steel reinforcement with epoxy, and carbon fiber are used in various models of railcars,” explains Thukaram.

“Fiber-reinforced polymer composites are widely used in train interiors,” Thukaram points out. “Lighter car bodies can be made with industrial processes, provided the right joining methods are used and their compliance with safety is assured.

“A major challenge is joining technology,” claims Thukaram. “Depending on choice of materials, welding, bolting, riveting and gluing are used. Joining methods are more complicated in the case of sandwich and composite structures.”

“[The most common] joining process used to assemble rolling stock is welding,” adds Randy Dull, principal engineer for arc welding at EWI. “Mechanical fasteners are used as well, especially for joining dissimilar metals. Adhesives are used extensively, but not so much in structural applications.”

According to Dull, joining large structural panels can be challenging in railway applications. “Distortion is a big concern, due to the heat input from welding,” he points out. “This is especially pronounced on thin sheet stainless steel welds in commuter railcar bodies. In addition to appearance, distortion creates challenges in fitting subassemblies for welding.

“[As carbon-fiber composites become more popular], adhesive bonding will be required for joining both matching and dissimilar materials," notes Dull. “Material preparation for bonding can be a challenge, and fatigue life will be a concern because railcars are typically expected to last 50 years.”

Composite Structures

Just like in the aerospace and automotive industries, most lightweighting efforts in the rail sector are currently focused on composite materials.

“Carbon fiber has high specific stiffness and strength compared to steel,” says Damon Roberts, engineering director at Magma Structures, a company that specializes in lightweight applications for the oil and gas, transport and wind power industries. “This means that structures of similar mechanical performance will be significantly lighter.

“The fatigue life of composite structures is considerably better than steel, so it should have a longer life span,” notes Roberts. “This can lead to potential downgrading of the design criteria, enabling further weight saving.

“In addition, unlike metallic components, composites don’t rust or corrode,” explains Roberts. “And, as the mechanical properties can be varied in different planes, the potential to include energy absorption in the principle structure can also be considered.”

“Composite materials have demonstrated a high potential for lighter, more energy- and cost-efficient structural components in other sectors, so the railway industry now wants to adopt them,” adds Cidetec’s Jubete. “Increasingly, composites are being used to replace metallic parts in car bodies, such as front cabs, rear ends, fairings, floors and under-frame coverings. Other parts, such as doors, running gear and seats, are currently under development.”

Jubete and her colleagues are developing lightweight materials based on glass, basalt and carbon-fiber reinforcements that meet strict fire, smoke and toxicity (FST) regulations. In fact, as part of the Mat4Rail project, a joint collaborative project coordinated by Cidetec Surface Engineering, three families of composite materials were developed, including a total of 24 potential candidates. Out of them, the six best new composites were identified.

“They are based on novel epoxy benzoxazine and hybrid resins that meet FST requirements,” claims Jubete. “This will enable the production of innovative car body parts, including novel door systems that replace current parts made out of honeycomb and aluminum or steel sheets, which have drawbacks regarding energy consumption, noise and thermal transmission.”

Mat4Rail also developed a new seating concept that consists of a small frame structure that holds a woven inlay structure. The lightweight frame system is cantilever suspended or floor-based fixed.

“This is expected to allow a weight reduction of car body shell sections by up to 30 percent and a weight reduction of access door systems by 10 percent to 20 percent,” says Jubete. “The new interior design concepts [will] allow an increase in capacity by up to 30 percent, reduced maintenance costs and reduced energy consumption due to the weight reduction.”

“Carbon-fiber composites can be used for both structural and nonstructural applications in the rail industry,” adds Camille Seurat, product development engineer at ELG Carbon Fibre Ltd. “They are ideal when lightweighting is needed with specific mechanical requirements. Many nonstructural applications have already been demonstrated, such as doors, side walls and floor panels.”

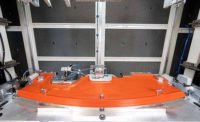

Seurat and her colleagues recently developed the world’s first carbon-fiber bogie. It’s 50 percent lighter than traditional metal bogies and optimizes both vertical and transverse stiffness.

“A traditional class 180 bogie frame in steel consists of two symmetrical longitudinal beams and two cross beams joining them,” explains Seurat. “It also includes brackets to attach components. All these parts are welded together to form the frame.

“Our carbon-fiber bogie frame is made of two symmetrical upper halves and two symmetrical lower halves,” notes Seurat. “This method [is] a cost-effective way to manufacture a low number of components.

“Internal tapping plates are used to attach the brackets to the frame,” says Seurat. “The four composite parts were bonded together. Internal bulkheads have been joined-up through hatches and an outside join-up was over laminated. Then, the whole structure was post cured.”