In September, Accelera, a zero-emissions business unit of Cummins, Daimler Trucks, and PACCAR announced that they had formed a joint venture to manufacture lithium-iron-phosphate (LFP) batteries in the United States.

Daimler, Accelera and PACCAR will each own 30 percent of the joint venture, which will initially focus on LFP technology for battery-electric commercial trucks. The joint venture will invest as much as $3 billion to build the new factory, which is expected to create enough batteries to power 80,000 medium-duty trucks a year or 40,000 electric buses.

A location for the new factory has not been announced, but Cummins is reportedly looking at sites in Indiana, where it already operates multiple assembly plants.

“This planned joint venture will enable economies of scale beyond Daimler Truck,” says Martin Daum, CEO of Daimler Truck.

The Cummins project is just the latest in a wave of new manufacturing construction projects in the United States. Indeed, the country has experienced a striking surge in construction spending for manufacturing facilities during the past two years.

According to a new report from the Treasury Department, real manufacturing construction spending has doubled since the end of 2021. The surge comes in a supportive policy environment for manufacturing construction: the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and CHIPS Act each provided direct funding and tax incentives for public and private manufacturing construction.

The boom is principally driven by construction for computer, electronic and electrical manufacturing—a relatively small share of manufacturing construction over the past few decades, but now a dominant component. Since the beginning of 2022, real spending on construction for that specific type of manufacturing has nearly quadrupled.

Importantly, the boom in this segment has not been offset by reduced spending on other manufacturing construction segments, which are largely consistent with long-term levels. In fact, construction for chemical, transportation, and food and beverage manufacturing is also up from 2022, albeit less than the computer and electronics sector.

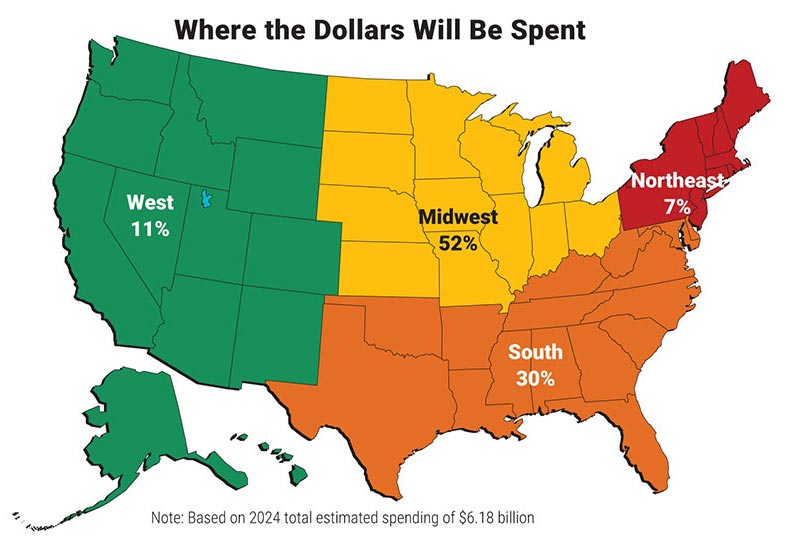

The Midwest will account for more spending in 2024 than any other region. The Midwest has held that distinction for all but two years in our survey. (Click the map to enlarge.)

This rise in the spending began in the months before the CHIPS Act passed, as many factors beyond policy contribute to construction spending. Still, the legislation has played a critical part in continuing and expanding this trend. In particular, private sector analysts have recognized the connection between the growth in construction for electronics manufacturing and the CHIPS Act. For example, Bank of America notes this rise came “potentially on the back of ongoing construction of semiconductor factories as part of the CHIPS Act.” According to Deutsche Bank Research, 18 new chip-making facilities will have started construction between 2021 and 2023. The Semiconductor Industry Association reports that more than 50 new semiconductor ecosystem projects have been announced in the wake of the CHIPS Act.

Companies have announced nearly 200 new projects totaling more than $110 billion of investment in America’s clean-energy economy. Those projects include the following:

- Maxeon Solar Technologies Ltd. plans to spend $1.2 billion to build the biggest U.S. factory for polysilicon solar panels. Construction on the plant in Albuquerque is set to start in the first quarter of 2024, with production expected to begin in 2025. The facility will be able to produce as much as 3 gigawatts of solar panels annually, doubling Maxeon’s manufacturing capacity.

- First Solar Inc. is investing up to $1.1 billion to construct a new solar panel assembly plant in Iberia Parish, LA. It will be the company’s fifth U.S. factory.

- Hanon Systems, a South Korean manufacturer of thermal and energy management technology for electric vehicles, plans to invest $170 million to build a new assembly plant in Loudon County, TN. The company’s fourth U.S. factory is expected to create 600 jobs.

- Canadian company Heliene will spend $145 million to build a new factory in the Minneapolis-St. Paul area to make solar panels and solar cells. The factory will have an annual capacity of about 1 gigawatt of modules and 1.5 gigawatts of cells. The company already makes panels in Minnesota and Ontario, Canada.

| Equipment Category | % of plants to buy 2024 | % of total spending 2024 | Estimated total spending 2024 | % change in spending 2023-24 |

|---|---|---|---|---|

| Dispensing | 26 | 3 | 210.4 | 7 |

| Multistation systems | 21 | 15 | 936.9 | -2 |

| Single-station machines | 49 | 17 | 1068.3 | -2 |

| Parts feeders | 26 | 2 | 101.9 | 3 |

| Conveyors & MH | 40 | 3 | 168.8 | 18 |

| Power tools | 38 | 4 | 264.8 | 15 |

| Bar coding & auto ID | 36 | 4 | 242.5 | 1 |

| Motion control | 20 | 3 | 171.8 | 15 |

| Welding, brazing, soldering | 19 | 3 | 170 | -15 |

| Robots | 38 | 13 | 799.4 | 11 |

| PCB assembly | 8 | 1 | 60.1 | -13 |

| Computers & software | 55 | 9 | 574.2 | 7 |

| Test equipment | 35 | 4 | 259.4 | -18 |

| Inspection equipment | 51 | 6 | 395.5 | 24 |

| Wire processing | 8 | 1 | 85 | -4 |

| Workstations | 35 | 2 | 102.2 | 3 |

| Packaging | 39 | 4 | 226.2 | 19 |

| Tooling | 49 | 2 | 120.3 | 9 |

| Additive manufacturing | 30 | 3 | 185.3 | -5 |

| Other | 4 | 1 | 37 | 3 |

| Total | 100 | 6180 | 3 |

IMI Sales Leads provides further evidence of robust investment in North American manufacturing in 2023. The consulting firm tracks industrial capital projects in the U.S. and Canada, including facility expansions, new plant construction, and modernization projects. The firm’s latest data show 161 new projects in October, compared with 150 in September 2023 and 130 in October 2022.

IMI Sales Leads reported 441 new projects in the third quarter of 2023, down slightly from the 450 projects reported in the third quarter of 2022.

Spending on new manufacturing construction isn’t the only thing that’s growing. Manufacturing jobs are also increasing. Just under 13 million people were employed in manufacturing in September 2023—the highest number since November 2008. Manufacturing employment has increased 14 percent since April 2020, the low point of the COVID pandemic.

Will manufacturers continue to put money into people, plants and equipment in 2024? The results of our 28th annual Capital Equipment Spending Survey point to an increase in investments next year.

Fifty-one percent of assemblers will invest in vision systems and other inspection technology next year, the highest percentage in five years. Photo courtesy Zebra Technologies

Spending to Increase

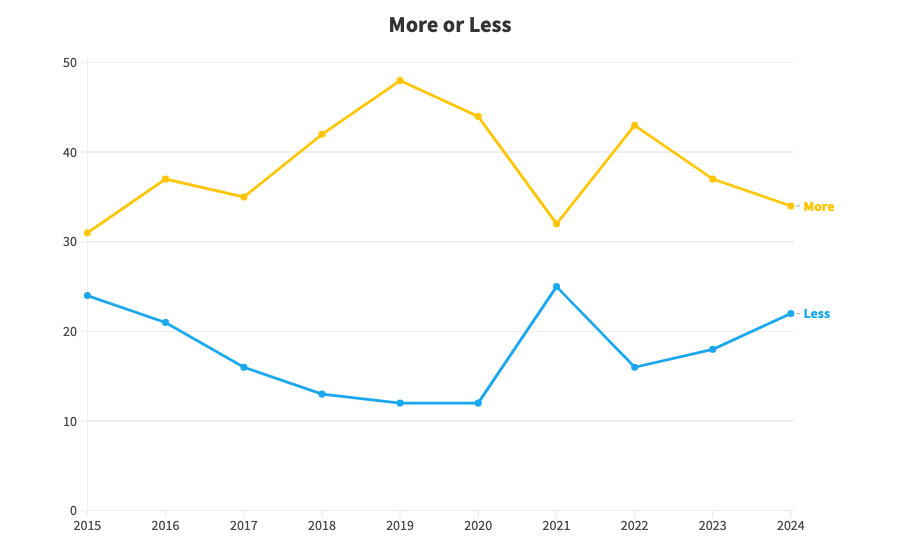

Some 34 percent of respondents will spend more on assembly technology next year than they did this year. That compares with 37 percent in last year’s survey, and it’s the 10th straight year in which that figure has topped 30 percent. In fact, in the 28-year history of the survey, the “spend more” ratio has been 30 percent or less just seven times.

Conversely, 22 percent of respondents will spend less in 2024 than they did 2023. That figure has topped 20 percent just four times in the past 10 years, and one of those was the COVID year of 2021.

Forty-four percent will spend the same in 2024 as they did in 2023.

Of those plants that will spend more, the average budget increase is 22 percent. Of those that plan to spend less, the average budget decrease is 25 percent.

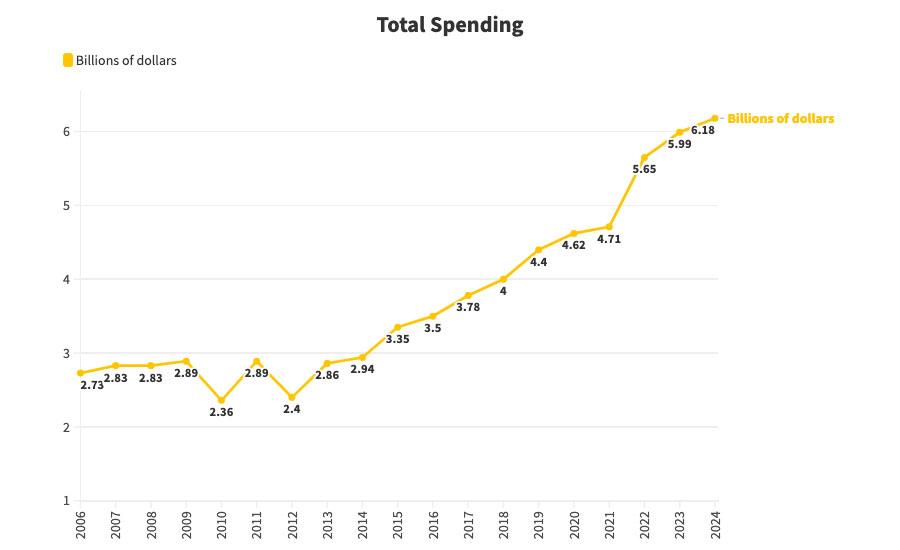

That’s not to say, however, that overall spending will increase that much. Our data indicate that U.S. assembly plants will spend $6.18 billion on new equipment in 2024, an increase of 3 percent from the $5.98 billion projected to be spent in 2023.

On average, manufacturers will spend $1,970,582 on assembly technology in 2024. That compares with $1,905,175 in 2023, and it’s the highest average in survey history. The median budget total is $200,000, which is significantly more than the $125,000 figure in 2023. In fact, it’s the second largest median budget in survey history.

Aggregate budget data indicate growth in spending. For example, 38 percent of plants have 2024 capital budgets of at least $500,000. That percentage has now exceeded 30 percent for six straight years. At the same time, 27 percent will spend between $100,000 and $499,999, the same ratio as in 2023. Only 35 percent will spend less than $100,000 on assembly technology in 2024. That percentage has been under 40 percent in five of the past six years.

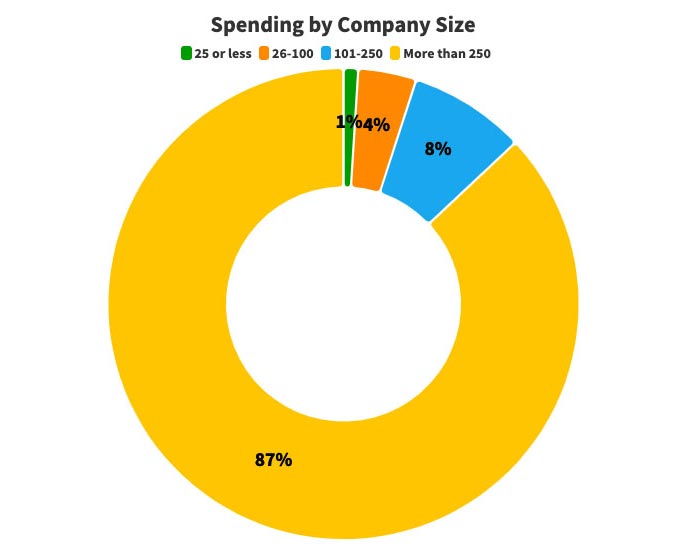

Companies with more than 250 employees will account for 87 percent of total spending on assembly technology in 2024. It’s the third time in the past 10 years in which that ratio has exceeded 85 percent.

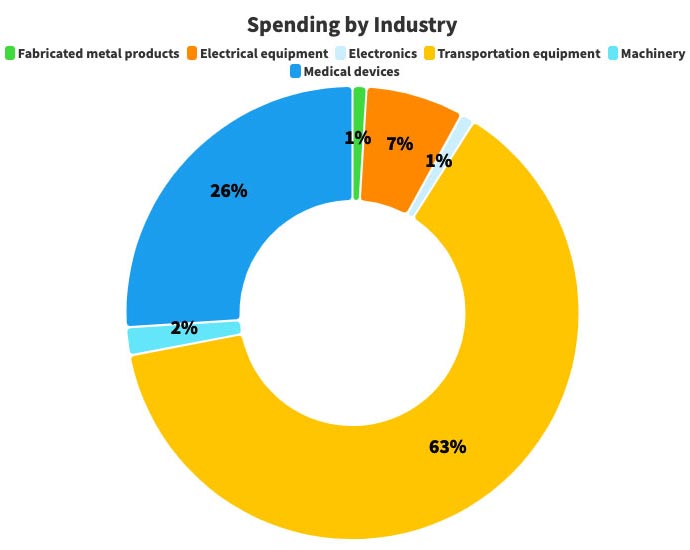

The automotive industry will account for 64 percent of all spending next year. That’s the highest share for this industry in survey history.

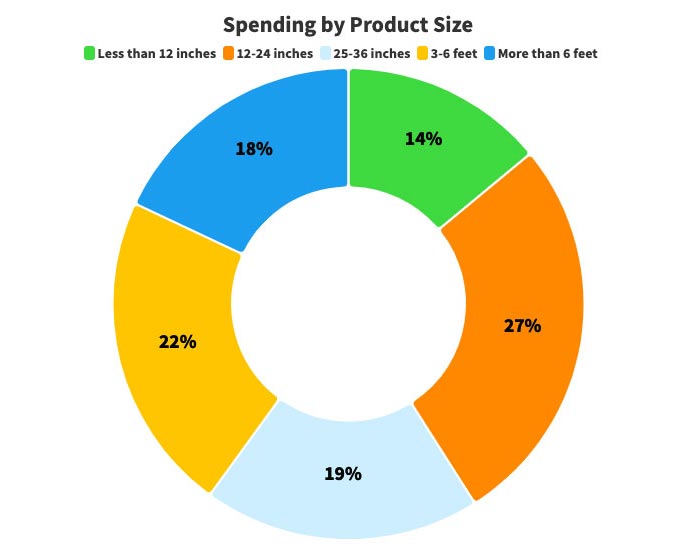

Assemblers of products larger than a 6-foot cube will account for 18 percent of total spending next year, the lowest percentage since 2020.

Click on any of the graphs to enlarge

Automotive Continues to Lead

On Nov. 15, EV start-up Rivian gained approval to start construction on a new assembly plant near Atlanta. Rivian was granted final approval for the project by the Georgia Department of Economic Development and the Joint Development Authority of Jasper, Morgan, Newton and Walton counties. The approval gives Rivian long-term rights to construct a factory in the Stanton Springs industrial area east of Atlanta, after the plans were first set in motion in 2021.

The factory will be Rivian’s second assembly plant, joining its first in Normal, IL, which produces the R1T pickup and the R1S SUV. The facility is expected to bring as many as 7,500 jobs to the area, and Rivian will spend $5 billion to build and equip the facility. Rivian is targeting 2026 for initial production, and the company eventually expects to reach an annual volume production of around 400,000 vehicles.

With news like that, it’s hardly surprising that the automotive industry is leading the way in capital investment. In fact, the industry will account for 63 percent of all spending next year. That’s more than any other industry, and it’s the highest share for this industry in survey history.

On average, automotive assemblers will spend $7,786,111 on capital equipment next year—almost four times the national average. Some 44 percent of automotive assemblers will spend more in 2024 than they did in 2023.

Compared with other industries, automotive manufacturers are less concerned about increasing capacity (22 percent vs. 48 percent for all U.S. plants) and replacing old or worn-out equipment (33 percent vs. 49 percent for all U.S. plants). But, they are more concerned about assembling new products (56 percent vs. 33 percent for all U.S. plants), which makes sense given the industry’s transition to EVs.

Warranty costs continue to be an issue for the auto industry. Some 22 percent of automakers are targeting warranty and service costs for investment in 2024—more than double the 10 percent figure for the nation as a whole.

That’s not surprising. Automakers issued 1,050 recalls in 2022, the third time in the past five years in which the number of recalls for the year has exceeded 1,000, according to the National Highway and Transportation Safety Administration. 2023 could be just as bad. Through the first six months of this year, there have already been 515 recalls involving 16.7 million vehicles.

U.S. assembly plants will spend $6.18 billion on new equipment in 2024, an increase of 3 percent from 2023 spending.

Middling Machinery Industry

After accounting for more than 30 percent of total equipment spending in each of the past two years, machinery manufacturers (NAIC 333) will represent just 2 percent of spending in 2024. That’s the lowest percentage for this industry in survey history.

Only 29 percent of plants in this industry will spend more in 2024 than they did in 2023, while another 29 percent will spend less.

On average, machinery makers will spend $306,523 on new equipment next year. That’s the lowest average budget for this industry since 2016. In 2023, 28 percent of plants in this industry spent at least $1 million on assembly technology. In 2024, just 13 percent will do so, the smallest percentage since 2018.

On average, machinery manufacturers will spend $306,523 on capital equipment in 2024—the lowest average for the industry in at least 10 years. Photo courtesy Caterpillar Inc.

One reason for the lack of investment may be that this industry is already at capacity. Some 39 percent of machinery makers are looking to increase capacity next year, compared with 48 percent for the nation as a whole.

Still, there are some bright spots. In August, for example, Deere & Co. announced that it will build a 115,000-square-foot assembly plant in Kernersville, NC, to increase production of its Kreisel Electric brand of batteries and charging equipment for electric tractors and off-road vehicles. Construction is scheduled to begin this fall, and production is estimated to begin in 2025.

Deere is also investing in additional production equipment at its battery manufacturing facility in Saran, France, the primary manufacturing location for Deere engines in Europe.

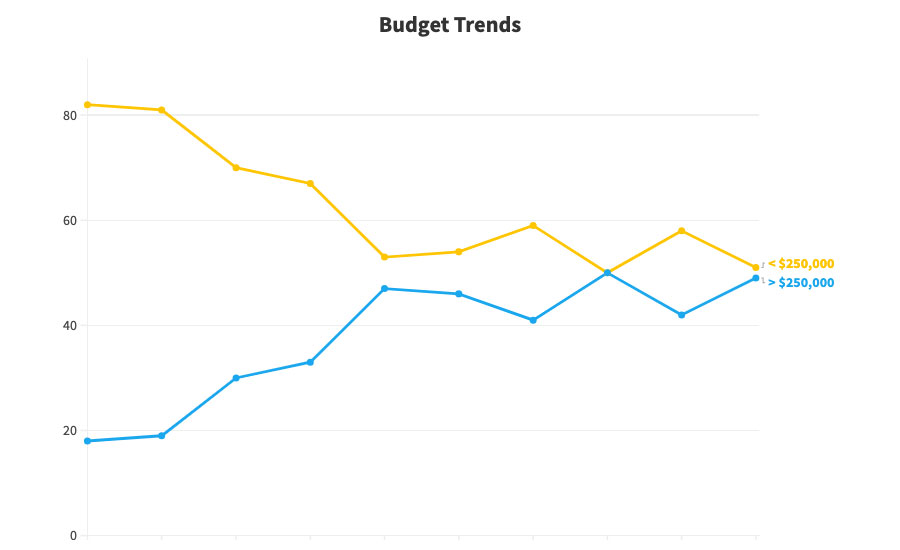

Some 49 percent of plants will spend at least $250,000 on assembly technology next year. It’s the sixth straight year in which that ratio has been 40 percent or more.

Largest Companies Drive Investment

Looking at budgets by company size, our data indicate that our largest manufacturers will once again dominate capital spending.

Some 39 percent of companies with more than 250 employees will spend more next year than they did this year, while just 16 percent will spend less. Conversely, only 29 percent of companies with up to 100 employees will spend more in 2024 than they did in 2023, while 28 percent will spend less.

Looking at actual budget figures, companies with more than 250 employees will spend, on average, $5,093,385 on assembly technology next year—a record high and $1 million more than the 2023 average. Conversely, the average budget for companies with fewer than 25 employees is $122,154, up from $71,692 in 2023.

As a group, companies with more than 250 employees will account for 87 percent of total spending on assembly technology in 2024, marking the third time in the past 10 years in which that ratio has exceeded 85 percent.

At the opposite end of the spectrum, companies with up to 100 employees will represent just 5 percent of spending in 2024. It’s the fourth straight year in which that ratio has been below 10 percent.

Some 34 percent of respondents will spend more on assembly technology next year than they did this year. It’s the 10th straight year in which that figure has topped 30 percent.

Spending by Region

The Midwest has traditionally been the epicenter of U.S. manufacturing, and next year will be no exception. The region will account for 52 percent of spending in 2024, more than any other part of the country and the most for the region since 2018. The Midwest has held the lion’s share of spending for all but two years in our survey. On average, Midwestern manufacturers will spend $3,105,449 on assembly technology next year. That’s up from $2,013,337 in 2023, and it’s the highest average in at least a decade.

There is ample evidence to support predictions of higher spending in the Midwest.

In October, for example, Ford Motor Co. agreed to invest $400 million in its Chicago Assembly Plant and another $30 million in its Chicago Stamping Plant as part of the new four-year contract agreement with the United Auto Workers union.

That same month, LG Energy Solution that it will invest $3 billion to expand its assembly plant in Holland, MI, to produce battery cells and modules for Toyota. The expansion is expected to add 1,000 jobs and quintuple output at the factory. Work on the plant is slated to be completed in 2025.

The factory will initially supply battery modules to a Toyota plant in Kentucky that is slated to build a new EV starting in 2025.

While the Midwest continues to dominate manufacturing, there’s little doubt that manufacturing investment is increasingly shifting to the South. The region will account for 30 percent of total spending next year, marking the sixth straight year the region has accounted for at least 30 percent of capital spending in the U.S.

On average, Southern assemblers will spend $2,982,100 on assembly technology next year. In fact, the average capital budget in the South has topped $1 million in four of the past five years.

Much of that spending can be attributed to increased spending in EV production, but it’s not the only source of investment. In May, for example, Siemens Mobility, the largest manufacturer of passenger train cars in the U.S., said it will build a $220 million advanced manufacturing and rail services facility in Lexington, NC. The factory will create more than 500 new jobs.

With the increased production capacity, Siemens Mobility will meet the growing demand for passenger trains in the North America. The Bipartisan Infrastructure Law is enabling American rail and transit operators to make critically needed investments in infrastructure that will position the country to meet the transportation needs for future generations.

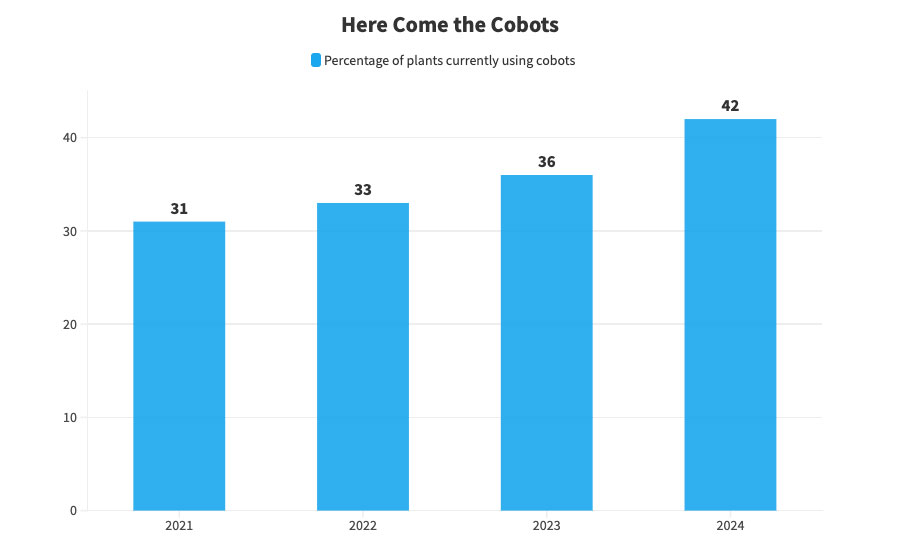

Some 42 percent of assemblers—a record high—are currently using collaborative robots or plan to within the next year. Another 15 percent expect to deploy the technology in the next two to three years.

Robots Remain Popular

Robots continue to be deployed at a record pace. According to the International Federation of Robotics (IFR), an all-time high of 553,052 new robots were installed in factories around the world in 2022, a 5 percent increase over 2022. Most of those installations (73 percent) were in Asia, followed by Europe (15 percent) and the Americas (10 percent).

“The world record of 500,000 units was exceeded for the second year in succession,” says Marina Bill, president of IFR and group vice president for robotics and discrete automation at ABB Inc. “In 2023, the industrial robot market is expected to grow by 7 percent to more than 590,000 units worldwide.”

On average, aerospace manufacturers will spend $647,593 on capital equipment next year—just one-third of the average for all U.S. assembly plants. Photo courtesy Boeing

Our survey indicates that demand for robots will continue unabated next year. We expect sales of six-axis robots, SCARAs, grippers and other robotic technology to increase 11 percent, from $720 million in 2023 to $799.4 million in 2024.

Thirty-eight percent of plants will purchase robots next year, a record high. Demand for robots should be particularly strong in the automotive, aerospace and electronics industries.

A driving force behind the spike in demand for robots is the continued popularity of collaborative robots. Some 42 percent of assemblers—a record high—are currently using the technology or plan to within the next year. Another 15 percent expect to deploy the technology in the next two to three years.

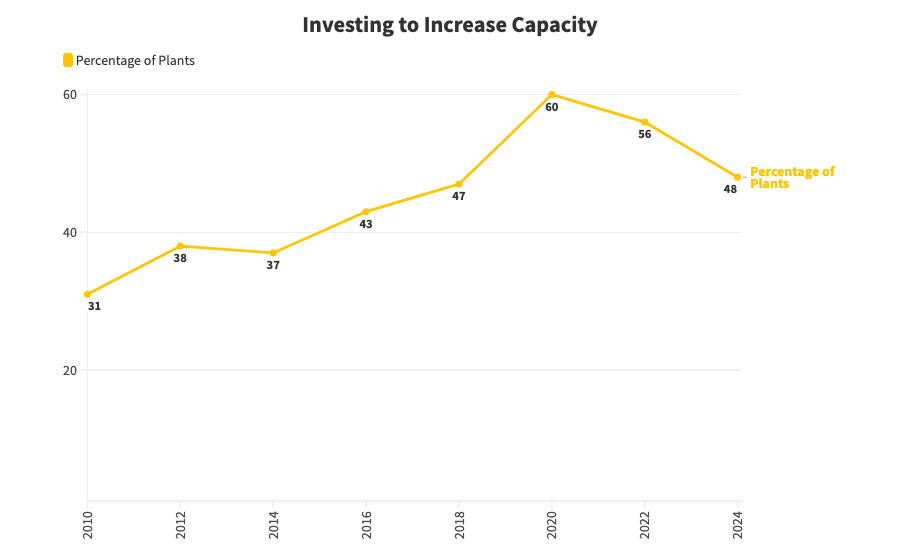

In 2020, 60 percent of assemblers—a record high—were investing in capital equipment to increase capacity. That percentage has been steadily decreasing ever since.

Conveyors Keep Moving

Another technology that should see an uptick in sales next year is conveyors and material handling equipment. Some 40 percent of assembly plants will invest in conveyors next year. That ties a the record high set in 2018.

Demand for conveyors will be particularly strong in the automotive, medical device and electrical equipment industries. All totaled, sales of conveyors will increase 18 percent, from $143 million in 2023 to $168.8 million in 2024.

“2023 has been good year,” says Mark Dinges, product manager for assembly automation at Bosch Rexroth. “We expect pallet-based assembly conveyance to continue to grow in 2024 and 2025, but not at an 18 percent growth rate—maybe 5 percent. That growth will continue to be driven by EV and battery-related applications.”

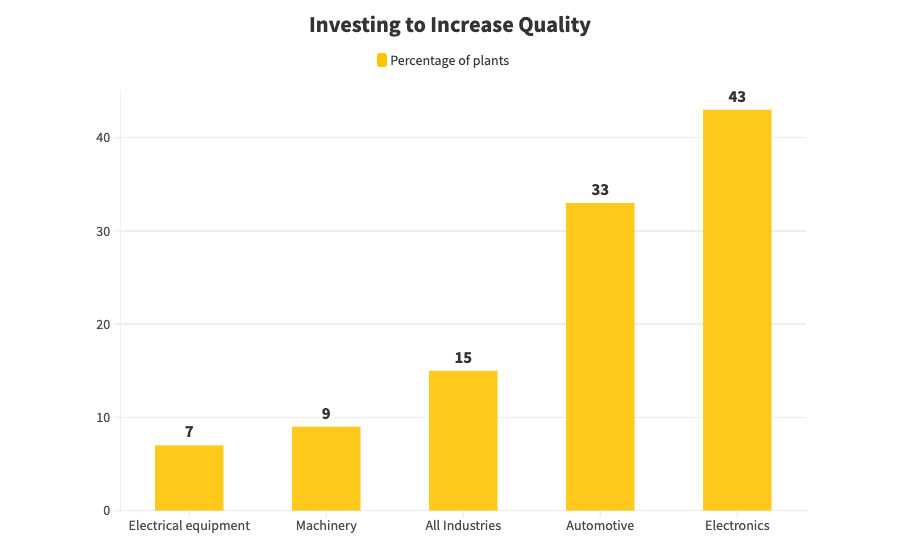

Quality is more of a concern in some industries than others. For example, one-third of automotive assemblers will buy equipment next year to increase quality—twice the national percentage. In contrast, only 7 percent of manufacturers in the electrical equipment industry will do so.

Fastening Tools Tighten Up

Sales of fastening tools should increase next year. Some 38 percent of assemblers will purchase DC electric nutrunners, pneumatic screwdrivers, cordless rivet setters and other tools next year, about the same percentage as in 2023. Demand will be particularly strong in the medical device, electrical equipment, and electronics industries.

All totaled, assemblers will spend $264.8 million on fastening tools next year, up 13 percent from 2023 sales.

“2023 was a record year for Desoutter. We experienced a lot of growth around the EV market,” says Russ Hughes, senior product marketing manager at Desoutter Industrial Tools. “Our brand recognition has been increasing year over year. With the partnership we have with BNP media and the ASSEMBLY Show and ASSEMBLY Show South, we expect continued growth throughout 2024.

“We have been having a lot of success around our data analytics software DeMeter and our process control software Pivotware. Manufacturers are realizing the advantages of the full Desoutter ecosystem.

“With the expected new product launches we have planned for 2024, we are planning on continuing to see double-digit growth in 2024.”

Survey Methodology

ASSEMBLY magazine is sent to 47,234 assembly professionals, 92 percent of whom are in the U.S.

The survey was conducted in conjunction with Clear Seas Research, an affiliate of BNP Media, ASSEMBLY magazine’s parent company. Clear Seas is a full service, B-to-B market research company. Custom research products include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

Questionnaires were e-mailed in mid-August to a random sample of 15,955 subscribers in management positions. Thirty-six percent of respondents were engineers; 43 percent were management; 15 percent were in quality assurance; and 6 percent were classified as purchasing or “other.”

The cutoff date for returning the surveys was Aug. 23. Some 222 surveys were returned for a response rate of 1 percent.

The survey was sent to manufacturers in the following industries: aerospace, electronics, appliances, fabricated metal products, furniture, machinery, medical devices, plastics and rubber products, automotive, energy and miscellaneous manufacturing.

Geographically, 17 percent of respondents were located in the Northeast, 49 percent were in the Midwest, 21 percent were in the South, and 13 percent were in the West.

Sixteen percent of respondents had 25 employees or less. In addition, 23 percent had 26 to 100 employees, 13 percent had 101 to 250 employees, and 48 percent had more than 250 employees.

Twenty-one percent of respondents assemble products that can fit inside a 12-inch cube, 17 percent make products that can fit inside a 24-inch cube, 20 percent make products that fit inside a 36-inch cube, 23 percent make products that fit inside a 6-foot cube, and 19 percent make products that are larger than a 6-foot cube.

To purchase and download the entire capital spending report, please visit https://clearseasresearch.com. You can also email info@clearmarkettrends.com with any questions.