Many consumer goods are still made in the United States, including brushes, flashlights, jewelry, lighters, knives, markers, padlocks, pens, razors, scissors and watches. Those items are typically found in traditional brick-and-mortar stores such as Ace, Home Depot, Kroger, Staples, Target, Walgreens and Wal-Mart, as well as Amazon and other online websites.

Supply chain lessons learned during the coronavirus pandemic have spurred demand for products labeled “Made in USA.” In fact, the Alliance of American Manufacturing (AAM) claims that 75 percent of American consumers would prefer to purchase items that are made in the United States. However, one-third say they rarely or never see America-made products while shopping.

Many consumers want to buy products that are made in the United States. Photo courtesy Home Depot Inc.

“Americans want to shop Made in USA,” claims Scott Paul, AAM’s president. “Retailers are missing out by not doing more to promote American-made [products] in their marketing and store displays. I am truly optimistic that the United States can still do big things, and that includes building a Made in America future.”

“Today, more manufacturers are reevaluating where they assemble products, because of the risk of losing China and Taiwan as a supply source due to recent adversarial conditions,” adds Harry Moser, founder and president of the Reshoring Initiative. “Destabilizing geopolitical and climate forces have brought to light supply chain vulnerabilities and the need to address them.

“COVID also was a wake-up call to American manufacturers and consumers,” explains Moser, author of ASSEMBLY’s “Moser on Manufacturing” column. “It opened their eyes and made them more sensitive to the risk or probability of disruption.”

Consumer Goods Are Different

Most consumer products are different than other types of mass-produced items such as cars, appliances, medical devices or furniture.

“There are many unique aspects about manufacturing consumer goods that need to be taken into consideration, starting with the product’s form factor,” says Jeff Cavanaugh, senior vice president of global business units at Jabil Inc., a contract manufacturer that works with a variety of companies in different industries. “Many consumer products represent small form factors manufactured in large volumes, with millions of units produced annually.

“For that reason, consumer products often are manufactured in centralized locations, mostly in China or other parts of Asia, and then shipped to the rest of the world at low cost from a logistics standpoint,” explains Cavanaugh. “The production of larger consumer goods, however, such as refrigerators, washers and dryers, typically is regionalized, driven in part by the costs of final assembly and distribution.

“Another important distinction is the reality of shorter product lifecycles, with 12- to 24-month refresh rates and continuous competitive pressures that accelerate product design, development and delivery,” Cavanaugh points out. “Consumer goods companies must move with speed and agility in bringing products to market, which includes ramping production volumes to maximize capacity, while optimizing productivity and efficiency.

Consumer goods manufacturers must move with speed and agility to bring new products to market. Photo courtesy Target Corp.

“There’s a lot of focus on new product introduction, as every opportunity to expedite the path to commercialization requires seamless collaboration with manufacturing partners to reduce complexities through the use of best-practices and proven processes,” adds Cavanaugh.

As a result, digital manufacturing technology is becoming increasingly critical as companies seek to leverage automated production, improve quality and increase value, while lowering production costs.

According to a recent McKinsey & Co analysis, automation, digitization and the drive for greater sustainability are changing the way that American manufacturers assemble their products. These factors are also encouraging CEOs to take a fresh look at where manufacturing is done.

For companies that supply U.S. markets, the evolution of factor costs has significantly eroded the comparative advantage of global production locations and supplier networks. When organizations expand their definition of value to take account of sustainability issues and supply chain risks, the gap can narrow even further.

Benefits of Domestic Production

Making consumer goods in the U.S. makes sense for some manufacturers. One of the biggest advantages is the ability to respond quickly. Companies can adjust swiftly to issues that may arise regarding production schedules, supply chain issues or staffing changes.

“Responding to a supply chain crisis quickly can save a company millions of dollars,” says Izzy Galicia, president and CEO of the Incito Consulting Group. “In addition, having employees close by to handle a problem can’t be understated.

“You are also able to get a product to market quicker,” notes Galicia. “Offshore production can lead to delays that eventually will be costly. While it might be cheaper to sometimes produce overseas, the potential for more problems does arise because of location and how long it may take to solve a supply chain issue.”

“When manufacturers produce consumer goods in the U.S., they have complete control over their supply chain,” adds Ryan McMartin, product marketing manager at Parsec Automation Corp. “[It] means not having to worry about trans-ocean shipping costs, currency exchange rates, tariffs or international trade agreements.

“Another benefit is related to basic geographic simplicity,” says McMartin. “It takes far less time to procure materials when you operate within U.S. borders. This relative logistical ease also means manufacturers don’t have to carry as much inventory. With faster delivery and just-in-time fulfillment, manufacturers gain the tremendous benefit of nimbler operations.

“We have seen an increased push for domestic production and Made in USA consumer goods,” claims McMartin. “American consumers tend to embody a sense of supporting the little guy when it comes to manufactured goods.

“When you consider the escalating political climate around China and Russia, it’s easy to see why Americans may have a sense of national pride and a preference for shopping locally,” McMartin points out. “Geopolitical factors aside, I think the Covid-19 pandemic also encouraged consumers to support domestic businesses with more of a homegrown story, even if it means paying slightly more.”

What Does ‘Made in USA’ Mean?

Designating a product “Made in USA” involves more than just slapping a sticker of an American flag on a package. In fact, what constitutes the claim is somewhat confusing and subject to debate.

There’s no law that requires most products sold in the U.S. to be marked or labeled Made in USA or have any other disclosure about the amount of U.S. content that they contain. However, manufacturers that choose to make claims about the amount of U.S. content in their products must comply with rules and policy adopted by the Federal Trade Commission (FTC).

The FTC monitors and enforces various claims, with violators subject to large fines. Its most recent Made in USA Labeling Rule went into effect Aug. 13, 2021.

Traditionally, the FTC has required that a product advertised as Made in USA be “all or virtually all” made in the United States. “All or virtually all” means that all significant parts and processing that go into the product must be of U.S. origin. That is, the product should contain no—or negligible—foreign content.

When a manufacturer makes an unqualified claim that a product is “Made in USA,” it should have “reasonable basis” to support the claim at the time it is made. This means the company needs competent and reliable evidence to back up the claim that its product is “all or virtually all” made in the United States.

When claiming a product is assembled in the U.S., manufacturers should be able to prove that the item is “substantially transformed in the U.S., its principal assembly takes place in the U.S. and U.S. assembly operations are substantial.”

The product’s final assembly or processing must take place in the United States. The FTC then considers other factors, including how much of the product’s total manufacturing costs can be assigned to U.S. parts and processing, and how far removed any foreign content is from the finished product. In some instances, only a small portion of the total manufacturing costs are attributable to foreign processing, but that processing represents a significant amount of the product’s overall processing.

A product that includes foreign components may be called “Assembled in USA” without qualification when its principal assembly takes place in the U.S. and the assembly is substantial. For the “assembly” claim to be valid, the product’s last “substantial transformation” also should have occurred in the United States.

Senator Tammy Baldwin (D-WI) has introduced bipartisan legislation to fix outdated labeling laws to inform Americans shopping online about where products are made, and to help U.S. manufacturers selling their goods through online retailers.

“Regardless of whether shopping online or in a store, Americans have a right to know whether the products they buy are being made right here in America, by American workers,” says Baldwin. “With more and more consumers buying their goods online, we must ensure online retailers are being just as transparent as brick-and-mortar stores.”

‘Locking’ In Customers

Pacific Lock Co. (Paclock) is a family-owned firm based in Valencia, CA, that specializes in padlocks. It produces multiple types of locks that are used to secure everything from garden sheds to gates and job boxes to trailer doors. Paclock’s customers include homeowners, locksmiths and the U.S. military, plus leading manufacturers such as Boeing and Mercedes-Benz.

Products are available in a variety of shapes and sizes for numerous light-and heavy-duty applications. The company also produces padlocks out of several materials, such as aluminum, brass and stainless steel. Options include traditional solid and laminated body padlocks, plus hidden shackle and hockey puck-style locks. Other variations include cylinder type, shackle diameter and shackle height.

While most of Paclock’s products are marketed through distributors, it has also sold padlocks in traditional retail settings, such as Home Depot, and online retailers such as Amazon. The company sells direct to large commercial customers like Disney and the U.S. Army.

“Our manufacturing capabilities allow us to manage and successfully produce large volumes,” says Greg Waugh, president and CEO of Paclock. “As the exclusive supplier of padlocks to Public Storage, for instance, we have delivered millions of the world’s best disc padlock without a single return for defects, while maintaining a near 100 percent on-time delivery rate.

This retail display encourages consumers to purchase padlocks that are manufactured domestically. Photo courtesy Pacific Lock Co.

“We engineer, machine, assemble and test a majority of our product line in the United States, which is our key differentiating factor,” explains Waugh. “Because we manufacture in the U.S., we can control quality, production capacity and quickly develop new, innovative products in a matter of weeks, not months or years."

According to Waugh, that gives his company a unique advantage vs. larger firms that dominate the market. “Our biggest competitor makes components in the U.S., but does final assembly in Mexico,” he explains. “When I first joined the company in 2005, all of our components were made overseas. Since then, we’ve steadily onshored production. But, we’ve always done all of our assembly here.

“We have to use a few components that come from overseas, such as shackles and cylinders, because of cost,” laments Waugh. “That’s why our packaging says ‘Made in USA with global components.’

“We are limited by certain price points in the market,” Waugh points out. “But, as we continue to develop more expensive, value-added products, we continue looking for ways to make more components domestically. We recently received a U.S. government contract for a high-security padlock, so we make its cylinder here.

“Innovation and quality are two of the biggest advantages of making products domestically,” claims Waugh. “By producing in the states, we can control our lead times. However, there’s also a lot of pride in U.S. manufacturing. That’s why we include an American flag on all of our packaging.

“Producing the bulk of our products here gives us the ability to make small runs of new items to solve unique customer problems without taking a big risk,” says Waugh. “There are a lot of unique needs that we cater to. For instance, we make custom padlocks for Disney World.

"Our competitors typically require at least a year to introduce a new product,” claims Waugh. “In contrast, we can have a new item ready to go in just a few weeks.”

High quality goes hand in hand with a domestic production strategy. Photo courtesy Pacific Lock Co.

High quality also goes hand in hand with Paclock’s domestic production strategy.

“We control quality,” explains Waugh. “Other lock manufacturers outsource production and pay Chinese or Taiwanese factories to make their products.

“In addition, our proprietary machining practices give us unprecedented manufacturing flexibility that leads to short runs, fast turnaround times, almost zero waste and cost savings,” claims Waugh. “We use American-made Haas Automation CNC machines to produce lock bodies, the most important component of a padlock. That enables us to maintain a 0.003-inch tolerance on all of our machining operations.

“To succeed, we have to be a jack of all trades,” says Waugh. “If a customer wants something unique, such as a custom color or a special engraving, we’ll find a way to make it.

“The only bad things about making products in the U.S. is the fact that finding skilled and competent workers is far more challenging today than it was in the past,” adds Waugh. “Regulations enforced by EPA and OSHA also make it challenging for domestic manufacturers to thrive. For instance, it’s becoming harder to find local vendors that specialize in anodizing and plating. With less competition out there, prices go up.”

The ‘Write’ Way to Manufacture

The Pen Company of America (PCA) is another family-owned firm that’s bullish on domestic manufacturing. The Garwood, NJ, company has been in business since 1928. Today, it mass-produces a wide variety of writing instruments, including pens and industrial markers, in a 50,000-square-foot factory that’s highly automated.

“We have never manufactured products outside the United States,” claims Colleen Shea, vice president of sales at PCA, who runs the company along with her father and two brothers.

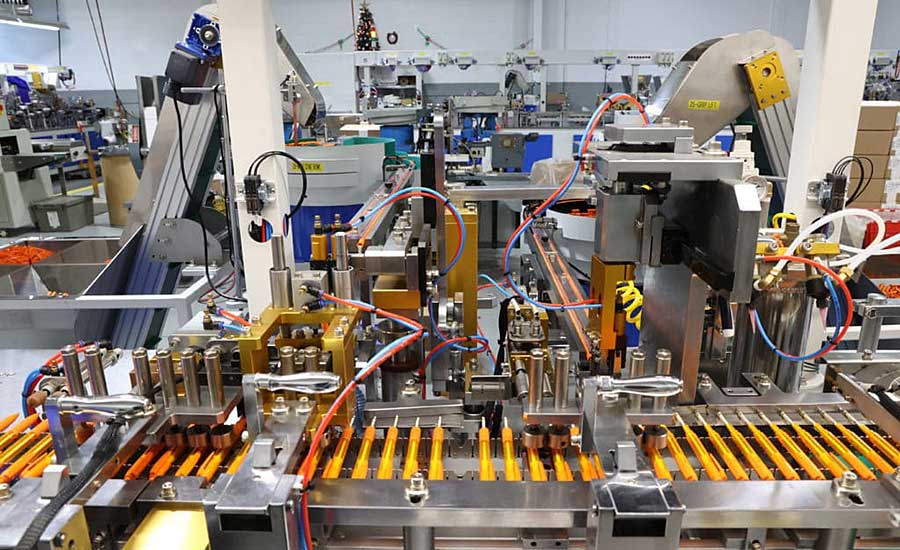

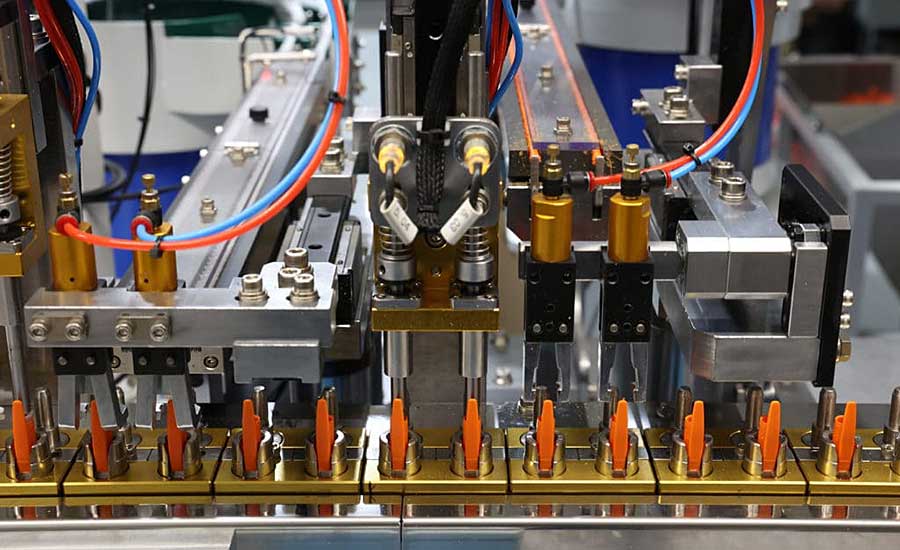

Automation enables U.S. manufacturers to go head to head with offshore competition. Photo courtesy Pen Company of America

“As a fourth-generation writing instrument manufacturer, we have always worked hard to keep all our production domestic,” explains Shea. “Many of our pens are customized for the promotional industry.

“In that arena, we are the only manufacturer whose entire line of metal and plastic pens is domestically made,” explains Shea. “While others moved offshore over the last few decades, we have dedicated our time, energy and resources to find creative ways to keep manufacturing in America.”

The company produces around 30 different styles of pens and markers. In addition, it makes internal metal components for other companies, such as Fisher Space Pen Co., which assembles its specialty products in Boulder City, NV. PCA also molds plastic parts that a medical device firm uses to produce surgical skin markers.

“The majority of our business involves custom-made pens that are used for promotional purposes,” says Shea. “They contain unique customer names, logos, colors and designs. We supply everyone from large banks to small mom-and-pop coffee shops.

“We are vertically integrated,” Shea points out. “We do all of our plastic-injection molding in-house, in addition to making the metal writing cartridges. We also do all printing, laser engraving and decorating ourselves. We even make our own springs, and we produce our own heat-transfer film, which is used for decorating pen barrels.”

PCA operates three assembly lines that mass-produce an average of 30,000 pens a shift or as many as 300,000 units a week.

“All our metal pens have ‘USA’ embossed in them,” says Shea. “All our plastic pens have ‘USA’ molded into them. Our standard, gift and executive boxes all indicate ‘Made in the USA.’ Even the boxes themselves are made domestically.”

A typical plastic pen consists of six main components, including the barrel, writing cartridge, a plunger and ratchet mechanism, a spring, a tip and a clip. Metal pens are more complex and contain up to 14 components.

“All of our production processes are automated, including robots for assembly and pick-and-place applications,” says Shea. “Automation plays an important role in keeping our pricing stable and constant. That’s the only way we can compete with imported products.

The writing instrument industry is very competitive, because pens are a commodity product. Photo courtesy Pen Company of America

“The writing instrument industry is very competitive, because pens are a commodity product,” explains Shea. “We pride ourselves on high quality and fast delivery times.

“A lot of metal pen companies have moved production offshore, including our biggest competitor,” notes Shea. “Unlike those companies, most of our products are delivered within seven to 10 business days.

“Another thing that sets us apart is customer service,” claims Shea. “Many small companies in our industry have been bought up by larger firms that moved customer service offshore. We are more nimble and have a definite advantage in that regard.

“With domestic production, we can react quickly to customers’ needs,” says Shea. “When a customer needs 100,000 custom pens in a few weeks or a specially molded pen, we have the ability to fulfill these orders much quicker than the imported products. The disruption in the supply chain over the past several years has given us a unique competitive advantage.

To succeed, domestic consumer products manufacturers must excel at customer service, delivery and quality. Photo courtesy Pen Company of America

“It’s not difficult for us to compete against offshore manufacturers,” adds Shea. “Even if we’re a little more expensive, we excel at customer service, delivery and quality. However, we have to be creative and stay one step ahead in terms of finding ways to improve our costs.

“Overall, this is a good time to be an American manufacturer, because the COVID pandemic exposed a lot of supply chain gaps and deficiencies,” concludes Shea. “We have seen a resurgence and appreciation for U.S. manufacturing.”

‘Brushing’ Away the Competition

Gordon Brush Manufacturing Co. is another firm that’s proud of its Made in USA business philosophy. The company has a rich heritage as an American manufacturer of brooms and brushes. In fact, two of its 12 brands date back to 1855 and 1897. Gordon has even trademarked the term “Proud to be an American Manufacturer.”

Today, the company mass-produces more than 17,000 standard and specialty items. Gordon’s diverse customer base includes NASA and the U.S. Bureau of Engraving and Printing, plus artists, bakers, chimney sweeps, doctors and janitors. Its products are used to clean everything from accordions to zoos and tanks to telescopes.

Gordon’s extensive product list includes brooms and brushes made out of a wide variety of materials, such as natural fibers, synthetic fibers and wire. Handles are made out of metal, plastic and wood.

“As the demand for American-made products increases, we are proud to be at the forefront of that movement,” says Ken Rakusin, president and CEO of Gordon Brush Manufacturing Co. “We never offshored anything and are proud that we’ve been able to dramatically grow over our 72 years in business.

Finding skilled and competent workers is far more challenging today than it was in the past. Photo courtesy Pacific Lock Co.

“We are dedicated to maintaining American jobs and continuing the tradition of great American manufacturers, while creating the highest quality [products],” Rakusin points out. “Other than a small amount of hand assembly that is done by our team of people in Mexico, we never explored moving production overseas. We value our American employees and never have had a situation where we would have needed to terminate them because we tried to save a buck.”

Most of Gordon’s products are manufactured in a state-of-the-art 183,000-square-foot factory in City of Industry, CA, that is ISO 9001:2015 certified. The company also operates a 66,000-square-foot factory in Hattiesburg, MS, that mass-produces brushes for automotive and marine applications. In addition, Gordon recently acquired Justman Brush Co. and its 45,000-square-foot facility in Omaha, NE.

“The last several years have been a challenge, especially sourcing raw materials and labor,” says Rakusin. “For a while during the pandemic, our lead times [doubled], but things are much better now.

“We’ve invested and are investing millions of dollars in new equipment to make us more efficient and productive,” explains Rakusin. “It seems like the more we invest, the more our business grows and the more people we need.

“We continue to invest a significant amount in new machinery and we have a couple of machines that use robotics,” adds Rakusin. “Our diverse product offering makes it challenging in most areas to have automated production lines, so we tend to invest in better, faster equipment.

“Our products are [primarily] not sold in a retail environment, so packaging isn’t critical,” notes Rakusin. “However, labels state that our products are ‘Made in the USA with global materials,’ as many of our raw materials are not available in the states.”