More than three-fourths of U.S. assembly plants will spend at least as much on capital equipment next year as they did this year.

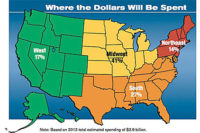

The Northeast will account for just 14 percent of total equipment spending in 2008. That’s the lowest share of any region, and it’s the fifth time in six years that the Northeast has held that distinction.

In a way, the story is indicative of the key findings of ASSEMBLY magazine’s 12th annual capital equipment spending survey. Large Midwestern manufacturers, assembling relatively large products, will be spending big dollars on assembly technology next year.

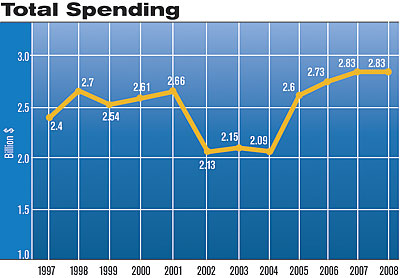

According to our survey, U.S. assembly plants will spend $2.83 billion on new equipment in 2008, which is just what we projected would be spent this year. More than three-fourths of respondents will allocate at least as many dollars to new assembly technology next year as they did this year. Specifically, 31 percent of respondents will spend more on assembly technology in 2008 than they did in 2007. That’s a shade more than last year’s survey, but it’s slightly less than the 12-year average for our survey (35 percent). In addition, a little less than half our respondents (46 percent) plan to spend about the same next year as they did this year.

On the other hand, 23 percent of respondents will spend less in 2008 than they did in 2007. That’s the same percentage as last year’s survey, and it’s slightly more than the 12-year average for our survey (22 percent).

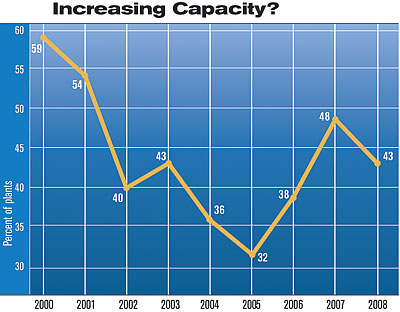

Examining the motives for buying equipment, there are signs that plants are more interested in tweaking existing assembly lines than installing whole new ones. For example, plants have fewer new products to assemble. Only one-third of assemblers will buy equipment next year to assemble a new product. That compares with 39 percent in 2007, and it’s the second-lowest percentage in 12 years. Similarly, in 2007 nearly half of respondents bought equipment to increase capacity. In 2008, only 43 percent will buy equipment to increase output.

On the other hand, 34 percent of plants will purchase equipment next year to reduce cycle time or eliminate a bottleneck. That compares with just 26 percent in 2007, and it’s the highest percentage since 2004.

The No. 1 reason for buying equipment in 2008 is, as always, cost reduction. However, in what may be an indication that manufacturers are getting their costs under control, just 53 percent of respondents will purchase equipment next year to reduce costs-the lowest percentage in the history of the survey.

The No. 1 target for cost reduction in 2008 is, as usual, direct labor. Other targets include:

indirect labor, such as setup, maintenance and material handling, 44 percent.

* scrap and rework, 42 percent.

* materials, 23 percent.

* work-in-process inventory, 22 percent.

* warranty and field service, 13 percent.

Another reason assemblers may be reluctant to increase spending next year is that they have less capital leftover from their 2007 equipment budgets. In August-when most of our surveys were completed-more than half (55 percent) our respondents had spent at least 70 percent of their 2007 equipment budgets. That’s still well below historic levels, but it’s the biggest percentage in four years. In comparison, just 43 percent of plants had spent at least 70 percent of their budgets in 2006.

Actual budget figures point to a slight increase in spending, particularly among plants with very large budgets. Eighteen percent of plants will spend at least $500,000 on assembly technology in 2008. That compares with 13 percent in 2006 and 16 percent in 2007. In contrast, 54 percent of plants will spend less than $100,000 on capital equipment next year. That compares with 59 percent in 2006 and 57 percent in 2007. Twenty-eight percent of plants will spend between $100,000 and $500,000, which is virtually the same percentage as in 2007.

The median equipment budget increased 50 percent, from $50,000 in 2007 to $75,000 in 2008. The average budget rose by 60 percent, from $431,103 in 2007 to $690,361 in 2008.

After three straight years of growth, spending on assembly technology will level off next year.

What Assemblers Want

For the first time since 2005, power tools are the most popular item on assemblers’ wish lists for next year. Fifty-seven percent of respondents will buy power tools in 2008, up from 47 percent in 2007. Forty-two percent of plants will purchase pneumatic screwdrivers and nutrunners, 34 percent will buy electric screwdrivers and nutrunners, and 14 percent will get rivet guns. All totaled, spending on power tools will increase 12 percent, from $202.3 million in 2007 to $226.3 million in 2008.Welding, brazing and soldering equipment is the next most popular item, with 54 percent of assemblers planning to purchase such technology in 2008. That’s an increase of 5 percentage points compared with 2007, and it’s the highest percentage since 2004, when a record 60 percent of plants invested in machines to weld metal and plastic parts. In all, spending on resistance welders, ultrasonic welders, brazing systems and other technology will increase 0.5 percent, from $286.6 million in 2007 to $288 million in 2008.

Suppliers of conveyors and material handling equipment can also expect a good year in 2008. Twenty-six percent of respondents will purchase pallet-transfer conveyors, flow racks, automated guided vehicles and other technology next year, up from 22 percent in 2007. In all, assemblers will spend $101.8 million on conveyors and material handling equipment next year, a 16 percent increase compared with 2007.

Another growth technology for 2008 will be single-station assembly machines, particularly assembly presses. Forty-three percent of assemblers will purchase presses, automatic screwdriving systems, impact riveters, and orbital and radial forming machines next year. That’s a significant improvement over 2007, when a record-low 39 percent of assemblers invested in such technology. All totaled, our readers will spend $246.1 million on single-station assembly machines in 2007, a 2 percent increase from 2007.

Increased investment in such technologies as power tools and single-station machines seems to fit with how manufacturers are assembling their products today. Some 87 percent of respondents still perform some assembly tasks manually, while 67 percent use semiautomatic machines. Neither percentage is much different from previous years. On the other hand, just 17 percent of facilities use fixed, or “hard,” automated assembly systems, which are typically cam-driven and relatively inflexible. That’s an all-time low for our survey, and it compares with 37 percent just 10 years ago.

Despite the importance of manual assembly, the coming year could be challenging for suppliers of workstations. Just 44 percent of respondents will buy workstations and ergonomic accessories in 2008. That may seem like a healthy percentage, but in fact, it’s the lowest percentage in 12 years. In 2007, workstations and ergonomic aids were the second most common item on assemblers’ shopping lists. In 2008, they will only be the sixth most common. All totaled, spending on workstations will decrease 9 percent, from $76.8 million in 2007 to $69.7 million in 2008.

Spending on circuit board assembly equipment appears to have reached a zenith in 1999. At that time, 25 percent of plants purchased printers, placement machines, reflow ovens and related equipment, and such machinery accounted for 10 percent of total spending on assembly technology. In 2008, just 15 percent of plants will buy electronics assembly equipment, and the technology will account for just 3.9 percent of total spending. Both are record lows for our survey. All totaled, spending on electronics assembly gear will decrease 13 percent, from $127.3 million in 2007 to $110.3 million in 2008.

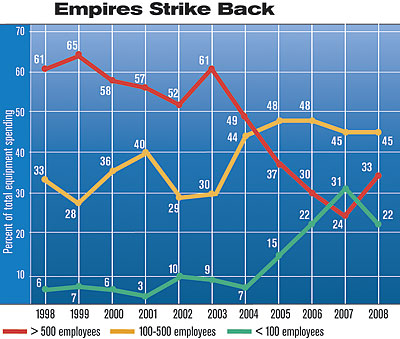

In 2006 and 2007, plants with less than 250 employees accounted for a greater share of total spending than larger facilities. Next year, the tide will shift in favor of the big guys. In 2008, plants with at least 250 employees will represent 61 percent of all spending on assembly technology.

Size Matters

If capital spending increases at all next year, it will be because large assembly plants are opening up their coffers for the first time in two years.From 1998 to 2005, assembly plants with 250 employees or more accounted for at least two-thirds of all capital equipment spending in the United States. Then, beginning in 2006, the tide shifted. Suddenly, plants with less than 250 employees represented a greater share of total spending than larger facilities.

Now, it appears the pendulum is swinging back. In 2008, plants with at least 250 employees will account for 61 percent of total spending on assembly technology, up from 44 percent in 2007. Two-thirds of all plants with equipment budgets of at least $1 million employ more than 250 people. In 2006 and 2007, only half of all plants with million-dollar budgets were that large.

Nearly half of all plants with 250 to 500 employees will spend more on assembly technology next year than they did this year, and the median budget for these plants will double, from $250,000 in 2007 to $500,000 in 2008. All totaled, plants with 250 to 500 employees will dole out $792.1 million on capital equipment next year, an increase of 40 percent compared with 2007.

The median budget for plants with more than 500 employees will also double, from $300,000 this year to $550,000 next. All totaled, plants of this size will spend $933.6 million on assembly technology next year, up 27 percent from 2007.

In contrast, smaller facilities are cutting capital spending. The median budget for plants with 26 to 50 employees will decrease from $50,000 in 2007 to $40,000 in 2008, while the median budget for plants with 51 to 100 employees will go from $100,000 in 2007 to $92,500 in 2008. For plants with 101 to 249 employees, the median budget will drop from $150,000 in 2007 to $130,000 in 2008. All totaled, plants with less than 250 employees will spend $1.1 billion on assembly technology next year, a 30 percent decrease compared with 2007.

One reason for the increase in spending by large facilities may be that there are simply more of them. The average number of employees among our respondents has increased from 267 people in 2006 to 298 people in 2007. That’s the highest average since 2004.

Manufacturers of large products-assemblies bigger than a 6-foot cube-will account for 30 percent of all equipment spending next year. That’s the biggest share for such manufacturers in five years.

All Products Large and Small

Since our survey began, manufacturers of small products have always yielded the lion’s share of capital equipment spending. This year is no exception. Producers of assemblies that can fit inside a 12-inch cube will account for 34 percent of all equipment spending next year, which is again more than any other product size category.However, manufacturers of very large products are closing the gap. Since 2005, producers of assemblies that are bigger than a 6-foot cube have accounted for an ever growing share of total spending. In 2006, these manufacturers represented 23 percent of total spending. In 2007, they contributed 27 percent. Next year, manufacturers of very large products will account for 30 percent of capital spending, the highest share ever for this category.

On average, large-product manufacturers will devote $733,090 to assembly technology in 2008. That’s a 48 percent increase from the 2007 average of $496,216, and it’s the second straight year that the per-plant average has increased. All totaled, these manufacturers will spend $848.7 million on capital equipment next year, an 11 percent increase from 2007.

In contrast, manufacturers of assemblies that can fit inside a 12-inch cube will spend an average of $354,693 on equipment next year. That’s 57 percent less than these manufacturers spent in 2007, and it’s half the average for all U.S. plants. As a whole, small-product manufacturers will spend $961.9 million on assembly technology in 2008, which is 10 percent less than they spent this year.

For the second straight year, the percentage of plants with equipment budgets over $1 million has increased.

Transportation Equipment

In October, General Motors Corp. (Detroit) announced that it will invest $73 million to revamp its assembly plant in Shreveport, LA, to produce the new Hummer pickup truck. With investment like that, it’s no wonder that capital spending among transportation equipment manufacturers (NAIC 336) is expected to increase 32 percent next year, from $537.3 million in 2007 to $707.2 million in 2008.In fact, for the first time since 2005, manufacturers of cars, planes, jet engines, motorcycles, trains, missiles, helicopters, boats, tanks and trucks will spend more on assembly technology than any other industry. NAIC 336 will account for 25 percent of total spending, up six percentage points from 2007.

The 2008 median budget for plants in NAIC 336 is $135,000, which is double the 2007 median of $65,000. The average budget figure is a whopping $2,221,561. That’s more than five times the 2007 average of $429,772, and it’s the second highest average for any industry in the history of the survey. (The record average, set in 2002 by NAIC 336, was $3.8 million.)

The average is so high because so many plants in NAIC 336 will be spending big next year. Indeed, 29 percent of all plants with million-dollar budgets are in NAIC 336. That’s more than any other industry, and it’s the second year in a row that transportation equipment manufacturers have held that distinction.

Like GM’s Shreveport plant, many facilities in NAIC 336 are making new products next year. Forty-one percent of plants in this industry will buy equipment to assemble new products in 2008. That compares with 33 percent for all U.S. plants, and it’s the second straight year that the industry percentage has exceeded the national one.

Cycle time reduction is another key issue in this industry. Some 47 percent of manufacturers in NAIC 336 will buy equipment next year to reduce cycle time. That compares with 34 percent for all U.S. plants, and it marks the fifth straight year that this industry has outpaced the nation in that regard.

Thanks to an influx of investment from Asian carmakers, the South will account for 28 percent of total equipment spending in 2008. That’s just one percentage point less than the highest ever percentage for the region, which was set in 1998.

Machinery Manufacturing

In July, Harvest International opened a new assembly plant in Cherokee, IA, to make auger-based machinery for moving grain. Thanks to the boom in ethanol production, the company is experiencing strong demand for its products. Harvest has added 12 jobs this year and expects to add another 26 jobs over the next three years.Harvest won’t be the only machinery manufacturer to invest in assembly technology next year. Only 16 percent of plants in NAIC 333 will spend less on assembly technology in 2008 than they did in 2007. That compares with 23 percent for all U.S. plants, and it’s the lowest such percentage of any industry. One-third of manufacturers in NAIC 333 will spend more on assembly technology next year, which is slightly higher than the national percentage.

All totaled, assemblers of hay balers, bulldozers, band saws, vending machines, gun sights, tripods, air conditioners, ball joints and boring machines will spend $622.4 million on new equipment next year. That’s 47 percent more than what the industry spent in 2007, and it represents 22 percent of all equipment spending in 2008.

Plants that did not spend much in 2007 appear ready to open their wallets in 2008. In 2007, 83 percent of assemblers in NAIC 333 spent less than $250,000 on new equipment. That compares with 79 percent in 2008. At the same time, 16 percent of plants will spend between $250,000 and $1 million next year. In 2007, that figure was 12 percent. Five percent of plants in NAIC 333 will spend more than $1 million on capital equipment in 2008, which is the same percentage as in 2007.

That boost from the low-budget group was enough to increase the median budget for NAIC 333 from $25,000 in 2007 to $50,000 in 2008, and the average budget from $172,460 in 2007 to $212,293 in 2008.

The No. 1 reason for capital investment in NAIC 333 is not to reduce costs, as it is with the rest of the nation, but rather to replace old or worn-out equipment. In fact, 53 percent of plants in this industry want to replace aging equipment. That compares with 47 percent for all U.S. plants, and it’s the fourth straight year that this figure has been higher than the national one.

Fifty-four percent of all plants with equipment budgets of $1 million or more are located in the Midwest. That’s the highest percentage for this region in the history of our survey.

Computers and Electronics

In October, Spansion Inc. (Austin, TX) revealed that it would spend $330 million to expand its memory chip manufacturing facility. The cost of the project will be spread over the next eight years and is expected to include funding from both state and local governments.Perhaps some of that cost is also reflected in the $594.1 million that manufacturers of computers and electronic products (NAIC 334) will spend next year on capital equipment. That total represents an increase of 31 percent from 2007 outlays, and it’s the second straight year with a double-digit increase in spending.

All totaled, assemblers of clocks, disk drives, video cameras, telephones, radar equipment, thermostats, microchips and other electronic products will account for 21 percent of all capital spending next year. That compares with 16 percent for 2007, and it’s the biggest share for this industry since we began using the NAIC system for this survey four years ago.

Looking at actual budget figures, companies that spent between $250,000 and $1 million in 2007 will be spending over $1 million next year. Some 11 percent of plants will spend more than $1 million on assembly technology in 2008, compared with 3 percent in 2007. At the same time, 12 percent will spend $250,000 to $1 million next year, compared with 19 percent in 2007. Although the average budget for 2008 is actually less than in 2007 ($343,514 vs. $593,414), the median budget is nearly twice what it was in 2007 ($95,000 vs. $50,000). Eighteen percent of all plants with budgets of $1 million or more are in NAIC 334, the highest ever percentage for this industry.

Compared with other industries, assemblers in NAIC 334 are less interested in boosting capacity than assembling new products. Just 35 percent of plants in NAIC 334 are buying equipment to increase capacity. That’s the lowest of any industry, and it’s the second straight year the industry has had such a low percentage. On the other hand, 46 percent are buying equipment to assemble a new product. That’s the biggest percentage of any industry, and it’s the fourth straight year in which NAIC 334 has led the nation in spending to assemble new products.

Some 31 percent of assemblers will spend more on equipment next year than they did this year. It’s the fourth straight year that the ratio of those spending more to those spending less has exceeded 1.3.

Fabricated Metal Products

Earlier this year, Franke USA (Hatfield, PA) added a production line for stainless steel beer kegs to its kitchen sink manufacturing plant in Ruston, LA. The line added some 75 new jobs to a facility that already employed approximately 200 people.Unfortunately, it appears that other manufacturers in the fabricated metal products industry (NAIC 332) won’t be following Franke’s lead next year. Only 28 percent of plants in NAIC 332 will spend more on assembly technology next year than they did this year, while almost as many-27 percent-expect to spend less.

Capital equipment investment was essentially flat in this industry from 2006 to 2007, but it will decrease sharply next year. All totaled, manufacturers of windows, cans, fasteners, valves, bearings, guns and other products will spend $339.5 million on assembly technology next year, which is 52 percent less than what the industry spent in 2007. That amount will give NAIC 332 a 12 percent share of total spending next year. That’s half what the industry contributed in 2007, and it’s the lowest percentage for NAIC 332 since 2002.

On average, manufacturers in NAIC 332 will spend $994,218 on assembly technology in 2008. That’s more than four times the 2007 average. However, the median budget figure-a more accurate reflection of what most plants will spend-is $50,000, or half the 2007 figure of $100,000.

Assemblers in NAIC 332 are not too concerned about the age of their equipment. Only 41 percent of plants are buying equipment to replace old or worn-out machinery. That compares with 47 percent for all U.S. plants, and it’s the fourth straight year that this percentage has been below the national figure.

On the other hand, the industry is very concerned about controlling costs. Some 62 percent of plants will buy equipment next year to cut costs. That’s the highest percentage of any industry, and it’s the third time in four years that NAIC 332 has held that distinction.

If capital spending increases at all next year, it will be because large assembly plants are opening up their coffers. Plants with more than 500 employees will account for 33 percent of total spending on assembly technology next year, up from 24 percent in 2007.

Electrical Equipment and Appliances

Besides NAIC 332, the only other industry that will decrease capital spending next year is electrical equipment and appliance manufacturing (NAIC 335). Collectively, assemblers of lamps, stoves, mixers, electric motors, batteries and other electrical equipment will spend $339.5 million on capital equipment in 2008, which is 37 percent less than the industry spent in 2007. After accounting 19 percent of total spending assembly technology in 2007, NAIC 335 will represent just 12 percent of spending next year.Compared with the nation as a whole, NAIC 335 has both a greater percentage of plants that will spend more next year (35 percent), as well as a greater percentage of those that will spend less (27 percent).

Actual budget figures show that the penny-pinchers will have a greater impact than the spenders. The median budget is $100,000, which is the same as in 2007. However, the average budget is less than half, going from $1,114,750 in 2007 to $459,233 in 2008. Only 9 percent of all plants with million-dollar budgets are in NAIC 335. That compares with 27 percent in 2007, and it’s the lowest percentage of any industry.

Many in this industry are buying equipment to increase capacity and improve quality. For the second straight year, NAIC 335 has led all other industries in the percentage of plants (54 percent) that are buying equipment to increase capacity. In addition, 19 percent of plants will buy equipment next year to increase quality. That compares with 14 percent for all U.S. plants, and it marks the fourth time in five years that NAIC 335 has held that distinction.

Labor costs continue to plague assemblers in NAIC 335. Ninety-one percent of plants cite direct labor as one of the costs they are most concerned about. That’s the highest percentage of any industry, and it’s the third consecutive year that NAIC 335 has posted so high a percentage.

The results of this year’s survey indicate that assemblers are more interested in tweaking existing assembly lines than installing whole new ones. In 2007, half our respondents invested in equipment to increase capacity. Next year, 43 percent will do so.

Miscellaneous Manufacturing

In July, Respironics Inc. (Murrysville, PA) announced that it will spend $32 million to build a new assembly plant in Upper Burrell, PA. The 165,000-square-foot facility will produce sleep therapy devices and employ 575 workers.The new Respironics plant is one example of the spending spree among companies classified under Miscellaneous Manufacturing (NAIC 339). According to the NAICS, Respironics and other medical and dental device manufacturers are classified under NAIC 339. Although this category also includes assemblers of sporting goods, jewelry, toys, pens, mops, musical instruments and caskets, companies like Respironics represent the lion’s share of capital investment from this industry.

As a group, NAIC 339 will spend $226.3 million on assembly technology in 2008. That’s a 33 percent increase from 2007, and it’s the second straight year of growth in capital investment for this industry. Over the past three years, the industry has gradually increased it’s share of the spending pie. In 2006, NAIC 339 claimed 4 percent of overall spending. Next year, it will have 8 percent.

Thirty percent of plants in NAIC 339 will spend at least $250,000 on capital equipment next year, compared with 25 percent in 2007. The median budget of $100,000 is twice what it was in 2007, while the average budget has quadrupled, from $116,062 in 2007 to $559,348 in 2008. Eleven percent of all plants with million-dollar budgets are in NAIC 339-the highest such percentage for this industry since 2005.

Since our survey began, cost reduction has always been the No. 1 reason for investing in assembly technology. However, it’s not as important as important as it used to be. Only 53 percent of respondents will purchase equipment next year to reduce costs. That’s the lowest percentage in the history of the survey.

Spending Falls in the Northeast

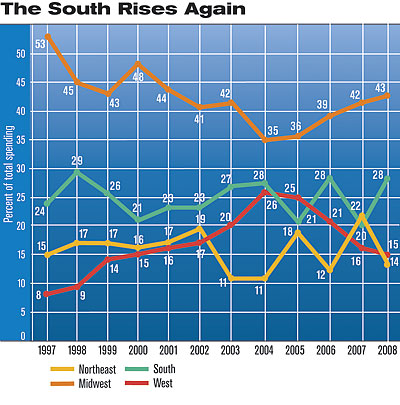

Manufacturers in the Northeast have been on quite a roller-coaster ride in recent years. In 2005, capital equipment spending doubled, only to fall by 30 percent the following year. In 2007, spending again doubled. And next year, seemingly on cue, spending is expected to decrease sharply.All totaled, manufacturers in Massachusetts, Pennsylvania, New York and the six other Northeastern states will spend $396.1 million on assembly technology in 2008, or 36 percent less than what the region spent in 2007. That sum gives the Northeast a 14 percent share of all U.S. spending next year. That’s the lowest percentage of any region for 2008, and it marks the fifth time in six years that the Northeast has held that distinction.

Twenty-nine percent of plants in the Northeast expect to spend less on assembly technology in 2008 than they did in 2007. That compares with 23 percent for all U.S. plants, and it’s the highest percentage of any region.

Actual budget figures show just how much less that spending will be. In 2007, 13 percent of Northeastern plants spent more than $1 million on assembly technology, while another 13 percent spent between $250,000 and $1 million. Next year, just 7 percent and 9 percent, respectively, will spend that much. The median budget figure for Northeastern plants is $50,000, down from $75,000 in 2007. The average budget figure is $332,181, which is less than half of the 2007 average.

Ironically, Northeastern plants are cutting back spending despite an apparent need for added capacity. Half of all plants in the region (49 percent) will buy equipment next year to increase capacity. That compares with 43 percent for the nation as a whole, and it marks the third straight year that the Northeast has outpaced the nation in that ratio.

More than a third of assembly plants will buy equipment next year to reduce cycle time or eliminate a bottleneck. That’s the highest percentage in four years.

Big Gain in the South

Like the Northeast, capital investment has seesawed in the South. Equipment spending fell by 7 percent in 2005, rose by 40 percent in 2006, and fell again, by 26 percent, in 2007. Next year, the yo-yo should be on the rise. Spending is expected to increase 40 percent, from $565.6 million in 2007 to $792.1 million in 2008. Plants in Texas, Alabama, North Carolina, Maryland and the 12 other states that make up this region will account for 28 percent of all spending on assembly technology next year, up from 20 percent in 2007.Only 18 percent of Southern plants will spend less on equipment in 2008 than they did in 2007. That compares with 23 percent for the nation as a whole, and it’s the lowest percentage for any region.

Some 27 percent of plants in the South will spend more than $250,000 on assembly technology in 2008. That compares with 21 percent in 2007 and 22 percent in 2006. The median budget figure for Southern plants is $75,000. That’s a 50 percent increase compared with the 2007 median of $50,000, and it’s the highest median figure for the region since 2004. The average budget figure is nearly double, from $179,089 in 2007 to $353,681 in 2008.

The Midwest Stays Ahead

2008 will mark the fourth consecutive year in which overall equipment spending has increased in the Midwest. Collectively, Wisconsin, Michigan, Ohio and the nine other states that make up this region will spend more than $1.21 billion on assembly technology next year, a 2 percent increase from the $1.18 billion spent by Midwestern manufacturers in 2007.Some 43 percent of all spending on assembly technology will occur in the Midwest, marking the 12th consecutive year that the nation’s heartland has outspent all other regions. The Midwest’s 43 percent share of total spending is the highest percentage for the region since 2001.

The gains in the Midwest will be driven by plants with very large budgets. The percentage of plants spending $250,000 to $1 million will decrease next year, from 22 percent in 2007 to 18 percent in 2008. However, that loss is more than offset by plants spending more than $1 million. A whopping 14 percent of plants in the Midwest will spend at least $1 million on assembly technology in 2008. That compares with just 5 percent in 2007, and it’s the highest percentage for the region since 2002. In fact, some 54 percent of all plants with million-dollar budgets in 2008 will be located in the Midwest. That’s the highest ratio in the history of our survey.

The median budget figure for Midwestern plants is $75,000, which is actually lower than the 2007 median of $85,000. However, the average budget figure is more than triple: $1,223,623 in 2008 vs. $360,750 in 2007. It’s only the second time in the history of our survey that any region has posted an average budget of $1 million or more. The other time came in 2002, when plants in the Midwest spent an average of more than $1.5 million on capital equipment.

Compared with the rest of the country, assemblers in the Midwest are less concerned about increasing capacity than with reducing costs. Forty percent of Midwestern plants are buying equipment to increase capacity. That compares with 43 percent for all U.S. plants, and it’s the sixth straight year that the Midwest has trailed the rest of the nation in that regard.

On the other hand, 57 percent of Midwestern plants are buying equipment to cut costs. That compares with 53 percent for all U.S. plants, and it’s the fifth straight year that the Midwest has led the rest of the nation in that ratio.

If there’s any cause for concern in the Midwest, it’s that 21 percent of plants will spend less on assembly technology in 2008 than they did in 2007. Yes, that’s less than the percentage for the nation as a whole (23 percent), but it is, in fact, the highest percentage for the region since 2004.

Manufacturers talk about how automation saves money, but they don’t seem to be using more of it. The amount of plants using manual and semiautomatic assembly methods is virtually unchanged since 1997. At the same time, the amount of plants using fixed and programmable automation has decreased. Indeed, just 17 percent of facilities use fixed, or “hard,” automated assembly systems, which are typically cam-driven and relatively inflexible. That’s an all-time low for our survey.

Spending Slips in the West

From 2003 to 2005, capital equipment spending in the West increased by at least 19 percent. In fact, in 2004, California, Utah, New Mexico and the 10 other states that make up the West region made up more than a quarter of all spending on assembly technology in the United States.Alas, that might have been the high water mark for the region. Spending decreased in 2006 and 2007, and it appears that it will decrease again next year. All totaled, the West will spend $424.3 million on assembly technology next year, a 6 percent decrease from what the region’s manufacturers spent in 2007. That total gives the West 15 percent of all U.S. spending, the lowest percentage for the region in eight years.

Ironically, a healthy 39 percent of Western facilities expect to spend more in 2008 than they did in 2007. That percentage has grown for four consecutive years, and it’s the highest percentage for the region since 2001.

However, as the saying goes, money talks, and actual budget figures for the region don’t support such optimism. Budgets that had seven figures in 2007 will likely have only six in 2008. Only 8 percent of plants in the West will spend more than $1 million on assembly technology next year, compared with 11 percent in 2007. At the same time, 13 percent of plants will spend between $250,000 and $1 million, whereas 11 percent did so in 2007. Only 11 percent of all plants with 2008 budgets over $1 million are located in the West. In 2007, 20 percent of those plants were located in the West.

The median budget figure for Western facilities is $50,000, which is actually larger than the 2007 median of $30,000. But, the average budget figure is 67 percent lower: $260,598 in 2008 vs. $783,889 in 2007.

If there’s a bright spot, it’s that new products are coming out of the West. Some 39 percent of Western plants are buying equipment to assemble a new product. That’s six percentage points more than the nation as a whole, and it’s the highest percentage for the region since 2004.

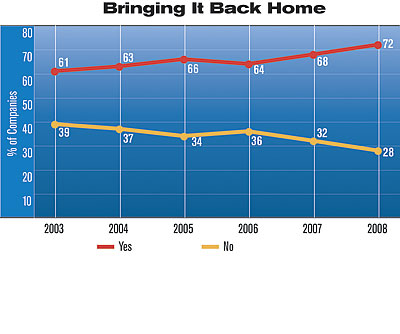

U.S. manufacturers may source parts and subassemblies from foreign countries, but they don’t appear to be interested in owning facilities abroad. Just 28 percent of respondents report that their companies maintain foreign manufacturing operations. That’s the lowest percentage since 2002.

Survey Method and Demographics

ASSEMBLY magazine would like to thank all the respondents who participated in its 12th annual capital equipment spending survey.ASSEMBLY magazine is sent to 60,207 assembly professionals in more than 32,399 locations. Questionnaires were mailed in mid-July to manufacturing managers and other professionals in similar positions, who hold the highest degree of equipment purchasing influence in a representative group of 4,500 plants. Forty-eight percent of respondents were corporate management, 41 percent were manufacturing management, and 11 percent were design management.

The cutoff date for returning the surveys was Aug. 31. Some 466 surveys were returned for a response rate of 10 percent.

For statistical reliability, the survey was only sent to manufacturers in NAIC 339 and 332 through 336, which represent 93 percent of ASSEMBLY’s readership. Manufacturers of wood products, plastic and rubber products, primary metals and furniture were excluded. By industry, 22 percent of respondents were in NAIC 332, 34 percent were in NAIC 333, 17 percent were in NAIC 334, 10 percent were in NAIC 335, 11 percent were in NAIC 336, and 6 percent were in NAIC 339.

Geographically, 23 percent of respondents were located in the Northeast, 41 percent were in the Midwest, 22 percent were in the South, and 14 percent were in the West.

Thirty percent of respondents had 25 employees or less. In addition, 18 percent had 26 to 50 employees, 19 percent had 51 to 100 employees, 17 percent had 101 to 250 employees, 8 percent had 251 to 500 employees, and 8 percent had more than 500 employees.

Thirty-one percent of respondents assemble products that can fit inside a 12-inch cube, 14 percent make products that can fit inside a 24-inch cube, 12 percent make products that fit inside a 36-inch cube, 16 percent make products that fit inside a 6-foot cube, and 27 percent make products that are larger than a 6-foot cube.

Some 19 percent of respondents were high-volume manufacturers, 46 percent were mid-volume manufacturers, and 35 percent were low-volume manufacturers. Twenty-seven percent of respondents were high-variety manufacturers, 40 percent were mid-variety manufacturers, and 33 percent were low-variety manufacturers.

Overall, the survey results have a sampling error of ±6 percent.