Home » Keywords: » reshoring

Items Tagged with 'reshoring'

ARTICLES

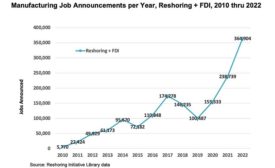

Reshoring

U.S. imports from 14 low-cost countries in Asia declined by $143 billion last year.

Read More

Consumer Products Manufacturing: Made in the USA

Domestic production is thriving in sectors eager to avoid supply chain disruptions.

July 7, 2023

EVENTS

Webinar Webinar

7/25/23 to 7/25/24

Contact: Meg M.

How to Rebuild Manufacturing, Restore High Wages, High Profits & National Prosperity

Get our new eMagazine delivered to your inbox every month.

Stay in the know on the latest assembly trends.

SUBSCRIBE TODAY!Copyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing