Hitachi Astemo Ltd. is one of the largest suppliers in the auto industry. It’s also one of the newest. However, the company’s roots go back decades.

Hitachi Astemo is owned by Hitachi Ltd. and Honda Motor Co. It was created in 2021 from the merger of Hitachi Automotive Systems with three other Japanese suppliers: Keihin (power train systems), Nissin Kogyo (brake systems) and Showa (suspension systems).

Astemo is an acronym for Advanced Sustainable Technologies for Mobility. The company focuses on electrification, comfort, safety and sustainability.

Like all Tier One suppliers, Hitachi Astemo is in a transition period, balancing between the unique demands of ICE and EV automakers. While producing traditional products, the company is investing heavily in e-axles, inverters and electric motors.

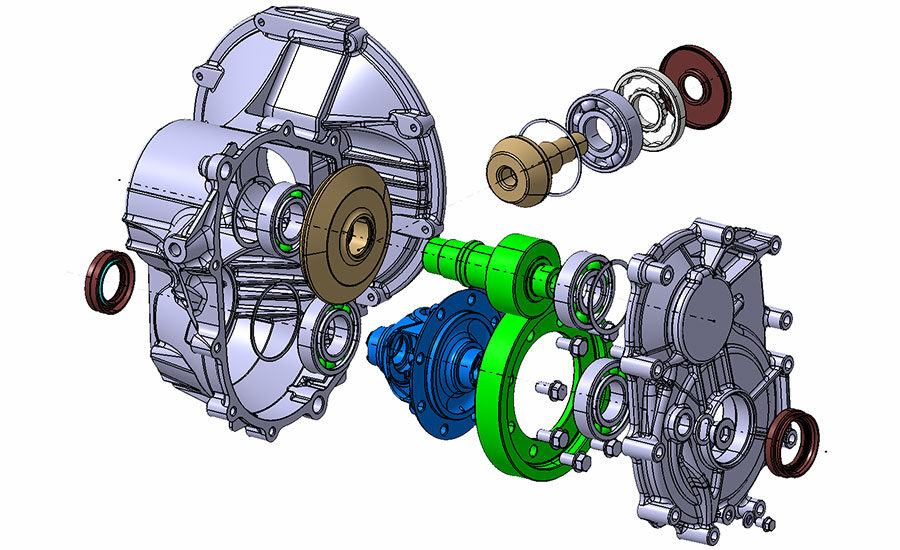

Hitachi Astemo engineers have developed a line of e-axles that feature efficiency, low vibration, low noise and modular design. The technology includes optimization control software for motors and gears.

The engineers have also developed an inverter with industry-leading power density, thanks to its unique cooling module and small, thin, highly heat-dissipating insulation mounting technology. The component consists of power modules with built-in power semiconductors, control boards, capacitors and current sensors.

Electric motors are Hitachi's legacy product, and Hitachi Astemo has established a competitive advantage in torque density through the technologies it cultivated over the years—including material development, analysis, sound-reduction and manufacturing technologies—to develop magnetic circuits comprised of magnets, electromagnetic steel sheets and windings.

At the recent Japan Mobility Show in Tokyo, Hitachi Astemo showcased a variety of advanced driver assistance systems, such as smart brakes and steer-by-wire technology, that contribute to highly automated driving and improved vehicle safety and comfort.

It also unveiled 360-degree sensing technology that uses multiple stereo cameras to measure distances by combining long-range detection with a wide viewing angle. It detects pedestrians and other objects with a high degree of accuracy, in addition to storing identification patterns in advance using artificial intelligence and machine learning.

Hitachi Astemo operates numerous factories throughout Japan. In North America, is has assembly plants in Georgia, Indiana, Kentucky and Ohio, plus Canada and Mexico. Its U.S. operation is headquartered in Farmington Hills, MI.

Last year, Hitachi Astemo’s plant in Berea, KY, was the site of a smart factory experiment conducted in conjunction with Ericsson and Amazon Web Services. Using Hitachi video analytics, real-time video of the component assembly operation was fed across a private Ericsson 5G wireless network to help detect defects earlier, reducing wasted material and lost production.

Autonomous & Electric Mobility recently asked John Nunneley, senior vice president of design engineering and IT at Hitachi Astemo Americas Inc., to talk about how the company is meeting the needs of electric vehicle manufacturers.

AEM: How does Hitachi Astemo combine the strengths and expertise of Hitachi and Honda?

Nunneley: We function independently of either company. But, we do have the ability to work with them on R&D projects. Hitachi is a strong digital technology company, which is very important to the automotive industry as it continues to evolve. Keihin, Nissin Kogyo and Showa were formerly owned by Honda. We’ve taken several component suppliers and positioned the new company to be a systems supplier. Our advanced development efforts are focused on tying the various product categories together with applications software and digital systems for OEMs. It gives us the additional size and capability that they’re looking for. In addition to Honda, we work with every major automaker in the world.

AEM: Can you explain what “Advanced Sustainable Technologies for Mobility” means?

Nunneley: It refers to several things, including the products that we develop for things such as electrification and smart chassis applications. In addition, it applies to our use of advanced development technologies and techniques such as digital twins, hardware-in-the-loop and virtual validation. “Sustainable” refers to our transition from fuel-based products to greener products. All of our production sites have goals to become carbon neutral in the future. Everything ties into providing products that contribute to safe, secure mobility for society.

AEM: How is Hitachi Astemo straddling the gap between the traditional ICE world and new EV world?

Nunneley: That’s tricky, because the electrification targets, projections and speed that OEMs are moving at is changing all the time. We have to be careful with our investments, since ICE products are still very important to automakers. We think gas-powered engines will be around for a long time. We currently have no plan to exit the ICE market, which generates the bulk of our revenue. We plan to support our existing products moving forward, because there will be a long bridge from ICE to hybrid to fully electric vehicles. Electrification is very capital intensive and everyone is struggling to figure out when and how much to invest.

AEM: Why do suppliers such as Hitachi Astemo play a key role in this important transition that’s occurring in the auto industry?

Nunneley: The OEMs are very capable vehicle manufacturers. But, for EV manufacturing, they need a supply base that can design, develop and produce new types of components. Because volumes are still low, they can’t afford to invest in things such as motor production or power inverter manufacturing. They need suppliers to fill that gap and make those products for them, due to the uncertainty of the transition speed.

AEM: How is Hitachi Astemo focusing on electrification? What are some of the products and technologies you’ve recently developed?

Nunneley: We are working on improving the energy density of our inverters, motors and power electronics. For our inverters, we expect an 85 percent power density increase in the next five years. We’re also in the process of combining inverters, motors and power electronics with gearboxes and software to create three-in-one e-axles that simplify the integration of drivetrains into electric vehicles. We’re currently ramping up production of the axle. It will be going through pilot production this year, followed by commercial production next year. We will be building this product in North America at our factory in Tallapoosa, GA.

AEM: Has the recent push to EV products changed how you assemble products or set up your production lines?

Nunneley: It has given us an opportunity to rethink our plants and production processes. Motors and power inverters are much different than many of the other products that we make. They’re larger, more complex and tougher to handle manually than brake and suspension parts. In the early stages, when volumes aren’t so high, we can do single-station batch builds of these products. But, as we ramp up to to higher volumes with EVs, it gives us an opportunity to create new assembly lines with Industry 4.0 tools, such as data collection and analysis, built in. That’s much better than adding them onto a legacy line. It’s easier to have things designed in at the beginning rather than trying to add them as we’re ramping up and running production. We can’t build a brake caliper and a motor on the same line. But, on the electronics side, we can build things such as battery pack control modules for EVs on the same surface-mount assembly lines as we build ICE engine controllers.

AEM: What are some of the products and technologies you are currently in the process of working on that relate to safety, comfort and sustainability?

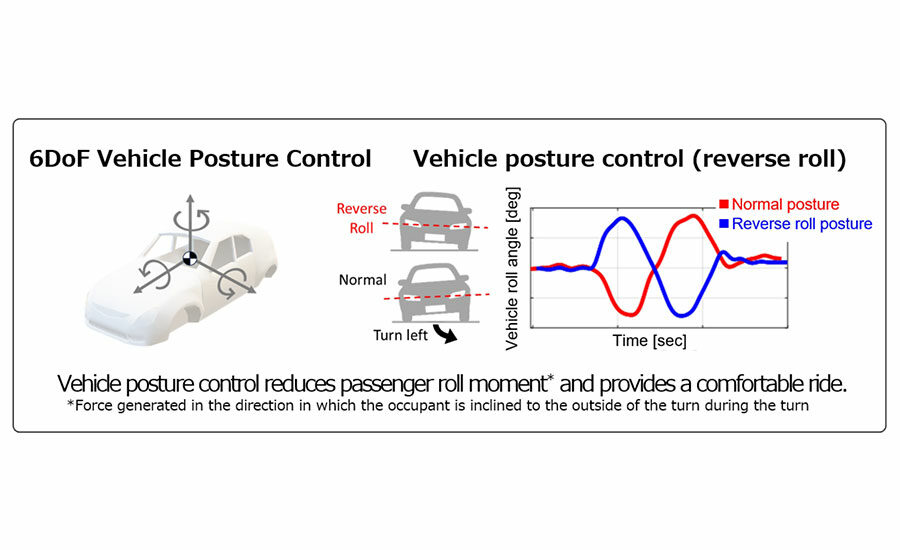

Nunneley: We are electrifying a lot of our components, going from hydraulic brakes to smart brakes and brake-by-wire. We’re also developing steer-by-wire systems and active suspension systems. The smart chassis takes each of these components and ties them together as one dynamic system. Stereo cameras and other sensors gather data from outside the vehicle and feed information to the smart chassis so that it can adapt. For instance, if a camera detects a big pothole, the suspension will quickly adapt to absorb the impact. A similar scenario would play out if the sensors detect ice on the road. On the comfort side, we can control lateral acceleration, which will become increasingly important in autonomous vehicles to maintain stability. However, it will still be another three to five years before the smart chassis is in production.

AEM: Can you provide any details on your next-generation AI-enhanced camera system?

Nunneley: The field of view is increased to 360 degrees, including about 90 degrees of stereo vision. Using artificial intelligence and data analytics technology, we can detect objects as small as a brick from more than 120 meters away. The target production timing for the stereo camera is 2025. It will initially be assembled in Japan, but as volumes ramp up, we’ll also produce it in North America.

AEM: What changes or improvements have you made recently in your Berea, KY, factory to improve productivity and efficiency on your assembly lines?

Nunneley: This facility currently makes suspension products. We’ve been adopting a lot of Industry 4.0 tools, such as data tracking, on equipment to observe and react to line performance, plus identify bottlenecks. The goal is to improve overall equipment effectiveness in the plant. We are also in the process of renovating part of the plant and installing new assembly lines for EV products. We started producing electric motors in 2022 and production will ramp up over the next few years.

AEM: What about your other U.S. manufacturing facilities, such as Greenfield, IN; Harrodsburg, KY; and Sunbury, OH?

Nunneley: Harrodsburg is our largest plant in the United States. It mainly produces components used for electronic control units, electronic throttle bodies, fuel rails and mass air flow sensors. The Sunbury plant assembles suspension products. The Greenfield facility is a former Keihin factory that makes ICE components, but is being converted over to make EV products such as power inverters. We have a lot of the same advanced manufacturing initiatives in place at all of our production sites. For instance, we have a digitalization initiative where we are creating an end-to-end digital thread from sales to engineering to production to aftermarket. We’re also implementing a standard enterprise resource planning system across all of our global sites. Other digital projects are focusing on product management, supplier relationship and customer relationship management tools.

AEM: How are you applying Industry 4.0 tools and smart factory technology in your U.S. facilities?