Heavy- and medium-duty trucks are one of the hottest segments of the electric vehicle industry today. Both legacy manufacturers and start-ups are scrambling to develop battery-powered machines. Vehicles are slowly starting to roll off assembly lines, but this new class of truck is expected to dominate the market within the next 15 years.

Established U.S. brands, such as Freightliner, International, Kenworth, Mack and Volvo, have already developed electric trucks in a variety of sizes and segments. In Europe, DAF, Daimler, Iveco, MAN, Renault and Scania are even further ahead.

They’re all competing against a slew of start-ups such as Battle Motors, Bollinger, BYD, Harbinger, Lion, Nikola, Quantron and Volta. Soon, Tesla and others will be entering the electric semi space, even though the extensive charging network they require is only just beginning to emerge.

A recent PwC study entitled "The Dawn of Electrified Trucking" predicts zero-emission vehicles powered by batteries or fuel cells will account for one-third of all newly registered trucks in China, Europe and North America by as early as 2030. By 2035, their share of new registrations in these markets is expected to rise to around 70 percent.

With fewer moving parts and increased reliability, electric trucks feature the environmental benefits of reduced emissions, as well as lower noise levels and less vibration than combustion engines.

“Without the transportation and logistics industry on board, it will not be possible to meet the world’s climate targets,” warns Matthias Zink, CEO of automotive technologies at Schaeffler Group, a leading Tier One supplier of electric motors, power electronics and thermal management systems. “Some 60 percent of all truck journeys are shorter than 500 kilometers and are therefore within the range achievable by battery electric trucks on a single charge.

“Electric trucks are a zero-emission, low-noise goods transportation solution that will not fall foul of increasingly stringent inner-city vehicle entry restrictions,” notes Zink. “Another advantage that e-trucks have over trucks with internal combustion engines is the ability to recover energy in stop-and-go urban traffic.”

One of the firms spearheading demand for electric commercial vehicles in the United States is brewing giant Anheuser-Busch Co. Four years ago, it formed a strategic partnership with Nikola Corp. in an effort to transition its long-haul fleet to zero-emission trucks. And, earlier this year, the brewery embarked on a three-month trial using BYD Auto Co.’s 8TT day cab tractor for local deliveries to bars, restaurants and retailers. It currently operates 25 BYD trucks across four California distribution centers.

PepsiCo Inc. is also jumping on the electric truck bandwagon and plans to take delivery of the first Tesla rigs this month. However, the automaker’s much-anticipated heavy-duty Semi truck has been delayed for several years. And, Geely’s Farizon brand recently unveiled a futuristic-looking truck called the AD21 that it believes will compete directly against Tesla.

Walmart Inc. is also a major player in the race to develop and deploy electric trucks on American roads. The retailer, which is currently experimenting with Freightliner Truck’s eCascadia and Nikola’s Tre machines, recently placed a large order with Canoo Inc. for electric delivery vans. In addition, Walmart conducted a test with an electric-powered refrigerated semitrailer made by Thermo King.

Rolling Down the Road

"The percentage of electric trucks out there in comparison to the total commercial truck market is extremely low," says Pedro Pacheco, an analyst at Gartner. "However, truck manufacturers are [putting] new models on the market, and they are starting to become more competitive from a technology standpoint."

According to Pacheco, the development and rollout of the Megawatt Charging System (MCS) standard will be critical for the success of long-haul electric trucks, because fleet operators and shipping organizations demand minimum downtime. MCS is a high-power charging connector for trucks and buses that’s being developed by the CharIN task force and several suppliers.

"Without that standard, it's extremely hard to make them work from an operational standpoint," warns Pacheco. "But, of course, these trucks first need to come to market, and the chargers need to be there, which also takes time. Once they are in place, this would make electric trucks much easier to use."

Pacheco calls the current range limitations the "Achilles' heel of the electric truck," with battery-powered semis simply unable to compete with the range offered by traditional diesel alternatives. Future success will depend on the ability to roll out infrastructure.

"When a manufacturer tells a fleet operator, 'the driving range of this truck is 500 kilometers,’ their first question is whether that applies to a loaded or unloaded truck," notes Pacheco, who believes electric trucks will more likely find acceptance—and build momentum—by first serving local distribution needs where range limitation isn’t a critical issue.

Volvo Hedges Its Charging Bet

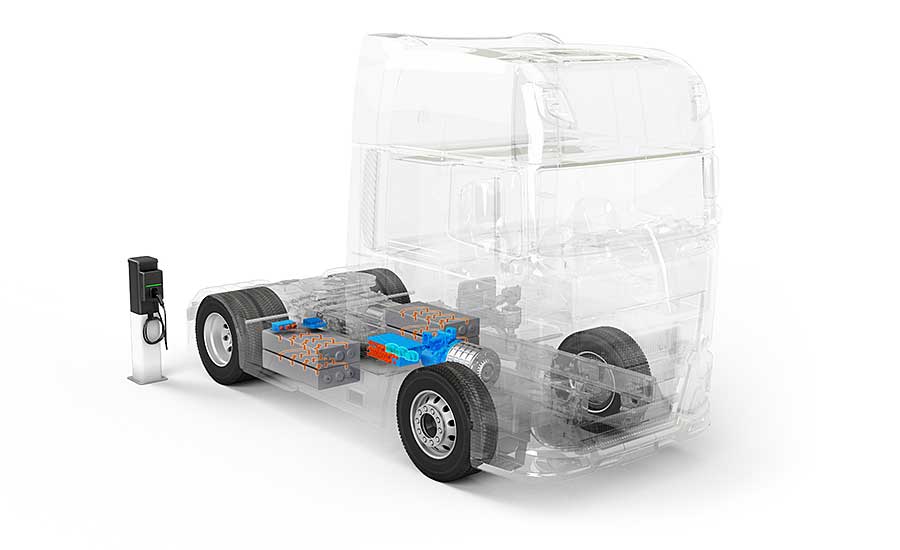

Volvo Trucks North America currently offers its VNR Electric in several configurations. The company is backing up its rolling product with plans to build out a charging network, starting first with a cross-California route.

With the Class 8 tractor, customers can choose either a four- or six-battery pack configuration. Class 7 trucks are only available with the former.

"We had a very strong base with our VNR model truck," says Andy Brown, product marketing manager for electromobility at Volvo Trucks North America. "Taking that truck platform, we were able to add the battery packs and the electric driveline."

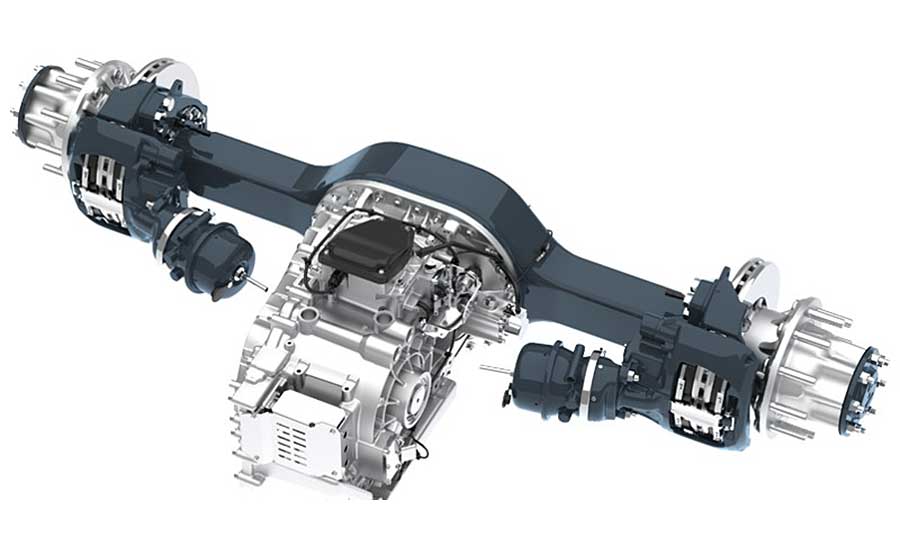

Volvo Trucks also recently announced a new e-axle at the IAA Transportation trade show in Hanover, Germany. It will enable battery-electric vehicles (BEVs) to have an extended range by combining the driveline and transmission into one piece and carrying more batteries onboard.

"This will be a complement to our current electric drivelines with the existing trucks still being ideal for local and regional distribution," explains Brown. "We’re confident that with those options we can fit our customers' needs for any and all local delivery options."

Brown claims that heavy-duty electric trucks are an ideal way for companies to reduce their greenhouse gas emissions and move to a zero-tailpipe emissions transportation system.

"Currently, we’re focusing on customers who have local and regional routes for our BEV offering, as that’s currently the ideal range," adds Brown. "We expect that to grow as batteries and other technologies continue to advance.

"Our first phase of trucks had a range of around 150 miles and now we’re able to provide up to 275 miles of range with a six-battery configuration, and up-to a 230-mile range with the four-battery configuration," Brown points out.

While charging infrastructure is a work-in-progress in North America, Volvo Trucks is actively working with its partners to address the issue. Earlier this year, the truck manufacturer announced that it was constructing an electrified charging corridor for medium- and heavy-duty vehicles in California. It’s scheduled to come online by the end of 2023.

The plan is to build a string of charging stations running from Dixon, CA, north of San Francisco, to La Mirada in Los Angeles County. Volvo Trucks is partnering with Shell Recharge Solutions, TEC Equipment, Affinity Truck Center and Western Truck Center to develop the publicly accessible EV charging network, which is backed by a $2 million grant from the California Energy Commission.

"California has been an early adopter of electric trucks, but we see this as something that can be a road map of sorts to be done in other places across North America," says Brown, who predicts that demand will increase steadily in the near future.

"Simply said, there are companies that are aggressively pursuing sustainability goals like we are,” explains Brown. "Transportation companies also know that their customers are demanding lower and zero-emission alternatives. In fact, they fear losing business if they don’t start investing in zero-tailpipe emissions transportation."

Building a Robust Charging Network

The conservative trucking industry has been slow to adopt electric vehicles and invest in a widespread charging infrastructure.

"These freight companies, as well as larger fleet operators, are debating whether to even make the [switch] to electric from a conventional power train," says Sandeep Mukunda, research manager for the digital automotive and transportation strategies program at IDC. "There needs to be some sort of flagbearer when it comes to introducing electrification in the industry, such as starting with building an infrastructure in areas like California."

Mukunda believes that it's going to take at least a decade for electric trucks to begin replacing conventional vehicles at the pace currently occurring in the passenger car market.

"I think the biggest challenge for truck manufacturers is to source batteries at an economical cost, because right now there is a tremendous competition for battery technology," notes Mukunda. "The technology is not yet mature enough to be mass-produced at economic scale, and there is tremendous competition from other automotive companies to try to source the battery materials, as well."

A second challenge is the pure capacity issue required to carry a heavy-duty truck over long distances, which means there needs to be enough chargers in place, as well as enough rest stops where the chargers can be used.

"The time it may take to charge a vehicle carrying a payload around 40 tons could be a few hours, even if it's at a supercharger," warns Mukunda. "There needs to be a lot of partnerships to build that infrastructure."

Investment in technologies such as a dynamic charging infrastructure, where vehicles can be charged while in transit on the road, might become a game changer at a later phase, but that’s further down the road from where the electric truck industry is today.

"Other aspects of future mobility, like connected vehicles and autonomous technology, are going to mature faster than the electrification of power trains in trucks," predicts Mukunda.

Harbinger Does the Electric Slide

Harbinger Motors Inc., a Los Angeles-based start-up focusing on Class 4, 5 and 6 trucks, recently exited stealth mode. It has developed a skateboard-type chassis for medium-duty applications that features autonomous-ready drive-by-wire steering, a floor height below 28 inches and a front suspension that reduces vehicle overhang. It expects to ramp up production in 2024.

"We produce our own electric motors, electric drive, battery systems, frame suspension and chassis," says Phillip Weicker, chief technology officer at Harbinger. “We believe our ground-up approach will help us stand out significantly from a technical and performance standpoint."

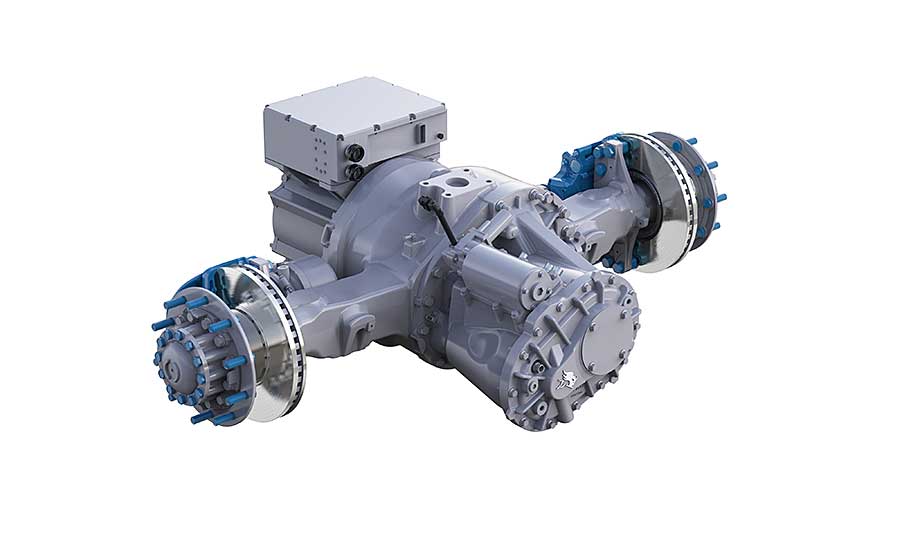

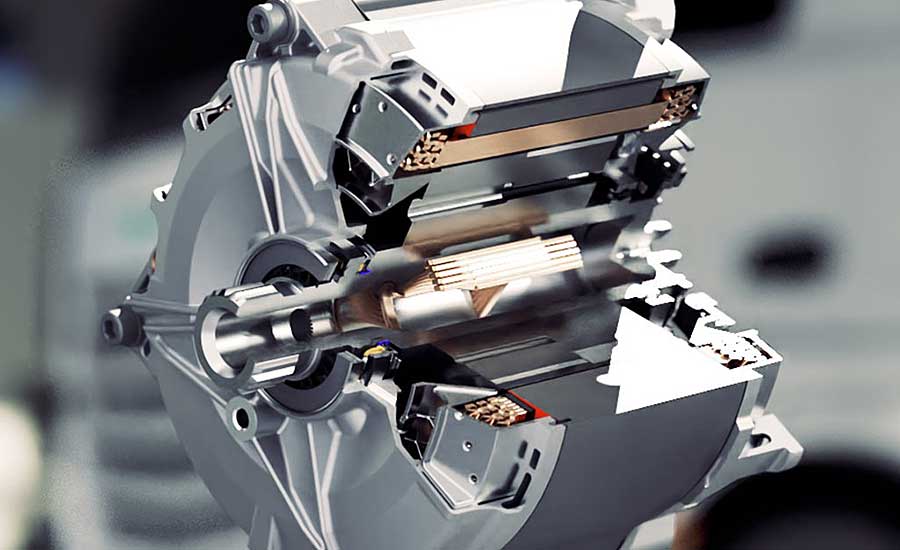

Harbinger's e-axle composes the heart of the vehicle, combining the motor, inverter and gearbox into an integrated unit, in tandem with an 800-volt liquid-cooled battery system. Designed for a 20-year, 450,000-mile standard operating life, the unit also claims one-hour DC fast-charging capability.

According to Weicker, the technology was developed from scratch to control chassis cost and provide a value proposition in the competitive commercial vehicle industry.

"The challenge is finding a vehicle that meets [customer] needs and can be acquired for the right price," explains Weicker. "The cost of operating them is calculated to the third decimal place per mile. Until battery prices and battery durability reached the point where vehicles like this made economic sense, nobody was going to look at them in any kind of serious way.

"Commercial vehicles are work tools and therefore they need to make economic sense for their customers," adds Weicker. "We think this is something that everybody operating fleets, large or small, will be interested in."

Educating customers about range capacity and other specifics of electric drivetrains is an important part of the sales pitch. However, 75 percent of medium-duty trucks in the United States drive less than 75 miles a day on predictable routes.

"These are usually centered at base stations or depots, which makes them well-suited to electrification, because we know where they're going to be charged," says Weicker. "We know how much energy they need to have on board, and we know that doesn't vary from day to day like it does in the passenger car world.

"Our challenges are centered around building a battery pack that will last in the commercial trucking environment,” notes Weicker. “[It must be] resistant to the environment, which means it has the necessary cooling capacity to make sure that the cells last a long time.”

If a battery must be replaced four times, then it suddenly becomes very difficult to think about the vehicle being economical in the same way.

"We want a battery that lasts both from life-cycle perspective, as well as from a durability perspective," Weicker points out.

Mack Concentrates on Short-Hauls

Earlier this year, Mack Trucks Inc. launched its next-generation LR Electric refuse vehicle, which features four nickel manganese cobalt oxide lithium-ion batteries powering twin electric motors. The 122-year-old truck manufacturer claims that the vehicle offers 42 percent more energy and a standard 376 kilowatt hour total battery capacity for increased range.

"Electric commercial trucks are a sustainable, zero-emission solution to the world’s transportation needs," says Scott Barraclough, senior product manager for e-mobility at Mack Trucks. "Decarbonization is a priority in addressing climate, environmental and social challenges. It also supports [our] purpose in helping to build a better world."

Because it’s part of the Volvo Group, Mack can leverage technology. "This helps reduce developmental costs and gives us access to [advanced] technology," explains Barraclough. "We also have resources to assist our customers in identifying what incentive or grant funds may be available to help them offset the increased cost of electric vehicles.

"We have proprietary tools that analyze a customer’s application and determine how an electric vehicle will fit in their operation, and we can work with customers to optimize its utilization," claims Barraclough.

Mack also offers a range calculator for electric vehicles, which aims to help fleet owners plan and build routes based on specific variables.

From a technological perspective, Barraclough says energy density is the top development that must occur to meet the demands of the large commercial truck industry. "We need to get as much energy as possible on the truck," he explains. "Today, BEVs are a good fit for some applications like local or regional delivery and refuse. However, they are not the only solution for commercial vehicles."

Fuel cell electric vehicles are on the horizon and promise to be even more practical and economical for long-haul applications.

"The lithium-Ion battery technology in use today has matured to the point where we don’t expect to see improvements coming at the rate they have been up to now," says Barraclough. "There will be improvements, but not like the 42 percent improvement in energy density [we] achieved with the LR Electric. The next big breakthrough will be from a change in battery technology."

Volta Offers Trucking as a Service

Volta Trucks Ltd. is a European startup that specializes in Class 5-7 medium-duty vehicles. The Class 7 Volta Zero features a unique center-mounted steering wheel and seat that enables drivers to enter or exit the delivery vehicle from either side.

The electric truck uses a modular battery pack supplied by Proterra that provides a range of 95 to 125 miles. A compact e-axle supplied by Meritor Inc. features an electric traction motor, transmission and axle in one unit.

Volta plans to start assembling vehicles in the U.S. by 2025. However, the first vehicles delivered to customers will be built at in Austria by contract manufacturer Magna Steyr.

The company will offer four versions of the Zero, including 7.5-, 12-, 16- and 18-ton variants, as well as a refrigerated version for temperature-sensitive cargo. The vehicle is designed for urban logistics and distribution applications.

Volta is using a truck-as-a-service strategy that bundles everything needed to transition to a full-electric fleet into one affordable monthly payment.

"We know that climate change and air quality problems are a reality that need addressing urgently and electrification is the answer," says Duncan Forrester, chief communications officer at Volta. "This is one of the main reasons why [we have] selected the urban distribution use-case at the outset.”

However, Forrester believes that the public charging network—and the charging network required for long-haul trucking applications—must be further developed to be able to fully electrify those areas of transport.

Battery Management Systems Help Extend Range

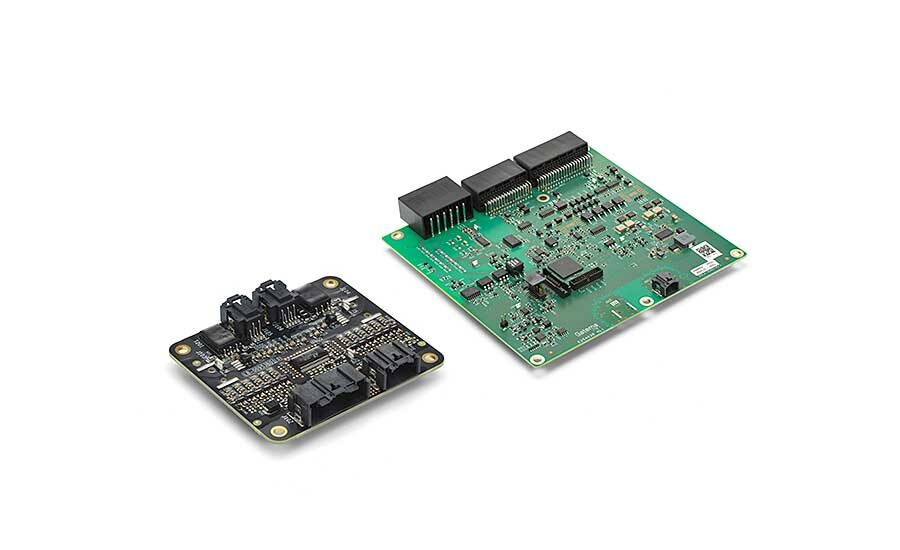

Battery management systems (BMS), the intelligent component that monitors and manages lithium-ion battery packs, could also help extend the range of electric commercial vehicles. It is the brain behind the battery and is critical to safety, performance, charge rates and longevity.

The BMS plays an important role in improving driving range, increasing battery lifetime and ensuring safe operation of the battery. These metrics are especially important for trucks, since they strongly influence vehicle uptime, which has a big impact on the profitability of operators.

To address the issue, Sensata Technologies Inc. has developed an ISO-26262 certified off-the-shelf BMS. The Lithium Balance n3-BMS reduces the time to market for battery pack manufacturers and OEMs.

"The software architecture has been separated into multiple layers, allowing customers to develop their own application software features without impacting the functional safety certification," says Ayoub Sidhom, product marketing manager for clean energy solutions at Sensata.

Even though customers can create their own application software features, Sensata engineers developed advanced algorithms and feature sets such as state of charge, state of health, state of power and balancing algorithms.

Sensata provides a diverse portfolio of products for commercial vehicle applications ranging from contactors and fuses to more complex systems, such as high-voltage distribution units.

"We think that the mass-market adoption of electric [trucks] is inevitable and is accelerating," says Martin Poceiro, product marketing manager for heavy vehicle and off-road applications at Sensata.

However, Poceiro believes there are three variables that will affect adoption rates: electric vehicle availability, total cost of ownership (TCO), which is impacted by government incentives to boost early demand, and the available charging infrastructure.

"The first two are on track,” claims Poceiro. “But, infrastructure [must catch up] to make the transition to zero emission possible for long-haul operation.”

Poceiro predicts that next two years will still see diesel engine trucks continue to dominate the market, with electrification adoption rates fairly low—below 5 percent, depending on the region.

"Early success in electrification adoption will be key to proving to the market that electric commercial vehicles are a viable solution going forward," Poceiro points out. "End users have concerns around initial cost and TCO parity, as well as investments and the availability of charging infrastructure."

Significant government incentives have fanned out in multiple countries and regions to limit the price difference between electric trucks and traditional ICE vehicles.

"Fleet owners’ investments in charging infrastructure are heavily subsidized," notes Poceiro. "The reliability of technology and the end value of the vehicle are also top of mind for fleet owners."

Most truck manufacturers are looking into warranty and maintenance offerings, as well as lease or fixed return value offerings, to address those concerns.

"There are [also] challenges around range and flexibility, driving the need for higher battery capacity and charging powers," says Poceiro. "This is the top development priority for vehicle manufacturers and the supply chain."

To address concerns related to initial cost, TCO, range and charging, Poceiro believes higher energy density batteries at lower cost will help facilitate fast charging at higher power levels. "Of course, all other components in the electric drivetrain will have to be able to deal with the higher power levels as well," he explains.

In the Lion's Den

Lion Electric Co. is a Canadian-based start-up that’s focusing on Class 6 and 8 trucks, in addition to buses. Boasting a range of up to 260 miles, the vehicles are available in various configurations, such as box trucks, reefer trucks and refuse collection trucks.

The company plans to assemble the vehicles at a new facility in Joliet, IL, that it claims will be “the largest plant in the United States for heavy-duty trucks.”

Equipped with batteries from BMW and Romeo Power Inc., Lion is targeting customers in the telecommunications utility sector, along with restaurant and food industries, last-mile, and medium-mile delivery services. To help customers take advantage of environmental incentives for going electric, Lion has a dedicated team focused on grants.

"Cost is a huge factor as a point of entry for a lot of customers," says Sydney Dunn, vice president of U.S. truck sales. "We also have Lion Energy, which focuses on [helping] customers [understand] what their charging infrastructure needs may be as it relates not only to our trucks, but also to any other EV adoption and vehicles that they have in their fleet."

This process entails figuring out the right types of charging infrastructure customers may need, looking at their current fleet, the way they're operating and helping them understand what type of battery packs they need on their trucks.

"It's about offering a holistic consultative approach to the way that they're managing their fleet and offering them those options," explains Dunn. "We want to understand their entire landscape and what their barriers and hesitations may be internally."

Part of that education process includes helping companies understand what their options are for the second lives of the vehicle batteries, once the useful lifecycle for the actual vehicle is over.

"The battery still has so much value in it," Dunn points out. "We're trying to get customers to think differently about what happens at the end of the lifecycle of the vehicle.”

According to Dunn, that initiative goes to the heart of the environmental issues that electric-powered drivetrains are trying to address.

"The main thing is we are helping our customers meet their ESG (environmental, social and governance) goals," Dunn says. "How can we as an industry also look at this journey differently?"

Keep on Truckin'

The twin issues that all truck manufacturers must solve are: How far can you go and how fast can you charge?

"It's not just the batteries,” says Gartner’s Pacheco. “The batteries are the most important piece, but it's also about the overall efficiency of the vehicle. How efficiently does it spend the energy stored in the battery?"

This requires the development of high-voltage circuits that range between 800 and 900 volts.

"It's about the thermal management of the vehicle, in terms of thermal management of the battery and other components of the power train," explains Pacheco. "It's about aerodynamics, which also matters a lot, even in a truck."

Engineers must address all these factors, because truckers will often find themselves in situations where driving range is poor, which means every little bit of power counts.

"Truck manufacturers have an advantage, because they can look to passenger car technology, which is more advanced,” Pacheco points out. “They need to source that technology. A truck maker that has a good relationship with a major player in passenger car EVs can benefit."

In the end, it is much easier to transfer technology from a passenger car application to a truck, rather than having to reinvent the wheel. Yet, despite the formidable list of challenges facing electric truck manufacturers, there remains a steady sense of optimism in the industry.

Mack's Barraclough says given the customer interest he's seen in the veteran truck company’s first electric product and its performance on the job, he can’t help but be optimistic about the future of electric commercial vehicles. "There is great potential for further innovation, which will make EVs an even more attractive alternative," he concludes.