In 1961, the first industrial robot was installed at a GM factory in Ewing Township, NJ, to lift hot pieces of metal from a die-casting machine. Soon, Chrysler, Ford, Fiat and other manufacturers would also be employing robots at their factories for machine tending, spot welding and other applications.

The automotive industry never looked back. Today, in fact, the industry has the largest number of robots working in factories around the world: Operational stock hit a new record of 1 million units in 2021, according to the latest figures from the International Federation of Robotics (IFR). This represents about a third of the total number of robots installed across all industries.

“The automotive industry effectively invented automated manufacturing,” says Marina Bill, IFR president and group vice president and head of marketing and sales for robotics and discrete automation at ABB. “Today, robots are playing a vital role in enabling this industry’s transition from combustion engines to electric power. Robotic automation helps car manufacturers manage the wholesale changes to long-established manufacturing methods and technologies.”

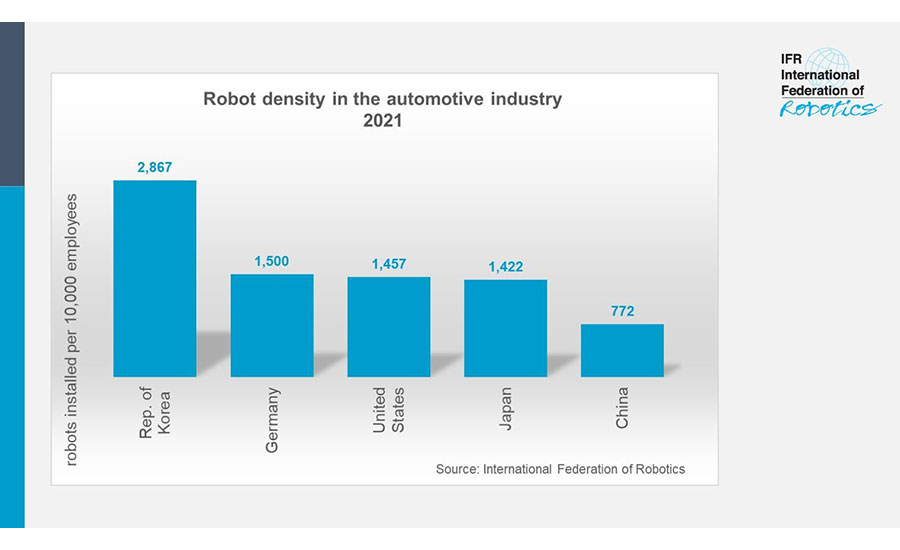

Robot density is a key indicator of the current level of automation in the top car-producing economies: Among South Korea automakers, 2,867 industrial robots per 10,000 employees were in operation in 2021. The German auto industry ranks second with 1,500 units per 10,000 workers, followed by the United States with 1,457 units and Japan with 1,422 units.

Robots are employed in every aspect of the automotive manufacturing process. Photo courtesy KUKA Robots

The world's biggest car manufacturer, China, has a robot density of 772 units, but is catching up fast: Within a year, new robot installations in the Chinese automotive industry almost doubled to 61,598 units in 2021, accounting for 52 percent of the total 119,405 units installed in factories around the world.

Ambitious political targets for electric vehicles are forcing the automotive industry to invest: The European Union has announced plans to end the sale of gas-powered vehicles by 2035. The U.S. government aims to reach a voluntary goal of 50 percent market share for electric vehicle sales by 2030 and all new vehicles sold in China must be powered by “new energy” by 2035. Half of them must be electric, fuel cell, or plug-in hybrid, with the remaining 50 percent, hybrid vehicles.

Most automotive manufacturers that have already invested in traditional “caged” robots for basic assembly processes are now also investing in collaborative robots for final assembly and finishing tasks. Tier-two automotive parts suppliers, many of which are small and midsized enterprises, are slower to automate fully. Yet, as robots become smaller, more adaptable, easier to program, and less capital-intensive, this is expected to change.

It's hard to imagine a modern automotive assembly plant without robots. Even in the '60s, robots were not seen as a replacement for human workers, but as a liberating technology—a machine that could spare people from dirty, dull and dangerous tasks. Moving forward, robot density will only increase.