The past year brought blockbuster headlines for U.S. manufacturing. Taiwanese electronics giant Foxconn unveiled plans to build a $10 billion assembly plant in Wisconsin that would make liquid-crystal display panels and employ as many as 13,000 people. Automakers Mazda and Toyota selected Huntsville, AL, as the site of a new joint-venture assembly plant. The $1.6 billion factory will have the capacity to build 300,000 vehicles annually and create up to 4,000 jobs. Spirit AeroSystems announced a $1 billion expansion that will bring 1,000 new jobs to its assembly plant in Wichita, KS. The five-year expansion calls for hiring 800 new employees by the end of 2018 and 200 more the following year.

The government helped, too. In December 2017, President Trump signed the Tax Cuts and Jobs Act into law. The largest shake-up to the federal tax code in more than 30 years, the law includes myriad changes that will benefit manufacturers. Among other things, the law reduces the corporate tax rate from 35 to 21 percent and repeals the corporate alternative minimum tax. The law also allows companies to immediately expense the full cost of capital equipment, and it maintains the R&D tax credit.

Ample evidence suggests that tax reform is spurring manufacturers to invest in equipment, hire more workers, and increase wages. For example, Fiat Chrysler Automobiles (FCA) cites tax reform as the reason why it plans to invest $1 billion in its assembly plant in Warren, MI. As part of the effort, FCA will be reshoring production of its Ram pickup truck from a factory in Mexico.

In short, the economy is humming. The unemployment rate stood at just 3.7 percent in October 2018—the lowest rate since 1969. The average job growth per month in 2018 has been 213,000—far exceeding the average monthly gains in 2016 and 2017. What’s more, average hourly earnings have increased by 83 cents, or 3.1 percent, from October 2017 to October 2018—the biggest October to October jump in a decade.

Some 12,785,000 Americans held manufacturing jobs in October 2018. That’s 1,332,000 more jobs than in March 2010, the low point of the Great Recession, and it’s the highest total since December 2008.

Continued Growth

Will growth continue? The results of our 23rd annual Capital Equipment Spending Survey indicate that manufacturers will increase spending on assembly technology in 2019.

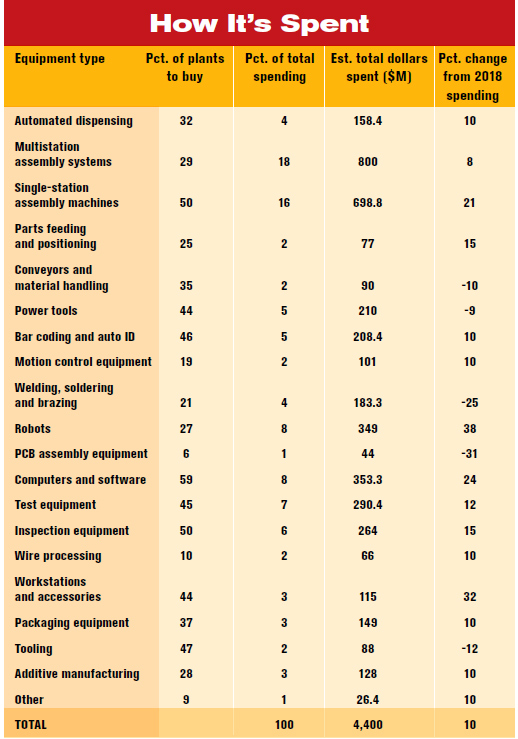

Specifically, U.S. assembly plants will spend $4.4 billion on new equipment in 2019, an increase of 10 percent from the $4 billion projected to be spent in 2018.

Some 48 percent of respondents will spend more on assembly technology next year than they did this year. That marks the ninth straight year that the “we’ll spend more” percentage has been above 30 percent, and it’s the highest such percentage in survey history. Forty percent will spend the same as they did in 2018, and only 12 percent of respondents will spend less in 2019 than they did 2018. The latter figure is an all-time low for our survey.

On average, manufacturers will spend $697,841 on assembly technology in 2019. That compares with $582,650 in 2018, and it’s the ninth highest average in survey history. The median budget total is $200,000—a record high.

Aggregate budget data also indicate a healthy increase in spending for 2019. For example, 24 percent of plants have capital budgets of at least $1 million. That compares with 19 percent in 2018, and it’s the highest percentage in survey history. At the same time, 43 percent of plants will spend between $100,000 and $999,999 in 2019. That compares with 28 percent in 2018, and it’s the highest percentage since 2001. Only 34 percent of plants will spend less than $100,000 next year. That compares with 53 percent in 2018, and it’s the second lowest percentage in survey history.

It’s worth noting, however, that we received an above-normal response rate from the largest assembly plants (facilities with more than 250 workers) and a below-normal response rate from the smallest plants (those with 25 employees or fewer). Presumably, very large factories have correspondingly higher capital budgets than those with fewer employees.

Similarly, we received above-normal response rates from the transportation equipment and medical device manufacturing industries. Since these high-volume industries rely more on automation than other industries, they tend to spend more on capital equipment and, thus may have skewed our spending data upward.

“We are optimistic about 2019 because we believe tariffs will force companies to look for ways to cut costs,” says Rick Brookshire, group product manager for Epson Robots. “Automation is the obvious choice for reducing costs, and we believe robot and automation suppliers will benefit.

“Reshoring will increase as companies bring more manufacturing back to North America from Southeast Asia. It’s already happening. Even if the tariffs are reduced or adjusted, many companies will begin implementing automation for the first time, and many ‘old hands’ at automation will be looking for new ways to get costs down and quality up to remain competitive.”

Brian Beaulieu, CEO of ITR Economics, an economic research and consulting firm in Manchester, NH, is cautiously optimistic about capital spending in 2019.

“It would be wonderful if assemblers are able to follow through on the results of your annual survey, and we see a 10 percent increase in capital spending,” he says. “Increasing their capabilities is an intermediate- to long-term ‘must’ for manufacturers. The shortage of skilled labor in many markets—combined with competitive pressures and potential new business stemming from trade issues—all make that number appear quite doable.”

On the other hand, Beaulieu believes single-digit growth in capital spending next year is a more realistic forecast. “Leading economic indicators in the U.S. and globally are pointing downward for 2019. Growth in consumer spending is already slowing. And, growing corporate profits in 2019 may prove to be difficult and, thus, impede capital spending,” he says. “For those reasons, a more prudent approach for 2019 would be to assume single-digit growth in capital spending, but have contingency plans for double-digit growth.”

Whether capital investment grows by single or double digits is debatable, but most other industrial forecasts agree that spending will increase next year. For example, the 2019 Metalworking Capital Spending Survey by Gardner Intelligence predicts that machine tool consumption will increase 11 percent to more than $7.74 billion in 2019. This follows increases of 3 and 6 percent in 2017 and 2018 respectively.

“In 2018, machine tool prices rose and delivery times lengthened as the demand for capital equipment outpaced the supply. Given the planned spending by machine shops detailed in our report, prices are likely to climb higher and delivery times will remain relatively long as demand remains strong,” says Steve Kline Jr., Gardner’s chief data officer.

The Manufacturers Alliance for Productivity and Innovation (MAPI) projects that U.S. gross domestic product (GDP) will grow by an average of 2.5 percent annually between 2018 and 2021.

“Our brighter forecast for overall growth has been especially buoyed by the stronger outlook for capital equipment investment,” says Kris Bledowski, senior economist with MAPI. “We currently project that capital equipment spending growth will average 6.8 percent annually between 2018 and 2021.”

MAPI’s capital spending forecast is based on expectations that global economic conditions will improve and that business tax reform will motivate executives to put at least some of a large stock of dormant cash to work.

As a further boost for U.S. manufacturing prospects, MAPI expects U.S. exports to grow by an average of 6 percent annually during the next four years. “If the dollar continues its persistent fall, export growth will likely accelerate,” says Bledowski. “However, the pace of import growth is expected to exceed the pace of export growth. Thus, trade pressures will remain an issue for the manufacturing sector even as economic conditions improve.”

Overall, MAPI expects the U.S. manufacturing sector to grow by an average of 2.8 percent annually between 2018 and 2021.

Boosting Capacity

For the first time in survey history, increasing capacity is the No. 1 reason for investing in assembly technology. Some 51 percent of assembly plants are looking to increase capacity or assemble higher volumes of existing products in 2019. That compares with 47 percent in 2018, and it’s the highest percentage since 2001.

That mirrors the latest data from the Federal Reserve. U.S. manufacturing operations were running at 76.2 percent of capacity in October. That compares with 75.2 percent in October 2017, and it’s the highest level since July 2015. Granted, that’s still below the high-water mark of 85.6 percent set in 1989, but it’s also well above the low point of 63.7 percent set in 2009 during the Great Recession. From 1972 to 2017, capacity utilization in manufacturing has averaged 78.3 percent.

Appliance assemblers, in particular, are looking to increase capacity. Some 82 percent of plants—more than any other industry—are investing in equipment to boost capacity. That’s a record high for this industry. That could be in response to tariffs on imported appliances imposed by the Trump administration, or it could be a reaction to increased home building. According to the Commerce Department, housing starts increased 1.5 percent to a seasonally adjusted annual rate of 1.228 million units in October. That’s a lot of new refrigerators, stoves and dishwashers.

The need to increase capacity jibes with other data from our survey. For example, 63 percent of appliance manufacturers will spend more on assembly technology next year than they did this year. That’s the most of any industry, and it’s a record high for this industry.

Already, 2018 has seen a flurry of investment among appliance manufacturers. For example, in June, GE Appliances announced plans to invest $115 million to expand its refrigerator assembly plant in Decatur, AL. The investment will add 255 new jobs to the plant, bringing the total number of full-time employees there to nearly 1,300. The investment will boost production capacity by 25 percent to help GE Appliances meet rising demand for its top-freezer refrigerators.

The expansion is one of several major investments made by the business since becoming part of Haier two years ago. In 2018 alone, GE Appliances’ investments have included: $200 million to add 400 jobs and expand dishwasher and laundry production at the company’s flagship Appliance Park manufacturing campus in Louisville, KY; a $55 million expansion of a distribution center in northern Georgia; the opening of a $45 million expansion of a “smart” distribution center in Dallas; and a $10 million expansion of an assembly plant in Selmer, TN.

But, GE Appliances wasn’t the only appliance assembler to announce major investments this year:

Electrolux is in the middle of a $250 million expansion project that will double the size of its assembly plant in Anderson, SC. The project, which will increase the number of assembly lines from one to four, is on schedule for completion in the first half of 2019.

Whirlpool Corp. plans to expand its assembly plant in Tulsa, OK, with the addition of a new $55 million factory distribution center. The warehouse will support increased production capacity and improve efficiencies within the appliance maker’s North American supply chain. Construction of the new, 798,000-square-foot facility is expected to be completed in December 2019. The project will support the creation of 150 additional manufacturing jobs.

Samsung will expand the production footprint of its assembly plant in Newberry, SC, making progress on a plan to create nearly 1,000 jobs in the state by 2020.

On the other hand, manufacturers of electronic products are not increasing capacity. Only 33 percent of plants in this industry will buy equipment next year to increase capacity. In fact, the electronics industry has been below the national percentage for increasing capacity in the eight of the past 10 years.

That fits with overall plans in the industry. Only 25 percent of electronics assemblers will spend more in 2019 than they did in 2018. That marks the seventh time in the past 10 years in which the electronics industry has been below the national figure for increasing capital spending.

Another industry that seems to be at capacity is medical device manufacturing. Only 25 percent of plants in this industry will buy equipment next year to increase capacity. That’s a marked change from recent history. In three of the past five years, the medical device industry had been above the national percentage for increasing capacity.

What’s more, only 38 percent of medical device assemblers will spend more in 2019 than they did in 2018. That’s 13 percentage points less than the national figure, and it marks the third time in four years in which this industry has been under the national percentage of those planning to spend more.

Getting Old

More than half of assemblers, 51 percent, will buy equipment next year to replace old or worn-out machinery—a record high for our survey.

That figure has been above 46 percent only five times since 2005, but three of those were recorded in the past five years. Perhaps assemblers are looking to take advantage of the Industrial Internet of Things. Or, it may be that manufacturers postponed replacing capital equipment during the Great Recession and are now desperate for new machinery.

The problem is particularly acute among manufacturers of transportation equipment. Sixty-five percent of transportation equipment assemblers will replace old machinery next year. That’s the most of any industry, and it’s the third time in the past four years in which this industry has led the nation in that statistic.

In contrast, only 41 percent of machinery manufacturers are looking to replace old equipment. That’s the least of any industry, marking the third time in six years in which this industry has held that distinction.

Increasing Quality

According to the National Highway Traffic Safety Administration, the total number of vehicles recalled fell to 30.7 million units in 2017, which is the fewest number of units taken back by their makers for inspections and repairs since 2013. By comparison, 17.6 million new vehicles were sold during 2017, which means the industry still recalled around 74 percent more cars and trucks than it delivered to consumers.

In the medical device industry, the statistics are not any better. The number of device recalls issued by the FDA has climbed steadily from 2,303 in 2013 to 3,202 in 2017. In the first quarter of 2018 alone, the FDA issued 343 medical device recalls—more than double the number from previous quarter. All totaled, the recalls involve some 208.4 million units—that’s more units than for all the recalls of 2017 combined.

Small wonder, then, that more assemblers are looking increase quality in 2019. Twenty-one percent of assembly plants will buy equipment next year to improve quality—up from 15 percent in 2018 and the highest percentage in 10 years.

Other motives for buying equipment include:

- cost reduction, 46 percent.

- reduce cycle time, 42 percent.

- assemble a new product, 40 percent.

- implement lean manufacturing, 27 percent.

- increase safety, 25 percent.

- keep up with competition, 18 percent.

- meet OEM or downstream requirements, 15 percent.

- comply with standards or industry regulations, 10 percent.

Labor Costs

As always, the top two targets for cost reduction are direct labor and indirect labor. However, only 68 percent of plants are looking to decrease direct labor costs next year. That compares with 77 percent in 2018, and it’s the second lowest percentage in survey history.

That’s somewhat puzzling, given that manufacturing wages are rising. According to the Bureau of Labor Statistics (BLS), wages for U.S. manufacturing workers have increased 3 percent, from an average of $21.05 per hour in October 2017 to $21.68 per hour in October 2018. That’s on par with wage growth in most other segments of the economy. But, the BLS estimates that there are approximately 488,000 open manufacturing jobs in the United States. With 3.7 percent unemployment, that could drive up labor costs next year.

One industry that is concerned about labor costs is appliance and electrical equipment manufacturing. Some 73 percent of assemblers of lamps, mixers and other electrical products are targeting direct labor costs next year. That’s more than any industry, and it marks the third time in six years that the appliance industry has led all others in this statistic.

One reason appliance makers are concerned about labor costs might be a lack of automation. Only 18 percent of plants in this industry use programmable automation and just 14 percent employ fixed automation. That compares with 40 percent and 31 percent for all U.S. assembly plants.

One industry that is not concerned about direct labor costs is medical device manufacturing. Only 56 percent of plants in that industry are targeting direct labor costs next year. That’s the lowest of any industry, and it’s the fifth straight year in which this industry has been below the national figure.

That makes sense. Medical devices tend to be small, high-value products produced at high volumes, which makes them ideal candidates for automated assembly.

Larger facilities are typically more concerned about labor costs that smaller ones. For example, 74 percent of plants with more than 250 workers are looking to reduce direct labor costs next year. That compares with 56 percent of plants with 25 workers or less and 62 percent of plants with 26 to 100 workers.

Material Costs

As manufacturers increase their consumption of exotic materials, such as composites and titanium, a growing number are concerned over the cost of those materials. Thirty-five percent of assembly plants are looking to lower material costs next year. That’s a record high, and it’s the seventh straight year in which that percentage has been 25 percent or more.

Material costs are particularly concerning to manufacturers of medical devices. Fifty percent of assemblers in this industry are concerned about material costs. That’s the most of any industry, and it marks the fifth time in 10 years that medical device makers have led all industries in that ratio.

In contrast, only 15 percent of plants in the fabricated metal products industry are concerned about material costs. That’s the least of any industry, and it marks the sixth time in 11 years that fabricators have held that distinction.

Other targets for cost reduction include:

- indirect labor, 47 percent.

- scrap and rework, 41 percent.

- energy costs, 21 percent.

- work in process, 18 percent.

- warranty, 15 percent.

What Assemblers Want

For only the fourth time in survey history, computers and software will be the No. 1 item on assemblers’ shopping lists next year. Some 59 percent of plants will invest in computers and software next year, compared with 45 percent in 2018.

These days, assembly plants rely on computers and software as much as nutrunners and robots. Thanks to sensors, computers and the Internet, networked machines can communicate with each other and their users in real time. Factory processes can become more visible and controllable. Web browsers can be used as dashboards to control equipment, identify snags, and make quick decisions that would have previously taken entire teams of people to handle. Supply chains can automatically adjust based on changes in demand or production capacity. Products can instruct machines how they should be processed.

This trend was reflected at this year’s ASSEMBLY Show, where at least 16 software vendors were exhibiting the latest Industry 4.0 technology. What’s more, investment in computers and software is not solely the province of large companies. Indeed, our survey indicates that the smallest companies (those with 25 or fewer employees) are equally likely to buy computers and software as the largest companies (those with more than 250 employees).

All totaled, assemblers will spend $353.3 million on computers and software next year, a 24 percent increase from 2018.

Our survey results also indicate a strong increase in demand for robots. Twenty-seven percent of plants will purchase robots next year, the most since 2011. In all, assemblers will spend $349 million on six-axis robots, SCARAs, grippers and other robotic technology next year, an increase of 38 percent over 2018 sales.

“We continue to see significant growth in the Americas, from both traditional robot users and small- and medium-sized manufacturing companies,” says Joe Campbell, senior manager for strategic marketing and application development at Universal Robots USA Inc. “UR’s industry-leading collaborative technology and lowest total installed cost are bringing automation to new users every week.”

“We are encouraged by the results of ASSEMBLY’s capital spending survey,” adds Cathy Powell, public relations and communications manager for FANUC America Corp. “We saw strong sales in 2018 and look forward to a strong 2019 as more companies look to robots and automation to increase productivity, quality and profits. In fact, we’re expanding our headquarters in 2019, which will allow us to keep pace with customer demands.”

Suppliers of automatic screwdriving equipment could see sales rise next year. Some 32 percent of plants will buy automatic screwdriving equipment next year. That compares with 29 percent in 2018, and it’s the highest percentage since 2011. Demand will be strongest in the machinery, transportation equipment, and appliance industries.

In all, assemblers will spend $279.5 million on automatic screwdriving equipment next year, an increase of 20 percent over 2018.

“We will continue our trend of double-digit growth in 2018 and also 2019,” asserts Lori Logan, marketing manager for DEPRAG Inc. “We have seen around a 25 percent increase in sales of feeding equipment alone this year, and we expect this trend to increase even further in 2019. In the automatic screwdriving sector, we have seen a triple-digit increase in sales of our Adaptive DFS system for installing flow drill screws.

“Manufacturing is expanding in the USA, and we are seeing this reflected in quote output, new leads, new customers and increased revenue. I expect this to continue until 2020.”

Assembly presses could also enjoy an uptick in sales. Thirty-six percent of plants plan to purchase presses next year. That compares with 23 percent in 2018, and it’s a record high for this technology. Demand will be strongest in the medical device, transportation equipment, and fabricated metal product industries.

In all, assemblers will spend $419.2 million on hydraulic, pneumatic and electric presses next year, an increase of 20 percent over 2018.

“2018 has been a stellar year, with sales of press systems specifically up 23 percent from 2017, year to date,” says Michael T. Brieschke, vice

president of sales at Aries Engineering Co. Inc. “A good portion of this growth was attributed to sales in Mexico.

“2019 will be an interesting year. We do expect an increase in sales, but to what degree is uncertain.”

Another technology that could see a boost in sales next year is dispensing equipment. Thirty-two percent of plants will buy equipment to dispense and cure adhesives in 2019. That compares with 22 percent in 2018, and it’s the most since 2011. Demand will be strongest in the transportation equipment and appliance industries.

“We are experiencing a record sales year in 2018,” says Frank Hart, sales and marketing manager for PVA. “Global sales are trending up roughly 15 percent, year over year. We are seeing our most significant growth in North America, where global trade restrictions and reshoring are resulting in sales increases topping 30 percent over 2017. I am very happy with how we are positioned for 2019 and expect another strong year.”

Product marking and automatic identification technology should also see a boost in sales. Forty-six percent of plants—a record high—will invest in label printers, laser markers, RFID systems and other technologies next year. Demand will be particularly strong among makers of transportation equipment and appliances.

All totaled, assemblers will spend $208.4 million on auto ID technology next year, up 10 percent from 2018.

“We’ve noted an increase in sales across many industries, from automotive to medical, where manufacturers are adopting digital and creative solutions to improve their production methods,” says Salay Quaranta, industry manager for the TruMark line of laser marking equipment at TRUMPF Inc. “For example, the continued implementation of the FDA’s Universal Device Identification regulation has expanded interest in traceability and vision tracking systems, like our Visionline packages for laser marking.”

Perhaps the most welcome sales increase in 2019 will be for multistation automated assembly systems. Some 29 percent of plants expect to purchase such systems next year. That compares with 18 percent in 2018, and it’s the most since 2009. All totaled, sales of multistation automated assembly systems should increase 8 percent next year, to $800 million.

“We are ending 2018 ahead of our goal and starting 2019 with a strong backlog that seems to support what you are seeing in your survey results, says Rick Blake, president of Edgewater Automation. “We feel very good about the first half of 2019 and are planning for another big year.”

To purchase and download the entire capital spending report, please visit https://clearseasresearch.com/product/2018-capital-spending-study-assembly/?r=6. You can also email info@clearmarkettrends.com with any questions.