U.S. manufacturers have faced significant headwinds this year: supply chain problems, a skilled labor shortage, inflation, and the war in Ukraine. And yet despite these issues—or perhaps, because of them—manufacturers continued to invest in people, plants and equipment.

Indeed, the push to boost domestic supply of things like microchips, medical devices and electric vehicles is propelling reshoring and foreign direct investment (FDI). In 2021, job announcements related to reshoring and FDI totaled 260,000, a record high, according to the Reshoring Initiative. That trend continued through the first half of this year. In fact, the Reshoring Initiative predicts that the total number of jobs created through reshoring or FDI will hit set a new record at 350,000 in 2022. If that projection is achieved, 2022 will bring the total number jobs announced since 2010 to more than 1.6 million.

Federal jobs data backs that up. U.S. manufacturers employed 12,922,000 people in October, according to the Bureau of Labor Statistics (BLS). That’s 4 percent more than in October 2021 and 13 percent more than in April 2020, the manufacturing employment low point of the COVID recession. The U.S. has now regained all the manufacturing jobs lost during the pandemic shutdowns and added an extra 137,000 jobs to boot. In fact, October’s manufacturing employment total is the highest since November 2008.

IMI Sales Leads, which tracks capital project activity in the U.S. and Canada, provides further evidence of robust investment in North American manufacturing in 2022. The consulting firm reports that 130 new “industrial manufacturing” projects were announced in October. That total consists of 40 new-construction projects, 48 expansions, and 42 plant renovations or equipment upgrades.

Fifteen of those projects represent investments of $100 million or more. The largest of those was announced by chip maker Micron Technology Inc., which is investing $100 billion to build a new manufacturing facility in Clay, NY.

IMI Sales Leads reported 450 new projects in the third quarter of 2022.

Manufacturers are investing in technology, too. Look at robots, for example. According to the Association for Advancing Automation, North American manufacturers spent $1.249 billion to purchase 23,903 robots in the first half of 2022. The dollar amount is 29 percent more than sales for the first half of 2021.

Or, consider the latest data from AMT—The Association for Manufacturing Technology. New orders for metal cutting, forming and fabricating equipment in the U.S. totaled $4.2 billion for the first nine months of 2022, a 3 percent increase over the same period in 2021. “Last year was the best on record…so it will be hard to match,” says Douglas K. Woods, president of AMT. “However, it’s possible we will come close.”

Manufacturers in every industry are investing in their operations. Just look at the Detroit Three automakers. In September, Ford Motor Co. announced that it will invest $700 million and add 500 additional hourly manufacturing jobs at its assembly plant in Louisville, KY, to support production of a new F-Series Super Duty pickup truck. A week earlier, General Motors said it will spend $760 million at its assembly plant in Toledo, OH, to prepare the facility for producing drive units for electric trucks. And, in August, Stellantis announced plans to invest $99 million in three North American assembly plants for production of a new four-cylinder turbocharged engine. Investments will be made at the Dundee Engine Complex in Michigan, the Kokomo Casting Plant in Indiana, and the Etobicoke Casting Plant in Toronto.

Other industries are spending, too. For example, in August, appliance manufacturer Sub-Zero Group Inc. said it will construct a 400,000-square-foot assembly plant in Cedar Rapids, IA. The $140.6 million project is expected to create 192 jobs. That same month, Milwaukee Tool opened a new assembly plant in West Bend, WI. The $55 million project is expected to create 150 jobs. And, in July, SHL Medical said it will spend $90 million to build a new assembly plant in North Charleston, SC, to make autoinjectors. The 270,000-square-foot facility is expected to create some 165 jobs.

Will investments like that continue into 2023? The results of our 27th annual Capital Equipment Spending Survey point to an increase in investments next year.

Spending to Increase

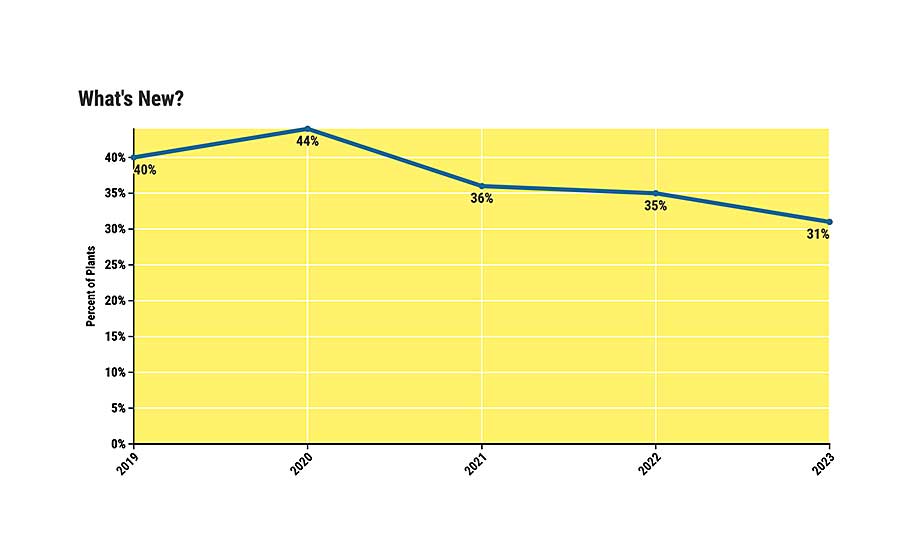

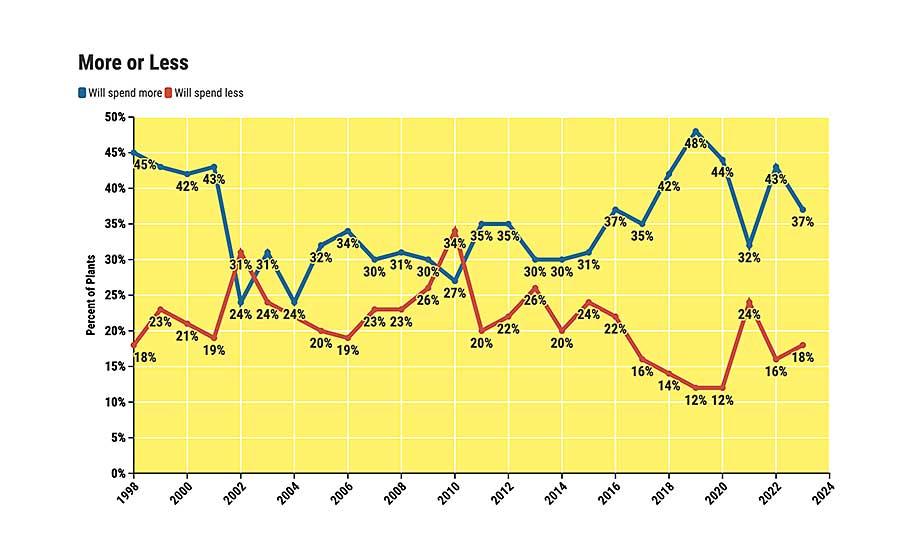

Some 37 percent of respondents will spend more on assembly technology next year than they did this year. That compares with 43 percent in last year’s survey, and it’s the ninth straight year in which that figure has topped 30 percent.

Conversely, just 18 percent of respondents will spend less in 2023 than they did 2022. It’s the sixth time in the past seven years in which that figure has been less than 20 percent.

Forty-five percent will spend the same in 2023 as they did in 2023.

Of those plants that will spend more, the average budget increase is 26 percent. Of those that plan to spend less, the average budget decrease is 34 percent.

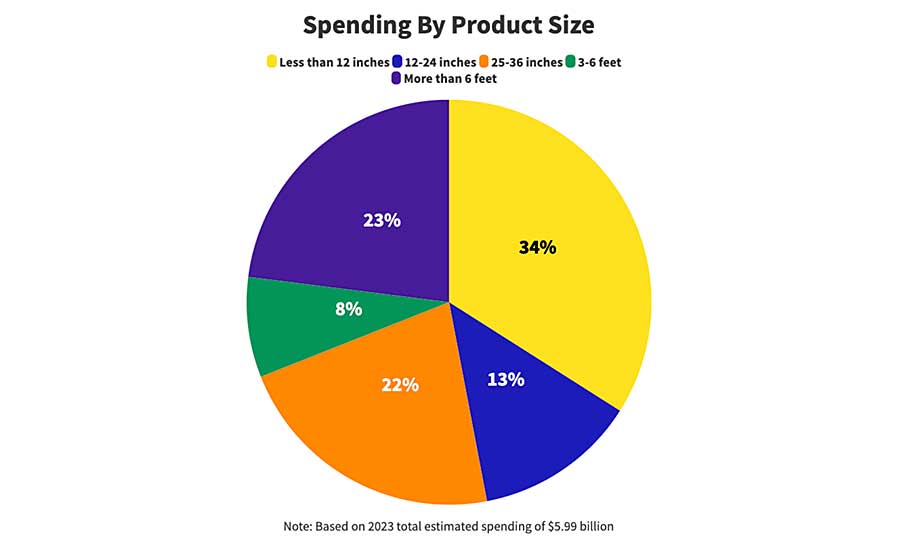

That’s not to say, however, that overall spending will increase that much. Our data indicate that U.S. assembly plants will spend $5.99 billion on new equipment in 2023, an increase of 6 percent from the $5.65 billion projected to be spent in 2022.

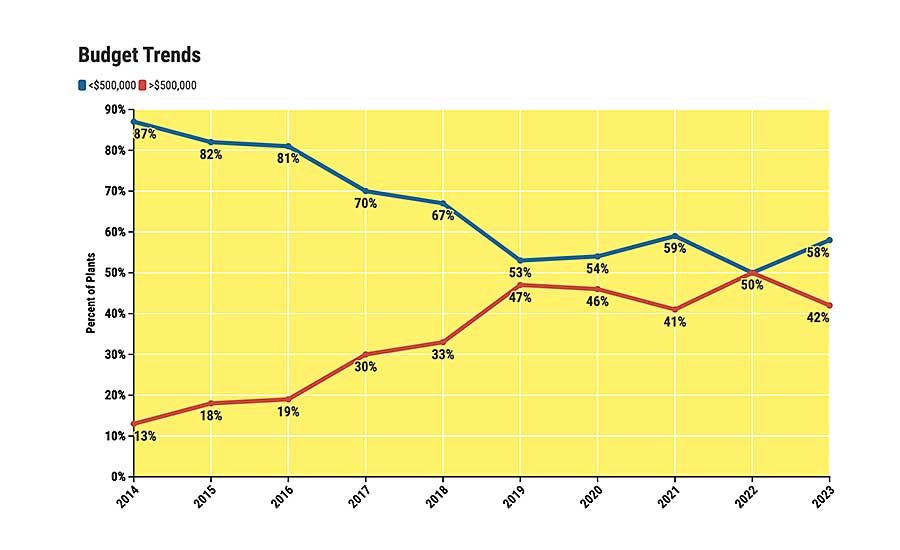

On average, manufacturers will spend $1,905,175 on assembly technology in 2023. That compares with $1,910,890 in 2022, and it’s the second highest average in survey history. The median budget total is $125,000. That’s less than the $220,000 figure in 2022, but it’s still the eighth largest median budget in survey history.

Aggregate budget data indicate growth in spending. For example, 35 percent of plants have capital budgets of at least $500,000 in 2023. That percentage has now exceeded 30 percent for five straight years. At the same time, 27 percent will spend between $100,000 and $499,999, up from 24 percent in 2022. Only 38 percent will spend less than $100,000 on assembly technology in 2023. That percentage has been under 40 percent in four of the past five years.

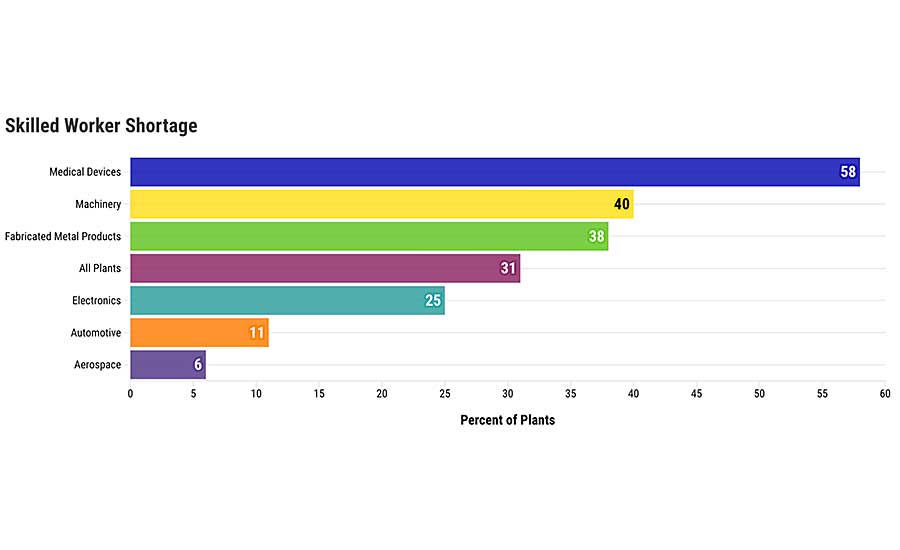

“2022 has been a good year for assembly and manufacturing overall, and we are expecting continued growth in 2023 for a variety of markets, including medical devices, electronics and EV component assembly,” says Jerry Perez, executive director for global accounts and manager for EST business development at FANUC America Corp. “A key reason for this growth is the ongoing labor shortage, which is driving increased demands for automation.

“In the medical device sector specifically, we are also seeing manufacturers looking to replace aging equipment that has been running for 20 years or more. This is in addition to new robot automation for new medical devices that are being scaled up in production.”

“2022 was a record sales year for us, beating our previous best by 23 percent,” says Glenn Nausley, president of Promess Inc., a manufacturer of electromechanical assembly presses and other technology. “November 2022 is actually the first month of our new fiscal year, and it was a record sales month for us. We are forecasting a strong December and January, too, so the strong sales should continue for a little longer at least. We are getting out of the gate fast for 2023.

“We do see some signs that activity will be slowing by midyear or so,” he continues. “This is mainly based on project discussions with some of our key customers. There are fewer projects being discussed for later in the year. We’ll see if that changes in the next months.”

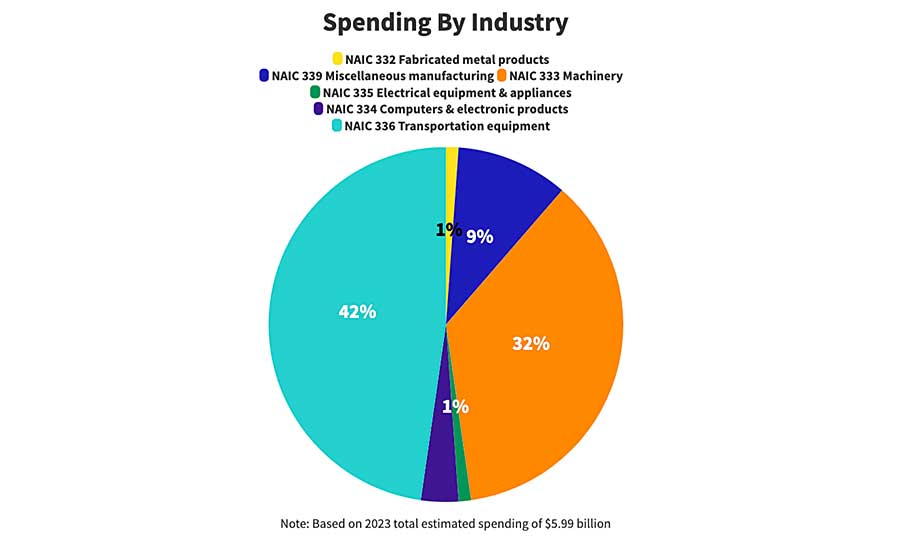

Automotive Continues to Lead

Driven by the ongoing transition from gas-powered vehicles to electric ones, the automotive industry is leading the way in capital investment. In fact, the industry will account for 42 percent of all spending next year. That’s more than any other industry, and it’s the highest share for this industry since 2019.

On average, automotive assemblers will spend $1,218,787 on capital equipment next year, or slightly less than the 2022 average of $1,290,045.

Those figures should not be surprising. Automotive OEMs across the U.S. and worldwide announced major investments throughout 2022. For example, in September, Toyota said it will invest an additional $2.5 billion in its newest North American assembly plant, Toyota Battery Manufacturing North Carolina in Liberty, NC. In October, auto parts manufacturer Joon Georgia Inc. reported that it will invest $317 million to build a new assembly plant in Statesboro, GA. The project is expected to create 317 jobs. And, in July, Magna International has opened a new 170,000-square-foot assembly plant in Duncan, SC, to produce exterior mirrors for BMW, Mercedes, Volvo and other OEMs. The new plant currently employs more than 250 employees, but that number is expected to grow to 400 over the next few years.

Cost reduction is a major concern for automakers. Some 78 percent of assemblers in the industry will buy equipment next year to cut costs. That compares with 50 percent for the nation as a whole, and it’s the most of any industry.

Like every other industry, the cost of direct and indirect labor are top concerns for automakers. But, other costs are significant, as well. For example, 33 percent of automakers are targeting energy costs for investment. That compares with 20 percent for the all U.S. plants, and it’s the most of any industry. That’s not too surprising, given that finishing and welding lines consume lots of energy.

Warranty costs are also an issue for the auto industry. Some 22 percent of automakers are targeting warranty and service costs for investment. That compares with 14 percent for the all U.S. plants.

The U.S. saw a record number of light-vehicle recall campaigns in 2021, though a smaller number of vehicles were affected, according to data from investment bank and advisory firm Stout. Individual recall campaigns reached a record high of 406 in 2021, while the total number of vehicles affected dropped to 21.6 million from 28.9 million over the same period.

This year is shaping up to be worse. Already, more than 14 million cars have recalled in the U.S. through the first half of 2022, for everything from faulty air bags to failing windshield wipers.

Medical Devices Provide Shot in the Arm

Medical device manufacturers could open their pocketbooks next year. Half the assembly plants in this industry will spend more next year than they did this year, the most of any industry.

On average, medical device manufacturers will spend $3,132,309 on capital equipment next year. That’s four times the industry average in 2022, and it’s the highest average of any industry.

One reason for the increased investment may be that the industry needs to boost capacity. Three-fourths of medical device assemblers will buy equipment next year to increase capacity. That compares with 56 percent for all U.S. plants, and it’s the most of any industry.

Quality, of course, is always an issue in medical device manufacturing. A third of assemblers in the industry will purchase equipment next year to meet more stringent quality standards—almost twice the national average.

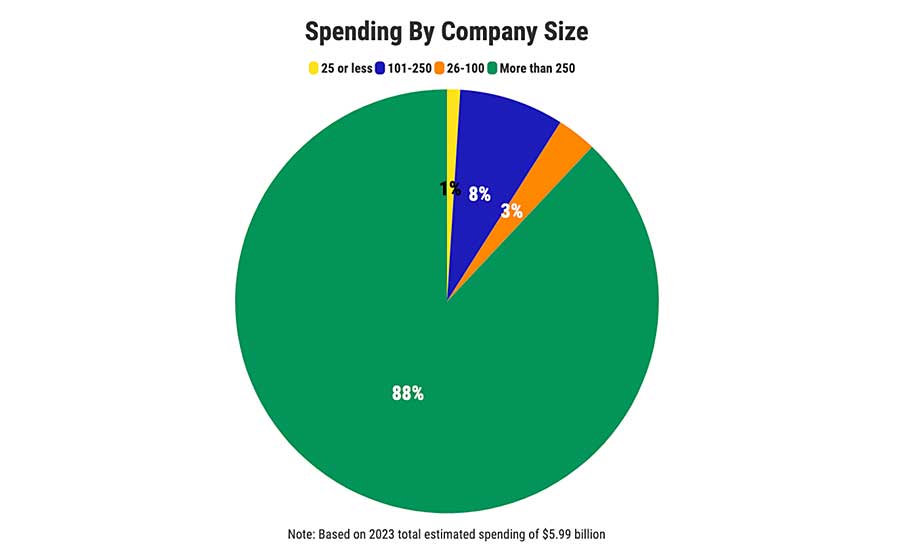

Largest Companies Drive Investment

Looking at spending plans by company size, it’s not surprising that larger companies will spend more than smaller ones. However, our data indicate that any increase in spending next year will be driven by the largest manufacturers.

Some 46 percent of companies with more than 250 employees will spend more next year than they did this year, while just 16 percent will spend less. Conversely, only 28 percent of companies with up to 100 employees will spend more in 2023 than they did in 2023, while 23 percent will spend less.

Looking at actual budget figures, companies with more than 250 employees will spend, on average, $3,659,974 on assembly technology next year—up from $3,093,904 in 2022. Conversely, the budget for companies with fewer than 25 employees will decrease from $137,169 in 2022 to $71,692 in 2023, while the budget for companies with 26 to 100 employees will increase from $438,786 to $355,753.

As a group, companies with more than 250 employees will account for 88 percent of total spending on assembly technology next year. That compares with 78 percent in 2022, and it’s the largest share for this group in survey history.

At the opposite end of the spectrum, companies with up to 100 employees will represent just 4 percent of spending in 2023. That’s the lowest share for this group since the recession year of 2001.

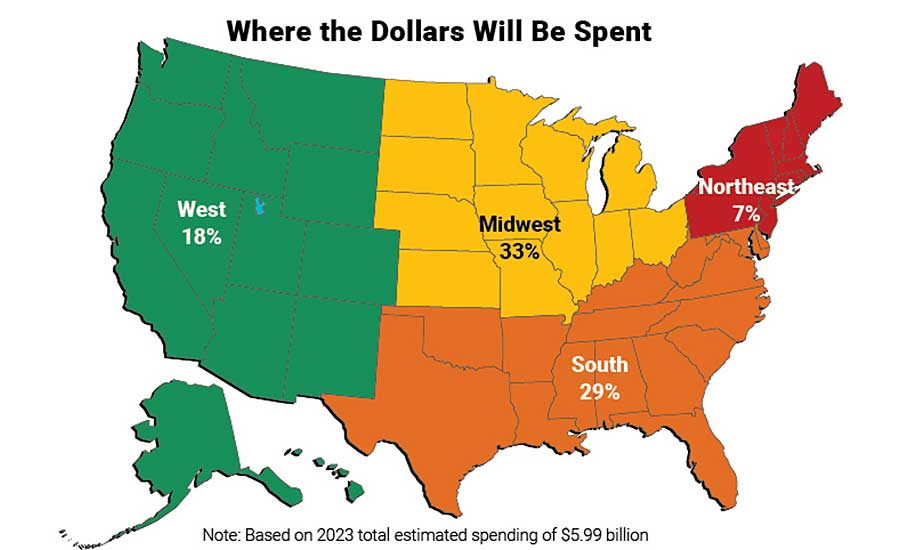

Spending by Region

The Midwest has traditionally been the epicenter of U.S. manufacturing, and that should continue next year. The region will account for 44 percent of spending in 2023, more than any other region. The Midwest has held that distinction for all but two years in our survey. On average, Midwestern manufacturers will spend $2,013,337 on assembly technology next year, up from $1,206,966 in 2022.

Clearly, the transition to EVs is fueling that investment. For example, in October, Our Next Energy announced plans to invest $1.6 billion to build a new battery cell manufacturing plant in Van Buren Township, MI. In June, Stellantis and Samsung said they will spend $2.5 billion to construct a new lithium-ion battery assembly plant in Kokomo, IN. The factory will produce battery cells and modules to supply Stellantis’ North American assembly plants. And in May, LG Energy Solution announced that it is investing $1.7 billion in its plant in Holland, MI, to increase production of lithium-ion polymer battery cells and packs for EVs by fivefold. The expansion will create more than 1,200 new jobs.

While the Midwest continues to dominate manufacturing, there’s little doubt that manufacturing investment is increasingly shifting to the South. The region will account for 31 percent of total spending next year, marking the fifth straight year the region has accounted for at least 30 percent of capital spending in the U.S.

On average, Southern assemblers will spend $2,365,767 on assembly technology next year. In fact, the average capital budget in the South has topped $800,000 for five straight years.

A sampling of headlines from this year reinforces that data. In June, for example, Kubota Manufacturing of America Corp. said it will invest $140 million to build a new assembly plant in Gainesville, GA, adding 500 workers to the 3,000 it already employs in the region. In April, Envision AESC said it will spend $2 billion to build a new assembly plant in Bowling Green, KY, to make battery cells and modules for electric cars for Mercedes and other OEMs. And in January, Roper Corp., a Haier company, said it will invest $118 million to expand its assembly plant in Lafayette, GA. The project is expected to create 600 jobs in Walker County.

The West is another region to watch. On average, assemblers in Washington, California, Arizona and other Western states will spend $2,095,250 on assembly technology next year. It’s the third straight year in which the average budget in the region has exceeded $1 million.

Aside from aerospace and electronics manufacturing, the region is fast becoming a hub for the EV and solar energy industries. For example, in March, Heliogen said it will build a new factory in Long Beach, CA, to develop, assemble and test heliostats and other components for its concentrated solar power system. And, in January, Swiss company Meyer Burger Technology began building a new assembly plant in Goodyear, AZ, to make high-performance solar modules. The project is expected to create 250 jobs, and more than 500 jobs at full capacity.

Robots to the Rescue

Robots continue to be deployed at a record pace. According to the International Federation of Robotics (IFR), an all-time high of 517,385 new robots were installed in factories around the world in 2021. This represents a growth rate of 31 percent year-on-year and exceeds the pre-pandemic record for robot installation in 2018 by 22 percent. Today, 3.5 million robots are operating in factories around the world.

“The use of robotics and automation is growing at a breathtaking speed,” says Marina Bill, IFR president and group vice president for robotics and discrete automation at ABB Inc. “Within six years, annual robot installations in factories around the world more than doubled. According to our latest statistics, installations grew strongly in 2021, although supply chain disruptions…hampered production.”

Our survey indicates that demand for robots will continue unabated next year. We expect sales of six-axis robots, SCARAs, grippers and other robotic technology to increase 20 percent, from $600 million in 2022 to $720 million in 2023.

Thirty-seven percent of plants will purchase robots next year, which ties the record high set in 2022. Demand for robots should be particularly strong in the automotive industry. More than half the plants in this industry expect to buy robots in 2023.

“After a record year for investments in manufacturing in 2022, the case for continued investments has never been stronger,” declares Milton Guerry, president of SCHUNK. “Companies are faced with numerous challenges, from supply difficulties to labor shortages. Technology investments are the best way to address the demand and free human capacity to be leveraged for highly cognitive tasks.

“The impressive results in ASSEMBLY’s Capital Spending Survey are no surprise,” he continues. “SCHUNK engineers and sales professionals are fielding record numbers of inquiries daily. …As uncertainties diminish in 2023, it is likely that the companies projecting to spend less will reassess and look to join the majority companies planning to invest more.”

A driving force behind the spike in demand for robots is the continued popularity of collaborative robots. Some 36 percent of assemblers are currently using the technology or plan to within the next year. An additional 17 percent expect to employ cobots within two to three years.

“Multiple market forces are continuing to drive sales of collaborative robots,” says Joe Campbell, senior manager for strategic marketing and application development at Universal Robots USA Inc.

“The first is the overall challenge in staffing manufacturing jobs. Dull, dirty and dangerous jobs are nearly impossible to fill, and are a natural fit for cobots. The labor challenge is compounded by significant reshoring activity.

“Large manufacturers continue to automate, and we see are increasing cobot investments from small- and medium-sized companies, as well.”

U.S. assembly plants will spend $5.99 billion on new equipment in 2023.

Keep it Moving

Another technology that should see an uptick in sales next year is conveyors and material handling equipment. Some 38 percent of assembly plants will invest in conveyors next year. That’s the most since 2018, and it’s the second highest percentage in the history of our survey.

Demand for conveyors will be particularly strong in the automotive, medical device and electronics industries. All totaled, sales of conveyors will increase 10 percent, from $130 million in 2022 to $143 million in 2023.

“2022 is turning out to be another record year and we are forecasting 2023 to be even busier,” , says Brian Shore, vice president of sales at Automation & Modular Components. “So much so, we are actively looking for additional shop space to allow us to increase our output and reduce lead times. We had to turn away a considerable amount of work because we were not able to meet the customers’ lead-time expectations.”

Single-Station Machines

Robots aren’t the only way assemblers can boost output from a limited workforce. Assemblers can also automate individual tasks like screwdriving, pressing and riveting.

Indeed, 52 percent of assemblers will invest in single-station assembly machines next year, a slight uptick from 2022 and the highest percentage since 2011. Demand for single-station machines will be highest in the aerospace, automotive, electronics and fabricated metal products industries.

Specifically, 27 percent will buy automatic screwdriving systems, 16 percent of plants will buy riveters, and 37 percent will buy presses. The latter two percentages are record highs.

“Over the last year, we have seen an increase in demand for riveting equipment and automation,” says Anthony Gianettino, general manager of BalTec Corp. “In particular, we have noticed an increase in business activity in the U.S. market, which is a positive sign for the future of manufacturing here in America. We haven’t yet seen the indicators of a downturn in our industry. We remain optimistic for the year ahead, encouraged by the long-range economic forecasts and the fact that many companies are making investments now to meet future demand.”

Jake Sponsler, president of Orbitform, is less optimistic. “Those are great statistics to see although a little different than what we are seeing,” he reports. “Activity levels for 2022 have been stable, but we have seen an increased number of customer delays on the timing of purchase order releases. Due to market uncertainty, we expect a flat year with lead activity similar to 2022, but delays in decisions to continue in 2023.”

All totaled, assemblers will spend $1.09 billion on single-station assembly machines next year, a 14 percent increase from 2022.

Test and Inspection

Sales increases are also expected for test and inspection technologies. Specifically, 45 percent of assemblers will purchase leak test instruments, electrical testers, torque testers and related equipment in 2023, compared with 38 percent in 2022. Similarly, 45 percent of assemblers will buy vision systems, gauges and other inspection technology next year, a slight uptick from 2022.

Demand for test equipment should be strongest in the aerospace, medical device, and electrical and appliance industries, while demand for inspection products will be highest in the electronics and medical device sectors.

“2022 was a good year, but not an exceptional one,” relates Jacques E. Hoffmann, president of InterTech Development Co., a supplier of leak and flow test instruments. “We developed some new products this year—the Universal Leak Tester and IP 67/68 test cells—which helped drive sales. Current inquiry and quote activity, as well as a backlog of orders, indicate that 2023 should be a very good year.”

All totaled, assemblers will spend $638 million on test and inspection technology next year, an 11 percent increase from 2022.

Parts Feeders

Although sales of multistation automated assembly systems are expected to hold steady in 2023, sales of parts feeding equipment should increase. Some 27 percent of plants will purchase bowl feeders, step feeders, flex feeders and other technology next year, the highest percentage since 2009.

Demand for feeders will be strongest in the automotive, medical device and fabricated metal products industries.

“Overall, we will be increasing our shipments this year by about 10 percent,” boasts Greg Pflum, president and CEO of Performance Feeders Inc. “Our sales projections for next year are a little higher than that, because we are expanding into some new areas.”

All totaled, assemblers will spend $99 million on feeders next year, a 10 percent increase from 2022.

Survey Methodology

ASSEMBLY magazine is sent to 33,000 assembly professionals, 92 percent of whom are in the U.S.

The survey was conducted in conjunction with Clear Seas Research, an affiliate of BNP Media, ASSEMBLY magazine’s parent company. Clear Seas is a full service, B-to-B market research company. Custom research products include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

Questionnaires were e-mailed in mid-August to a random sample of 19,506 subscribers in management positions. Forty-one percent of respondents were engineers; 54 percent were management; and 5 percent were classified as purchasing or “other.”

The cutoff date for returning the surveys was Sept. 1. Some 240 surveys were returned for a response rate of 1 percent.

The survey was sent to manufacturers in the following industries: aerospace, electronics, appliances, fabricated metal products, furniture, machinery, medical devices, plastics and rubber products, automotive, energy and miscellaneous manufacturing.

Geographically, 16 percent of respondents were located in the Northeast, 46 percent were in the Midwest, 27 percent were in the South, and 12 percent were in the West.

Eighteen percent of respondents had 25 employees or less. In addition, 18 percent had 26 to 100 employees, 17 percent had 101 to 250 employees, and 47 percent had more than 250 employees.

Twenty-two percent of respondents assemble products that can fit inside a 12-inch cube, 18 percent make products that can fit inside a 24-inch cube, 19 percent make products that fit inside a 36-inch cube, 19 percent make products that fit inside a 6-foot cube, and 22 percent make products that are larger than a 6-foot cube.

To purchase and download the entire capital spending report, please visit https://clearseasresearch.com. You can also email info@clearmarkettrends.com with any questions.