For the 15th consecutive year, the Midwest will spend more on assembly technology than any other region.

General Motors Co. announced a $190 million investment in its Lansing (MI) Grand River Assembly Plant. The investment will create 600 jobs and result in the addition of a second shift. Since emerging from bankruptcy in July 2009, GM has invested more than $3.1 billion in its U.S. facilities and created or retained more than 7,900 jobs in 21 U.S. plants.

Not to be outdone, Chrysler Group LLC announced that it will invest $850 million in its Sterling Heights, MI, assembly plant, $150 million in its Dundee, MI, engine plant, and $600 million in its Belvidere, IL, assembly plant. Since it reformed in June 2009, Chrysler has poured some $2.1 billion into its U.S. facilities.

For its part, Ford Motor Co. said it would invest an additional $850 million in Michigan between 2011 and 2013 as part of the company’s commitment to grow its engineering and manufacturing employee base, upgrade its facilities in the state, and improve vehicle fuel economy. Ford’s investment will generate up to 1,200 new full-time manufacturing and engineering positions in Michigan by 2013.

And that was just the Big Three automakers. If a company made something that rolls, floats or flies, management was writing a check:

• Progress Rail Services, a subsidiary of Caterpillar Inc., revealed plans to locate a $50 million locomotive factory in Muncie, IN, creating up to 650 jobs by 2012.

• Navistar Inc. announced plans to renovate its 69-year-old diesel engine assembly plant in Melrose Park, IL.

• Manufacturing startup Current Motor Co. launched production of electric scooters at a new assembly plant in Ann Arbor, MI.

• Ranger Boats announced a $13 million expansion of its assembly plant in Flippin, AR, creating 115 jobs.

• Boeing Co. installed the final steel girder for a new $750 million assembly plant in North Charleston, SC. The plant, which will employ some 3,800 workers, is expected to deliver its first 787 in early 2012.

With news like that, the results of our 15th annual capital equipment spending survey come as no surprise. Manufacturers of all stripes-particularly those assembling cars, planes and other big things-will spend more on assembly technology next year than they did this year. Specifically, U.S. assembly plants will spend $2.89 billion on new equipment in 2011. That’s an increase of 22 percent from the $2.36 billion projected to be spent in 2010, and it ties the high water mark for capital spending set in 2009.

Some 35 percent of respondents will spend more on assembly technology next year than they did this year. That’s the highest percentage in a decade. Conversely, only 20 percent of respondents will spend less in 2011 than they did 2010. That compares with 34 percent in last year’s survey, and it’s the lowest percentage since 2006.

Actual budget figures indicate that larger companies that had cut back in previous years are ready to spend again in 2011. For example, 18 percent of respondents will spend more than $500,000 on assembly technology in 2011, compared with 13 percent in 2010.

However, only 22 percent of respondents will spend between $100,000 and $500,000 in the coming year. That compares with 26 percent in 2010 and 28 percent in 2009. At the same time, 61 percent of plants will spend less than $100,000 on new equipment in 2011, which is about the same percentage as in 2010. In other words, many companies with middle-of-the-road budgets in 2010 will significantly boost spending in 2011.

The average budget decreased 21 percent, from $829,094 in 2010 to $657,451 in 2011. However, the median budget for 2011 is the same as it was in 2010: $50,000.

One reason assemblers will spend more in 2011 is because they didn’t spend as much as they wanted to this year. As they did in 2009, when the recession was at its worst, manufacturers cut back on planned spending in 2010. Less than half (44 percent) of assembly plants spent at least 70 percent of their 2010 capital equipment budgets and 25 percent of plants spent less than 40 percent of their budgets for the year.

As a whole, assemblers spent, on average, just 59 percent of their 2010 budgets, which ties the record low set last year. By way of comparison, assemblers spent an average of 67 percent of their 2008 budgets and 79 percent of their 2002 budgets.

Assemblers may be willing to spend more on capital equipment next year, but they also expect a quick return on their investment. Only 32 percent of respondents have an ROI period of two years or more. That compares with 49 percent last year, and it’s the smallest percentage in the history of our survey. One-fourth of respondents expect to see a return in 12 months or less.

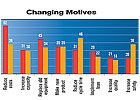

For the first time since we began our survey back in 1996, cost reduction is not the No. 1 reason for buying assembly equipment.

Spending Motives

For the first time since we began our survey back in 1996, cost reduction is not the No. 1 reason for buying assembly equipment. In fact, it’s not even the No. 2 reason. Instead, assemblers named cycle time reduction and safety improvements as their top two reasons for investing in assembly technology.Only 38 percent of plants will buy equipment next year to cut costs, the lowest percentage in the history of our survey. In comparison, 62 percent wanted to cut costs in 2010. At the same time, 46 percent of plants are getting equipment to reduce cycle time or eliminate a bottleneck. That compares with 31 percent in 2010, and it’s the highest percentage in survey history.

The No. 2 reason for buying equipment is safety improvement. In 2010, only 20 percent of plants bought equipment to boost safety and ergonomics. Next year, almost twice as many will do so.

Other reasons are changing, too. For example, over the past six years, the percentage of plants looking to replace old or worn-out equipment has remained around 45 percent. Next year, however, only 34 percent of plants are replacing old machinery. Similarly, only 30 percent of plants-a record low-are buying equipment to boost capacity. A decade ago, that figure was 54 percent.

Other motives for buying equipment include:

• assembling a new product, 35 percent.

• implement lean manufacturing, 22 percent.

• increase quality, 18 percent.

The No. 1 target for cost reduction in 2011 remains direct labor. However, assemblers continue to be concerned about warranty costs. Twenty-four percent of plants will buy equipment to lower warranty costs, a record high for our survey.

Assemblers are less concerned about scrap and material costs than they are about getting product out the door. Some 33 percent of assemblers are looking to reduce scrap costs and just 16 percent want to lower the cost of materials. Both are record lows for our survey.

At the same time, 31 percent of plants want to reduce the cost of work-in-process (WIP) inventory. That compares with 23 percent in 2010 and it’s the highest percentage since 2002.

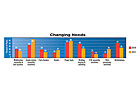

Sixty-four percent of plants will purchase single-station assembly machines next year, a record high for this technology.

What Assemblers Want

Although assemblers will be increasing capital investment next year, don’t expect them to sink money into expensive, lights-out automation projects. Rather, assemblers are looking to make targeted investments in equipment to automate specific processes or tasks.For example, 64 percent of plants will buy single-station assembly machines next year. That compares with 54 percent in 2010, and it’s a record high for this technology. In fact, for the first time in survey history, single-station assembly machines are the No. 1 technology on manufacturers’ shopping lists.

All totaled, assemblers will spend $419.3 million on presses, automatic screwdriving and nutrunning equipment, automatic riveting equipment, and other single-station assembly machines in 2011, a 78 percent increase over 2010.

Along the same lines, more assemblers will be buying robots next year. Some 27 percent of respondents will purchase robots in 2011, a record high for this technology. All totaled, spending on Cartesian, SCARA, six-axis and delta robots will increase by 5 percent, from $124.1 million in 2010 to $130 million in 2011.

That prediction would seem to match what’s already happening in the robotics industry. According to the latest figures from the Robotic Industries Association, sales of robots in North America totaled $618.4 million for the first nine months of 2010, a 45 percent increase over the same period in 2009.

“Overall, 2010 has been a solid recovery year for the robotics industry in North America,” says Jeff Burnstein, president of the RIA. “What really jumps out at me is that orders placed by nonautomotive customers...jumped 53 percent and accounted for 52 percent of all orders through September.

“Orders from automotive-related customers...increased 18 percent, which is still quite healthy, given the downsizing in North American automotive manufacturing operations.”

Dispensing is another assembly process where relatively small investments can yield big savings in labor and material costs, and spending on technology to dispense epoxy, grease, tape and other materials is expected to increase for the third straight year in 2011. Indeed, one out of every three assembly plants will buy dispensing equipment next year, up from 29 percent in 2010.

All totaled, assemblers will spend $134.6 million on time-pressure dispensers, meter-mix equipment, curing lamps, tape dispensers and related technology next year. That’s a 58 percent increase from 2010, and it’s a record high total for this technology.

Another technology that could enjoy strong sales gains next year is motion control. Three factors could be behind this trend. First, manufacturers are investing in energy-efficient motors and other technologies to comply with various provisions of the Energy Independence and Security Act of 2007, which are scheduled to go into effect at the end of this year. Second, acting on lean manufacturing principles, assemblers are increasingly designing and building their own small, custom automation projects using preconfigured, modular components. And third, assemblers are taking advantage of advances in servo control to create flexible assembly systems.

In any case, 20 percent of respondents plan to buy motion control technology in 2011, compared with 13 percent in 2010. All totaled, sales of energy-efficient electric motors, programmable pick-and-place units, linear slides and other motion control devices will increase 79 percent, from $36.8 million in 2010 to $65.8 million in 2011.

Given the high-profile recalls over the past two years, as well as the U.S. Food and Drug Administration’s push to implement a Unique Device Identification database, we expected assemblers to invest in automatic identification technology next year, and that’s exactly what our data revealed.

Some 31 percent of plants will buy auto ID technology next year, which is about the same percentage as 2010. However, assemblers will be devoting a larger portion of their budgets to the technology. All totaled, assemblers will spend $138.7 million on radio frequency identification equipment, bar code scanners, label printers, dot-peen markers and other auto ID technology next year. That’s a 46 percent increase from 2010 spending.

Only three technology categories are expected to see a decrease in sales in 2011: power tools, computers and software, and test equipment.

Power tools, which had held the top spot on factory shopping lists for the past three years, are now the second-most popular assembly technology. Whereas 69 percent of plants were expected to buy handheld screwdrivers, nutrunners and riveting tools in 2010, just 58 percent will do so next year. While that’s still a sizeable percentage, assemblers will not be spending as much money on tools as they once did. All totaled, assemblers will spend $127.7 million on power tools next year, 28 percent less than they spent in 2010 and a record low total for the technology.

The biggest drop in sales will be in computers and software. In 2010, 53 percent of assembly plants were expected to buy computers, programmable logic controllers, manufacturing execution systems, CAD software and similar technologies. Next year, only 35 percent will do so.

Funds for these technologies are also down. In 2010, assembly plants spent $189.9 million on computers and software. Next year, they will spend 33 percent less, or $127.4 million.

Spending on test equipment is also expected to decrease. Some 42 percent of plants will invest in various technologies to check the integrity and functionality of assemblies in 2011, down from 50 percent in 2010. In all, spending on test equipment will go from $174.9 million in 2010 to $152.9 million in 2011. That’s a decrease of 13 percent, and it’s the second straight year of declining sales for this technology category.

Perhaps testing is becoming less important to assemblers. In 2008, 68 percent of plants performed some sort of product testing, whether it be a leak test of a fuel tank or a hi-pot test of a wire harness. In 2009, 66 percent of plants tested their products. This year, only 61 percent of plants did so.

Although plants with more than 500 employees represent just 10 percent of ASSEMBLY’s readership, they will account for 58 percent of total spending next year.

Size Matters

According to our survey, the economic downturn affected smaller companies much harder than larger ones. In 2007, companies with fewer than 100 employees accounted for 31 percent of total spending on assembly technology. Since then, however, small companies have held a smaller and smaller share of the pie.Even though companies with fewer than 100 employees represent 64 percent of ASSEMBLY’s readership, they will account for just 7 percent of total spending next year, their lowest share since 2004. In terms of dollars, small manufacturers will spend $202.2 million on assembly technology in 2011, 29 percent less than they spent in 2010.

Indeed, 24 percent of companies with fewer than 100 employees will spend less in 2011 than they did in 2010. Amazingly, that’s a higher percentage than last year, and it’s four percentage points higher than the percentage for the nation as a whole.

Not one company with fewer than 100 employees reported an equipment budget of $1 million or more for 2011. That’s happened only once before in our survey, the recession year of 2001.

On the flip side, the nation’s biggest companies appear to have rode out the storm and are ready to turn stockpiled cash into productivity-enhancing assets. Indeed, 47 percent of companies with 250 to 500 employees and 38 percent of companies with more than 500 employees say they’ll spend more on assembly technology next year than they did this year. Both figures are higher than the percentage for the nation as a whole.

Whereas companies with more than 500 employees represent just 10 percent of ASSEMBLY’s readership, they will account for 58 percent of total spending in 2011. Indeed, 46 percent of all manufacturers with million-dollar capital equipment budgets are companies with more than 500 employees. On average, our largest companies will spend more than $3.41 million on assembly technology in 2011-more than five times the average for all plants.

All totaled, companies with more than 500 employees will spend $1.67 billion on assembly technology in 2011, up 8 percent from 2010.

Similarly, companies with 250 to 500 employees will also boost capital outlays next year. On average, these companies will spend $832,607 on assembly technology in 2011, compared with $532,273 in 2010.

As a whole, companies with 250 to 500 employees will account for 20 percent of total spending next year, up from 13 percent in 2010. These companies will boost spending on assembly technology by 88 percent, from $306.8 million in 2010 to $578 million in 2011.

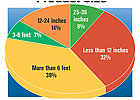

After accounting for just 12 percent of total spending in 2010, manufacturers of products that fit inside a 12-inch cube will represent 32 percent of spending next year.

All Products Large and Small

From 2004 to 2008, manufacturers of small products-assemblies that fit inside a 12-inch cube-had always accounted for the lion’s share of total equipment spending. Then, the recession hit. Even though small-product manufacturers represent a third of ASSEMBLY’s readership, they accounted for just 12 percent of spending in 2010, the lowest share for this group in the history of our survey.Next year, however, small-product manufacturers will be back near the top, accounting for 32 percent of total spending. Collectively, these manufacturers will spend $924.8 million on assembly technology in 2011. That’s more than three times what this group spent in 2010, and it’s second only to manufacturers of very large products (assemblies larger than a 6-foot cube).

On average, small-product manufacturers will spend $954,064 on capital equipment in 2011. That compares with $657,451 for all plants, and it’s the biggest average of any product-size group.

If small-product manufacturers did allocate fewer dollars to assembly technology in 2010, at least they spent most of what they planned. Some 31 percent of these manufacturers spent at least 90 percent of their 2010 capital budgets. That compares with 21 percent for all plants.

As might be expected, small-product manufacturers have different reasons for buying equipment than manufacturers of larger products. For example, small-product manufacturers are less interested in getting lean (15 percent vs. 23 percent for all plants), increasing quality (13 percent vs. 18 percent for all plants), or improving safety (29 percent vs. 38 percent for all plants).

They also have different cost concerns than other manufacturers. For example, small-product manufacturers are less worried about indirect labor costs (36 percent vs. 41 percent for all plants), warranty costs (17 percent vs. 25 percent for all plants), and material costs (7 percent vs. 16 percent for all plants).

Compared with other assembly plants, small-product manufacturers are also more likely to use semiautomatic equipment (74 percent vs. 68 percent for all plants), programmable automation (49 percent vs. 36 percent for all plants), and fixed, or “hard-tooled,” automation (28 percent vs. 19 percent for all plants).

Like small-product manufacturers, assemblers of very large products also lost prominence in 2010. Next year, however, will be a different story.

Forty percent of large-product assemblers will spend more on assembly technology next year than they did this year. Only 16 percent will spend less.

Although they represent 24 percent of ASSEMBLY’s readership, manufacturers of products larger than a 6-foot cube will account for 38 percent of total spending in 2011.

Sixteen percent of plants in this category will spend $250,000 to $999,999 on assembly technology next year, compared with 12 percent for all plants. Collectively, these manufacturers will spend $1.09 billion assembly technology next year, more than twice what they spent in 2010.

Compared with other plants, large-product assemblers are buying equipment to increase quality (27 percent vs. 18 percent for all plants), get lean (30 percent vs. 23 percent for all plants), reduce cycle time (52 percent vs. 46 percent for all plants), and improve safety (57 percent vs. 38 percent for all plants).

These manufacturers are also more concerned about the cost of WIP (41 percent vs. 31 percent for all plants), scrap (38 percent vs. 33 percent for all plants), and materials (22 percent vs. 16 percent for all plants).

Not surprisingly, large-product manufacturers are more likely to use manual assembly methods (91 percent vs. 84 percent for all plants) and less likely to use fully automated systems (25 percent vs. 36 percent for all plants).

Machinery manufacturers will account for 19 percent of total spending next year, almost twice what they contributed in 2010.

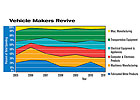

Transportation Equipment

There can be little doubt that the increase in capital spending next year will be led by manufacturers of transportation equipment (NAIC 336). Only 15 percent of plants in this industry will spend less next year than they did in 2010-the lowest such percentage of any industry.All totaled, manufacturers of cars, planes, motorcycles, trucks, boats and missiles will spend $859.9 million on assembly technology in 2011. That’s $347 million more than any other industry, and it’s 58 percent more than NAIC 336 spent in 2010.

The transportation equipment industry will account for 31 percent of total spending next year. That’s the biggest share of any industry, and it’s the fourth straight year that this industry has held that distinction.

Twelve percent of transportation equipment manufacturers will spend at least $1 million on assembly technology next year, compared with 15 percent in 2010. However, 22 percent of plants will spend between $250,000 and $1 million, compared with 17 percent in 2010. The mean 2011 budget for manufacturers in this industry is $806,346, almost $150,000 more than the national average.

Much of that cash may be leftover from this year. Only 11 percent of manufacturers in NAIC 336 have spent at least 90 percent of their 2010 capital budgets. That compares with 21 percent for all plants, and it ties the record low for this industry set in 2007.

If the recession can be said to have a bright side, it has apparently enabled manufacturers of transportation equipment to get their costs under control. Some 43 percent of plants in NAIC 336 are buying equipment to reduce costs. That’s still the highest percentage of any industry, but it’s an all-time low for NAIC 336. To put that figure in perspective, 65 percent of plants in NAIC 336 bought equipment to cut costs in 2010 and 56 percent did so in 2009.

Another encouraging sign is that this industry is preparing to introduce new products. Some 41 percent of plants are buying equipment to assemble a new product. That compares with 36 percent in 2010 and 35 percent for all industries next year.

Compared with other industries, manufacturers in NAIC 336 are more likely to buy test equipment (56 percent vs. 42 percent for all plants), inspection equipment (49 percent vs. 42 percent for all plants), wire processing equipment (38 percent vs. 30 percent for all plants), and workstations and ergonomic accessories (41 percent vs. 35 percent for all plants).

They’re also less likely to buy used or rebuilt equipment. Manufacturers in NAIC 336 will supply an average of 27 percent of their operational needs with used or rebuilt equipment in 2011, compared with 34 percent for all industries.

For the fourth straight year, the transportation equipment industry will claim the biggest share of total spending.

Machinery Manufacturing

In 2009, only 20 percent of machinery manufacturers (NAIC 333) expected to spend more on assembly technology in the coming year. What a difference a year makes! Now, 42 percent of machinery manufacturers plan to spend more in 2011 than they did in 2010, the highest percentage for this industry since 2001.As a group, assemblers of lawn tractors, printing presses, photocopiers, pizza ovens, elevators and turbines will account for 19 percent of total spending next year, up from 10 percent in 2010. In terms of dollars, the industry will spend $549.1 million on assembly technology in 2011, more than twice what it spent this year.

Some 23 percent of plants will spend at least $1 million next year. In fact, manufacturers in this industry will spend an average of $1.23 million on assembly technology in 2011. That’s the biggest average of any industry in 2011, and it’s the largest average for NAIC 333 in six years.

For machinery makers, the No. 1 reason to buy equipment in 2011 is to assemble a new product. Indeed, 48 percent the plants in this industry will buy equipment next year for that reason, more than any other industry.

Machinery makers are also looking to replace old and worn-out equipment. Nearly half the plants in this industry cite that as a reason for buying assembly technology in 2011. That compares with 34 percent for all plants, and it marks the seventh straight year that NAIC 333 has exceeded the percentage for the nation as a whole.

Indirect labor costs remain a concern in this industry. Some 56 percent of plants in NAIC 333 are looking to reduce the cost of set-up, maintenance and related labor expenses. That’s more than any other industry, and it’s the second straight year that NAIC 333 has held that distinction.

Compared with other industries, manufacturers in NAIC 333 are more likely to buy dispensing equipment (42 percent vs. 33 percent for all plants), automatic screwdriving equipment (62 percent vs. 39 percent for all plants), robots (42 percent vs. 27 percent for all plants), and test equipment (50 percent vs. 42 percent for all plants).

Manufacturers in NAIC 333 aren’t looking for quick payback on this equipment. In fact, 88 percent have an ROI period of more than 12 months. In comparison, that figure is just 67 percent for electronics manufacturers and 75 percent for the nation as a whole.

If machinery makers cut their capital budgets in 2010, at least they spent most of what they wanted. Thirty-four percent of plants spent at least 90 percent of the 2010 budgets, the highest figure for this industry since 2004.

Twelve percent of plants will spend at least $1 million on assembly technology next year, the most since 2004.

Computers and Electronics

If you’re looking for factories with million-dollar equipment budgets, you won’t find many in the computer and electronics industry (NAIC 334). Indeed, only 7 percent of all plants with million-dollar budgets are in NAIC 334. That’s the lowest percentage of any industry, and it’s the second straight year NAIC 334 has held that distinction.However, that’s not to say that spending in this industry won’t be respectable. Indeed, assemblers of clocks, disk drives, telephones, radar equipment, thermostats, microchips and other electronic equipment will account for 19 percent of total spending next year, about the same as in 2010.

All totaled, equipment spending in NAIC 334 will increase 29 percent, from $424.8 million in 2010 to $549.1 million in 2011. Some 22 percent of plants will spend between $250,000 and $1 million, with an average budget of $365,835. In 2010, the average budget was just $110,630.

One reason for the lack of seven-figure budgets may be that this industry has too much capacity. Only 18 percent of plants in NAIC 334 are buying equipment to increase capacity next year. That compares with 24 percent in 2010 and 46 percent in 2009, and it’s an all-time low for this industry.

Warranty issues are a nagging problem in this industry. Twenty-seven percent of plants in NAIC 334 are worried about warranty costs. That’s the highest percentage of any industry, and it marks the fourth time in eight years that NAIC 334 has held that distinction.

Compared with other industries, manufacturers in NAIC 334 are more likely to buy power tools (70 percent vs. 58 percent for all plants), welding and soldering equipment (44 percent vs. 32 percent for all plants), computers and software (45 percent vs. 35 percent for all plants), and packaging equipment (44 percent vs. 35 percent for all plants).

Some of that equipment might well be used. Compared with other industries, plants in NAIC 334 are much more likely to buy used or rebuilt equipment. Next year, these manufacturers will fulfill 43 percent of the operational needs with used or rebuilt equipment. That’s the largest percentage of any industry, and it’s the second straight year that this percentage has exceeded 40 percent.

Some 35 percent of plants will spend more on assembly technology next year than they did this year, the highest percentage in a decade.

Fabricated Metal Products

Last month, can manufacturer Impress USA opened a new factory in Conklin, NY. The facility will initially employ 65 full-time workers, and that figure could double within a few years.According to our survey data, investments like that should continue next year among manufacturers in the fabricated metal products industry (NAIC 332).

In fact, 8 percent of plants in this industry will spend more than $1 million on assembly technology next year, compared with 5 percent in 2010. The average budget in this industry will go from $182,344 in 2010 to $415,276 in 2011.

As a group, manufacturers of windows, cans, springs, bearings, guns and other products will spend $260.1 million on capital equipment in 2011, accounting for 9 percent of total spending.

Among manufacturers in NAIC 332, the No. 1 reason for buying equipment in 2011 is reducing cycle time. More than half (51 percent) the plants in this industry will get equipment next year to reduce cycle time or eliminate a bottleneck. That’s more than any other industry, and it’s the second time in three years that this industry has that distinction.

Compared with other industries, manufacturers in NAIC 332 are more likely to buy automatic riveting equipment (47 percent vs. 30 percent for all plants), robots (32 percent vs. 27 percent for all plants), auto ID technology (36 percent vs. 31 percent for all plants), motion control technology (25 percent vs. 20 percent for all plants), and workstations and ergonomic aids (40 percent vs. 35 percent for all plants).

Assemblers are less concerned about scrap and material costs than they are about getting product out the door.

Electrical Equipment and Appliances

In September, Whirlpool Corp. announced that it will build a $120 million assembly plant in Cleveland, TN. When complete, the 1-million-square-foot facility will produce premium built-in cooking products.The new building will replace a 100-year-old manufacturing plant less than seven miles away. Whirlpool will also build a 400,000-square-foot distribution facility on the site of the new plant, adding 130 new positions to the existing 1,500 manufacturing employees.

Whirlpool will not be the only company in the electrical equipment industry (NAIC 335) that will be investing in new facilities and equipment next year. Indeed, 42 percent of plants in this industry will spend more on assembly technology in 2011 than they did in 2010. (On the other hand, 28 percent say they’ll spend less next year, which is the most of any industry.)

On average, assemblers of lamps, refrigerators, mixers and other electrical products will spend $1.1 million on capital equipment in 2011, marking the second straight year that this industry has posted an average of $1 million or more. In fact, 34 percent of all plants with million-dollar equipment budgets in 2011 are in NAIC 335.

All totaled, assemblers in NAIC 335 will spend $433.5 million on assembly technology next year, 3 percent less than what the industry spent in 2010.

Quality control is a nagging concern in this industry. Thirty percent of assemblers in NAIC 335 will buy equipment next year to meet more stringent quality standards. That’s the highest percentage of any industry, and it marks the sixth time in eight years that this industry can claim that distinction.

Only 24 percent of plants in NAIC 335 are concerned about the cost of WIP. That’s the lowest percentage of any industry, and it’s the third straight year that this industry has posted such a low percentage.

Compared with other industries, manufacturers in NAIC 335 are more likely to buy dispensing equipment (51 percent vs. 33 percent for all plants), single-station assembly machines (77 percent vs. 64 percent for all plants), conveyors (36 percent vs. 26 percent for all plants), motion control technology (31 percent vs. 20 percent for all plants), and inspection technology (51 percent vs. 42 percent for all plants).

Companies with fewer than 100 employees will account for just 7 percent of total spending next year, their lowest share since 2004.

Miscellaneous Manufacturing

In October, syringe manufacturer Unilife Corp. announced that it will construct a new global headquarters and manufacturing facility in York, PA. The 165,000-square-foot, state-of-the-art facility will include eight Class 100,000 clean rooms and three Class 7 clean rooms. The $31 million facility is expected to output some 400 million syringes annually.Unilife’s new facility is indicative of the massive investments being made in the medical device industry-spending that should increase in the coming year.

According to the NAIC system, Unilife and other medical and dental device manufacturers are classified under Miscellaneous Manufacturing (NAIC 339). Although this category also includes assemblers of sporting goods, jewelry, toys, pens, mops, musical instruments and caskets, companies like Unilife represent the lion’s share of capital investment by this industry.

Capital spending in NAIC 339 is expected to increase 22 percent next year, from $165.2 million in 2010 to $202.3 million in 2011. It’s the second straight year that spending has increased in this industry. In fact, manufacturers in NAIC 339 have increased capital spending in three of the past four years-no other industry can make that claim.

Some 24 percent of plants in this industry plan to spend less next year, and that is higher than the national figure. However, 33 percent of plants will spend more, which is about the same as for all U.S. plants.

Only 5 percent of plants will spend more than $1 million next year, which is half what it was in 2010. However, 15 percent will spend between $250,000 and $1 million, which is almost three times the percentage in 2010. On average, manufacturers in NAIC 339 will invest $193,595 on assembly technology in 2011, compared with $290,917 in 2010.

The No. 1 reason for buying equipment in this industry is to reduce cycle time. Half the plants in NAIC 339 are buying equipment to get product out the door faster.

Interestingly, manufacturers in NAIC 339 are looking to get lean. Some 36 percent of plants are investing in equipment to implement lean manufacturing. That’s the highest percentage of any industry, and it’s the second straight year that NAIC 339 has led all industries in that regard.

Titanium, stainless steel and other materials that go into medical devices are not inexpensive, so it’s not surprising that manufacturers in this industry are concerned about material costs. Indeed, 29 percent of plants hope to reduce material costs next year. That’s more than any other industry, and it’s the second straight year that NAIC 339 has held that distinction.

Compared with other industries, manufacturers in NAIC 339 are more likely to buy assembly presses (50 percent vs. 33 percent for all plants), electronics assembly equipment (17 percent vs. 13 percent for all plants), and workstations (44 percent vs. 35 percent for all plants).